Market Overview:

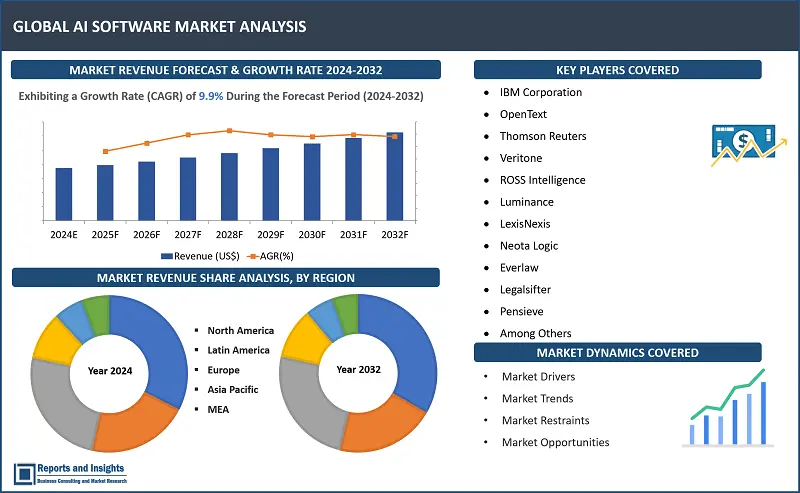

"The global legal AI software market size reached US$ 2.2 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 5.2 billion in 2032, exhibiting a growth rate (CAGR) of 9.9% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

9.9% |

Legal AI software is software that uses artificial intelligence (AI) to aid legal professionals in tasks such as legal research, document analysis, contract review, and predictive analytics. This technology automates repetitive processes, improving efficiency, accuracy, and cost-effectiveness in legal operations. It also offers insights and supports decision-making, enhancing productivity in law firms and legal departments.

The legal AI software market encompasses a range of AI-powered tools and platforms designed to enhance legal operations. These solutions assist legal professionals in tasks such as legal research, contract review, and document analysis, leading to improved efficiency and accuracy. The market is driven by the growing demand for automation in the legal sector, the need to reduce costs, and the increasing complexity of legal work. Key players in the market offer innovative solutions that leverage machine learning and natural language processing to provide valuable insights and streamline legal work flows.

Legal AI Software Market Trends and Drivers:

The legal AI software market is primarily fueled by the increasing demand for automation and efficiency in legal operations, leading to cost reductions and improved accuracy. Another significant driver is the growing complexity of legal work, which requires advanced tools for tasks like research, document analysis, and contract review. Additionally, the rise of big data and the need for data-driven insights in legal decision-making are driving the adoption of AI technology in the legal sector. Key market trends include the development of AI solutions tailored to specific legal tasks, such as e-discovery and due diligence, as well as the integration of AI with other technologies like blockchain and cloud computing to enhance security and scalability.The legal AI software market growth is influenced by several factors which include the increasing demand for automation and efficiency in legal operations, which leads to cost reductions and improved accuracy. Another significant factor is the growing complexity of legal work, which requires advanced tools for tasks such as research, document analysis, and contract review. Additionally, the rise of big data and the need for data-driven insights in legal decision-making are driving the adoption of AI technology in the legal sector. Furthermore, the market is influenced by the development of AI solutions tailored to specific legal tasks, such as e-discovery and due diligence, as well as the integration of AI with other technologies like blockchain and cloud computing to enhance security and scalability.

Legal AI Software Market Restraining Factors:

Several factors act as restraints on the growth of the legal AI software market. These include concerns regarding data privacy and security, given that AI involves the processing and analysis of sensitive legal information. Additionally, there is a lack of awareness and understanding among legal professionals regarding the capabilities and benefits of AI technology, which hampers adoption. Moreover, the high initial investment needed for implementing AI solutions and the complexity of integrating AI with existing legal systems pose challenges to market growth. Furthermore, regulatory uncertainties and the potential for AI to replace certain legal jobs also contribute to restraining the market's growth.Legal AI Software Market Opportunities:

The legal AI software market offers numerous opportunities for expansion and advancement. One key area of opportunity is the rising demand for AI-driven solutions that enhance legal operations, boost efficiency, and lower costs. With legal work becoming increasingly complex, there is a growing need for advanced tools for tasks like legal research, document analysis, and contract review, creating a significant market opening. Additionally, integrating AI with other technologies such as blockchain and cloud computing presents further opportunities to enhance security, scalability, and functionality. Moreover, developing AI solutions tailored to specific legal tasks, along with expanding AI into new areas like regulatory compliance and risk management, provides avenues for market growth and innovation.

