Market Overview:

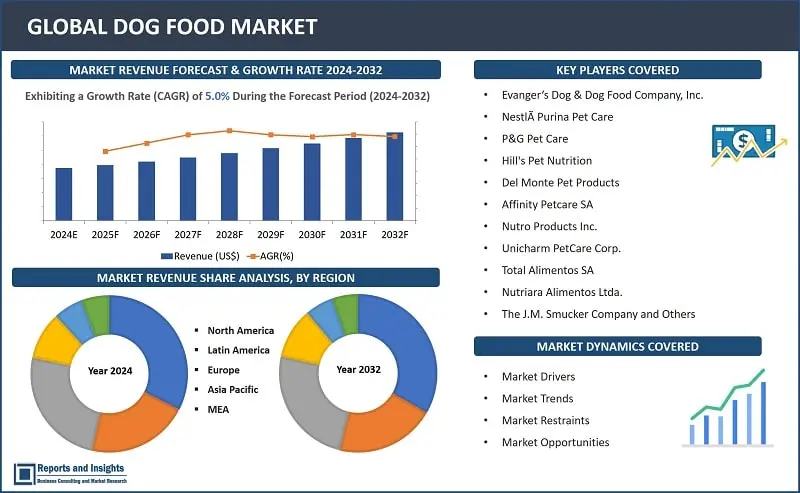

"The global dog food market was valued at US$ 46,721.3 million in 2024 and is expected to register a CAGR of 5.0% over the forecast period and reach US$ 72,480.1 million in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

5.0% |

Dog food is specifically formulated to meet the dietary requirements of domestic dogs, offering a complete and balanced source of nutrition with essential nutrients, vitamins, and minerals crucial for maintaining a dog's health. It is available commercially in dry kibble, canned wet food, and semi-moist options. These products are crafted to meet the nutritional needs of dogs throughout distinct life stages, which include puppyhood, adulthood, and the senior years.

The process of producing dog food involves a precise sequence of steps designed to craft products that are both safe and nutritionally well-balanced. It begins with the careful selection of high-quality ingredients, including proteins, carbohydrates, fats, vitamins, and minerals, followed by processing such as grinding and blending. In the case of dry kibble, extrusion is commonly used to shape, dry, and cool the mixture. For wet dog food, cooking is employed for safety and flavor enhancement. Additional nutrients and supplements are added, and the entire process is subject to rigorous quality control measures. The final product is packaged to maintain freshness, convey information to consumers, and comply with regulatory standards, ultimately reaching retailers or consumers. This comprehensive process ensures the production of dog food that meets strict nutritional requirements and safety standards.

The dog food market is a dynamic and diverse industry, offering a broad array of products to meet dogs' nutritional needs. It encompasses various options like dry kibble, canned wet food, and specialized diets, tailoring to the dietary requirements of dogs at different life stages. The rise in popularity of premium and organic dog food reflects a growing awareness among pet owners about the significance of providing high-quality nutrition for their canine companions. Emerging trends include grain-free and natural ingredients, with a heightened focus on formulations addressing specific health concerns or dietary restrictions in dogs. As consumers increasingly prioritize their pets' well-being, the dog food market is poised for continual innovation and expansion to meet evolving demands.

Dog Food Market Trends and Drivers:

The dog food market is undergoing significant transformations propelled by an increased focus on the health and well-being of pets. There's a growing preference among consumers for premium dog food choices, emphasizing natural ingredients and sparking a surge in demand for specialized diets such as grain-free, organic, and hypoallergenic options. Reflecting the trend of humanizing pets, products now incorporate superfoods and functional ingredients in alignment with contemporary human food preferences. Convenience is a notable driving force, leading to a rise in ready-to-eat and personalized meal plans tailored to the hectic lifestyles of pet owners. The integration of e-commerce has been instrumental, offering a convenient avenue for consumers to explore diverse product options and access relevant information. In summary, the dog food market is evolving towards sophisticated, nutritionally advanced offerings that cater to the changing preferences and concerns of discerning pet owners.

Dog food market growth is influenced by several factors which include the increasing focus on pet health and well-being has led to a rising demand for premium and specialized dog food options, with consumers specifically seeking natural ingredients and specialized dietary formulations like grain-free, organic, and hypoallergenic choices. The trend of humanizing pets has further fueled market growth, driving the incorporation of superfoods and functional ingredients in canine nutrition. Convenience is a significant driver, with a growing preference for ready-to-eat and customized meal solutions catering to the busy lifestyles of pet owners. Additionally, the pervasive impact of e-commerce has played a crucial role, providing consumers with convenient access to a diverse range of dog food products and information, contributing substantially to the overall expansion of the market.

