Market Overview:

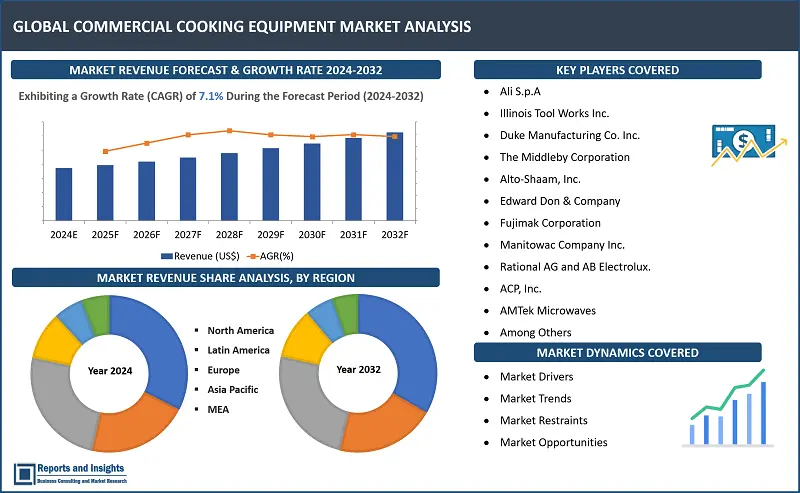

"The global commercial cooking equipment market size reached US$ 12,456.8 million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 21,563.6 million by 2032, exhibiting a growth rate (CAGR) of 7.1% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

7.1% |

Commercial cooking equipment comprises a diverse array of appliances and tools tailored for use in professional kitchens and food service settings. These tools are typically more durable and effective than their residential counterparts, capable of managing substantial food preparation volumes. Examples include ovens, stovetops, grills, fryers, steamers, and refrigeration units. Such equipment is vital for commercial kitchens, catering services, restaurants, and similar food-focused businesses, facilitating the efficient and safe preparation of a wide range of dishes to meet customer demands.

The market for commercial cooking equipment involves the production, distribution, and sale of various appliances and tools intended for use in professional kitchens and food service settings. This market encompasses a wide range of products, including ovens, stovetops, grills, fryers, steamers, and refrigeration units. Growth in the food service industry, a rising demand for energy-efficient equipment, and a focus on innovative and advanced products are key drivers of this market. Competition is intense, with manufacturers continuously introducing new products to meet the changing demands of commercial kitchens and food service establishments.

Commercial Cooking Equipment Market Trends and Drivers:

The commercial cooking equipment market is on a robust growth trajectory, primarily propelled by several key trends and drivers. One significant factor is the escalating demand for energy-efficient and eco-friendly cooking appliances, which is being driven by increasing environmental awareness and stringent regulatory standards. Moreover, the surge in quick-service restaurants and the expanding foodservice sector are fueling the adoption of advanced cooking technologies to boost efficiency and productivity. Additionally, the shift towards healthier food choices has spurred the development of equipment that facilitates healthier cooking techniques. Furthermore, the incorporation of smart technologies such as IoT and AI into commercial cooking equipment is anticipated to propel market expansion, offering superior control, monitoring, and automation features.

The commercial cooking equipment market growth is influenced by several factors the escalating need for energy-efficient and eco-friendly cooking solutions, propelled by environmental concerns and regulatory requirements. The expansion of quick-service restaurants and the broader foodservice industry is also a significant driver, prompting the adoption of advanced cooking technologies to enhance efficiency and productivity. Furthermore, the shift towards healthier food choices has spurred the development of equipment that supports healthier cooking methods. Additionally, the incorporation of smart technologies like IoT and AI is driving market growth by providing improved control, monitoring, and automation features.

Commercial Cooking Equipment Market Restraining Factors:

Several factors restrain the growth of the commercial cooking equipment market. These include the significant initial investment needed for advanced and energy-efficient equipment, which can be a hurdle for smaller businesses. Moreover, the industry's reliance on traditional cooking methods in some regions and sectors limits the adoption of modern cooking technologies. Economic uncertainties and fluctuations in raw material prices also impact market growth by affecting consumer spending and manufacturing costs. Additionally, the shortage of skilled labor to operate and maintain sophisticated cooking equipment presents a challenge to market expansion. Furthermore, regulatory hurdles and compliance requirements related to safety and emissions standards can impede market growth by increasing operational complexities and costs for manufacturers and operators.Top of Form

Commercial Cooking Equipment Market Opportunities:

The commercial cooking equipment market offers numerous opportunities for growth and innovation. One significant area is the development of cost-effective, user-friendly, and energy-efficient cooking solutions to address the growing demand for sustainability. Incorporating advanced technologies such as IoT and AI allows manufacturers to create smart cooking equipment with enhanced features like remote monitoring and predictive maintenance. The trend towards customization in the foodservice industry also presents an opportunity for manufacturers to provide tailored solutions to meet specific customer needs. Furthermore, the increasing popularity of delivery and takeout services is driving demand for compact and mobile cooking equipment, opening up new market segments for manufacturers to explore.