Legal AI Software Market Segmentation:

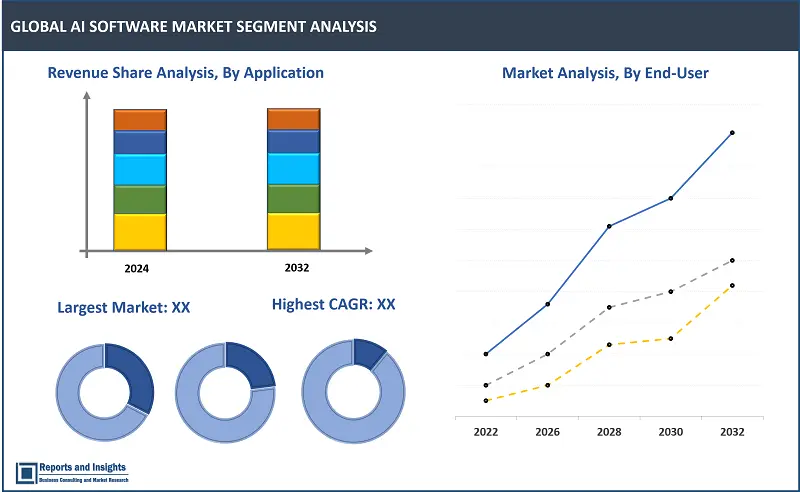

By Application

- eDiscovery

- Legal Research

- Contract Management

- Compliance

- Case Prediction

- Others

By Services

- Professional Services

- Managed Services

In the legal AI software market, professional services are currently the dominant service offering. These services encompass consulting, implementation, training, and support for legal AI software, assisting law firms and legal departments in effectively integrating and optimizing AI technologies. Professional services providers offer expertise in selecting the appropriate AI solutions, tailoring them to specific requirements, and ensuring seamless implementation and adoption. Managed services, which involve outsourcing the management of AI software and related infrastructure, are also gaining traction as organizations aim to streamline operations and focus on core legal activities, relying on external experts to manage their AI systems.

By Deployment

- Cloud

- On-Premises

Cloud deployment is the prevailing choice in the legal AI software market, surpassing on-premises deployment. This trend is fueled by the scalability, accessibility, and cost-efficiency of cloud solutions, which align with the requirements of law firms and legal departments. Although on-premises deployment remains relevant in scenarios demanding stringent data control and compliance, cloud-based alternatives are preferred for their flexibility and ease of implementation, gaining momentum in the legal sector.

By Technology

- Machine Learning and Deep Learning

- Natural Language Processing

In the legal AI software market, Natural Language Processing (NLP) takes precedence over Machine Learning (ML) and Deep Learning (DL). NLP's proficiency in analyzing and comprehending human language is vital for applications like document summarization, contract analysis, and legal research, all crucial functions in the legal sector. Despite the importance of ML and DL in legal AI, NLP's unique ability to interpret text data and extract meaningful information positions it as the dominant technology in this market.

By End-Use

- Corporate Legal Departments

- Law Firms

- Others

Law firms have historically been the primary users of legal AI software, dominating the market. This is largely due to their extensive utilization of AI tools for tasks such as litigation support, e-discovery, and document analysis. These solutions enable law firms to efficiently process vast amounts of information, enhance legal research capabilities, and improve overall decision-making processes. Although corporate legal departments are also adopting AI solutions, especially for contract analysis, compliance management, and legal research, law firms remain the key drivers of demand in the legal AI software market.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

North America leads the global legal AI software market, driven by its robust technological infrastructure and widespread adoption of AI in the legal industry. The region shows a strong demand for AI solutions that streamline legal research, contract analysis, and litigation support. Following closely behind is Europe, where countries like the UK, Germany, and France are increasingly integrating AI into legal practices. In Asia Pacific, rapid digitalization and AI adoption in countries such as China, Japan, and India are fueling market growth. While Latin America, the Middle East, and Africa are also witnessing a gradual uptake of legal AI software, they are progressing at a slower pace due to regulatory complexities and the early stage of AI adoption in their legal sectors.

Leading Legal AI Software Manufacturers & Competitive Landscape:

The legal AI software market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to customers' evolving needs in terms of efficiency, performance, and sustainability.

