Market Overview:

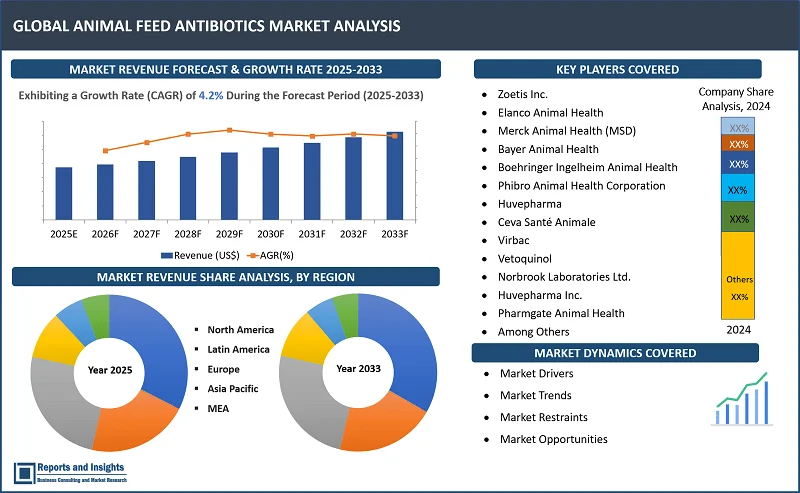

"The global animal feed antibiotics market was valued at US$ 2.7 Billion in 2024 and is expected to register a CAGR of 4.2% over the forecast period and reach US$ 3.9 Billion in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Animal Feed Antibiotics Market Growth Rate (2025-2033) |

4.2% |

Animal feed antibiotics are antimicrobial agents that are added to the feed of livestock, poultry, and aquaculture species to improve feed efficiency, enhance growth, and prevent or treat diseases They are also, used in sub-therapeutic doses, helping in weight gain and productivity, particularly in poultry, swine, and cattle industries. However, this raises significant concerns about public health, animal welfare, and environmental sustainability. In addition, these antibiotics treat human and animal infections, when used excessively in animal feed, resistant bacterial strains can emerge and spread.

The animal feed antibiotics market is registering significant growth, driven by growing livestock production, advancements in animal husbandry practices, and the need to maintain animal health and productivity. Moreover, many regions such as the EU and the US have imposed restrictions on antibiotics as growth promoters, promoting the demand and use of alternatives like probiotics, prebiotics, and phytogenics. Furthermore, leading players such as Zoetis Inc., Elanco Animal Health, Merck Animal Health (MSD), and Bayer Animal Health focus on innovation and strategic partnerships to align with evolving regulations and consumer preferences.

Animal Feed Antibiotics Market Trends and Drivers:

The increasing demand for meat, dairy, and poultry products worldwide drives the global animal feed antibiotics market growth. Antibiotics are used in animal feed primarily to prevent diseases, promote growth, and enhance feed efficiency. Innovations such as precision feeding systems use data analytics to optimize nutrient intake which improves feed efficiency, contributing to the market growth. In addition, the use of enzyme additives in feed formulations leads to better digestion and nutrient absorption, reducing the need for antibiotics. Animal feed manufacturers are increasingly adopting automation, AI, and machine learning to ensure the production of high-quality, custom-made feeds.

Moreover, the rise in livestock farming, particularly in countries such as China, India, and Brazil, further drives market growth. The increasing population and improving income levels in these regions lead to higher consumption of animal products, prompting farmers to seek ways to maximize production and reduce losses from disease outbreaks. Furthermore, antibiotics play a vital role in achieving these objectives by enhancing animal growth rates and preventing diseases such as mastitis and respiratory infections.

