Market Overview:

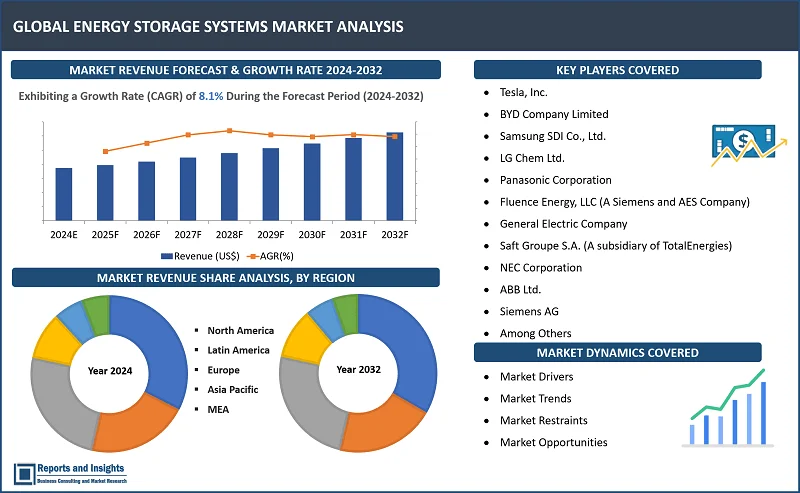

"As per Reports and Insights analysis, the energy storage system (ESS) market is estimated to be valued at USD 248.7 billion in 2024, and is projected to register a CAGR of 8.1% in terms of revenue from 2024 to 2032. The global energy storage system (ESS) market is anticipated to reach USD 501.3 billion by 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

8.1% |

Energy Storage Systems (ESS) offer diverse solutions, such as grid balancing, peak shaving, and backup power during outages, all of which play a key role in the modern energy landscape by addressing the intermittent nature of renewable energy sources and enhancing grid reliability. Various technologies make up an ESS, including lithium-ion batteries, thermal systems, pumped hydro storage, flywheels, and compressed air energy storage. ESS batteries are typically used for storage of energy generated from solar, wind, and renewable energy sources. Battery Energy Storage System or BESS is a type of electrochemical ESS, and comprises batteries to store electric energy as chemical energy, which is then converted back to an electrical form when needed. BESS is also one of many sub-categories of the broad ESS framework and can also integrate renewable energy sources such as solar and wind.

Ongoing technological advancements have been resulting in increased efficiency, longer lifespans, and reduced costs, making these systems more economically viable for wider adoption. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in ESS management optimizes energy storage performance, predicting demand patterns and enhancing overall efficiency. Steady traction of distributed energy systems and the electrification of transportation are driving further demand for ESS, and the rising global focus on sustainability and the transition towards clean energy sources are key factors expected to continue to support revenue growth of the ESS market over the forecast period.

Energy Storage Systems Market Trends and Drivers:

Among the key factors driving market growth are increasing integration of renewable energy sources, such as solar and wind, necessitating need for efficient energy storage solutions to address inherent intermittency. An ESS enables storing excess energy during periods of availability, enabling a reliable and continuous power supply during periods of low renewable energy generation.

Advancements in ESS technologies, particularly the declining costs of lithium-ion batteries, have significantly enhanced the economic viability of energy storage solutions. This has been prompting rising investments in large-scale energy storage projects, making ESS an attractive option for utilities and grid operators seeking to optimize energy resources and improve overall grid resilience. Also, high focus on reducing dependence on fossil fuel, rapid traction of smart grid electrification, shift towards electrification in transportation, including inclining adoption of Electric Vehicles (EVs) currently, are factors driving demand for energy storage systems and solutions worldwide. ESS plays a pivotal role in supporting EV charging infrastructure, managing grid impact, and ensuring seamless energy availability for the expanding fleet of electric vehicles and some among these trends are expected to maintain momentum going ahead.

In addition, rising concerns related to grid stability and the need for reliable backup power during outages are driving incline in deployment of ESS in a number of developed countries. This is particularly crucial in regions prone to extreme weather events, where resilient energy storage systems contribute to enhanced grid resilience and disaster preparedness. Moreover, government incentives, regulatory support, and rising focus on sustainable energy practices are creating a favorable environment for ESS adoption. Policies promoting energy storage deployment, coupled with ambitious renewable energy targets, are accelerating the global transition towards a more sustainable and resilient energy infrastructure. For example, governments in various countries are amending electricity rules or regulations, and focus in high integrating energy storage systems as a part of the power system.