These companies include:

- IBM Corporation

- OpenText

- Thomson Reuters

- Veritone

- ROSS Intelligence

- Luminance

- LexisNexis

- Neota Logic

- Everlaw

- Legalsifter

- Pensieve

- Cognitiv+

- Casetext

- Klarity

- Omni Software Systems

- Nalanda Technology

- LawGeex

- Kira

- CaseMine

Legal AI Software Market Research Scope:

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

9.9% |

|

Segment covered |

Application, services, deployment, technology, end-use and regions. |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

IBM Corporation, OpenText, Thomson Reuters, Veritone, ROSS Intelligence, Luminance, LexisNexis, Neota Logic, Everlaw, Legalsifter, Pensieve, Cognitiv+, Casetext, Klarity, Omni Software Systems, Nalanda Technology, LawGeex, Kira and CaseMine. |

1. Global Legal AI Software Market Report Overview

1.1. Introduction

1.2. Report Description

1.3. Methodology

2. Global Legal AI Software Market Overview

2.1. Introduction

2.1.1. Introduction

2.1.2. Market Taxonomy

2.2. Executive Summary

2.3. Global Legal AI Software Market Snapshot

2.4. Global Legal AI Software Market Size and Forecast, 2019–2027

2.4.1. Introduction

2.4.2. Market Value Forecast and Annual Growth Rate (AGR) Comparison (2019–2027)

2.5. Global Legal AI Software Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.5.4. Trends

2.6. Key Regulations

2.7. Porter’s Five Forces Model

3. Global Legal AI Software Market, By Application

3.1. Introduction

3.1.1. Annual Growth Rate Comparison, By Application

3.1.2. BPS Analysis, By Application

3.2. Market Revenue (US$Mn) Forecast, By Application

3.2.1. eDiscovery

3.2.2. Legal Research

3.2.3. Contract Management

3.2.4. Compliance

3.2.5. Case Prediction

3.2.6. Others

3.3. Global Legal AI Software Market Attractiveness Index, By Application

4. Global Legal AI Software Market, By Component

4.1. Introduction

4.1.1. Annual Growth Rate Comparison, By Component

4.1.2. BPS Analysis, By Component

4.2. Market Revenue (US$Mn) Forecast, By Component

4.2.1. Solutions

4.2.2. Services

4.3. Global Legal AI Software Market Attractiveness Index, By Component

5. Global Legal AI Software Market, By Solutions

5.1. Introduction

5.1.1. Annual Growth Rate Comparison, By Solutions

5.1.2. BPS Analysis, By Solutions

5.2. Market Revenue (US$Mn) Forecast, By Solutions

5.2.1. Software solutions

5.2.2. Platform

5.3. Global Legal AI Software Market Attractiveness Index, By Solutions

6. Global Legal AI Software Market, By Services

6.1. Introduction

6.1.1. Annual Growth Rate Comparison, By Services

6.1.2. BPS Analysis, By Services

6.2. Market Revenue (US$Mn) Forecast, By Services

6.2.1. Professional Services

6.2.2. Managed Services

6.3. Global Legal AI Software Market Attractiveness Index, By Services

7. Global Legal AI Software Market, By Deployment

7.1. Introduction

7.1.1. Annual Growth Rate Comparison, By Deployment

7.1.2. BPS Analysis, By Deployment

7.2. Market Revenue (US$Mn) Forecast, By Deployment

7.2.1. Cloud

7.2.2. On premises

7.3. Global Legal AI Software Market Attractiveness Index, By Deployment

8. Global Legal AI Software Market, By Technology

8.1. Introduction

8.1.1. Annual Growth Rate Comparison, By Technology

8.1.2. BPS Analysis, By Technology

8.2. Market Revenue (US$Mn) Forecast, By Technology

8.2.1. Machine Learning and Deep Learning

8.2.2. Natural Language Processing

8.3. Global Legal AI Software Market Attractiveness Index, By Technology

9. Global Legal AI Software Market, By End Userr

9.1. Introduction

9.1.1. Annual Growth Rate Comparison, By End Userr

9.1.2. BPS Analysis, By End Userr

9.2. Market Revenue (US$Mn) Forecast, By End Userr

9.2.1. Corporate Legal Departments

9.2.2. Law Firms

9.2.3. Others

9.3. Global Legal AI Software Market Attractiveness Index, By End Userr

10. Global Legal AI Software Market, By Region

10.1. Introduction

10.1.1. Annual Growth Rate Comparison, By Region

10.1.2. BPS Analysis, By Region

10.2. Market Revenue (US$Mn) Forecast, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East

