Market Overview:

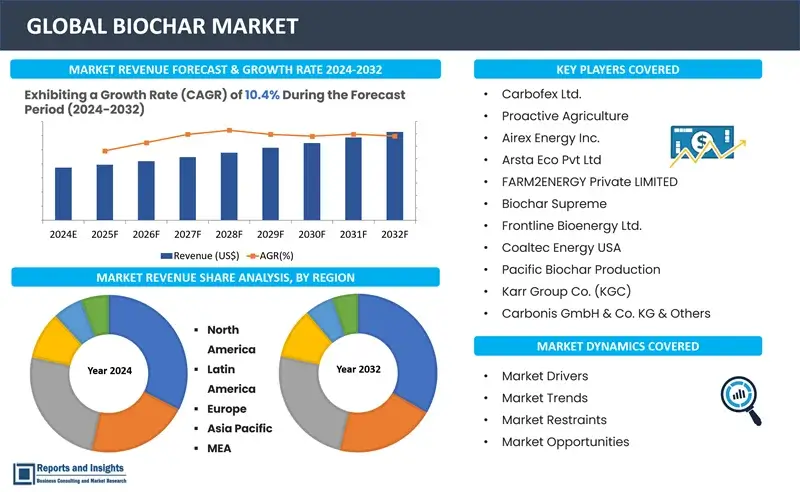

"The biochar market size reached US$ 220.4 Million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 537.0 Million by 2031, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

10.4% |

Biochar is an organic or charcoal-like product produced from materials such as forestry wastes, animal manures, and crop residues through thermal decomposition or pyrolysis under a limited supply of oxygen (O2) and at relatively low temperatures. It is characterized by its high carbon content, porous structure, and dark color. Its properties fluctuating with processing temperature include volatile matter, and pH, while the feed-dependent properties are absolute carbon content, cation exchange capacity, thermal stability, and mineral composition, which are the important factors that influence the transformation, migration, and bioavailability of contamination of soil.

The biochar market growth is driven by the growing consumption of biochar in water filtration systems to remove contaminants from drinking water, stormwater runoff, and wastewater. It is used to improve nutrient retention, water retention, and microbial activity which increases the demand in the market. Furthermore, the rising popularity of bio-char-based materials in the construction industry due to their lightweight nature, insulation properties, and carbon footprint reduction drives the market growth. Moreover, organic and sustainably grown food products rise the demand as they are cultivated without the use of harmful synthetic fertilizers in the soil. Overall, all these factors contribute to the biochar market growth.

Biochar Market Trends and Drivers

The biochar market is witnessing notable trends and being driven by several factors. The increasing demand of biochar in farming as soil additive to improve fertility, boost crop yield, and enhance water retention drives the market growth. Additionally, heightened awareness of climate change and the need and storage of carbon in plants and soils leads to the recognition of biochar, which helps to mitigate greenhouse gas emissions and contributes to sustainable land management practice and its ability to store carbon for hundreds of years. Moreover, the integration of biochar into building materials, adsorber in functional clothing, as carbon electrodes in super-capacitors for energy storage, waste water treatment, food packaging, air cleaning, silage agent or feed supplement drives the biochar market growth.

Biochar market growth is influenced by several factors which include the growing demand of organic and sustainably produced agriculture products, applications find in other sectors such as energy and construction material, advancements in production technology that improves efficiency and reduce costs, the growing demand for water filtration and purification, and for remediating contaminated soils and adsorbing pollutants makes it valuable for environmental cleanup initiatives. Overall, all these factors drive the biochar market growth.

Biochar Restraining Factors

Despite the positive trajectory observed in the biochar market, growth is hindered by various restraining factors. Firstly, the lack of knowledge of manufacturing processes or methods used in biochar production ranging from pyrolysis to feedstock selection creates a challenge and limits the scalability of the technology for farmers. Secondly, the impact of biochar on soil and crop yield can differ based on factors such as climate, soil type, and crop type. Moreover, the limited availability of technology for low-emission biochar synthesis such as pyrolysis methods, while effective in producing biochar, often involves high temperatures and energy consumption, leading to elevated emissions and environmental concerns and inhibits the scalability and sustainability of biochar production. Furthermore, the availability and cost of biomass feedstock can influence the economic feasibility of biochar production. Competition for biomass resources with other industries can also impact availability. Overall, addressing these challenges requires investment in research and development to improve technology, raise awareness, and establish supportive regulatory frameworks.