Energy Storage Systems Market Restraining Factors:

A major restraining factor for businesses and utilities is the high upfront costs associated with implementing ESS technologies, despite the long-term benefits offered. This can partly be attributed to factors such as lack of effective standardization, providers of these systems manufacturing their own batteries to fit a specific need at the time, and changing project requirements necessitating replacement of entire existing battery systems adding up to substantial costs. Regulatory challenges and a lack of standardized frameworks for integrating ESS into existing energy infrastructure is also a key factor contributing significantly to hesitancy among stakeholders. Uncertain and evolving regulatory environments create a level of unpredictability, deterring potential investors and slowing down adoption rates.

Also, technological limitations and concerns about the environmental impact of certain energy storage technologies, such as rare earth materials in batteries, pose challenges. Overcoming these technical and environmental hurdles can be complex and time is essential for gaining broader acceptance. In addition, economic uncertainties and the current global economic climate may lead to budget constraints, diverting funds away from ESS projects. Another key factor is insufficient awareness and education about the benefits of ESS, which is restraining potential positive sentiment in public and private sectors.

Energy Storage Systems Market Opportunities:

Increasing demand for electric vehicles presents a substantially lucrative opportunity for players in the market currently. ESS can play a pivotal role in supporting EV charging infrastructure, ensuring a reliable power supply, and addressing concerns about grid impact. Also, the integration of ESS in microgrids offers majorly lucrative revenue avenues, especially in a number of developed countries, through optimizing energy distribution, enhancing grid resilience, and supporting remote or off-grid communities.

The smart city trend also presents opportunities for facilitation of energy management in urban environments, contributing to sustainability goals and improving overall energy efficiency. Companies offering ESS systems and solutions can focus on partnerships and collaborations with utilities for grid-scale energy storage projects to aid utilities in managing peak demand, reducing transmission losses, and enhancing grid stability. In addition, advancements in technology, such as the development of next-generation batteries, present opportunities for innovation and differentiation. As companies, existing and new entrants, continue to invest in research and development, breakthroughs in energy storage materials and designs can position such entities at the forefront in terms of market competitiveness.

Energy Storage Systems Market Segmentation:

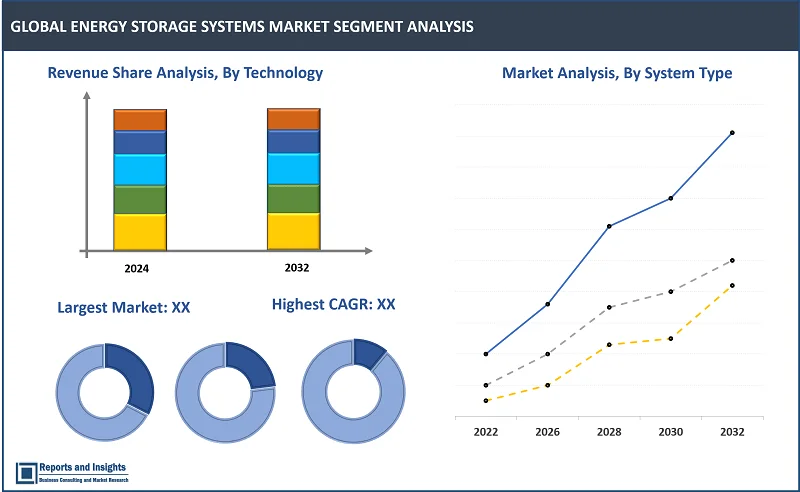

By Technology

- Lithium-Ion Batteries

- Pumped Hydro Storage

- Flywheels

- Compressed Air Energy Storage

Among the technology segments, the lithium-ion batteries segment is expected to account for the largest revenue share, owing to high performance advantages. Also, continuous advancements in lithium-ion batteries, such as increased energy density and longer cycle life, make this technology a preferred choice for grid-scale and distributed energy storage projects, contributing to the dominant position in terms of revenue share of this segment.

