Market Overview:

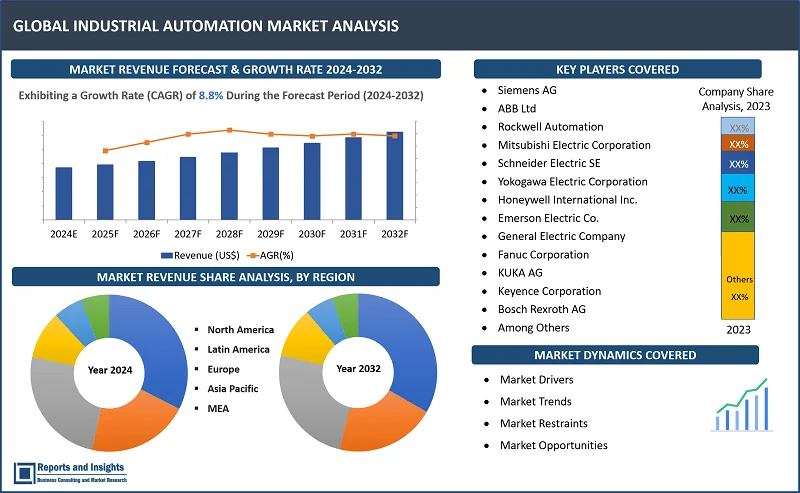

"The global industrial automation market was valued at US$ 201.2 Billion in 2023 and is expected to register a CAGR of 8.8% over the forecast period and reach US$ 429.8 Bn in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Industrial Automation Market Growth Rate (2024-2032) |

8.8% |

Industrial automation entails the use of technology to control and operate machinery, processes, and systems in various industries. These solutions enhance efficiency, productivity, and safety by minimizing human intervention. Industrial automation products encompass a wide spectrum, including Programmable Logic Controllers (PLCs), robotics, SCADA (Supervisory Control and Data Acquisition) systems, and industrial IoT devices. PLCs enable precise control of manufacturing processes, while robotics automate tasks like assembly and material handling. SCADA systems monitor and manage large-scale operations, and IoT devices gather real-time data for analysis. Collectively, these offerings streamline operations, reduce errors, and elevate industrial processes across sectors like manufacturing, energy, and logistics.

The global industrial automation market is registering robust revenue growth, driven by increasing demand for operational efficiency and cost savings across industries. Rapid technological advancements have led to heightened consumption of automation solutions, encompassing robotics, AI, IoT, and data analytics. Services such as predictive maintenance and remote monitoring are becoming integral and initiatives promoting Industry 4.0 and smart manufacturing are further accelerating adoption. The advantages include enhanced productivity, reduced downtime, improved safety, and better resource allocation. Comprehensive analysis and insights into market trends indicate a shift towards collaborative robots, edge computing, and sustainable practices, and these are expected to continue to shape the future of industrial automation.

Industrial Automation Market Trends and Drivers:

Technological Advancements: Continuous innovations in robotics, AI, and IoT are driving growth of the global industrial automation market. Advanced technologies enable more precise and efficient production processes and increasing awareness regarding the benefits and advantages are driving deployment and supporting steady market revenue growth.

Industry 4.0 Adoption: Integration of digital technologies with traditional manufacturing, known as Industry 4.0, enhances connectivity and data exchange. This trend optimizes production, reduces costs, and accelerates time-to-market, and is having a positive impact on revenue growth.

Operational Efficiency: Industrial automation streamlines workflows, reduces human error, and enhances overall efficiency. Improved productivity and reduced downtime translates to increased revenue as production output rises.

Global Supply Chain Optimization: Automation aids supply chain management by enabling real-time tracking, demand forecasting, and inventory management. Optimized supply chains lead to cost savings and other cost-related benefits.

Safety and Compliance: Automation improves workplace safety by replacing humans in hazardous tasks. Compliance with safety regulations minimizes the risk of accidents, potential litigation, and downtime, all of which can impact revenue.

