Market Overview:

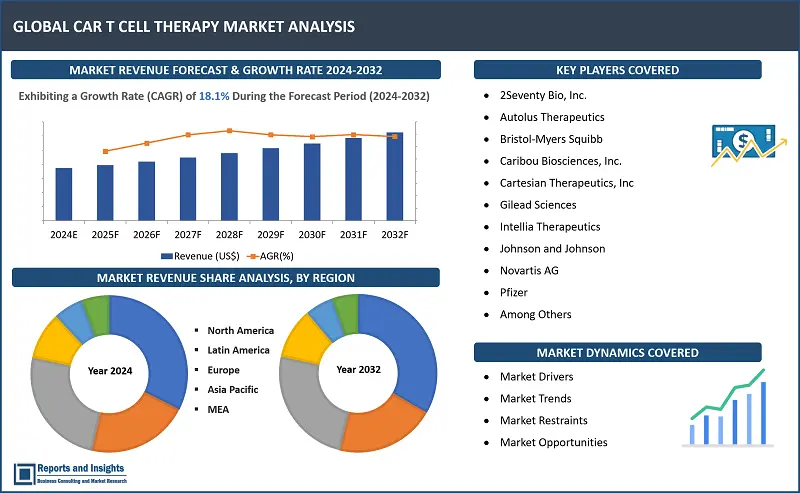

"The global Car T Cell Therapy market was valued at US$ 3.1 Billion in 2023, and is expected to register a CAGR of 18.1% over the forecast period and reach US$ 13.9 Bn in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

18.1% |

CAR T cell therapy, a revolutionary immunotherapy, has transformed cancer treatment by harnessing the power of a patient's immune system to battle cancer cells. This advanced approach comprises genetically engineering a patient's T cells to express chimeric antigen receptors (CARs), allowing them to determine and target specific cancer antigens. CAR T cell therapy has illustrated ground-breaking efficacy in treating hematologic malignancies such as leukaemia and lymphoma, with some patients achieving long-term remission. The global market for CAR T cell therapy is undergoing robust growth, led by growing investments in research and development, diversifying clinical applications, and regulatory approvals for new indications. In addition, collaborations between biotechnology firms, pharmaceutical companies, and academic institutions are boosting advancements in CAR T cell technology, leading the way for personalized cancer treatments and offering hope to patients facing previously untreatable cancers. As the field continues to evolve, CAR T cell therapy holds immense promise as a revolutionary approach in the battle against cancer.

Innovations in genetic engineering techniques and vector delivery systems are improving the specificity and potency of CAR T cells, paving its way to enhanced treatment outcomes and lowered adverse effects. Moreover, novel targeting strategies, such as dual-targeting CARs and switchable CAR T cells, are expanding the therapeutic potential of CAR T cell therapy beyond hematologic malignancies to solid tumours. Additionally, breakthroughs in manufacturing processes and automation technologies are streamlining production and lessening treatment costs, making CAR T cell therapy more accessible to patients across the globe.

Pioneering firms such as Novartis, Gilead Sciences (through its acquisition of Kite Pharma), and Bristol Myers Squibb (following its acquisition of Juno Therapeutics) have surfaced as top contenders in developing and commercializing CAR T cell therapies. These companies have achieved regulatory approvals for cutting-edge therapies targeting hematologic malignancies, comprising lymphoma and leukaemia. Furthermore, they continue to invest in research and development to diversify the therapeutic scope of CAR T cell therapy, exploring novel targets and engineering approaches to address hindrances such as tumour heterogeneity and antigen escape. Collaborations with academic institutions and smaller biotechnology firms also hold an essential role in fuelling innovation in the CAR T cell therapy panorama, highlighting a collaborative effort to advance the field and enhance results for cancer patients.

Car T Cell Therapy Market Trends and Drivers:

One of the notable factors is the soaring prevalence of leukaemia and other hematologic malignancies across the globe. With leukaemia being one of the leading targets for CAR T cell therapy, the increasing incidence of this disease is boosting demand for innovative treatment alternatives that offer potential cures.

