Market Overview:

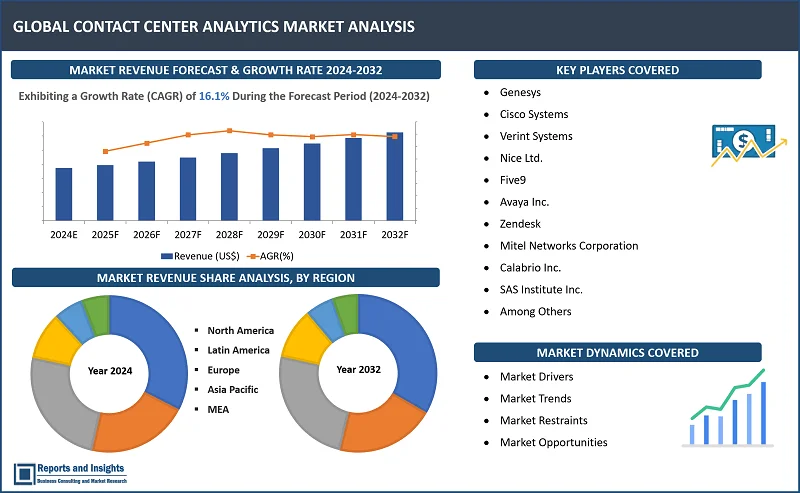

"As per Reports and Insights analysis, the contact center analytics market is estimated to be valued at USD 1.9 billion in 2024. The contact center analytics market is predicted to rise at a CAGR of 16.1% from 2024 to 2032. The global contact center analytics market is anticipated to reach USD 7.3 billion by 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

16.1% |

Contact center analytics refers to the systematic analysis of data generated within customer service operations to derive actionable insights and improve overall efficiency. Contact centers can process vast volumes of data generated through customer interactions, and extract valuable and insightful information to enhance decision-making and customer experience by leveraging advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics. These analytics tools enable organizations to track Key Performance Indicators (KPIs), identify trends, and optimize operational processes, ultimately leading to improved customer satisfaction and loyalty.

Benefits also include offering companies means to gain a deeper understanding of customer behavior, preferences, and sentiments, thereby allowing them to tailor services and products accordingly. Real-time monitoring enables swift issue resolution, reducing response times and enhancing customer interactions, and predictive analytics can also forecast customer needs, contributing to proactive problem-solving.

In terms of services, contact center analytics providers offer comprehensive solutions, including speech analytics, text analytics, and sentiment analysis. Key trends in the market include integration of omnichannel analytics to track customer interactions across various channels, growing use of AI-driven virtual assistants for customer engagement, and rising focus on actionable analytics that prioritize insights with direct impact on business outcomes.

Contact Center Analytics Market Trends and Drivers:

Rising focus on providing enhanced customer experiences is a primary factor driving the increasing adoption of contact center analytics. Organizations are leveraging these solutions and services to gain comprehensive insights into customer interactions, preferences, and sentiments, understand data and tailor their services. Also, addressing customer needs proactively, and delivering personalized experiences are keen focus areas to drive customer loyalty. Also, the steadily expanding volume and increasing complexity of customer data necessitates advanced analytics tools, and contact centers are oftentimes overwhelmed with data from diverse channels such as calls, emails, chats, and social media. Analyzing such a volume of information manually is impractical, making automated analytics solutions indispensable, and increasing awareness of the advantages and benefits, and speed and convenience are among other key factors driving adoption.

In addition, increasing adoption of AI and ML technologies is enhancing capability of contact center analytics by automating tasks, predicting customer behavior, and optimizing operational efficiency. AI-driven virtual assistants and chatbots are becoming integral components of contact centers and serving to enhance customer engagement and service delivery. Moreover, the imperative for businesses to remain competitive in a digital landscape is supporting inclining adoption of contact center analytics, and as companies recognize the strategic value of data-driven decision-making, analytics becomes a vital for staying ahead in the market.

Contact Center Analytics Market Restraining Factors:

A major challenge is investment required for implementing advanced analytics solutions, and some organizations may be deterred by the high upfront costs. Also, concerns about data security and privacy, especially given the sensitive nature of customer information handled in contact centers, is a key factor dampening wider adoption and preference. In addition, lack of skilled personnel with expertise in data analytics and AI is slowing down effective implementation and utilization of contact center analytics tools, further resulting in underutilization of the technology, and limiting its potential impact on business operations.

