Market Overview:

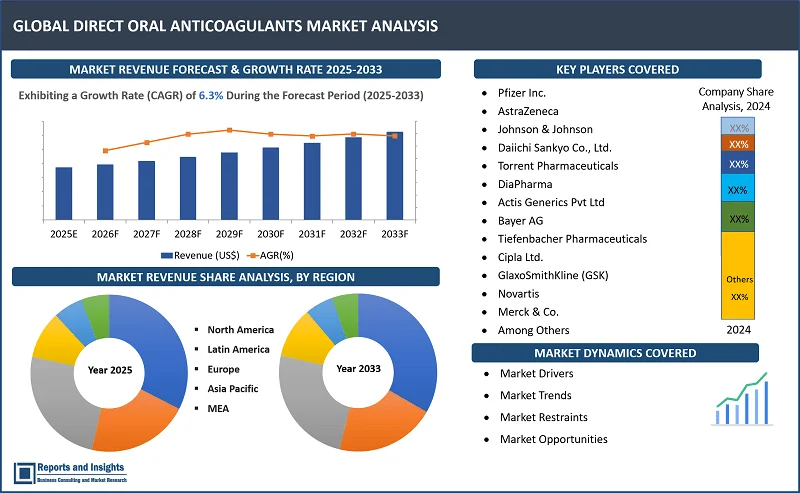

"The global direct oral anticoagulants market was valued at US$ 4,876.2 Million in 2024 and is expected to register a CAGR of 6.3% over the forecast period and reach US$ 8,450.5 Million in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Direct Oral Anticoagulants Market Growth Rate (2025-2033) |

6.3% |

Direct Oral Anticoagulants (DOACs) are the new class of drugs created to prevent and treat clots by directly inhibiting certain clotting factors of the coagulation cascade, such as thrombin (Factor IIa) or Factor Xa. DOACs do not require the same routine monitoring or the need for frequent dose adjustments like that with traditional anticoagulants, such as warfarin. DOACs are commonly used in the management of conditions such as atrial fibrillation, DVT, and PE to reduce the risk of stroke and other clot-related complications. They are characterized by predictable pharmacokinetics, fewer dietary restrictions, and a lower risk of certain side effects compared to older anticoagulants. Examples of DOACs include dabigatran, rivaroxaban, apixaban, and edoxaban.

The DOACs market is experiencing significant growth, driven by the increasing prevalence of atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE), requiring effective anticoagulant therapy. DOACs have increasingly been adopted due to their ease of use, the reduced need for monitoring, and a lower risk of complications as opposed to traditional anticoagulants such as warfarin. Advancements in healthcare systems, increasing awareness of thrombotic disorders, and an aging population with increased susceptibility to such conditions support the expansion of the market. Innovation, improved formulations, expanded therapeutic indications, and access in emerging markets are areas of focus for leading market players. However, high treatment costs and limited availability in some regions remain challenges to wider adoption.

Direct Oral Anticoagulants Market Drivers and Trends:

The Direct Oral Anticoagulants (DOACs) market is propelled by the increasing incidence of thromboembolic conditions such as atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE), along with the aging population's heightened susceptibility to these disorders. DOACs are gaining popularity due to their advantages over traditional anticoagulants like warfarin, including simplified usage, minimal need for routine monitoring, and fewer dietary limitations. Advancements in medical research are expanding their therapeutic applications, further fueling market growth.

Additionally, rising healthcare awareness and improved availability of anticoagulant therapies in emerging regions are supporting the market’s expansion. Notable trends include the development of reversal agents to enhance safety and the growing presence of affordable generic alternatives, which improve accessibility and address cost-related challenges globally.

Direct Oral Anticoagulants Market Restraining Factors:

The DOACs market faces several challenges. The biggest challenge is associated with high treatment costs, more so in low- and middle-income regions where prices are out of reach for these patients. Limited availability and lack of healthcare infrastructure prevent the wider adoption of DOACs in underdeveloped healthcare systems. Although this convenience saves patients from routine monitoring, safety issues arise for different patient groups, such as in the case of liver or renal impairments.

