Market Overview:

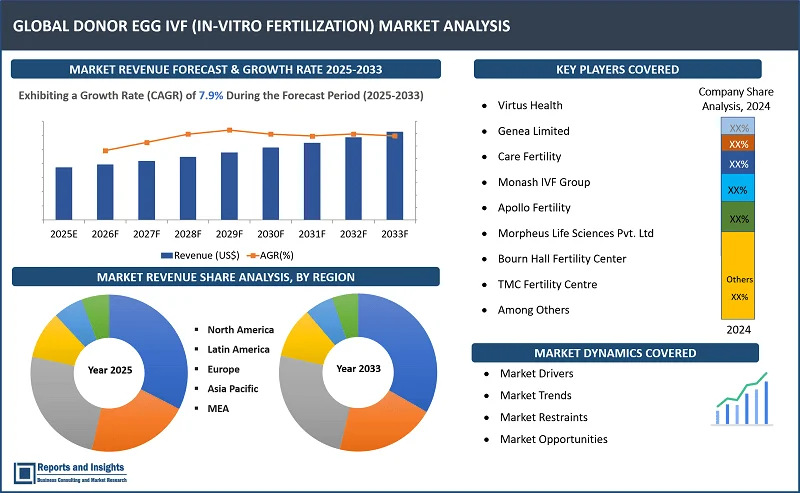

"The global donor egg IVF (In-Vitro Fertilization) market was valued at US$ 3.3 Billion in 2024 and is expected to register a CAGR of 7.9% over the forecast period and reach US$ 6.2 Billion in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Donor Egg IVF (In-Vitro Fertilization) Market Growth Rate (2024-2032) |

7.9% |

Donor Egg IVF is an advanced form of fertility treatment wherein the egg obtained from a healthy donor is fertilized with sperm in the laboratory to produce embryos that can then be implanted into the uterus of the recipient for the purpose of achieving pregnancy. It is often recommended for patients who are unable to achieve a pregnancy due to reduced ovarian reserve, genetic conditions, or age-related factors. Donor eggs are obtained from screened and healthy donors. This ensures that the gametes received are of high quality. In this process, the recipients can carry and care for the pregnancy themselves. Donor Egg IVF is a pathway to parenthood for those who cannot conceive using their own eggs, offering hope and new possibilities.

The Donor Egg IVF market is one of the growing sectors in the global fertility services industry, mainly due to increased infertility rates, delayed parenthood trends, and advancements in assisted reproductive technologies. Awareness about fertility treatments has increased while success rates of donor egg IVF have improved, leading to increased adoption among individuals and couples facing fertility challenges. Positive reimbursement policies in some geographies and availability of trustworthy donor egg banks further fuel the market. However, there are ethical concerns, high cost, and differences in regulations between countries. The growth in the market reflects the increased demand for innovative solutions to overcome infertility and achieve parenthood.

Donor Egg IVF (In-Vitro Fertilization) Market Drivers and Trends:

Factors driving the Donor Egg IVF market include increasing infertility due to lifestyle changes, childbearing at older ages, and medical conditions such as polycystic ovary syndrome (PCOS). Improved cryopreservation techniques and genetic screening in assisted reproductive technologies have increased the success rate, thereby fueling demand. Increased social acceptance of fertility treatments and government policies supporting such treatments in some countries are also fueling market growth. Key trends consist of cross-border reproductive care for economic treatment, the use of artificial intelligence in embryo choice, and the growth in donor egg banks with heterogeneous profiles to meet patient desires. Ethical and regulative considerations remain key drivers to influence market dynamics.

Donor Egg IVF (In-Vitro Fertilization) Market Restraining Factors:

The Donor Egg IVF market has several restraining factors, such as high treatment costs, which may limit access for many patients, especially in low-income regions. Ethical concerns and societal stigma associated with the use of donor eggs may also discourage potential recipients. Regulatory challenges, different laws in various countries, and the lack of standardized global guidelines complicate market operations and cross-border fertility services. Growth is also hindered in some regions by the lack of availability of diverse and well-screened donor eggs. Additionally, the physical and emotional stress of the procedure and the uncertainty of success rates may discourage people from going through donor egg IVF treatments.

