Market Overview:

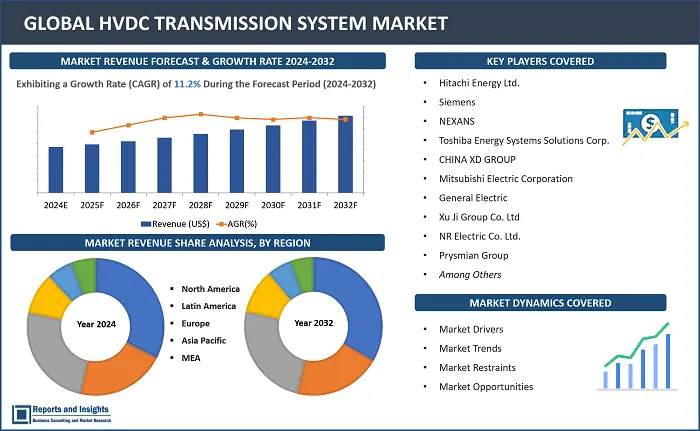

"The HVDC transmission system market size reached US$ 11.1 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 28.9 billion by 2031, exhibiting a growth rate (CAGR) of 11.2% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

XX% |

HVDC transmission system mainly use the direct current for the transmission of the power and transmits the power between the unsynchronized AC system, efficiently transporting large amounts of electrical power over long distances with a minimum loss. This system also facilitates asynchronous interconnections between power grids operating at different frequencies or with varying grid conditions. This feature enhances grid stability and allows for the integration of various energy sources. Additionally, HVDC enables the efficient transmission of power between regions with disparate electrical systems, promoting better resource utilization and grid reliability. Converter stations serve as pivotal components in HVDC systems, converting AC to DC at the transmitting end and vice versa at the receiving end. The development of voltage source converter (VSC) technology has further improved the flexibility and control of HVDC systems, allowing for better adaptation to varying load conditions and grid disturbances.

The high voltage direct current (HVDC) transmission system market has experienced significant growth driven by the increasing demand for efficient and reliable long-distance power transmission. HVDC technology enables the transmission of large amounts of electricity over extended distances with lower energy losses. The market is driven by the rising integration of renewable energy sources, such as solar and wind, which often require long-distance power transmission from remote locations to urban centers.

HVDC Transmission System Market Trends and Drivers

HVDC transmission system market growth is driven by several factors. Firstly, the growing demand for long-distance power transmission where HVDC technology allows for efficient electricity transfer with minimal power losses for connecting remote renewable energy sources, such as offshore wind farms, to population centers. Secondly, the increasing importance on renewable energy integration into existing grids, as the world is transitioning towards cleaner energy sources. Further, smart grid operators with greater control and flexibility, enabling the efficient management of power flows, grid reliability, and voltage stability fuels the market. Furthermore, the rise in intercontinental and cross-border power transmission projects, contributing to the growth as these projects aim to connect power networks that enhance energy security, promoting cross-border energy trading, and optimizing the utilization of diverse energy resources.

HVDC transmission system market growth is influenced by several factors which include renewable energy integration, grid expansion and interconnection, grid reliability and stability, efficient long-distance transmission, cross border power trading, and energy storage integration and others. Overall, the combination of these factors indicates a growth for the HVDC transmission system market.

HVDC Transmission System Restraining Factors

Despite the positive trajectory observed in the HVDC transmission system market, growth is hindered by various restraining factors. Firstly, the high initial installation cost to build the necessary converter stations and high-voltage infrastructure requires capital investment, as it involves converter stations at both ends of the transmission line to convert between AC and DC which leads to higher operational and maintenance costs owing to their complex design, maintenance, and construction. Secondly, differences in voltage levels, grid control mechanisms, and frequency can be challenging to integrate HVDC systems into existing AC grids. Further, its economic viability for shorter distances created an issue related to additional costs and complexities linked with its implementation. Additionally, environmental concern and issues related to land use, electromagnetic fields, and the visual impact of overhead lines or converter station can lead to public resistance and regulatory challenges. Overall, these restraining factors requires research and development, collaboration with stakeholders to encourage the adoption of HVDC transmission systems in a sustainable and cost-effective manner.

HVDC Transmission System Market Opportunities

The HVDC transmission system market is experiencing significant growth, presenting various opportunities. Firstly, the rising demand for efficient and reliable long-distance power transmission that are shaped by increasing renewable energy integration, the need for modernizing power grids, and technological advancements. Secondly, the growing need to transmit power from remote renewable energy-rich locations to urban centers, as the world transitions towards renewable energy sources, such as solar and wind. Additionally, the interconnection of power grids across regions and countries to enhance grid stability, energy exchange between neighboring countries, and support the efficient utilization of various energy resources. Moreover, the advancement for efficient and resilient energy systems by providing a more controllable and flexible means of power transmission to control power flow and manage grid stability makes HVDC an important component in the modernization of power infrastructure. Furthermore, HVDC technology, mainly submarine cable systems, is suitable for efficiently transmitting large amounts of power over long underwater distances, presents a substantial opportunity for HVDC transmission systems. Moreover, the electrification of transportation, including electric vehicles and high-speed trains demands reliable and efficient power transmission for long-distance power transmission to support the networks, providing an opportunity for HVDC transmission system market.