Animal Feed Antibiotics Market Restraining Factors:

One of the restraining factors of the global animal feed antibiotics market growth is the regulatory restrictions and bans on the use of antibiotics in animal feed. In particular, the European Union has implemented strict regulations that prohibit the use of antibiotics for promoting growth in animals. Also, the United States has implemented measures to limit the use of certain antibiotics in food-producing animals, emphasizing the need for veterinary oversight. These regulations are driven by concerns about antimicrobial resistance (AMR), which can be worsened by the overuse of antibiotics in agriculture, posing risks to human health.

Another, restraining factor for the market is the increasing consumer awareness and demand for antibiotic-free products. As consumers become more concerned about the potential health risks associated with antibiotic residues in food, there is a shift toward organic and antibiotic-free animal products. This change in consumer preference is forcing producers to explore alternative methods for maintaining animal health which may be more costly and less effective than traditional antibiotics.

Animal Feed Antibiotics Market Opportunities:

Companies can collaborate with research institutions, pharmaceutical companies, and veterinary organizations to develop innovative and sustainable feed additives. Also, expand their market presence and improve product portfolios. For instance, major firms such as Zoetis, Elanco, and Merck have acquired smaller biotech companies to integrate advanced technologies and expand their product offerings in the animal health segment. In addition, emerging markets, particularly in Asia-Pacific present significant growth opportunities for animal feed antibiotic suppliers, owing to the rising demand for meat products and the intensification of livestock farming.

With the global rise in animal-based food consumption and the need to ensure animal health, the use of antibiotics in animal feed presents a significant opportunity for innovation in the market. Companies can invest in research and development to create new feed additives that improve animal health while adhering to sustainability guidelines. Moreover, there is rising interest in precision livestock farming technologies that use data analytics to optimize feeding strategies, reduce waste, and enhance overall animal productivity.

Animal Feed Antibiotics Market Segmentation:

By Product Type

- Tetracyclines

- Penicillins

- Sulfonamides

- Lincosamides

- Others

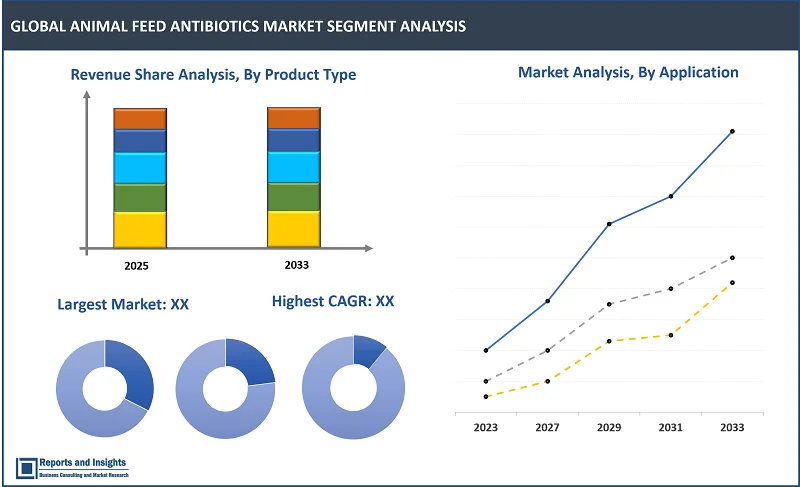

Thе tetracyclines sеgmеnt among the product type sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе global animal feed antibiotics markеt. The dominance can be attributed to their ability to enhance growth and feed conversion rates, crucial for improving farm productivity. These antibiotics are commonly used to prevent and treat infections which is essential for maintaining healthy livestock and ensuring the safety and quality of animal products.

By Livestock

- Poultry

- Swine

- Cattle

- Others

Thе poultry sеgmеnt among thе livestock sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе global animal feed antibiotics markеt. This dominance is due to the rapid growth of poultry consumption, particularly in Asia-Pacific where rising incomes and urbanization increase the demand for chicken and eggs. In addition, poultry farming benefits significantly from antibiotics which help control diseases, improve growth rates, and increase production efficiency.