Another challenge is presence of legacy infrastructure and systems within many contact centers, which presents challenges in integrating advanced analytics solutions seamlessly. Outdated technology may require substantial upgrades or replacements, causing operational disruptions and further delaying adoption. Moreover, resistance to change and organizational inertia can impede the adoption of contact center analytics, and established processes and cultural resistance to new technologies can slow down decision-making and implementation processes.

Contact Center Analytics Market Opportunities:

Leading players in the global contact center analytics market have a number of opportunities to capitalize on in the evolving landscape and meet the growing demands of businesses. Increasing adoption of cloud-based contact center analytics solutions presents a significant opportunity, owing to capacity of this type of deployment offering scalability, flexibility, and cost-effectiveness, making it an attractive option for organizations looking to enhance their customer service capabilities without significant infrastructure investments. Also, the rising trend of omnichannel customer engagement creates opportunities for analytics providers to offer integrated solutions that can analyze data from various channels, providing a comprehensive view of customer interactions. As businesses strive to deliver seamless experiences across multiple touchpoints, analytics solutions that support omnichannel strategies become indispensable.

In addition, surge in demand for real-time analytics solutions is driven by need for immediate response to customer issues, improving overall service quality and customer satisfaction. This capability is particularly valuable in industries where timely actions significantly impact customer experience. Moreover, rapidly expanding use of AI-driven virtual assistants and chatbots in contact centers opens avenues for analytics providers to enhance these technologies further. Integrating analytics into virtual assistants can optimize their performance, improve decision-making, and personalize customer interactions. As data privacy concerns continue to rise, there is opportunity for analytics companies to develop and market solutions that prioritize robust security features. Addressing these concerns proactively can instill confidence in businesses and customers, and drive wider adoption of contact center analytics over the forecast period.

Contact Center Analytics Market Segmentation:

By Deployment Type

- On-Premises

- Cloud-Base

The cloud-based deployment segment is expected to account for largest revenue between 2024 and 2032. This projection is supported by increasing trend of organizations transitioning to cloud-based solutions due to their scalability and cost-effectiveness and elimination of the need for substantial upfront investments in infrastructure, making it an attractive option for businesses of all sizes. Also, the flexibility of cloud-based contact center analytics allows companies to easily scale their operations based on changing business requirements. The accessibility of real-time data from anywhere further enhances decision-making capabilities. As businesses prioritize agility and seek solutions that align with modern IT strategies, the cloud-based deployment model is expected to remain a dominant option well into the future.

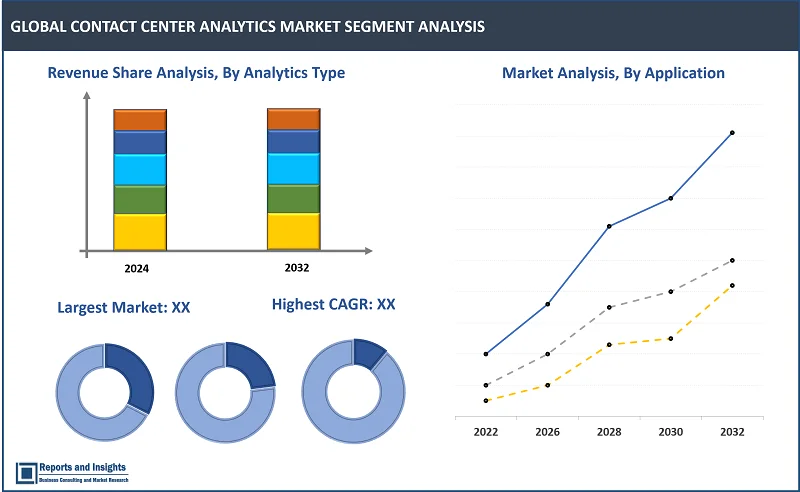

By Analytics Type

- Speech Analytics

- Text Analytics

- Predictive Analytics

The speech analytics segment is expected to maintain dominance in terms of revenue share among the analytics segments over the forecast period. This is attributed to increasing importance placed on understanding customer interactions and sentiments, and this technology allows organizations to extract valuable insights from spoken conversations, providing a comprehensive understanding of customer needs, preferences, and pain points. Steadily increasing volumes of voice-based customer interactions across various channels, including calls and virtual assistants, is expected to continue to necessitate rapid adoption of speech analytics, and as an increasing number of businesses are recognizing the advantages and benefits, demand is only expected to increase further.