10.2.6. Africa

10.3. Global Legal AI Software Market Attractiveness Index, By Region

11. North America Legal AI Software Market Analysis and Forecast, 2019–2027

11.1. Introduction

11.1.1. Annual Growth Rate Comparison, By Country

11.1.2. BPS Analysis, By Country

11.2. Market Revenue (US$Mn) Forecast, By Country

11.2.1. U.S. Legal AI Software Market

11.2.2. Canada Legal AI Software Market

11.3. North America Legal AI Software Market, By Application

11.3.1. eDiscovery

11.3.2. Legal Research

11.3.3. Contract Management

11.3.4. Compliance

11.3.5. Case Prediction

11.3.6. Others

11.4. North America Legal AI Software Market, By Component

11.4.1. Solutions

11.4.2. Services

11.5. North America Legal AI Software Market, By Solutions

11.5.1. Software Solutions

11.5.2. Platforms

11.6. North America Legal AI Software Market, By Services

11.6.1. Professional Services

11.6.2. Managed Services

11.7. North America Legal AI Software Market, By Deployment

11.7.1. Cloud

11.7.2. On premises

11.8. North America Legal AI Software Market, By Technology

11.8.1. Machine Learning and Deep Learning

11.8.2. Natural Language Processing

11.9. North America Legal AI Software Market, By End User

11.9.1. Corporate Legal Departments

11.9.2. Law Firms

11.9.3. Others

11.10. North America Legal AI Software Market Attractiveness Index

11.10.1. By Country

11.10.2. By Application

11.10.3. By Component

11.10.4. By Solutions

11.10.5. By Services

11.10.6. By Deployment

11.10.7. By Technology

11.10.8. By End User

12. Latin America Legal AI Software Market Analysis and Forecast, 2019–2027

12.1. Introduction

12.1.1. Annual Growth Rate Comparison, By Country

12.1.2. BPS Analysis, By Country

12.2. Market (US$Mn) Forecast, By Country

12.2.1. Brazil Legal AI Software Market

12.2.2. Mexico Legal AI Software Market

12.2.3. Argentina Legal AI Software Market

12.2.4. Rest of Latin America Legal AI Software Market

12.3. Latin America Legal AI Software Market, By Application

12.3.1. eDiscovery

12.3.2. Legal Research

12.3.3. Contract Management

12.3.4. Compliance

12.3.5. Case Prediction

12.3.6. Others

12.4. Latin America Legal AI Software Market, By Component

12.4.1. Solutions

12.4.2. Services

12.5. Latin America Legal AI Software Market, By Solutions

12.5.1. Software Solutions

12.5.2. Platforms

12.6. Latin America Legal AI Software Market, By Services

12.6.1. Professional Services

12.6.2. Managed Services

12.7. Latin America Legal AI Software Market, By Deployment

12.7.1. Cloud

12.7.2. On premises

12.8. Latin America Legal AI Software Market, By Technology

12.8.1. Machine Learning and Deep Learning

12.8.2. Natural Language Processing

12.9. Latin America Legal AI Software Market, By End User

12.9.1. Corporate Legal Departments

12.9.2. Law Firms

12.9.3. Others

12.10. Latin America Legal AI Software Market Attractiveness Index

12.10.1. By Country

12.10.2. By Application

12.10.3. By Component

12.10.4. By Solutions

12.10.5. By Services

12.10.6. By Deployment

12.10.7. By Technology

12.10.8. By End User

13. Europe Legal AI Software Market Analysis and Forecast, 2019–2027

13.1. Introduction

13.1.1. Annual Growth Rate Comparison, By Country

13.1.2. BPS Analysis, By Country

13.2. Market (US$Mn) Forecast, By Country

13.2.1. U.K. Legal AI Software Market

13.2.2. Germany Legal AI Software Market

13.2.3. Italy Legal AI Software Market

13.2.4. France Legal AI Software Market

13.2.5. Spain Legal AI Software Market

13.2.6. Russia Legal AI Software Market

13.2.7. Poland Legal AI Software Market

13.2.8. BENELUX Legal AI Software Market

13.2.9. NORDIC Legal AI Software Market

13.2.10. Rest of Europe Legal AI Software Market

13.3. Europe Legal AI Software Market, By Application

13.3.1. eDiscovery

13.3.2. Legal Research

13.3.3. Contract Management

13.3.4. Compliance

13.3.5. Case Prediction

13.3.6. Others

13.4. Europe Legal AI Software Market, By Component

13.4.1. Solutions

13.4.2. Services

13.5. Europe Legal AI Software Market, By Solutions