Moreover, the challenge from the traditional anticoagulants, particularly warfarin, due to its lower cost of care for most patients has continued to exist. Secondly, DOACs were relatively recently launched into the market, and the large safety data from long term usage is still being compiled, thus creating some concern for healthcare providers and patients and thus limited adoption of DOACs in the global market.

Direct Oral Anticoagulants Market Opportunities:

The DOACs market has significant growth opportunities, driven by the expansion of healthcare infrastructure in emerging markets and growing awareness of thromboembolic disorders. The availability of affordable generic alternatives will improve accessibility in cost-sensitive regions, further boosting adoption. Ongoing research is unlocking new therapeutic applications for DOACs, broadening their scope beyond existing indications. Personalized medicine emphasis creates an opportunity for DOAC therapies to be optimized for individual patients. Therefore, efficacy and safety may be improved.

Also, reversal agents specifically for managing emergencies in the setting of DOAC use can address the issues associated with safety and contribute towards increased acceptance. Therefore, these factors collectively offer an excellent growth prospect for DOACs market.

Direct Oral Anticoagulants Market Segmentation:

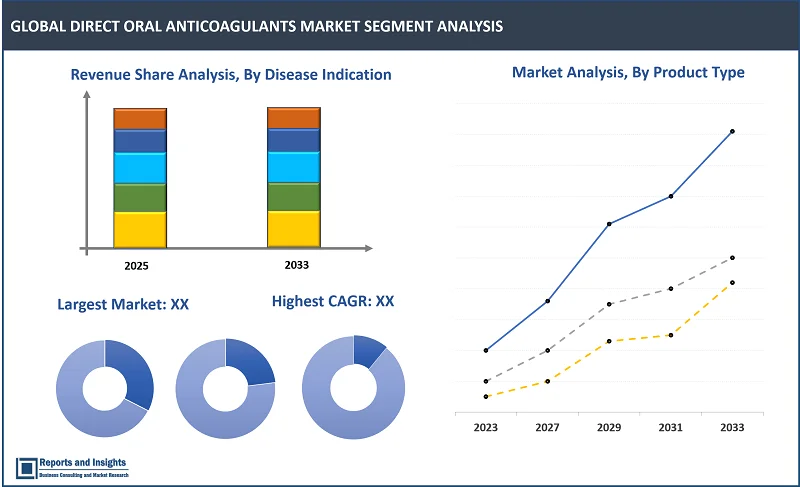

By Product Type

- Factor Xa Inhibitors

- Direct Thrombin Inhibitors

The Factor Xa Inhibitors sub-segment dominates the DOACs market due to their wide clinical usage and good safety profiles. Drugs such as rivaroxaban, apixaban, and edoxaban are used for atrial fibrillation, DVT, and PE. These drugs are popular because of their predictable pharmacokinetics, minimal monitoring requirement, and lower risk of bleeding compared to traditional anticoagulants. Even though Direct Thrombin Inhibitors such as dabigatran are effective, Factor Xa Inhibitors dominate the market in their range, with broad clinical evidence and acceptance among healthcare providers to support varied needs for the patient population.

By Disease Indication

- Atrial Fibrillation

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Heart Attacks

- Post-Surgical Thromboprophylaxis

- Others

In the DOACs market, the lead is Atrial Fibrillation because of the high prevalence of this condition and the effective reduction in stroke and thromboembolic risks with these patients, which is a key cause of stroke, and preferred DOACs are the ones such as apixaban and rivaroxaban due to the lack of requirement for minimal monitoring to prevent strokes. These apart, other requirements include those of Deep Vein Thrombosis or Pulmonary Embolism, or post-surgery thromboprophylaxis, and most prominently, atrial fibrillation drives the growth curve for DOACs.

By Patient Demographic

- Paediatric

- Adult

- Geriatric

The Adult sub-segment will dominate the DOACs market because of the higher incidence of thromboembolic conditions in this age group, for example, atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE). Adults and especially those with cardiovascular disease are the main users of DOACs for preventing stroke, anticoagulant therapy, and post-surgical thromboprophylaxis. While geriatric patients also contribute to the market demand due to their increased risk of clotting disorders, the adult population remains the largest consumer of DOACs given the widespread nature of these conditions among adults.