Biochar Market Opportunities

The biochar market is lucrative for growth and advancement, presenting various opportunities. Firstly, biochar is widely used in agriculture as it improves soil fertility, water retention, and nutrient availability which leads to increased crop yields and improved soil health. Secondly, it can be integrated into waste management practices that attract municipalities and waste management companies as it provides sustainable waste management solutions. Additionally, the collaboration with environmental remediation projects leads to a great opportunity for industries dealing with soil pollution as it can remediate contaminated soils and absorb pollutants. Moreover, water treatment application increases the demand for sustainable water purification technologies as the porous structure of biochar is effective for water purification and filtration. Collaborating with industries such as agriculture, waste management, and water treatment provides opportunities for integrated and comprehensive solutions. Overall, the biochar market can seize these opportunities by adapting to these opportunities requires industry collaboration and acceptance of biochar across different sectors.

Biochar Market Segmentation:

By Particle size

- Coarse

- Fine

The biochar market is categorized into particle size that is based on coarse and fine particle size. Fine biochar particle sizes are suitable for incorporation into soil blends and potting mixes. Coarse biochar particle size is used for environmental applications, such as stormwater filtration.

By Biomass Feedstock

- Agriculture Waste

- Bioenergy Crops

- Forest Residue

- Organic Waste

- Sewage Sludge

- Other Waste Materials

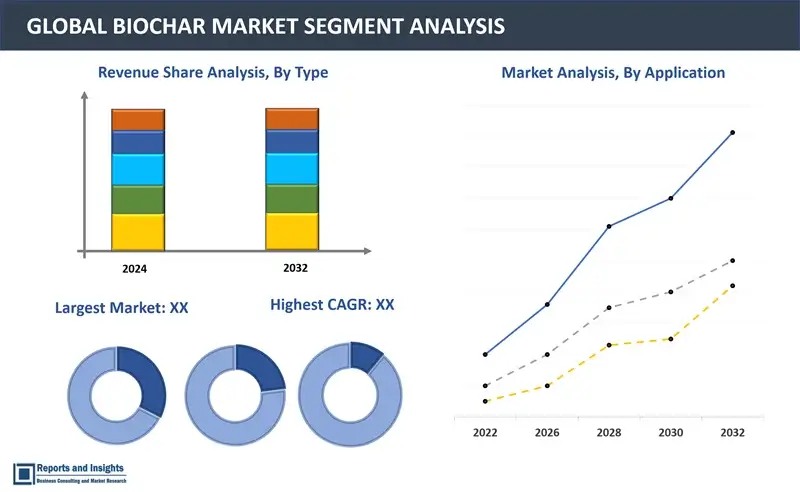

The Biochar market is diverse biomass feedstock, the agricultural waste segment dominates the global biochar market. The agricultural waste segment comprises corncob, coconut shells, palm fronds, oil palm shells, palm leaves, bamboo, rice straw, and rice husk for biochar production. This method is primarily used in underdeveloped or economically weaker countries due to its easy availability and affordability. Later, the efficiency of these agricultural wastes is induced by the pyrolysis process. On the other hand, organic segment is predicted to dominate the market. Green waste, including yard trimmings and leaves, provides a source of biomass for biochar. It contributes to waste management and recycling efforts.

By Technology

- Pyrolysis

- Gasification

- Others

The Biochar market strategically caters to diverse technology, the pyrolysis segment dominates the global biochar market and to maintain growth. Pyrolysis is the process of converting biomass to form biochar at a particular temperature range and widely used process for creating biochar under oxygen-deprived conditions, as it can potentially convert any biomass into biochar. The pyrolysis process is further segmented into slow, moderate, and fast pyrolysis. However, fast pyrolysis at the elevated temperature of 500°C is considered the ideal state for biochar formation. However, the gasification segment is estimated to witness a significant increase in the upcoming year owing to the continuous advancement in gasification technology. The gasification process partially combusts biomass/biowaste to produce high-quality biochar. This thermal conversion process was initially developed for converting coal.

By Applications

- Electricity Generation

- Agriculture

- Waste Management

- Energy Production

- Soil Improvement

- Others

Biochar finds diverse applications across various segments due to its unique properties and benefits. The primary application of biochar is in agriculture as a soil additive, improving soil structure, enhancing water retention, and promoting nutrient availability, leading to increased crop yields and soil health. It is effective for environmental remediation, including the removal of contaminants from soil or water, mitigating pollution, and contributing to ecosystem restoration. The use of organic waste materials in biochar production contributes to sustainable waste management practices, offering a solution for recycling biomass waste. Biochar production through pyrolysis generates bioenergy as a by-product. This aligns with renewable energy initiatives and provides an additional revenue stream. Meanwhile, it is used for water treatment to improve water quality and create a favourable environment for aquatic organisms. It is also used for other applications such as in construction material to improve insulation properties and reduce the carbon footprint.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