In addition to that, there has been a substantial increment in investment for research and development of new CAR T-cell therapies. Pharmaceutical firms, biotechnology companies, and academic institutions are allocating significant resources to advance the science of CAR T cell therapy, exploring novel targets, engineering methods, and manufacturing processes. This rise in R&D investment indicates the industry's conviction in the potential of CAR T cell therapy to transform cancer treatment and enhance patient outcomes.

Another critical driving force behind the growth of the CAR T cell therapy market is its greater effectiveness in comparison to traditional drugs for cancer treatment. Clinical trials have illustrated pioneering response rates and durable remissions in patients with relapsed or refractory leukaemia and lymphoma, establishing CAR T cell therapy as a propitious therapeutic modality. The capability of CAR T cells to specifically target cancer cells while sparing healthy tissues downplays systemic toxicity and improves treatment tolerability, making it an appealing alternative for patients who have exhausted standard treatment alternatives.

Car T Cell Therapy Market Restraining Factors:

One of the chief restraints of the global Car T cell therapy is the high cost associated with CAR T-cell therapy. The intricate manufacturing process, personalized nature of treatment, and extensive clinical monitoring contribute to the excessive expenses, making it financially exorbitant for many patients and healthcare systems. In addition, reimbursement challenges and limited insurance coverage further worsen the affordability issue, impeding access to CAR T-cell therapy for eligible patients.

Alongside, the potential for severe adverse effects, comprising cytokine release syndrome and neurotoxicity, poses crucial safety concerns and necessitates specialized management expertise and infrastructure, adding to the overall cost strain. Furthermore, logistical challenges associated with the transport and storage of CAR T cell products, as well as the necessity for close collaboration between treatment centres and referring physicians, present additional barriers to widespread adoption.

Manufacturing constraints and regulatory complexities also contribute to the market's growth constraints, as stringent regulatory needs and capacity limitations may hinder the timely development and commercialization of CAR T-cell therapies. Addressing these restraining factors will require synergistic efforts from stakeholders across the healthcare ecosystem to mitigate cost barriers, streamline regulatory processes, and improve patient access to this revolutionary therapy.

Car T Cell Therapy Market Opportunities:

A substantial soar in research and development activities, accelerated by surging investments from pharmaceutical firms, biotechnology companies, and academic institutions, highlights the potential for innovation and advancement in CAR T-cell therapies. Moreover, the growing number of clinical trials exploring novel targets, engineering techniques, and combination therapies offers a fertile ground for expanding the therapeutic scope of CAR T-cell therapy beyond hematologic malignancies to solid tumours.

Clinical trials and real-world applications of CAR T-cell therapy have demonstrated extraordinary feat, particularly in haematological malignancies such as certain types of leukaemia and lymphomas. Patients who have undergone CAR T-cell therapy time and again experience sustained remissions, offering a potential cure rather than merely managing the disease.

For instance, according to a 2023 report by National Library of Medicine, it was reported that CAR-T cells, have generated extraordinary results in phase I/II clinical trials in the treatment of CD19+ B-cell haematological malignancies. In addition, according to a 2022 report by National Cancer Institute, it was reported that, in two large clinical trials, CAR T-cell therapy proved to be more effective than the standard treatment for patients with non-Hodgkin lymphoma whose cancer returned after their initial, or first-line, chemotherapy. Thus, high efficiency of the CAR T-cell therapy in treating the lymphoma is expected to drive the growth of the market.