By Form

- Tables

- Capsules

In the market of DOACs, the Tablets sub-segment has the highest share since it is easy to use and has high convenience with maximum availability. Tablets are preferable in dosage form to the patients as they are easier to take, provide accurate dosing, and are also less expensive than capsules in many cases. Furthermore, tablets are prescribed for the largest number of indications including atrial fibrillation and DVT, thus gaining significant market share. Although capsules are also available, tablets are the preferred form because they are more widely accepted and practical in the treatment regimen of patients.

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hospital Pharmacies dominate the Direct Oral Anticoagulants (DOACs) market, as hospitals are generally at the forefront of prescribing and dispensing anticoagulants to patients diagnosed with atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE). Hospital pharmacies are the first point of contact for DOACs, especially for patients that require specialized care, like those undergoing post-surgical thromboprophylaxis or stroke prevention. Hospitals also provide a more controlled environment for the treatment of patients under anticoagulant therapies, thus enhancing the demand for DOACs through this sales channel, outperforming the retail and online pharmacies.

By Application

- Stroke Prevention

- Venous Thromboembolism Prevention

- Treatment of Acute Thrombotic Events

- Long-Term Prophylaxis

- Others

In the DOACs market, the Stroke Prevention sub-segment is also leading due to the prevalence of atrial fibrillation, which is one of the main causes of stroke. Apixaban and rivaroxaban, for instance, are being used to prescribe stroke prevention in atrial fibrillation patients with the alternative to traditional anticoagulants such as warfarin, and with a more effective and convenient course of treatment. This application is the driving force behind DOAC use because prevention of stroke is an important and well-understood therapeutic need. Even though other applications, such as prevention and treatment of acute thrombotic events by venous thromboembolism, contribute to the market, it is stroke prevention that primarily propels the DOACs market.

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Homecare Settings

- Others

In the Direct Oral Anticoagulants (DOACs) market, the hospitals sub-segment leads due to the pivotal role hospitals play in treating conditions like atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE), which require anticoagulant therapy. Hospitals are the primary environment for prescribing and administering DOACs, especially for patients needing urgent or specialized care, such as those undergoing surgery or managing acute thrombotic events. With access to advanced medical facilities and healthcare professionals, hospitals remain the dominant end-user of DOACs, driving the largest share of demand in the market.

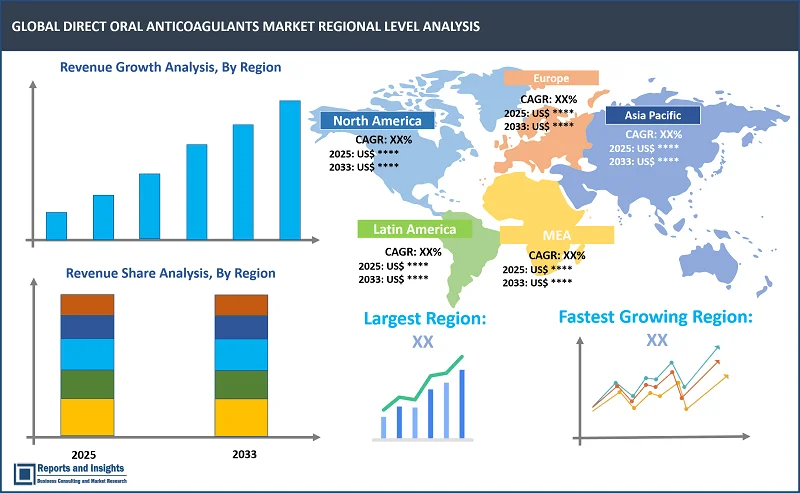

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

North America is the largest region in the Direct Oral Anticoagulants (DOACs) market, primarily led by the United States. The region's infrastructure for healthcare is more advanced, and patients are highly prone to such thromboembolic disorders as atrial fibrillation, deep vein thrombosis (DVT), and pulmonary embolism (PE), which makes its use more common. The high awareness of anticoagulant therapies, the robust pharmaceutical market, and easier access to newer treatments are all added advantages for North America, making it the region with the highest DOAC consumption.

