Market Overview:

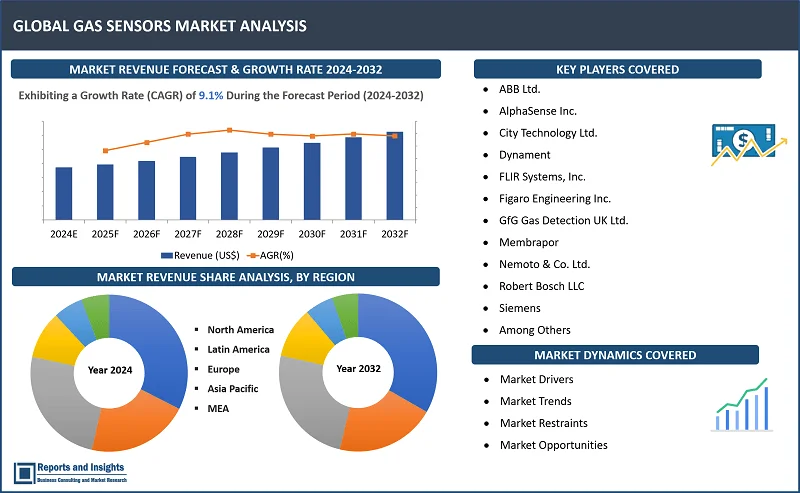

"The global gas sensors market was valued at US$ 2.8 Billion in 2023 and is expected to register a CAGR of 9.1% over the forecast period and reach US$ 6.1 Billion in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Gas Sensors Market Growth Rate (2024-2032) |

9.1% |

Gas sensors are important components that help detect and monitor different gaseous substances in industries, environment, residential buildings among others. Examples of gases detected by gas sensors include carbon dioxide, methane and volatile organic compounds (VOCs). They ensure safety at workplaces, adherence to regulations and environmental protection. Gas sensors have been able to change the global market scenario owing to their widespread use across different sectors, technological innovations and increasing environmental concerns.

In technical environments, gas sensors helps in tracking emissions, find leaks or monitor the safety of the working conditions. They are extensively utilized in manufacturing domains such as oil extraction and refinery as well chemical industry so as to prevent accidents while at the same time conforming international air quality standards. Moreover with the advent of smart factories together with Industry 4.0 gas sensors have become part of automatic control systems able to perform real-time tracking or analytical examination of data in order to optimize operations while minimizing risks.

Moreover, environmental monitoring has seen a rise in the use of gas detectors. Across the globe, different governments as well as organizations constantly seek to mitigate air pollution and tackle climate change. Gas sensors play an important role in this as they help detect bad pollutants and greenhouse gases, thus enabling people to monitor air quality. This information is critical in developing regulations and laws meant to mitigate environmental hazards.

Furthermore, there are more gas detectors these days among homeowners for security reasons in their houses. The increasing concern for indoor air quality together with home security has made smart home gadgets and systems incorporate gas sensors. These instruments have ability of recognizing dangerous gasses such as carbon mono-oxide thus alerting residents so that they can act accordingly towards creating safe living places.

In recent times, several technological advancements in gas sensors technologies have made it more effective. For instance, they have become smaller, more sensitive, and energy competent due to inventions made in areas like nanotechnology, MEMS (Micro-Electro-Mechanical Systems), and wireless communication for them. This has supported their use in different types of equipment and mechanisms starting from portable air quality monitors to more complex industrial control systems.

In conclusion, gas sensors are evidently revolutionizing worldwide markets especially when it comes to health protection, compliance with regulations and safeguarding environmental resources. The global safety as well as monitoring frameworks are being revamped by integrating these into industry, nature and home settings spurred on by technological progress together with greater awareness.

Gas Sensors Market Trends and Drivers:

Miniaturization as well as wireless capabilities are some of the important market drivers which has led to the creation of smaller, more efficient, and portable gas sensors. These innovations has helped in seamless integration of gas sensors into a multitude of devices and machines by enhancing their capabilities and application scope. Communication technologies including IoT (Internet of Things) or sophisticated wireless protocols serve these sensors for data transmission in real time so that remote monitoring and control can be facilitated. This capability is particularly important in industrial and environmental applications where detecting toxic gases from a safe distance is crucial for ensuring safety and compliance.