Dog Food Market Restraining Factors:

The dog food industry faces a multitude of challenges, including regulatory constraints, intricacies in quality control, and the fluctuating nature of ingredient costs. Manufacturers encounter obstacles in complying with stringent regulatory standards, while the significance of quality control is heightened due to consumer preferences centered around pet health. Fluctuating global market dynamics influence ingredient prices, impacting both production costs and retail pricing, thereby affecting consumer affordability. Additionally, mainstream dog food brands face challenges arising from heightened consumer awareness of nutritional preferences and the growing popularity of specialized diets. Achieving equilibrium amidst these factors is imperative for industry players aiming to navigate a fiercely competitive landscape while meeting the dynamic expectations of consumers.

Dog Food Market Opportunities:

The dog food market offers substantial opportunities for companies seeking growth and innovation. The increasing trend of pet humanization has generated a growing demand for premium and specialized dog food products, establishing a unique market niche. Developing nutritionally advanced options that cater to the preferences of health-conscious pet owners provides avenues for expansion. Leveraging e-commerce platforms for direct-to-consumer sales and employing personalized marketing strategies enhances market reach. Additionally, integrating sustainable practices in dog food production aligns with the rising consumer awareness of environmental concerns, offering a pathway for differentiation and market penetration. Advancements in technology further create potential for incorporating smart and functional ingredients, fostering product innovation and differentiation in a competitive market landscape. Seizing these opportunities demands a proactive approach, staying informed about evolving consumer trends, and being responsive to the dynamic demands of the market.

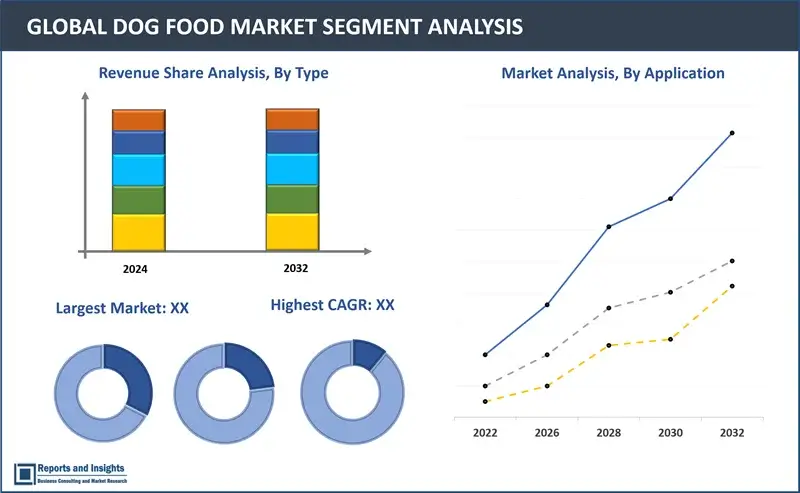

Dog Food Market Segmentation:

Reports and Insights provides an analysis of the key trends in each segment of the global dog food market report, along with forecasts at the global, regional, and country levels from 2024-2032. Our report has categorized the market based on by product, by ingredient type, by distribution channel and by region segments.

By Product

- Dry Food

- Wet Food

- Veterinary Diets

- Treats and Snacks

- Other Products

The dog food market encompasses a diverse range of products tailored to meet various pet dietary needs. Dry food, a popular and convenient option, is known for its extended shelf life and easy storage. Wet food, with its higher moisture content, offers a palatable alternative that appeals to pets with specific taste preferences. Veterinary diets address health concerns and medical conditions, providing specialized nutrition under professional guidance. Treats and snacks serve as indulgent rewards and training incentives, aligning with the trend of humanization in pet care. Other products include a broad spectrum of dietary supplements, meal toppers, and specialty items, reflecting the market's commitment to fulfilling the evolving demands of pet owners for diverse, high-quality, and personalized nutritional choices.