Car T Cell Therapy Market Segmentation:

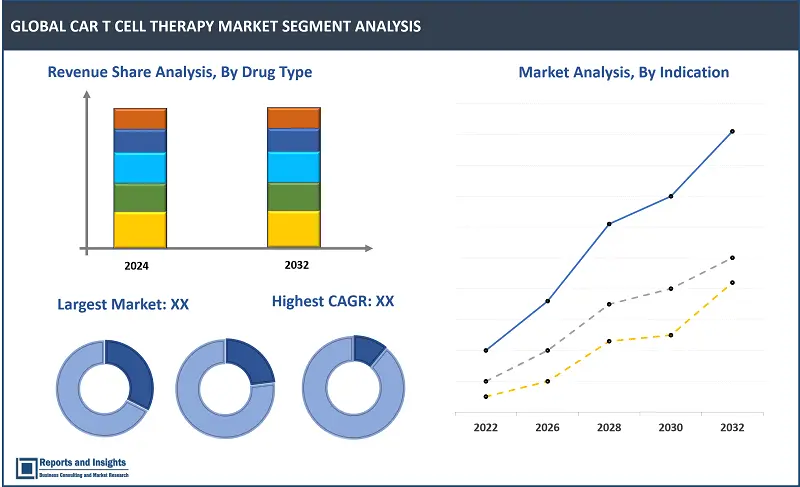

By Drug Type

- Axicabtagene Ciloleucel

- Tisagenlecleucel

- Brexucabtagene Autoleucel

- Others

The axicabtagene ciloleucel segment holds a larger share in the global CAR T cell therapy market due to its established efficacy and regulatory approvals for various hematologic malignancies, including certain types of lymphoma, making it a preferred choice among physicians and patients.

By Indication

- Lymphoma

- Acute Lymphocytic Leukemia

- Other

The lymphoma segment holds a larger share in the global CAR T cell therapy market due to the higher prevalence of lymphoma compared to acute lymphocytic leukaemia. Additionally, CAR T cell therapies have demonstrated significant efficacy in treating various types of lymphoma.

By End User

- Hospital

- Cancer Treatment Centers

The cancer treatment centers segment accounts for a larger share in the global CAR T cell therapy market due to their specialized expertise, dedicated infrastructure, and comprehensive range of services tailored to cancer patients, facilitating seamless integration and delivery of CAR T cell therapies.

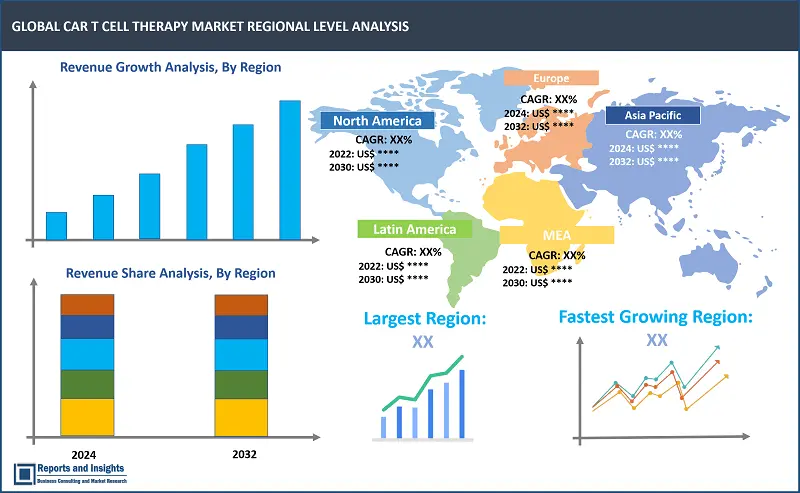

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global CAR T cell therapy market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The growth in this region is mainly attributed to high R&D activities to develop new CAR T-cell therapies and strong presence of key players in the region. In addition, the presence of several major players, such as Bristol-Myers Squibb, Johnson & Johnson, Gilead Sciences, and Intellia Therapeutics., and Pfizer Inc. contribute to the market growth in the region.

Europe is anticipated to grow at the highest rate during the forecast period. This is owing to high prevalence rate of cancer, a large and diverse population, enhancing healthcare infrastructure, and rise in geriatric population as they are more prone to cancer disease. In addition, the rise in research and clinical trials, soaring awareness, and rise in pharmaceutical and biotechnology investments for the development of novel drugs are the factors that fuel the market growth in this region.