By Application

- Customer Experience Management (CEM)

- Workforce Optimization

- Risk Management and Compliance

The Customer Experience Management (CEM) segment is projected to account for largest revenue share due to rising emphasis on delivering exceptional customer experiences as a strategic differentiator for businesses. CEM leverages analytics to gain insights into customer interactions across multiple channels, enabling organizations to optimize processes and personalize services. Investment in CEM solutions has been inclining significantly as businesses are recognizing the direct impact of customer satisfaction on brand loyalty and revenue, and by employing contact center analytics for customer experience management, companies can identify patterns, preferences, and pain points, enabling them to tailor services, predict customer needs, and foster long-term relationships.

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The large enterprises segment is expected to continue to account for largest revenue share compared to the SME segment, and this is attributed to the complexity and scale of operations in larger organizations necessitating need for advanced analytics solutions for efficient customer service management. Large enterprises typically handle a higher volume of customer interactions across diverse channels, making it imperative to leverage analytics for insights into customer behavior, operational efficiency, and workforce optimization.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

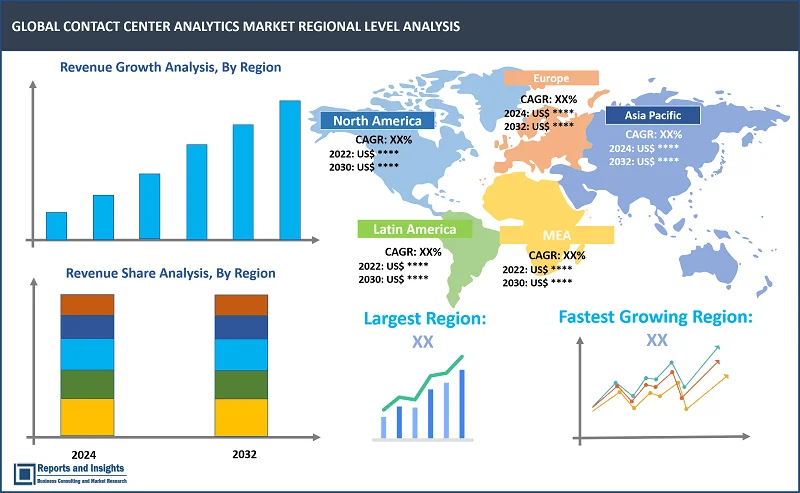

The global contact center analytics market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America has been a prominent market for contact center analytics, with the United States often leading in adoption. In Europe, the United Kingdom, Germany, and France have shown significant interest. Meanwhile, in Asia Pacific, countries such as India and China have been playing a major role in driving revenue growth of the overall market, and this trend is expected at a rapid pace.

Some common factors driving the growth of the global contact center analytics market include increasing emphasis on improving customer experiences, rising adoption of advanced technologies such as artificial intelligence and machine learning, and growing recognition of analytics as a strategic tool for enhancing operational efficiency and decision-making in customer service operations.

Leading Contact Center Analytics Providers & Competitive Landscape:

The competitive landscape in the global contact center analytics market is characterized by significantly high competition among leading companies striving to establish and maintain their positions. Key players in this market, such as Genesys, Cisco Systems, Verint Systems, and Nice Ltd., are adopting strategic initiatives to strengthen market presence and expand their consumer base. One prevalent strategy is to focus on continuous innovation to stay ahead in technology offerings, incorporating artificial intelligence and machine learning capabilities to provide more advanced analytics solutions. Also, companies are investing in strategic partnerships and collaborations to enhance their product portfolios and reach a broader audience. Mergers and acquisitions are also common strategies to consolidate market share and gain a competitive edge. In addition, commitment to customer-centric solutions and providing excellent support services are essential components of maintaining and expanding consumer bases in this dynamic market.

These companies include:

- Genesys

- Cisco Systems

- Verint Systems

- Nice Ltd.

- Five9

- Avaya Inc.

- Zendesk

- Mitel Networks Corporation

- Calabrio Inc.

- SAS Institute Inc.