By Application

- Grid Balancing

- Peak Shaving

- Backup Power

- Renewable Integration

The grid balancing segment is projected to account for largest revenue share over the forecast period. This is substantiated by the increasing need for managing the variability and intermittency of renewable energy sources, and grid balancing applications play a crucial role in stabilizing power supply, optimizing energy distribution, and ensuring grid reliability. As the integration of renewable energy sources continues to incline, the demand for effective grid balancing solutions using ESS is expected to increase, driving significant revenue growth of this segment.

By End-User

- Utilities

- Commercial & Industrial

- Residential

- Transportation

The utilities segment is expected to continue to maintain dominance in terms of revenue share among the end-user segments over the forecast period. Increasing reliance on energy storage for grid stability, peak demand management, integration of renewable energy, and need for utilities to optimize power distribution, reduce transmission losses, and enhance overall grid resilience are driving investments in large-scale energy storage projects currently.

By System Type

- Centralized Storage Systems

- Distributed Storage Systems

- Residential Storage Systems

- Utility-Scale Storage Systems

The utility-scale storage systems segment is expected to account for largest revenue share among the system type segments in the global Energy Storage Systems (ESS) market. This projection is fortified by the escalating demand for large-scale energy storage solutions to meet the requirements of grid operators and utilities. Utility-scale ESS offers enhanced grid flexibility, peak demand management, and support for renewable integration, and as the global transition to sustainable energy accelerates, the deployment of utility-scale storage projects is expected to increase significantly in future.

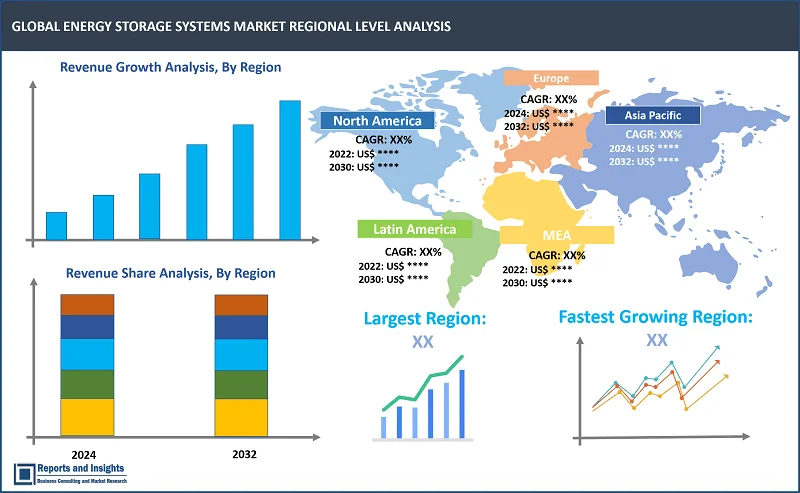

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global Energy Storage Systems (ESS) market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America has been a prominent player, with the United States leading in ESS deployments due to high focus on renewable energy integration, grid modernization, and supportive policies. In Europe, countries such as Germany and the United Kingdom have been at the forefront of ESS adoption, driven by ambitious renewable energy targets and energy transition initiatives. In Asia Pacific, China and South Korea have demonstrated strong growth, influenced by commitment to clean energy and advancements in manufacturing. Some common factors driving overall growth of markets in these regions include renewable energy integration, grid modernization, and supportive government policies and incentives.

Leading Energy Storage Systems and Services Providers & Competitive Landscape:

The competitive landscape in the global Energy Storage Systems (ESS) market is dynamic, marked by the presence of key players implementing various strategies to maintain and enhance their positions while expanding consumer bases. Leading companies are focusing on research and development to advance ESS technologies, aiming for higher efficiency, longer lifespans, and reduced costs. Strategic collaborations and partnerships with utilities, technology firms, and other stakeholders enable these companies to leverage complementary expertise and broaden market reach.

Also, investments in manufacturing capabilities contribute to economies of scale, lowering production costs and enhancing competitiveness. Some companies also adopt a diversified product portfolio approach, offering a range of ESS solutions to cater to different applications and end-users. As the market matures, education initiatives highlighting the benefits of ESS and addressing potential barriers become crucial strategies to expand consumer awareness and drive adoption.

These companies include:

- Tesla, Inc.

- BYD Company Limited

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Panasonic Corporation

- Fluence Energy, LLC (A Siemens and AES Company)

- General Electric Company

- Saft Groupe S.A. (A subsidiary of TotalEnergies)

- NEC Corporation

- ABB Ltd.