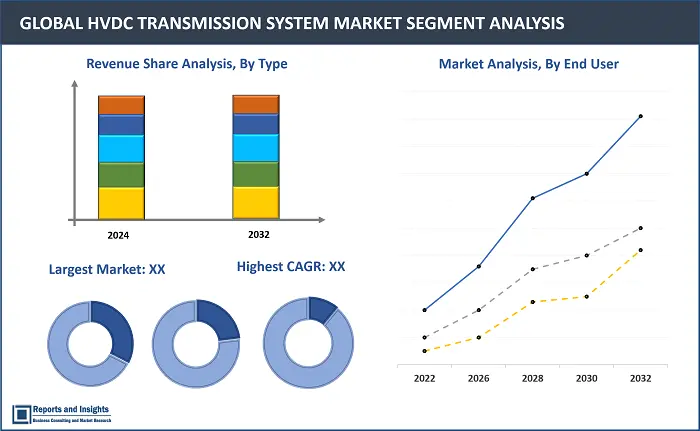

HVDC Transmission System Market Segmentation:

By Component

- Transmission Cables

- Converter Stations

- Filters

- Other

The HVDC transmission system market is categorized into four segments based on the components. Converter stations have substations which convert an AC to DC are called rectifier terminal while which convert DC to AC are called inverter terminal. Every terminal is designed to work in both the rectifier and inverter mode. Therefore, each terminal is called converter terminal, or rectifier terminal. A two-terminal HVDC system has only two terminals and one HVDC line. Further, filters are connected between the converter transformer and the station AC bus to suppress any high frequency currents. Sometimes such filters are provided on high-voltage DC bus connected between the DC filter and DC line and also on the neutral side.

By Technology

- Capacitor Commutated Converter

- Line Commutated Converter

- Voltage Source Converter

- High Voltage Direct Current

- Ultra-High Voltage Direct Current

The HVDC transmission system uses a wide range of technology that incudes capacitor commuted converter use a combination of capacitors and thyristors to achieve commutation in the converter and used for long-distance power transmission, line commutated converter uses thyristor-based converters to convert AC to DC at the transmitting end and DC back to AC at the receiving end, used for point-to-point long-distance transmission and interconnecting asynchronous AC systems. Additionally, voltage source converter uses power electronic devices, such as insulated gate bipolar transistors (IGBTs), to create a controllable voltage source at both ends of the transmission line and suitable for connecting AC grids with different frequencies, offshore wind power integration, and enhancing grid stability, and high voltage direct current and ultra-high voltage direct current involve more than two converter stations, allowing for the connection of multiple AC grids and used for connecting multiple power systems, integrating renewable energy sources, and enhancing grid resilience.

By Project Type

- Point-to-Point

- Back-to-Back

- Multi-terminal

The HVDC transmission system has a project type segmentation, including point-to-point, back-to-back and multi terminal. Back-to-Back HVDC system enables the interconnection of asynchronous grids without any system interference, no increase of short circuit current and high-speed tie-line power control. Connecting two AC systems with a short distance between them and are used to control power flow, stabilize voltage, or enable asynchronous interconnection in regions with close proximity. connecting more than two AC systems or grids through a single HVDC network. Further, multi-terminal HVDC configurations enable the creation of large-scale interconnected power systems, supporting the integration of multiple sources and improving grid reliability.

By Transmission Type

- Submarine

- Overhead

- Underground

The HVDC transmission system uses a transmission type such as submarine, overhead and underground.

By Application

- Bulk Power Transmission

- Interconnecting Grids

- Infeed Urban Areas

The HVDC transmission system used in various applications, including bulk power transmission, interconnecting grids and infeed urban areas.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