Recent Development:

-

20 December 2023: Neptune Intelligence Computer Engineering (NICE) announced the launch of its ‘2023 CXone Fall Release’, enhancing Artificial Intelligence (AI) and automation and delivering extended cloud storage options to users. CXone is the company’s AI-powered interaction centric platform, which enables organizations to manage attended and unattended interactions effectively. As organizations seek to integrate AI and automation with CX operations, this enhanced version of CXone will further strengthen NICE’s leadership with unique capabilities that allow end-use organizations to stay ahead of competition in the digital era.

- June 2023: Verint Systems Inc., which is a customer engagement company, empowering 85% of ‘Fortune 100’ companies and numerous brands globally, demonstrated its newly launched platform − Open Contact Center as a Service (CCaaS), at the industry’s premier event ‘Engage 2023 customer conference’ held in Las Vegas. The company’s Open CCaaS Platform provides organizations with a foundation to choose the right option for contact centers. This next-generation platform delivers CX automation, while lowering the operating costs and enabling brands to achieve more enhanced contact center operations.

- February 2022: Neptune Intelligence Computer Engineering (NICE) Ltd. announced extension of the company’s collaboration with Google LLC with regards to CXone platform for Chrome Operating System (OS). NICE Ltd.’s highly secure and scalable platform is considered as an absolute solution for users with Chrome OS integrated devices, specifically designed for contact centers.

- January 2021: Infosys, announced launch of ‘Infosys Cortex’, which is a customer engagement platform. This platform leverages technology from Genesys Cloud Services, Inc., which is provider of contact center solutions and cloud customer experience, along with Contact Center AI services from Google Cloud and its managed Artificial Intelligence (AI) and analytics services.

Contact Center Analytics Market Research Scope:

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

16.1% |

|

Segment covered |

Deployment Type, Analytics Type, Application, Organization Size |

|

Regions Covered |

North America: The U.S. Canada Latin America: Brazil, Mexico, Argentina, Rest of Latin America Asia Pacific: China, India, Japan, Australia New Zealand, ASEAN, Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, Rest of Europe The Middle East Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and the Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Genesys, Cisco Systems, Verint Systems, Nice Ltd., Five9, Avaya Inc., Zendesk, Mitel Networks Corporation, Calabrio Inc., SAS Institute Inc |

Frequently Asked Question

What is the market size of the Contact Center Analytics Market in 2023?

The Contact Center Analytics Market size reached US$ 1.9 billion in 2023.

At what CAGR will the Contact Center Analytics Market expand?

The market is expected to register a 16.1% CAGR through 2024-2032.

Which are some of the market leaders in the contact center analytics market?

Some of the leading companies highlighted in the contact center analytics market report include Genesys, Cisco Systems, and Verint Systems.

What are some key factors driving revenue growth of the global contact center analytics market?

The revenue growth of the contact center analytics market is driven by factors such as the increasing demand for enhanced customer experiences, the adoption of advanced technologies like artificial intelligence and machine learning, and the growing recognition of analytics as a strategic tool for optimizing operational efficiency and decision-making in customer service operations.

What are some major challenges faced by companies in the contact center analytics market?

Companies in the contact center analytics market often face challenges such as high initial investment costs for implementing advanced analytics solutions, concerns related to data security and privacy, a shortage of skilled personnel, integration difficulties with legacy infrastructure, and resistance to change within organizations.

How is the competitive landscape in the global contact center analytics market?

The competitive landscape in the global contact center analytics market is characterized by intense rivalry among leading companies. Key players, including Genesys, Cisco Systems, Verint Systems, Nice Ltd., and others, engage in strategies like continuous innovation, partnerships, mergers and acquisitions, and a commitment to customer-centric solutions to maintain and expand their market positions.

How is the contact center analytics market segmented?

The market is segmented by deployment type (on-premises, cloud-based); analytics type (speech analytics, text analytics, predictive analytics); application (customer experience management, workforce optimization, risk management and compliance); organization size: (small and medium-sized enterprises (SMEs), large enterprises); and regions.

Who are the key players in the global contact center analytics market?

Key companies included in the global contact center analytics market report are Genesys, Cisco Systems, Verint Systems, Nice Ltd., Five9, Avaya Inc., Zendesk, Mitel Networks Corporation, Calabrio Inc., SAS Institute Inc.