Leading Companies in Direct Oral Anticoagulants Market & Competitive Landscape:

The direct oral anticoagulants market are highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Pfizer Inc.

- AstraZeneca

- Johnson & Johnson

- Daiichi Sankyo Co., Ltd.

- Torrent Pharmaceuticals

- DiaPharma

- Actis Generics Pvt Ltd

- Bayer AG

- Tiefenbacher Pharmaceuticals

- Cipla Ltd.

- GlaxoSmithKline (GSK)

- Novartis

- Merck & Co.

- Eli Lilly and Company

- Boehringer Ingelheim

- Teva Pharmaceuticals

- Mylan N.V.

- Eisai Co., Ltd.

- Among Others

Recent News and Development

- August 2024: Alembic Pharmaceuticals received final approval from the U.S. Food and Drug Administration for its 110 mg dabigatran etexilate capsules, a generic version of Boehringer Ingelheim's PRADAXA 110 mg capsules. These capsules are used to reduce the risk of pulmonary embolism and deep vein thrombosis after hip replacement surgery.

- July 2024: Adalvo obtained decentralized procedure (DCP) approval for its apixaban tablets, a generic version of Eliquis. Apixaban is commonly prescribed for the treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE).

Direct Oral Anticoagulants Market Research Scope

|

Report Metric |

Report Details |

|

Direct Oral Anticoagulants Market size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

6.3% |

|

Segment covered |

By Product type, Disease Indication, Form, Distribution Channel, Application, and End-User |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

U.K. |

|

Largest Market |

North America |

|

Key Players |

Pfizer Inc., AstraZeneca, Johnson & Johnson, Daiichi Sankyo Co., Ltd., Torrent Pharmaceuticals, DiaPharma, Actis Generics Pvt Ltd., Bayer AG, Tiefenbacher Pharmaceuticals, Cipla Ltd., GlaxoSmithKline (GSK), Novartis, Merck & Co., Eli Lilly and Company, Boehringer Ingelheim, Teva Pharmaceuticals, Mylan N.V., Eisai Co., Ltd., and among others |

Frequently Asked Question

What is the market size of the direct oral anticoagulants market in 2024?

The direct oral anticoagulants market size reached US$ 4,876.2 Million in 2024.

At what CAGR will the direct oral anticoagulants market expand?

The market is expected to register a 6.3% CAGR through 2025-2033.

How big can the global direct oral anticoagulants market be by 2033?

The market is estimated to reach US$ 8,450.5 Million by 2033.

What are some key factors driving revenue growth of the direct oral anticoagulants market?

Some key factors driving revenue growth include increasing prevalence of cardiovascular diseases, aging population, easier administration and convenience, clinical evidence and safety profile, expanding applications, patent expirations and generic competition, growing healthcare infrastructure in emerging markets.

What are some major challenges faced by companies in the direct oral anticoagulants market?

Major challenges include Intense Competition, High Development Costs, Adverse Effects, Cost Constraints in Emerging Markets, Regulatory Hurdles, Price Pressures, Need for Continuous Innovation and Educating Healthcare Providers.

How is the competitive landscape in the direct oral anticoagulants market?

The competitive landscape is characterized by the presence of several global and regional players. Companies compete on factors such as product quality, price, distribution network, and brand reputation. Innovation and marketing strategies play crucial roles in gaining market share.

How is the direct oral anticoagulants market report segmented?

The market report is segmented into product type, disease indication, form, distribution channel, application, and end-user.

Who are the key players in the direct oral anticoagulants market report?

Key players in the market report include Pfizer Inc., AstraZeneca, Johnson & Johnson, Daiichi Sankyo Co., Ltd., Torrent Pharmaceuticals, DiaPharma, Actis Generics Pvt Ltd., Bayer AG, Tiefenbacher Pharmaceuticals, Cipla Ltd., GlaxoSmithKline (GSK), Novartis, Merck & Co., Eli Lilly and Company, Boehringer Ingelheim, Teva Pharmaceuticals, Mylan N.V., Eisai Co., Ltd., and among others.