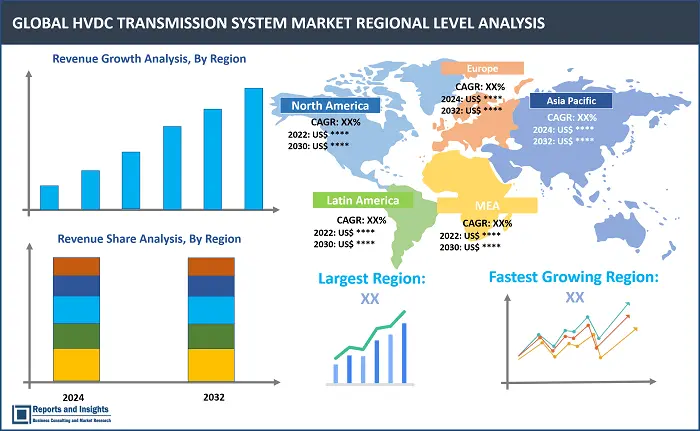

HVDC transmission system market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among all regions, the Asia Pacific region holds the largest part in the HVDC transmission system market share in the global market and is expected to maintain a steady growth rate. North America is expected to hold a prominent position in the market due to increasing demand for renewable energy sources, rising government initiatives to reduce carbon emissions, and increasing investments in the transmission infrastructure. Europe will dominate the market due to expanding industrial infrastructure and increased investment in energy sectors. Countries in the Middle East and Africa are largely dominated by companies that need reliable power supplies. African countries primarily focus on industrial infrastructure developments that offer a positive outlook for the HVDC transmission system market growth during the forecast period.

Leading HVDC Transmission System Providers & Competitive Landscape:

The HVDC transmission system market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Hitachi Energy Ltd.

- Siemens

- NEXANS

- Toshiba Energy Systems Solutions Corporation

- CHINA XD GROUP

- Mitsubishi Electric Corporation

- General Electric

- Xu Ji Group Co. Ltd

- NR Electric Co. Ltd.

- Prysmian Group.

- TBEA Co., Ltd.

- NKT

Recent News and Development

- September 2023: Hyundai Engineering & Construction won a $145m contract from the Saudi Electricity Company to build the Neom-Yanbu 525kV high-voltage direct current (HVDC) transmission line project. The 605km-long line will run from the Yanbu region, a power production hub on the west coast of Saudi Arabia, to the new city of Neom. It secured a turnkey contract for its design, procurement and construction. The company implemented portion one, the construction of 207km of transmission lines and 450 transmission towers.

- July 2023: L&T announced that it secured a contract in the Middle East, for the construction of one of the world’s first 525kV high voltage direct current (HVDC) transmission system. This link is part of a large capacity, voltage source converter (VSC) based HVDC system that connects NEOM industrial city and Yanbu city in western Saudi Arabia.

- June 2023: Minnesota power upgraded its high-voltage, direct-current (HVDC) transmission system that delivers renewable wind energy from its Bison Wind Energy Center in North Dakota to 150,000 customers in northeastern Minnesota, 14 municipalities and some of the largest industrial customers in the United States.

- April 2023: Hitachi energy selected by the UK’s SSEN transmission as a preferred bidder for the supply of multiple onshore high-voltage direct current (HVDC) converter stations to drive integration of bulk renewables into the UK power grid. The agreement included the deployment of up to five HVDC electricity transmission superhighways to enable renewable power to be transported from northern Scotland to areas of higher consumption in the south. Each of these connection systems has a capacity of up to 2GW and a voltage level of 525kV.

HVDC Transmission System Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

11.2% |

|

Segment covered |

Component, Technology, Project Type, Application and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

Hitachi Energy Ltd., Siemens, NEXANS, Toshiba Energy Systems Solutions Corporation, CHINA XD GROUP, Mitsubishi Electric Corporation, General Electric, Xu Ji Group Co. Ltd, NR Electric Co. Ltd., Prysmian Group., TBEA Co., Ltd., NKT |

Frequently Asked Question

At what CAGR will the HVDC transmission system market expand?

The market is anticipated to rise at 11.2% CAGR through 2032.

What are some key factors driving revenue growth of the HVDC transmission system market?

Some key factors driving market revenue growth include long-distance power transmission, increasing importance on renewable energy integration into existing grids, smart grid operators with greater control and flexibility, rise in intercontinental and cross-border power transmission projects and others.

What are some major challenges faced by companies in the HVDC transmission system market?

Companies face challenges such as high initial installation cost, differences in voltage levels, grid control mechanisms, and frequency, environmental concern and issues related to land use, electromagnetic fields, and the visual impact of overhead lines, and others.

How is the competitive landscape in the global HVDC transmission system market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

What is the market size of HVDC transmission system market in the year 2023?

The HVDC transmission system market size reached US$ 11.1 billion in 2023.

What are the potential opportunities for companies in the HVDC transmission system market?

Companies can leverage opportunities such as rising demand for efficient and reliable long-distance power transmission, growing need to transmit power from remote renewable energy-rich locations to urban centers, advancement for efficient and resilient energy systems, and others.

Which region has the biggest market share in HVDC transmission system market?

Asia Pacific has the biggest market share in HVDC transmission system market.

How is the HVDC transmission system market segmented?

The market is segmented based on factors such as component, technology, project type, transmission type, application and regions.