By Ingredient Type

- Animal-Derived

- Plant-Derived

- Cereals and Cereal Derivatives

- Insect- Derived

- Other Ingredient Types

The dog food market caters to diverse pet dietary preferences through various ingredient types. Animal-derived ingredients, like meat and poultry, form the foundation of protein-rich formulations crucial for canine health. Plant-derived components address the demand for vegetarian and vegan options, diversifying dietary choices. Cereals and cereal derivatives serve as essential carbohydrate sources, contributing energy and nutritional balance. The introduction of insect-derived ingredients aligns with sustainable practices, offering an alternative protein source. Other ingredient types encompass a range of additives, supplements, and novel components, showcasing the industry's commitment to innovation and meeting evolving nutritional expectations in a dynamic market landscape.

By Distribution Channel

- Specialized Pet Shops

- Supermarkets/Hypermarkets

- Online Channel

- Other Distribution Channels

Distribution channels for dog food encompass diverse options to accommodate the preferences of pet owners. Specialized pet shops provide a tailored selection and personalized guidance for a unique shopping experience. Supermarkets and hypermarkets offer convenient access to a broad range of mainstream dog food brands, catering to a wider audience. The online channel has gained popularity, providing a vast array of choices, detailed product information, and the convenience of home delivery. Other distribution channels may include veterinary clinics, boutique pet stores, and direct-to-consumer models, highlighting the industry's flexibility in reaching consumers through various avenues. The distribution landscape of the market reflects a balance between specialized, personalized service, and the convenience-driven choices of a diverse consumer base.

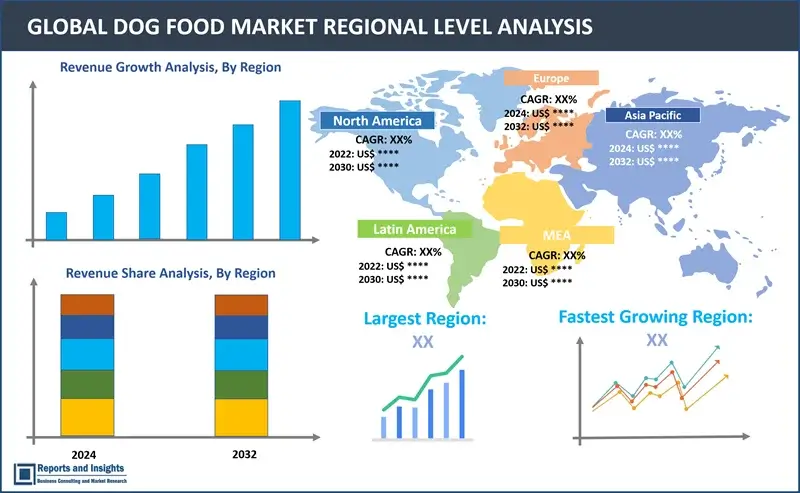

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The dog food market extends its reach globally, encompassing diverse regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe take the forefront in the dog food market, driven by elevated rates of pet ownership, a rising inclination toward humanizing pets, and a robust demand for premium and specialized pet nutrition. The Asia Pacific region is experiencing substantial growth, fueled by increasing disposable incomes, urbanization, and a heightened awareness of pet health and nutrition. Latin America is gaining momentum with a rising middle class and a cultural shift towards viewing pets as companions. The Middle East and Africa present untapped potential, marked by a growing pet population and a shifting consumer mindset towards prioritizing pet well-being. The global dog food market is shaped by regional intricacies influenced by cultural, economic, and demographic factors, contributing to a dynamic and evolving market landscape.

Leading Dog Food Manufacturers & Competitive Landscape:

The dog food market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Evanger’s Dog & Dog Food Company, Inc.

- Nestlà Purina Pet Care

- P&G Pet Care

- Hill's Pet Nutrition

- Del Monte Pet Products

- Affinity Petcare SA

- Nutro Products Inc.

- Unicharm PetCare Corp.

- Total Alimentos SA

- Nutriara Alimentos Ltda.

- The J.M. Smucker Company

- Dave's Pet Food

- Fromm Family Foods LLC

- Boulder Dog Food Company

- Real Pet Food Company Pty Ltd

- Burgess Group PLC

- Freshpet

- Party Animal, Inc.

- Rollover Pet Food Ltd.

Recent News and Developments

-

September 2024: Growel Group, a Seafood processor has entered the pet food market with the launch of its new brand Carniwel. Carniwel aims to provide high-quality nutrition for pets while maintaining affordable pricing.