Leading Car T Cell Therapy Solution Providers & Competitive Landscape:

Leading pharmaceutical companies such as Novartis, Gilead Sciences (including Kite Pharma), and Bristol Myers Squibb (following its acquisition of Juno Therapeutics) leverage their extensive resources to fuel research and development, expand product pipelines, and secure regulatory approvals for new indications. These players emphasize on strategic collaborations, mergers, and acquisitions to strengthen their market position and gain access to novel technologies and intellectual property. In addition, partnerships with academic institutions and smaller biotechnology firms allow them to harness leading-edge innovations and boost the development and commercialization of CAR T cell therapies, thereby improving their competitiveness in this swiftly evolving market outlook.

These companies include:

- 2Seventy Bio, Inc.

- Autolus Therapeutics

- Bristol-Myers Squibb

- Caribou Biosciences, Inc.

- Cartesian Therapeutics, Inc

- Gilead Sciences

- Intellia Therapeutics

- Johnson and Johnson

- Novartis AG

- Pfizer

Recent Development:

- December 2023, Bristol-Myers Squibb announced that it received manufacturing and marketing approval of the supplemental New Drug Application for an additional indication for Abecma (idecabtagene vicleucel), a B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T cell immunotherapy, for patients with relapsed or refractory multiple myeloma (RRMM) who have received at least two prior therapies, including an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 antibody.

- September 2023, 2seventy bio, Inc. and JW Therapeutics announced their intention to expand their strategic alliance. The companies intend to add up to two additional candidates from the 2seventy portfolio, one in solid tumour indications using T-cell receptor (TCR) based technology and a second in autoimmune disease using a CAR T cell approach.

- April 2022, Autolus Therapeutics plc, announced that it has collaborated with Cardinal Health Inc. to support the launch and commercialization of its CAR T-cell therapies in the U.S., subject to FDA approval.

Car T Cell Therapy Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

18.1% |

|

Segment covered |

Drug Class, Indication, End User |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

UK |

|

Largest Market |

North America |

|

Key Players |

Autolus Therapeutics, 2Seventy Bio, Inc., Bristol-Myers Squibb, Gilead Sciences, Intellia Therapeutics, Caribou Biosciences, Inc., Cartesian Therapeutics, Inc, Novartis AG, Pfizer, and Johnson and Johnson |

Frequently Asked Question

What is the market size of the Car T cell therapy market in 2023?

The Car T Cell Therapy market size reached US$ 3.1 Billion in 2023.

At what CAGR will the Car T cell therapy market expand?

The market is expected to register a 18.1% CAGR through 2024-2032.

Which is the fastest growing country in Europe Car T Cell Therapy market?

The U.K. is the fastest growing country in Europe Car T Cell Therapy market.

What are some key factors driving revenue growth of the Car T Cell Therapy market?

Some key factors driving revenue growth are rise in prevalence of leukemia, surge in research and development activities to develop new CAR T-cell therapy, and high effectivity of CAR T-cell therapy over other conventional drugs for cancer treatment, among others.

What are some major restraints affecting the growth of Car T Cell Therapy market?

Some key barriers include high cost associated with CAR T-cell therapy. The intricate manufacturing process, personalized nature of treatment, and extensive clinical monitoring contribute to the excessive expenses, making it financially exorbitant for many patients and healthcare systems.

How is the competitive landscape in the Car T Cell Therapy market?

The competitive landscape in the Car T cell therapy market is dynamic with solution and service providers emphasizing strategic collaborations, mergers, and acquisitions to strengthen their market position and gain access to novel technologies and intellectual property.

How is the Car T Cell Therapy market segmented?

The market report is segmented based on drug class, indication, end user, and region.

Which top companies are included in the global Car T Cell Therapy market report?

Top companies included in the report are Autolus Therapeutics, 2Seventy Bio, Inc., Bristol-Myers Squibb, Gilead Sciences, Intellia Therapeutics, Caribou Biosciences, Inc., Cartesian Therapeutics, Inc, Novartis AG, Pfizer, and Johnson and Johnson.