Data-Driven Insights: Vast volumes of data are generated from automation and such similar processes, and these offer insights into production trends, customer preferences, and equipment performance, among others. Derived insights enable more informed decision-making, and deployment of appropriate strategies can support revenue growth.

Industrial Automation Market Restraining Factors:

High Initial Investment: The substantial upfront costs associated with implementing industrial automation solutions, including equipment, software, and training, is relatively high and this can deter companies from adopting these technologies.

Integration Challenges: Integrating new automation systems with existing infrastructure can be complex and time-consuming. Compatibility issues and disruptions during the transition phase can lead to temporary decreases in productivity and revenue.

Skilled Workforce Shortage: The shortage of skilled personnel to operate and maintain advanced automation systems is a major factor restraining adoption. This gap in expertise can limit the effective implementation of automation, thereby also having negative impact on market revenue growth.

Cybersecurity Concerns: As automation systems become more interconnected and reliant on data exchange, the risk of cyberattacks increases. Security breaches can result in downtime, data loss, and reputational damage, and this is a factor that is creating a sense of reluctance to shift entirely to automation across some industries that deal in sensitive materials and products etc.

Resistance to Change: Employees and management may resist automation due to fear of job displacement or reluctance to adapt to new technologies. This resistance can delay adoption and impede revenue growth potential.

Maintenance and Downtime: While automation can minimize downtime through predictive maintenance, any unforeseen system failures can lead to extended periods of inactivity. Downtime directly affects production capacity and revenue generation.

Industrial Automation Market Opportunities:

Solution Customization: Offering tailored automation solutions for specific industries and processes presents a significant opportunity. Companies can provide specialized systems that cater to unique needs, generating higher revenues from customization fees.

Maintenance and Support Services: Providing ongoing maintenance, troubleshooting, and support services for automated systems ensures reliable operation. Subscription-based models or service contracts can create a consistent revenue stream while building long-term relationships with clients.

Data Analytics and Insights: Developing data analysis tools that help clients make informed decisions based on the data generated by automated systems opens opportunities. Selling analytics software or offering data-driven consulting services can be a valuable revenue source.

Training and Skill Development: Addressing the skills gap by offering training programs in automation technology can generate revenue. Certified training courses for employees to operate, maintain, and troubleshoot automated systems can become a lucrative venture.

IoT and Connectivity Solutions: Creating IoT-enabled devices and connectivity solutions to integrate legacy equipment into the automation ecosystem is a growing opportunity. Revenue can be generated from hardware sales, software licensing, and ongoing connectivity services.

Consulting and Implementation Services: Companies can offer consulting services to guide businesses through their automation journey. Revenue can be earned from consulting fees, system design, project management, and successful implementation.

Industrial Automation Market Segmentation:

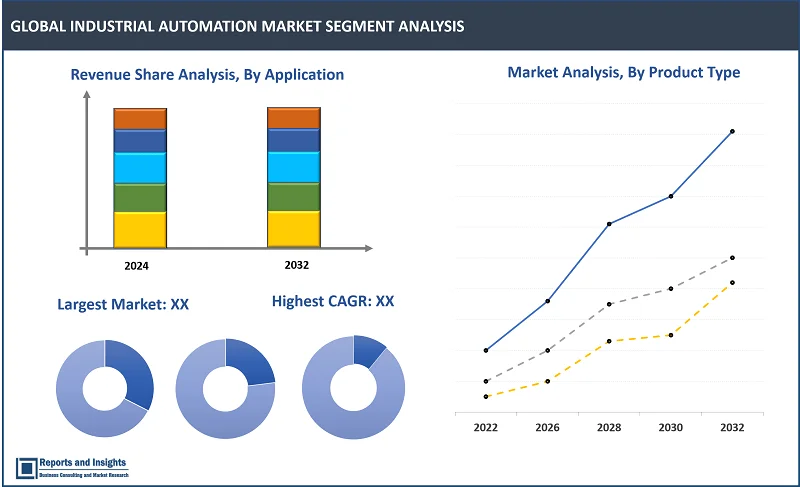

By Product Type:

- Programmable Logic Controllers (PLCs)

- Human Machine Interface (HMI)

- Supervisory Control and Data Acquisition (SCADA) Systems

- Robotics

- Distributed Control Systems (DCS)

- Process Automation

- Others

By Technology:

- Industrial IoT (IIoT)

- Artificial Intelligence (AI) and Machine Learning

- Cloud Computing

- Big Data Analytics

- Edge Computing

- Cybersecurity Solutions

By End-user Industry:

- Manufacturing

- Energy and Utilities

- Oil and Gas

- Automotive

- Pharmaceuticals

- Food and Beverage

- Aerospace and Defense

- Chemicals

- Mining and Metals

- Others

By Application:

- Process Control

- Material Handling

- Assembly and Packaging

- Quality Control and Inspection

- Maintenance and Predictive Analytics

- Supply Chain Management

- Others

By Region:

North America:

- United States

- Canada

Europe:

- Germany

- The U.K.

- France

- Spain

- Italy

- Russia

- Poland

- BENELUX

- NORDIC

- Rest of Europe

Asia Pacific:

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America:

- Brazil

- Mexico

- Argentina

Middle East & Africa:

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

In North America region, the United States stands as the largest market for industrial automation due to diverse and advanced manufacturing sector spanning various industries such as automotive, aerospace, and electronics. This factor is driving demand for enhanced efficiency and productivity and deployment of automation solutions. The country's longstanding tradition of technological innovation and research creates an environment conducive to developing and integrating cutting-edge automation technologies. Supported by a robust economy, businesses in the US possess the financial capacity to invest in automation systems that optimize their operations.

In Europe, a dynamic landscape of key trends is set to significantly drive industrial automation sales. The steady adoption of Industry 4.0, which integrates cutting-edge digital technologies into manufacturing processes, is driving robust demand for automation solutions. This is further augmented by commitment to sustainable practices across countries in Europe, where automation plays a pivotal role in achieving energy-efficient processes and minimizing waste. The ascendancy of collaborative robots (cobots) designed to collaborate harmoniously with human workers addresses the diverse manufacturing needs, and offers flexible and secure automation solutions. High focus on precision in sectors such as automotive and aerospace further supports adoption of automation across industries, as this ensures stringent manufacturing standards are consistently met.

In Asia Pacific, investing in China and India is a crucial driver for growth of the global industrial automation market owing to both countries being bases for expansive manufacturing sectors that span a multitude of industries and substantially high demand for automation solutions that enhance productivity, streamline operations, and fortify competitive standing on the global stage. Escalating labor costs in these regions has prompted manufacturers to shift towards automation, as it offers a means to mitigate dependency on labor and ensure cost-effectiveness. The robust economic growth being registered by China and India positions these countries as veritable hotspots for industrialization, thereby catalyzing the imperative for automation to meet heightened production requisites. Also, proactive government initiatives aimed at encouraging advanced manufacturing solutions and technologies and deploying Industry 4.0 is supporting the investment landscape for automation.

Japan Industrial Automation Market Analysis and Overview

The Japan industrial automation market was valued at US$ 6.3 Billion in 2023 and is expected to register a CAGR of 8.4% over the forecast period and reach US$ 12.9 Bn in 2032. Japan has consistently been a pioneer in creating and developing an automated industrial economy. Japan’s manufacturing hub allows it to distribute a wide range of automated products to other regions, alongside supplying factory automation systems and industrial controls to other countries. The growing application of robots, particularly those with AI capabilities, has driven the development of new technologies that increase company efficiency and reduce errors. These developments have also resulted in an increased workforce and enhanced workplace safety measures.

Japan industrial automation market growth is driven by various factors and trends. Since Prime Minister Shinzo Abe started promoting the use of robots to counter the effects of the country's declining working-age population, the Japanese industrial automation market has become increasingly competitive. This push for automation is a way of mitigating the shrinking labor force and the challenges with population aging in the country. This push has created new opportunities and driven the adoption of automation technologies in various industries, including manufacturing, healthcare, and agriculture. The Japanese government's efforts have also led to significant investments in research and development, as well as supportive policies and funding for automation projects, further fueling the growth of the market.