Apart from that, the rising concerns and awareness regarding environment along with stricter regulations on emissions and air quality standards is further fuelling the demand for gas sensors across the world. In particular, oil and gas, manufacturing as well as chemical industries depends prominently on gas sensors to monitor and manage emissions, preventing hazardous leaks and ensuring worker safety. The residential market is also on the rise due to a greater emphasis on maintaining good indoor air quality (IAQ) and enhancing home security through use of gas detectors in intelligent home setups.

Gas Sensors Market Restraining Factors:

The complexity of manufacturing gas sensors for a particular industry can pose as a major concern in the market. Customizing sensors to meet the precise requirements of various sectors—such as automotive, oil and gas, and healthcare—demands significant research and development efforts, which can be time-consuming and costly.

Also, high production costs tend to have a negative effect on the market growth since advanced gas sensors require cutting-edge technologies like nanomaterials and MEMS which are generally expensive. Besides that, budget restraints and economic fluctuations may lead to reduced investments in these technologies thus slowing the overall market growth.

Gas Sensors Market Opportunities:

Rise in the usage of Internet of Things (IoT), cloud computing and big data technologies portrays major opportunities for the global gas sensors market. The Internet of Things (IoT) integration facilitates real-time, remote monitoring and control on gas sensors which makes them more efficient and applicable in a variety of sectors. Cloud computing helps in storing and assessing the information collected from the sensors for timely and precise insights. Also, big data analytics enhances gas detection systems which results in higher safety as well as operational performance with the help of preemptive maintenance. These technological advancements will not only broaden the uses of gas sensors but can also create opportunities to tap into new markets and industries, thereby promoting innovation and growth in the industry.

Gas Sensors Market Segmentation

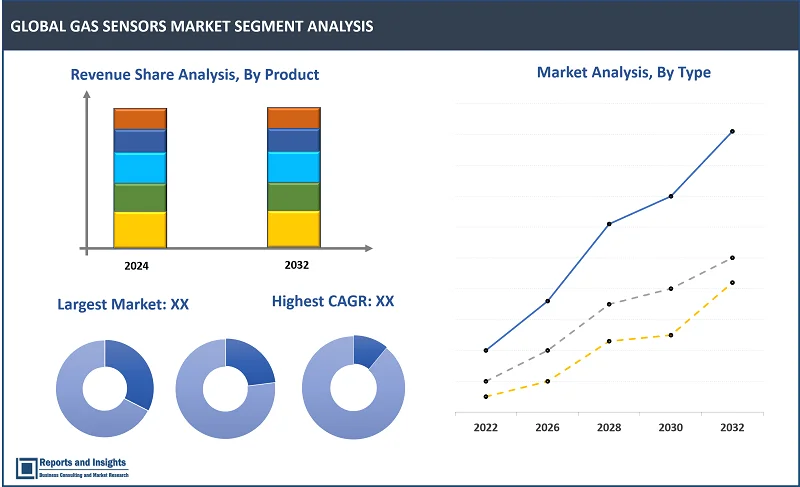

By Product

- Oxygen (O2)/Lambda Sensors

- Carbon Dioxide (CO2) Sensors

- Carbon Monoxide (CO) Sensors

- Nitrogen Oxide (NOx) Sensors

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, and Hydrogen Sulfide)

The carbon dioxide (CO2) sensors segment dominates the market and accounted for the biggest share of the global revenue. Carbon dioxide sensors are primarily used for monitoring indoor air quality in homes, office buildings, automotive, healthcare, and other applications. Numerous companies are focusing on developing MEMS-based carbon dioxide sensors for various applications.

By Type

- Wireless

- Wired

The wired segment dominates the market and accounted for the highest share of the global revenue. The wired gas sensors offer advantages, such as compact size, low maintenance, low cost, and higher accuracy. In several situations, wired sensors are among the most reliable systems as they directly link the sensor to the device receiving the input, making them suitable for use in mines, oil rigs, and nuclear power plants. Additionally, the growing adoption of wired gas sensors in residential applications is a significant factor responsible for segment growth.

By Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

The electrochemical segment dominates the market and accounted for the biggest share of the global revenue. The demand for electrochemical sensors is soaring as these sensors use lesser power, have essentially safer operations, and offer improved specificity to the target gas. Electrochemical technology can detect toxic gas concentration with the oxidation of target gas in the electrode and offers efficient measurement of the resultant current.

By End-Use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

The industrial segment dominates the market and accounted for the biggest share of the global revenue. Industrial gas sensors are used to monitor and detect hazardous vapours and gases and trigger visual and audible alarms. Numerous gas sensor manufacturers are focusing on developing miniature industrial gas sensors.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global gas sensors market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific dominates the market and accounted for the significant share of the global revenue. Rise in awareness about the impact of air pollutants on human health across the countries in the Asia Pacific, such as India and China, is accelerating the demand for gas sensors for air quality monitoring. Continued urbanization in the region is also contributing to the increasing demand for gas sensors. Moreover, the governments in the Asia Pacific regions are investing heavily in smart city projects, thus creating significant potential for smart sensor devices.

Leading Gas Sensors Manufacturers & Competitive Landscape:

The competitive landscape of the global gas sensors market is marked by intense rivalry among the leading players who are adopting diverse strategies to maintain and expand their market share. Leading companies are investing heavily in research and development to innovate and introduce advanced sensor technologies. They are also emphasizing on strategic partnerships, mergers, and acquisitions to enhance their product portfolios and expand their global reach. Also, market leaders are leveraging IoT and AI to develop smart, connected sensors that offer real-time monitoring and predictive maintenance capabilities, thereby addressing evolving customer demands and regulatory requirements.

These companies include:

- ABB Ltd.

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- FLIR Systems, Inc.

- Figaro Engineering Inc.

- GfG Gas Detection UK Ltd.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- Among Others

Recent Development:

- July 2024, In a ground-breaking development for the field of gas leak detection, ION Sciences Ltd unveiled the SF6 LEAKCHECK P1 XTL, innovative solution which is purpose-built to tackle a critical customer problem; identifying SF6 and C4-FN leaks with unmatched precision and efficiency.

- September 2023, DOD Technologies released the ChemLogic Revive CL4R Four-Point Toxic Gas Detection System designed to upgrade and replace fixed four-point legacy monitors. This advanced gas detector was specially engineered to retrofit into existing monitor racks, seamlessly replacing and upgrading older units. With no required modifications, the CL4R provides upfront cost savings without the need for additional installation and integration.

Gas Sensors Market Research Scope

|

Report Metric |

Report Details |

|

Gas Sensors Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

9.1% |

|

Segment covered |

Product, Type, Technology, and End Use |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

ABB Ltd., AlphaSense Inc., City Technology Ltd., Dynament, FLIR Systems, Inc., Figaro Engineering Inc., GfG Gas Detection UK Ltd., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Siemens, and among others |

Frequently Asked Question

What is the market size of the gas sensors market in 2023

The gas sensors market size reached US$ 2.8 Billion in 2023.

At what CAGR will the gas sensors market expand?

The market is expected to register a 9.1% CAGR through 2024-2032.

Which is the fastest growing country in Europe?

Germany is the fastest growing country in Europe.

What are some key factors driving revenue growth of the gas sensors market?

Some key factors driving revenue growth are development of miniaturization and wireless capabilities, coupled with the improvements in the communication technologies that enable their integration into various devices and machines to detect toxic gases at a safe distance, among others.

What are some major challenges faced by adopters of gas sensors solutions?

Some key challenges include complexity of manufacturing gas sensors for a particular industry, high production costs, and among others.

How is the competitive landscape in the gas sensors market?

The competitive landscape of the global gas sensors market is marked by intense rivalry among the leading players who are adopting diverse strategies to maintain and expand their market share. Leading companies are investing heavily in research and development to innovate and introduce advanced sensor technologies.

How is the gas sensors market segmented?

The market report is segmented based on by product, type, technology, and end use.

Which top companies are included in the global gas sensors market report?

ABB Ltd., AlphaSense Inc., City Technology Ltd., Dynament, FLIR Systems, Inc., Figaro Engineering Inc., GfG Gas Detection UK Ltd., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Siemens, and among others