13.5.1. Software Solutions

13.5.2. Platforms

13.6. Europe Legal AI Software Market, By Services

13.6.1. Professional Services

13.6.2. Managed Services

13.7. Europe Legal AI Software Market, By Deployment

13.7.1. Cloud

13.7.2. On premises

13.8. Europe Legal AI Software Market, By Technology

13.8.1. Machine Learning and Deep Learning

13.8.2. Natural Language Processing

13.9. Europe Legal AI Software Market, By End User

13.9.1. Corporate Legal Departments

13.9.2. Law Firms

13.9.3. Others

13.10. Europe Legal AI Software Market Attractiveness Index

13.10.1. By Country

13.10.2. By Application

13.10.3. By Component

13.10.4. By Solutions

13.10.5. By Services

13.10.6. By Deployment

13.10.7. By Technology

13.10.8. By End User

14. Asia Pacific Legal AI Software Market Analysis and Forecast, 2019–2027

14.1. Introduction

14.1.1. Annual Growth Rate Comparison, By Country

14.1.2. BPS Analysis, By Country

14.2. Market (US$Mn) Forecast, By Country

14.2.1. China Legal AI Software Market

14.2.2. India Legal AI Software Market

14.2.3. Japan Legal AI Software Market

14.2.4. Australia and New Zealand Legal AI Software Market

14.2.5. South Korea Legal AI Software Market

14.2.6. ASEAN Legal AI Software Market

14.2.7. Rest of Asia Pacific Legal AI Software Market

14.3. Asia Pacific Legal AI Software Market, By Application

14.3.1. eDiscovery

14.3.2. Legal Research

14.3.3. Contract Management

14.3.4. Compliance

14.3.5. Case Prediction

14.3.6. Others

14.4. Asia Pacific Legal AI Software Market, By Component

14.4.1. Solutions

14.4.2. Services

14.5. Asia Pacific Legal AI Software Market, By Solutions

14.5.1. Software Solutions

14.5.2. Platforms

14.6. Asia Pacific Legal AI Software Market, By Services

14.6.1. Professional Services

14.6.2. Managed Services

14.7. Asia Pacific Legal AI Software Market, By Deployment

14.7.1. Cloud

14.7.2. On premises

14.8. Asia Pacific Legal AI Software Market, By Technology

14.8.1. Machine Learning and Deep Learning

14.8.2. Natural Language Processing

14.9. Asia Pacific Legal AI Software Market, By End User

14.9.1. Corporate Legal Departments

14.9.2. Law Firms

14.9.3. Others

14.10. Asia Pacific Legal AI Software Market Attractiveness Index

14.10.1. By Country

14.10.2. By Application

14.10.3. By Component

14.10.4. By Solutions

14.10.5. By Services

14.10.6. By Deployment

14.10.7. By Technology

14.10.8. By End User

15. Middle East Legal AI Software Market Analysis and Forecast, 2019–2027

15.1. Introduction

15.1.1. Annual Growth Rate Comparison, By Country

15.1.2. BPS Analysis, By Country

15.2. Market (US$Mn) Forecast, By Country

15.2.1. GCC Countries Legal AI Software Market

15.2.2. Israel Legal AI Software Market

15.2.3. Oman Legal AI Software Market

15.2.4. Rest of Middle East Legal AI Software Market

15.3. Middle East Legal AI Software Market, By Application

15.3.1. eDiscovery

15.3.2. Legal Research

15.3.3. Contract Management

15.3.4. Compliance

15.3.5. Case Prediction

15.3.6. Others

15.4. Middle East Legal AI Software Market, By Component

15.4.1. Solutions

15.4.2. Services

15.5. Middle East Legal AI Software Market, By Solutions

15.5.1. Software Solutions

15.5.2. Platforms

15.6. Middle East Legal AI Software Market, By Services

15.6.1. Professional Services

15.6.2. Managed Services

15.7. Middle East Legal AI Software Market, By Deployment

15.7.1. Cloud

15.7.2. On premises

15.8. Middle East Legal AI Software Market, By Technology

15.8.1. Machine Learning and Deep Learning

15.8.2. Natural Language Processing

15.9. Middle East Legal AI Software Market, By End User

15.9.1. Corporate Legal Departments

15.9.2. Law Firms

15.9.3. Others

15.10. Middle East Legal AI Software Market Attractiveness Index

15.10.1. By Country

15.10.2. By Application

15.10.3. By Component

15.10.4. By Solutions

15.10.5. By Services

15.10.6. By Deployment

15.10.7. By Technology

15.10.8. By End User

16. Africa Legal AI Software Market Analysis and Forecast, 2019–2027

16.1. Introduction