Donor Egg IVF (In-Vitro Fertilization) Market Opportunities:

The Donor Egg IVF market has high growth opportunities driven by technological advancements in reproductive technologies and increasing global awareness of fertility treatments. Improving access to fertility services in emerging markets, driven by an increase in healthcare expenditure and infrastructural development, provides an enormous growth opportunity. Innovative applications such as artificial intelligence for embryo selection, more advanced genetic screening methods, and better cryopreservation techniques give fertility clinics a competitive advantage. Fertility tourism trends are growing because of price and accessibility advantages in regions. New revenue streams are unlocked by this factor. Apart from this, the fact that LGBTQ+ parenthood and single-parent families have gained acceptance has further increased customers for donor egg IVF. Expanding the egg donor database with a diverse ethnicity profile and a supportive legal framework can help overcome all these limitations, thus accelerating market growth. Collaboration between fertility clinics, biotech companies, and donor egg banks also provides opportunities for further growth and innovation in the dynamic sector.

Donor Egg IVF (In-Vitro Fertilization) Market Segmentation:

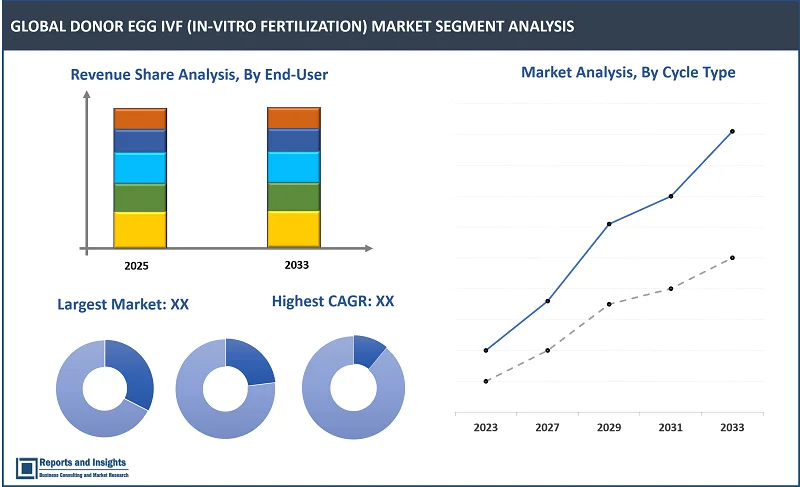

By Cycle Type

- Fresh Donar Egg IVF Cycle

- Frozen Donar Egg IVF Cycle

The frozen donor egg IVF cycle segment is dominating the Donor Egg IVF market due to its convenience, flexibility, and cost-effectiveness compared to fresh cycles. Frozen donor eggs are readily available through established egg banks, eliminating the need for synchronized cycles between the donor and recipient. Logistical complexities and waiting times are reduced with this process, making it more accessible to patients. Furthermore, the technique of cryopreservation, including vitrification, has improved survival rates in thawed eggs, and their success rates are now comparable with fresh cycles. The possibility of preserving unused embryos for use in future cycles further increases the attractiveness of frozen cycles, making them the market leaders.

By Pricing Model

- Pay-per cycle

- Bundled Package

Bundled package pricing is a model that dominates the Donor Egg IVF market because of cost transparency and perceived value. Bundled packages usually consist of multiple cycles, consultations, medications, and sometimes even embryo storage, providing a full solution to patients at a discounted price compared to the pay-per-cycle costs. Such a model appeals to patients who look for financial predictability and higher chances of success with multiple attempts. Moreover, the clinic offering the bundled package can attract more patients since repeated treatments bring financial stress, which this model helps eliminate. Pay-per-cycle models are always available to individuals who require flexibility, but affordability and inclusivity make the bundled package model the most popular choice for many.

By End-User

- Fertility Clinics

- Hospitals

- Surgical Centers

- Others

Fertility clinics end-user segment dominate the Donor Egg IVF (In-Vitro Fertilization) market as the major end-user segment. They are equipped with state-of-the-art reproductive technologies and provide individualized care, making them the most sought-after destinations for those requiring assisted reproductive treatments, including donor egg IVF. Fertility clinics have their major thrust on IVF procedures, and most clinics provide wide ranges of services that range from genetic screening to embryo freezing and egg donation. Their ability to make higher success rates due to resources dedicated to patient care places them in greater success compared to hospitals or surgical centers.