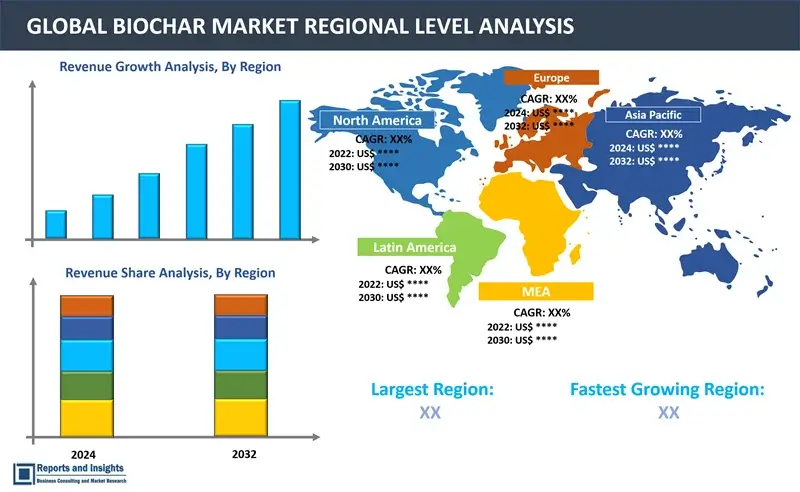

The biochar market exhibits distinctive characteristics across various regions, influencing consumer preferences and market dynamics. The Asia Pacific region holds a dominant share in the global biochar market, driven by its significant role in soil improvement and carbon sequestration. The region's robust economic and agricultural development, particularly in China, positions it as a leading producer of biochar. The market expansion in Asia Pacific addresses key agricultural challenges, including crop residue disposal, soil pollution, quality degradation, slash-and-burn practices, and greenhouse gas emissions. North America is the second-largest market for biochar globally and is anticipated to witness significant expansion driven by a rising demand for organic food and high meat consumption. The sector's growth is supported by a mix of local and large manufacturers operating at national and global levels. Furthermore, Europe, Latin America and Middle East & Africa region holds a share in the biochar market, driven by the use as soil additive, integration in construction material and other applications.

Leading Biochar Providers & Competitive Landscape:

The biochar market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Carbofex Ltd.

- Proactive Agriculture

- Airex Energy Inc.

- Arsta Eco Pvt Ltd

- FARM2ENERGY Private LIMITED

- Biochar Supreme

- Frontline Bioenergy Ltd.

- Coaltec Energy USA

- Pacific Biochar Production

- Karr Group Co. (KGC)

- Carbonis GmbH & Co. KG

- Safi Organics

Recent News and Development

- November 2023: BIOSORRA, a leading carbon removal startup launched the biggest biochar-producing plant in East Africa to provide its high-quality biochar to Kenya Nut Company, a multinational agribusiness firm growing a variety of products.

- August 2023: Karbon-X and Laconic Infrastructure Partners Inc. (Laconic) signed a Letter of Intent (LOI) to develop a cutting-edge biochar verification methodology. The novel methodology aimed to ensure the accuracy and transparency of Karbon-X's reforestation project in the Chiquitania Region of Bolivia, and subsequently, it will be applied to verify other Biochar projects worldwide.

- December 2022: EVOIA Inc. announced its first product, a seed treatment manufactured from biochar that complaint with USDA National Organic Program standards by the California Department of Agriculture (CDFA) and Organic Materials Review Institute Bio preferred program as 100% biobased and Fertilizing Materials Law and Regulations of California.

Biochar Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

10.4% |

|

Segment covered |

Particle Size, Biomass Feedstock, Technology, Applications, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

Carbofex Ltd., Proactive Agriculture, Airex Energy Inc., Arsta Eco Pvt Ltd, FARM2ENERGY Private LIMITED, Biochar Supreme, Frontline Bioenergy Ltd., Coaltec Energy USA, Pacific Biochar Production, Karr Group Co. (KGC), Carbonis GmbH & Co. KG, Safi Organics |

Frequently Asked Question

What are some key factors driving revenue growth of the biochar market?

Some key factors driving market revenue growth include increasing demand in farming, climate change, integration in building materials, waste water treatment and others.

What are some major challenges faced by companies in the biochar market?

Companies face challenges such as lack of knowledge of manufacturing process, limited availability of technology, and availability and cost of biomass feedstock.

How is the competitive landscape in the global biochar market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

What is the market size of biochar market in the year 2023?

The biochar market size reached US$ 220.4 million in 2023.

At what CAGR will the biochar market expand?

The market is anticipated to rise at 10.4% CAGR.

What are the potential opportunities for companies in the biochar market?

Companies can leverage opportunities such as agriculture products, collaborations with environmental remediation projects, waste management practices, water related application.

Which region has the biggest market share in biochar market?

Asia Pacific has the biggest market share in Biochar market.

How is the biochar market segmented?

The market is segmented based on factors such as particle size, biomass feedstock, applications and regions.