16.1.1. Annual Growth Rate Comparison, By Country

16.1.2. BPS Analysis, By Country

16.2. Market (US$Mn) Forecast, By Country

16.2.1. South Africa Legal AI Software Market

16.2.2. Egypt Legal AI Software Market

16.2.3. North Africa Legal AI Software Market

16.2.4. Rest of Africa Legal AI Software Market

16.3. Africa Legal AI Software Market, By Application

16.3.1. eDiscovery

16.3.2. Legal Research

16.3.3. Contract Management

16.3.4. Compliance

16.3.5. Case Prediction

16.3.6. Others

16.4. Africa Legal AI Software Market, By Component

16.4.1. Solutions

16.4.2. Services

16.5. Africa Legal AI Software Market, By Solutions

16.5.1. Software Solutions

16.5.2. Platforms

16.6. Africa Legal AI Software Market, By Services

16.6.1. Professional Services

16.6.2. Managed Services

16.7. Africa Legal AI Software Market, By Deployment

16.7.1. Cloud

16.7.2. On premises

16.8. Africa Legal AI Software Market, By Technology

16.8.1. Machine Learning and Deep Learning

16.8.2. Natural Language Processing

16.9. Africa Legal AI Software Market, By End User

16.9.1. Corporate Legal Departments

16.9.2. Law Firms

16.9.3. Others

16.10. Africa Legal AI Software Market Attractiveness Index

16.10.1. By Country

16.10.2. By Application

16.10.3. By Component

16.10.4. By Solutions

16.10.5. By Services

16.10.6. By Deployment

16.10.7. By Technology

16.10.8. By End User

17. Recommendation

17.1. Market Strategy

18. Competitive Landscape

18.1. Competition Dashboard

18.2. List and Company Overview of Global Key Players

18.3. Company Profiles

18.3.1. IBM Corp.

18.3.1.1. Company Overview

18.3.1.2. Financial Overview

18.3.1.3. Application Portfolio

18.3.1.4. Key Developments

18.3.1.5. Business Strategies

18.3.2. OpenText

18.3.3. Thomson Reuters

18.3.4. Veritone

18.3.5. ROSS Intelligence

18.3.6. Luminance

18.3.7. LexisNexis

18.3.8. Neota Logic

18.3.9. Everlaw

18.3.10. Legalsifter

18.3.11. Pensieve

18.3.12. Cognitiv+

18.3.13. Casetext

18.3.14. Klarity

18.3.15. Omni Software Systems

18.3.16. Nalanda Technology

18.3.17. LawGeex

18.3.18. Kira

19. Acronyms

Frequently Asked Question

At what CAGR will the legal AI software market expand?

The market is anticipated to rise at 9.9% through 2032

What are some key factors driving revenue growth of the legal AI software market?

Some key factors driving legal AI software market revenue growth includes efficiency and cost savings, increased accuracy and risk reduction, growing demand for data-driven insights, rising complexity of legal work, and digital transformation in the legal sector

What is legal AI software?

Legal AI software, also known as legal tech or law tech, refers to technology solutions that use artificial intelligence (AI) and machine learning (ML) to streamline legal processes, improve efficiency, and provide insights for legal professionals.

What are some major challenges faced by companies in the legal AI software market?

Companies face challenges such as data privacy and security, integration with existing systems, regulatory compliance, skills gap, and cost and ROI.

How is the competitive landscape in the legal AI software market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

How is AI used in the legal industry?

AI is used in the legal industry in various ways, including contract analysis, legal research, e-discovery, case prediction, and document automation. These applications help lawyers and legal professionals save time, reduce costs, and make more informed decisions.

How much does legal AI software cost?

The cost of legal AI software varies depending on the provider, the features included, and the size of the firm or organization.

Who are the leading key players in legal AI software market?

The leading key players in the legal AI software market are IBM Corporation, OpenText, Thomson Reuters, Veritone, ROSS Intelligence, Luminance, LexisNexis, Neota Logic, Everlaw, Legalsifter, Pensieve, Cognitiv+, Casetext, Klarity, Omni Software Systems, Nalanda Technology, LawGeex, Kira and CaseMine.