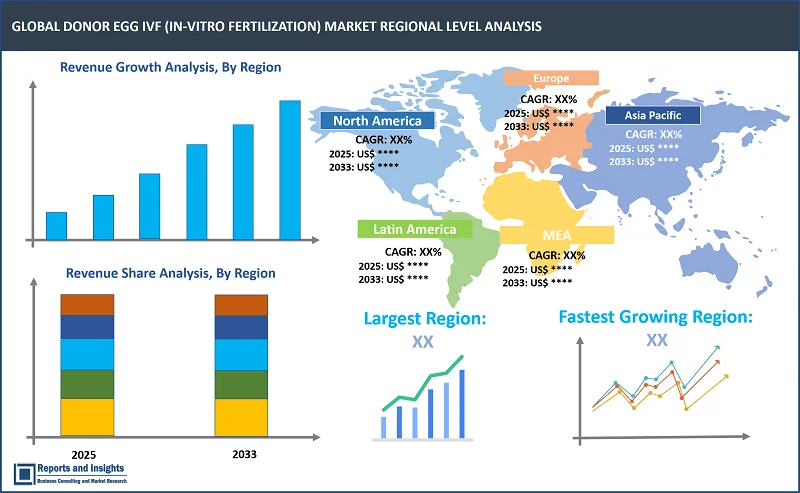

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

-

Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The Donor Egg IVF (In-Vitro Fertilization) market is mainly dominated by North America, and the United States holds a large share because of advanced healthcare infrastructure, high acceptance of third-party reproduction, and major players in the industry. The market is also highly dominated by Europe, due to the positive reimbursement policies and the prevalence of infertility treatments being on a higher side. The Asia-Pacific region also faces rapid growth, especially in countries such as China and India, through heightened awareness of fertility treatments, economic development, and supporting government initiatives. Regions, therefore, make the overall global landscape of Donor Egg IVF market.

Leading Companies in Donor Egg IVF (In-Vitro Fertilization) Market & Competitive Landscape:

The donor egg IVF (in-vitro fertilization) market are highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Virtus Health

- Genea Limited

- Care Fertility

- Monash IVF Group

- Apollo Fertility

- Morpheus Life Sciences Pvt. Ltd

- Bourn Hall Fertility Center

- TMC Fertility Centre

- Among Others

Recent News and Development

- February 2024: Fertility Centers of New England, Inc. acquired Fertility Solutions, a respected fertility clinic with locations in Massachusetts and Rhode Island. This acquisition is a significant step forward in FCNE's mission to expand patient access to advanced fertility treatments and increase its geographic presence.

- August 2023: Shady Grove Fertility launched a new Donor Egg Program, which now offers six eggs from a Shady Grove Fertility donor at a flat fee, whether the eggs are fresh or frozen, and additional eggs at a per-egg fee. Patients are assured of at least one blastocyst embryo, which is eligible. This initiative aims to increase customer satisfaction while boosting revenue for the company.

Research Scope

|

Report Metric |

Report Details |

|

Donor Egg IVF (In-Vitro Fertilization) Market size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

7.9% |

|

Segment covered |

By Cycle Type, Pricing Model, End-User, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

The U.K. |

|

Largest Market |

North America |

|

Key Players |

Virtus Health, Genea Limited, Care Fertility, Monash IVF Group, Apollo Fertility, Morpheus Life Sciences Pvt. Ltd, Bourn Hall Fertility Center and TMC Fertility Centre. |

Frequently Asked Question

What is the market size of the donor egg IVF (in-vitro fertilization) market in 2023?

The donor egg IVF (in-vitro fertilization) market size reached US$ 3.3 Billion in 2023.

At what CAGR will the donor egg IVF (in-vitro fertilization) market expand?

The market is expected to register a 7.9% CAGR through 2024-2033.

How big can the global donor egg IVF (in-vitro fertilization) market be by 2033?

The market is estimated to reach US$ 6.2 Billion by 2033.

What are some key factors driving revenue growth of the donor egg IVF (in-vitro fertilization) market?

Some key factors driving revenue growth include rising infertility rates, advancements in IVF technologies, growing awareness and acceptance, economic growth, availability of egg donor banks, fertility tourism and supportive government policies.

What are some major challenges faced by companies in the donor egg IVF (in-vitro fertilization) market?

Major challenges include high costs of technology, regulatory compliance, aging infrastructure, lack of skilled labor, inaccurate detection, environmental and operational factors, pressure to reduce downtime, cost vs. effectiveness.

How is the competitive landscape in the donor egg IVF (in-vitro fertilization) market?

The competitive landscape is characterized by the presence of several global and regional players. Companies compete on factors such as product quality, price, distribution network, and brand reputation. Innovation and marketing strategies play crucial roles in gaining market share.

How is the donor egg IVF (in-vitro fertilization) market report segmented?

The market report is segmented into cycle type, pricing model, end-user, and regions.

Who are the key players in the donor egg IVF (in-vitro fertilization) market report?

Key players in the market report include Virtus Health, Genea Limited, Care Fertility, Monash IVF Group, Apollo Fertility, Morpheus Life Sciences Pvt. Ltd, Bourn Hall Fertility Center and TMC Fertility Centre.