-

June 2024: The ACANA pet food launched a new initiative called "Lights, Camera, Classics," designed to introduce their latest ACANA Classics recipes to American audiences. To highlight the premium ingredients used in these new dishes, they have embraced the classic outdoor movie experience, turning it into a dog-friendly event where dog owners can bring their furry friends to screenings in the park.

-

May 2024: Dr. Clauder's partnered with innovative protein producer Calysta to introduce the world's first dog treats formulated with FeedKind Pet protein, a new pet food ingredient. This collaboration marks a significant milestone in pet nutrition, offering pet owners a novel, sustainable, and high-quality protein source for their furry companions.

-

April 2024: General Mills completed its acquisition of Edgard & Cooper, a leading independent premium pet food brand in Europe. The acquisition aims to expand General Mills' pet food segment and further strengthen its commitment to the premium pet food category.

-

March 2024: GREENIES is a popular pet food brand announced the launch of its first-ever meal options, designed specifically for dogs. These new offerings provides a balanced, flavourful dining experience for canine companions.

-

January 2024: PawCo Foods introduced two new plant-based dog food products to their lineups. These products cater to the growing trend of pet owners seeking healthier and more sustainable food options for their furry friends. PawCo's plant-based dog food provides all the essential nutrients and flavours dogs need while reducing the environmental impact of traditional animal-derived diets.

-

November 2023: The Food and Drug Administration has announced an expansion of the recall for dog food from Mid America Pet Food, which is potentially contaminated with salmonella.

-

October 2023: Unicharm Corporation Group's subsidiary, Peparlet Co., Ltd., a manufacturer of pet care products for dogs and cats, has established a new facility in Shimada, Shizuoka Prefecture.

-

April 2022: Hill's Pet Nutrition Inc. has introduced a prescription diet pet food line, emphasizing new formulations and redesigned packaging. The product line aims to target specific pet health issues, incorporating a total of 66 dry and wet foods, along with dog treats, into the expanded portfolio.

-

April 2022: The Nutro Brand introduced its newest product line, Nutro So Simple, which provides nutritious dog food alternative featuring delicious meals and snacks crafted from a select few high-quality key ingredient sources.

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

5.0% |

|

Segment covered |

Product, ingredient type, distribution channel, and regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Evanger’s Dog & Dog Food Company, Inc., Nestlà Purina Pet Care, P&G Pet Care, Hill's Pet Nutrition, Del Monte Pet Products, Affinity Petcare SA, Nutro Products Inc., Unicharm PetCare Corp., Total Alimentos SA, Nutriara Alimentos Ltda., The J.M. Smucker Company, Dave's Pet Food, Fromm Family Foods LLC, Boulder Dog Food Company, Real Pet Food Company Pty Ltd, Burgess Group PLC, Freshpet, Party Animal, Inc. and Rollover Pet Food Ltd. |

Frequently Asked Question

At what CAGR will the dog food market expand?

The market is anticipated to rise at 5.0% CAGR through 2032.

What is the market revenue of dog food market in 2023?

The dog food market size reached US$ 44,531 million in the year 2023.

What are some key factors driving revenue growth of the dog food market?

Some key factors driving market revenue growth include rising demand for premium and natural nutrition, and rapid expansion of e-commerce platforms.

What are some major challenges faced by companies in the dog food market?

Companies face challenges such as regulatory constraints, intricacies in quality control, and the fluctuating nature of ingredient costs.

How is the competitive landscape in the global dog food market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

What are the potential opportunities for companies in the dog food market?

Companies can leverage opportunities such as e-commerce expansion, sustainability focus, premium and specialized products, and consumer awareness.

How is the dog food market segmented?

The market is segmented based on factors such as product, ingredient type, distribution channel and regions.

Who are the key players in dog food market?

Evanger’s Dog & Dog Food Company, Inc., Nestlà Purina Pet Care, P&G Pet Care, Hill's Pet Nutrition, Del Monte Pet Products, Affinity Petcare SA, Nutro Products Inc., Unicharm PetCare Corp., Total Alimentos SA, Nutriara Alimentos Ltda., The J.M. Smucker Company, Dave's Pet Food, Fromm Family Foods LLC, Boulder Dog Food Company, Real Pet Food Company Pty Ltd, Burgess Group PLC, Freshpet, Party Animal, Inc. and Rollover Pet Food Ltd.