- Siemens AG

- Hitachi, Ltd.

- EnerSys

- Greensmith Energy (A Wärtsilä Company)

- Doosan GridTech, Inc.

Recent Development:

-

January 2024: Grenergy entered into a strategic agreement with BYD Company Limited for deployment of 1.1 GWh large-scale energy storage systems. Under this collaboration, BYD will supply 2,136 units of its MC Cube ESS model, known for safety, extended lifespan, and high performance due to the Blade battery technology. Grenergy will deploy these systems in the initial and subsequent phases of the Oasis de Atacama project. This project, with a total investment of US$1.4 billion and a global capacity of 4.1 GWh and 1 GW solar, stands as the world's largest energy storage initiative, and the first phase is set to be operational by 2024, followed by the second in 2025.

- December 2023: LG Energy Solution Vertech unveiled plans for 10 GWh of grid-scale BESS projects in the US for 2024. These projects consist of 10 integrated battery energy storage systems, although specific details about their locations, sizes, and durations remain unspecified. The lithium-ion batteries for all projects will be supplied by LG Energy Solution, while LG Energy Solution Vertech will handle hardware integration, system controls software, and related services. The deployment of the AEROS software suite across all sites will offer end-users onsite supervisory and control services along with cloud-based access to performance analytics.

Energy Storage Systems (ESS) Market Research Scope:

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

8.1% |

|

Segment covered |

Technology, Application, End-User, System Type |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market in Asia Pacific |

China |

|

Key Players |

Tesla, Inc., BYD Company Limited, Samsung SDI Co., Ltd., LG Chem Ltd., Panasonic Corporation, Fluence Energy, LLC (A Siemens and AES Company), General Electric Company, Saft Groupe S.A. (A subsidiary of TotalEnergies), NEC Corporation, ABB Ltd., Siemens AG, Hitachi, Ltd., EnerSys, Greensmith Energy (A Wärtsilä Company), Doosan GridTech, Inc. |

Frequently Asked Question

What is the market size of the Energy Storage Systems (ESS) market in 2024?

The Energy Storage Systems (ESS) market is estimated to reach US$ 248.7 billion by 2024 end.

At what CAGR will the Energy Storage Systems (ESS) market expand?

The market is expected to register a CAGR of 8.1% through 2024-2032.

Who is a leader in the Energy Storage Systems (ESS) market

Tesla Inc. is a leader in the market as of ranking among the leading energy storage integration system companies worldwide by market share.

What are some key factors driving revenue growth of the Energy Storage Systems (ESS) market?

Some key factors are increasing integration of renewable energy sources, advancements in ESS technologies, rising demand for electric vehicles, grid modernization initiatives, and supportive government policies promoting sustainability.

What are some major challenges faced by companies in the Energy Storage Systems (ESS) market?

Companies in the ESS market face challenges such as high initial costs, regulatory uncertainties, and technological limitations. The economic viability of large-scale storage projects, standardization issues, and concerns about the environmental impact of certain storage technologies are additional hurdles.

How is the competitive landscape in the Energy Storage Systems (ESS) market?

The competitive landscape in the ESS market is dynamic, with key players implementing strategies like research and development, strategic collaborations, partnerships, and investments in manufacturing capabilities. Diversified product portfolios, customer education initiatives, and a focus on advancing ESS technologies are common strategies. The market is characterized by established players like Tesla, BYD, and LG Chem, as well as collaborations between technology and utility companies to address evolving energy needs.

How is the Energy Storage Systems (ESS) market report segmented?

The Energy Storage Systems (ESS) market report is segmented on the basis of Technology (Lithium-Ion Batteries, Pumped Hydro Storage, Flywheels, Compressed Air Energy Storage); Application (Grid Balancing, Peak Shaving, Backup Power, Renewable Integration); End-User (Utilities, Commercial & Industrial, Residential, Transportation); and System Type (Centralized Storage Systems, Distributed Storage Systems, Residential Storage Systems, Utility-Scale Storage Systems).

Who are the key players in the Energy Storage Systems (ESS) market report?

Key players in the Energy Storage Systems (ESS) market report include Tesla, BYD, Samsung SDI, LG Chem, Panasonic, Fluence Energy, General Electric, Saft Groupe, NEC, ABB, Siemens, Hitachi, EnerSys, Greensmith Energy, and Doosan GridTech.