Commercial Cooking Equipment Market Segmentation:

By Product Type:

- Broilers

- Cook-chill Systems

- Fryers

- Ovens

- Cookers

- Ranges

- Kettles

- Steamers

- Others

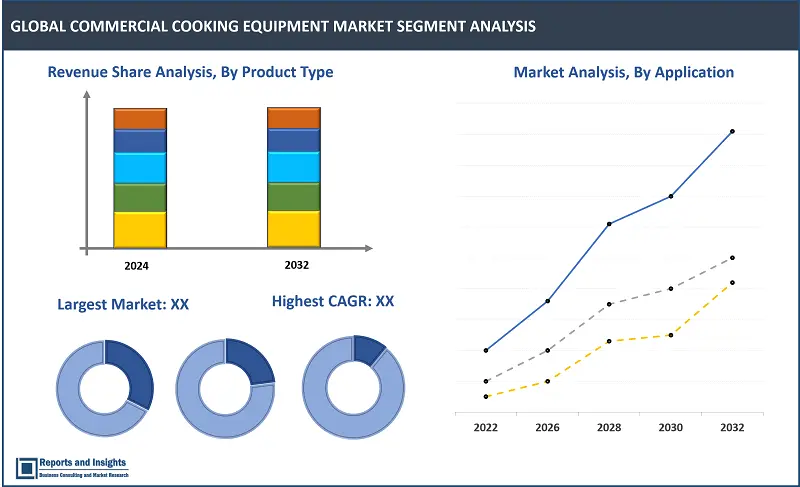

The product type segment is categorised into broilers, cook-chill systems, fryers, ovens, cookers, ranges, kettles, steamers and others. Among these, ovens stand out as a dominant sub-segment. They play a fundamental role in professional kitchens, enabling the cooking and baking of a wide range of dishes. Ovens offer versatility, with various types such as convection ovens, deck ovens, and conveyor ovens, each tailored to different cooking needs. They are essential for baking bread, pastries, and pizzas, as well as for roasting meats and vegetables, making them indispensable in restaurants, bakeries, and other foodservice establishments. Their efficiency, user-friendly design, and capacity to handle large volumes of food solidify their position as a leading product type in the commercial cooking equipment market.

By Applications:

- Full-Service Restaurants and Hotels

- Quick Service Restaurants

- Catering Services

The application segment is categorised into full-service restaurants and hotels, quick service restaurants, and catering services. Among these, full-service restaurants and hotels tend to dominate the commercial cooking equipment market due to their extensive and diverse cooking requirements. These establishments often need a wide array of equipment, including large-scale ovens, grills, fryers, and food preparation stations to accommodate varied menus and high customer volumes. Their focus on quality, presentation, and speed in food preparation drives the demand for specialized equipment like combi-ovens and commercial-grade refrigeration units. In contrast, quick-service restaurants and catering services, while also needing cooking equipment, typically require more standardized and efficiency-focused equipment such as fryers, griddles, and microwaves.

By Region:

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

North America stands out as a dominant region in the commercial cooking equipment market. This is primarily driven by the region's substantial hospitality industry, encompassing full-service restaurants, hotels, and catering services, all of which exhibit significant demand for commercial kitchen equipment. Moreover, the region's emphasis on food preparation quality and efficiency contributes to the requirement for advanced cooking technologies. Additionally, strict food safety regulations in North America necessitate the use of high-quality, dependable cooking equipment, further fueling market growth in this region.

Leading Commercial Cooking Equipment Manufacturers & Competitive Landscape:

The commercial cooking equipment market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Ali S.p.A

- Illinois Tool Works Inc.

- Duke Manufacturing Co. Inc.

- The Middleby Corporation

- Alto-Shaam, Inc.

- Edward Don & Company

- Fujimak Corporation

- Manitowac Company Inc.

- Rational AG and AB Electrolux.

- ACP, Inc.

- AMTek Microwaves

- Bizerba USA Inc.

- Caddy Corporation

- Duke Manufacturing Co.

- Electrolux AB

- R.M Kitchen Equipments Pvt. Ltd.

- RM GASTRO s.r.o.

Recent News and Development

- March 2024: V-Guard Consumer Products (VCPL), a wholly owned subsidiary of the company, has started commercial production of kitchen appliances.

Commercial Cooking Equipment Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

7.1% |

|

Segment covered |

Product type, applications and regions. |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Ali S.p.A, Illinois Tool Works Inc., Duke Manufacturing Co. Inc., The Middleby Corporation, Alto-Shaam, Inc., Edward Don & Company, Fujimak Corporation, Manitowac Company Inc., Rational AG and AB Electrolux., ACP, Inc., AMTek Microwaves, Bizerba USA Inc, Caddy Corporation, Duke Manufacturing Co, Electrolux AB, R.M Kitchen Equipments Pvt. Ltd. and RM GASTRO s.r.o. |

Frequently Asked Question

At what CAGR will the Commercial Cooking Equipment market expand?

The market is anticipated to rise at 7.1% through 2032.

How is the application segment is categorised commercial cooking equipment market?

The application segmented is categorised into full-service restaurants and hotels, quick service restaurants, and catering services.

Which region accounted for the largest market share in 2023?

North America region accounted for the largest market share in 2023

What are some key factors driving revenue growth of the commercial cooking equipment market?

Some key factors driving market revenue growth include rising demand in foodservice industry, increasing number of food outlets, technological advancements, and stringent food safety regulations.

What are some major challenges faced by companies in the commercial cooking equipment market?

Companies face challenges such as cost and pricing pressures, competition and market saturation, regulatory compliance and supply chain disruptions.

How is the competitive landscape in the commercial cooking equipment market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

What are the major players in the commercial cooking equipment market?

The major key players in commercial cooking equipment are Ali S.p.A, Illinois Tool Works Inc., Duke Manufacturing Co. Inc., The Middleby Corporation, Alto-Shaam, Inc., Edward Don & Company, Fujimak Corporation, Manitowac Company Inc., Rational AG and AB Electrolux., ACP, Inc., AMTek Microwaves, Bizerba USA Inc, Caddy Corporation, Duke Manufacturing Co, Electrolux AB, R.M Kitchen Equipments Pvt. Ltd. and RM GASTRO s.r.o.

What is the forecast period of market?

Market is forecasted from the year 2024 to 2032.