By Form

- Dry

- Liquid

- Powder

Among the form segments, powder segment is expected to account for the largest revenue share The dominance can be attributed to the use in large-scale farming operations as this form is easy to mix with animal feed. Offering benefits such as ease of transport, long shelf life, and relatively simple packaging. Also, the production of antibiotics in powder form is more cost-effective and can be sold in bulk to feed manufacturers.

By Application

- Growth Promotion

- Disease Prevention

- Treatment

Among the application segments, growth promotion segment is expected to account for the largest revenue share. The dominance can be attributed to the use of antibiotics in animal feed to promote growth by enhancing feed conversion efficiency. Growth-promoting antibiotics help animals gain weight more quickly which is particularly crucial in the poultry and swine industries.

By Sales Channel

- Veterinary Clinics and Shops

- Pharmacy Stores

- Online Portal

Among the sales channel segments, veterinary clinics and shops segment is expected to account for the largest revenue share. This dominance can be attributed to their direct interaction with livestock owners, farmers, and pet owners. Providing personalized consultations which are essential for ensuring that the appropriate antibiotics are used to prevent or treat diseases in animals.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

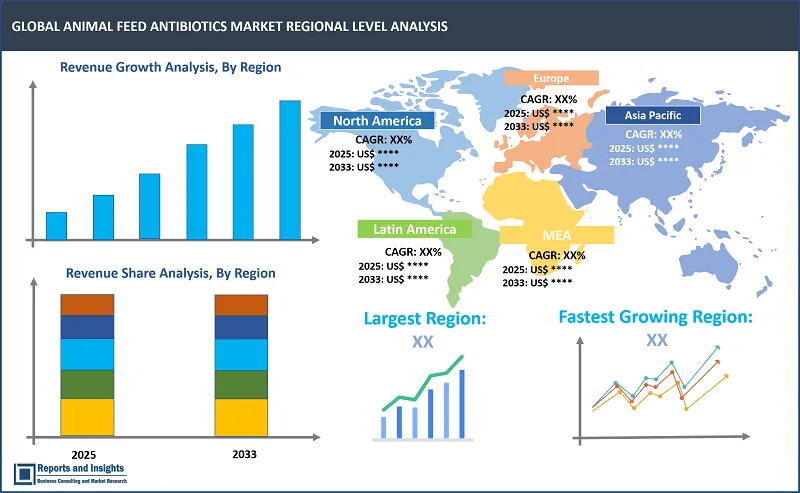

Thе global animal feed antibiotics markеt is dividеd into fivе kеy rеgions: North Amеrica, Europе, Asia Pacific, Latin Amеrica and thе Middlе East and Africa. Regionally, the United States is a key market in North America, and the market growth is driven by a large-scale meat production industry and the widespread use of antibiotics in feed. However, the Food and Drug Administration (FDA) has taken steps to limit the use of certain antibiotics in animal feed, influencing the market growth. The European Union has implemented stringent regulations regarding the use of antibiotics in animal feed. While, the Asia-Pacific region is registering significant growth due to the rapidly expanding livestock sector in countries such as China, India, and Vietnam. Latin America and Africa show moderate growth. In Latin America, the use of antibiotics in animal feed is widespread, driven by robust poultry and pork industries. Meanwhile, Africa is concentrating on enhancing animal husbandry practices, although antibiotic use continues to increase in many regions.

Leading Companies in Animal Feed Antibiotics Market & Competitive Landscape:

The competitive landscape in the global animal feed antibiotics market is characterized by intense competition among leading manufacturers seeking to leverage maximum market share. Major companies provide a wide range of veterinary antibiotics and other solutions for livestock and pets. Also, focuses on providing sustainable solutions to improve animal health and productivity. Some key strategies adopted by leading companies include investing significantly in Research and Development (R&D) to enhance antibiotic efficacy and safety. In addition, companies focus on improving durability, energy efficiency, and properties of global animal feed antibiotics, and maintain their market position by steady expansion of their consumer base. Companies also engage in strategic partnerships and collaborations with research firms and manufacturers, which allows them to integrate their global animal feed antibiotics with different technologies. Moreover, the market dynamics for new treatments can be significantly influenced by the approval and regulatory environment.

These companies include:

- Zoetis Inc.

- Elanco Animal Health

- Merck Animal Health (MSD)

- Bayer Animal Health

- Boehringer Ingelheim Animal Health

- Phibro Animal Health Corporation

- Huvepharma

- Ceva Santé Animale

- Virbac

- Vetoquinol

- Norbrook Laboratories Ltd.

- Huvepharma Inc.

- Pharmgate Animal Health

- Zhejiang Hisun Pharmaceutical Co., Ltd.

- Jiangsu Hengrui Medicine Co., Ltd.

- Shandong Lukang Pharmaceutical Co., Ltd.

- Vetpharm Group

- Bimeda AquaTactics

- kyoritsuseiyaku Company

- Others

Animal Feed Antibiotics Market Research Scope

|

Report Metric |

Report Details |

|

Animal Feed Antibiotics Market size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

4.2% |

|

Segment covered |

By Product Type, Livestock, Form, Application, and Sales Channel |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

UK |

|

Largest Market |

North America |

|

Key Players |

Zoetis Inc., Elanco Animal Health, Merck Animal Health (MSD), Bayer Animal Health, Boehringer Ingelheim Animal Health, Phibro Animal Health Corporation, Huvepharma, Ceva Santé, Animale, Virbac, Vetoquinol, Norbrook Laboratories Ltd., Huvepharma Inc., Pharmgate Animal Health, Zhejiang Hisun Pharmaceutical Co., Ltd., Jiangsu Hengrui Medicine Co., Ltd., Shandong Lukang Pharmaceutical Co., Ltd., Vetpharm Group, Bimeda AquaTactics, kyoritsuseiyaku Company, and Others |

Frequently Asked Question

What is the size of the global animal feed antibiotics market in 2024?

The global animal feed antibiotics market size reached US$ 2.7 Billion in 2024.

At what CAGR will the global animal feed antibiotics market expand?

The global animal feed antibiotics market is expected to register a 4.2% CAGR through 2025-2033.

How big can the global animal feed antibiotics market be by 2033?

The market is estimated to reach US$ 3.9 Billion by 2033.

What are some key factors driving revenue growth of the global animal feed antibiotics market?

Key factors driving revenue growth in the global animal feed antibiotics market includes increased demand for animal products, technological advancements in feed production, expansion of the livestock industry in emerging economies, increased investments in animal nutrition, growth of the aquaculture sector, and others.

What are some major challenges faced by companies in the global animal feed antibiotics market?

Companies in the global animal feed antibiotics market face challenges such as regulatory pressure and bans, public health concerns, supply chain issues, and others.

How is the competitive landscape in the global animal feed antibiotics market?

The competitive landscape in the global animal feed antibiotics market is marked by intense rivalry among leading manufacturers. Companies compete on product quality, innovation, and cost-effectiveness.

How is the global animal feed antibiotics market report segmented?

The global animal feed antibiotics market report segmentation is based on product type, livestock, form, application, and sales channel.

Who are the key players in the global animal feed antibiotics market report?

Key players in the global animal feed antibiotics market report include Zoetis Inc., Elanco Animal Health, Merck Animal Health (MSD), Bayer Animal Health, Boehringer Ingelheim Animal Health, Phibro Animal Health Corporation, Huvepharma, Ceva Santé, Animale, Virbac, Vetoquinol, Norbrook Laboratories Ltd., Huvepharma Inc., Pharmgate Animal Health, Zhejiang Hisun Pharmaceutical Co., Ltd., Jiangsu Hengrui Medicine Co., Ltd., Shandong Lukang Pharmaceutical Co., Ltd., Vetpharm Group, Bimeda AquaTactics, kyoritsuseiyaku Company, Others.