Significant investment in advanced automation solutions such as industrial robots, SCADA (Supervisory Control and Data Acquisition) systems, and human-machine interfaces (HMIs) by leading companies is projected to drive Japan's industrial automation market. For instance, Mitsubishi recently acquired land in Aichi Prefecture, Japan to build a factory automation component manufacturing plant, expected to be completed by 2025. This facility will be a three-story, seismically resilient structure covering 33,600 square meters. Additionally, the collaboration between Mitsubishi Electric, the EEC (Economic and Industrial Cooperation), and the Thai-Japan Ecosystem Alliance aimed at the transfer of advanced knowledge and technology to over 60 Thai firms and over 1,000 companies worldwide.

Leading Companies in Industrial Automation Market & Competitive Landscape:

The global industrial automation market features a dynamic and competitive landscape, shaped by a diverse array of companies vying to innovate and provide cutting-edge solutions. This sector has witnessed consistent growth due to high demand for increased efficiency, productivity, and connectivity across industries. Leading industrial automation solutions providers are currently contributing significantly to evolution of the market.

A frontrunner in the industry, Siemens AG is known for its comprehensive range of automation products and solutions, spanning PLCs, SCADA systems, robotics, and industrial software. Its global presence and innovative offerings solidify its standing as a market leader.

ABB Ltd. is a major in industrial automation, offering robotics, control systems, and digital solutions. The company's commitment to sustainable practices and focus on smart manufacturing technologies keep it at the forefront of the competitive landscape.

With keen focus on industrial control systems, Rockwell Automation is recognized for its PLCs, HMIs, and software solutions. It maintains a strong position through its emphasis on digital transformation and connectivity.

Mitsubishi Electric Corporation is a significant player with a wide portfolio of automation products, including PLCs, HMIs, and servo systems. The company's commitment to technological advancements and global expansion enables it to maintain its competitive edge.

Schneider Electric SE offers a range of automation solutions, including PLCs, SCADA systems, and building automation. The company’s dedication to energy efficiency and sustainability aligns with current market trends.

Yokogawa Electric Corporation specializes in process automation and control systems, and is renowned for solutions in industries such as oil & gas, chemicals, and power. Its domain expertise and tailored solutions contribute to its competitive positioning.

Honeywell International Inc. offers a diverse range of automation and control solutions, leveraging AI and IoT technologies. Its innovations in industrial cybersecurity and process optimization bolster its competitiveness.

Leading players continue to maintain an edge through innovations in robotics, AI, IoT integration, and digital transformation. Their global reach, strong R&D capabilities, and commitment to addressing industry-specific challenges cement their positions in the competitive landscape. As the industrial automation market evolves, these players remain pivotal in shaping the industry's trajectory and meeting the demands of a rapidly changing technological landscape.

Company List:

- Siemens AG

- ABB Ltd

- Rockwell Automation

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Yokogawa Electric Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- General Electric Company

- Omron Corporation

- Fanuc Corporation

- KUKA AG

- Keyence Corporation

- Beckhoff Automation GmbH

- Bosch Rexroth AG

Research Scope

|

Report Metric |

Report Details |

|

Industrial Automation Market size available for the years |

2021-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

8.8% |

|

Segment covered |

By Product Type, Technology, End-user Industry, and Application |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Siemens AG, ABB Ltd, Rockwell Automation, Mitsubishi Electric Corporation, Schneider Electric SE, Yokogawa Electric Corporation, Honeywell International Inc., Emerson Electric Co., General Electric Company, Omron Corporation, Fanuc Corporation, KUKA AG, Keyence Corporation, Beckhoff Automation GmbH, Bosch Rexroth AG, and among others. |

Frequently Asked Question

What are some key technologies driving innovation in the industrial automation sector?

The industrial automation sector is witnessing innovations driven by technologies such as Industrial IoT (IIoT), Artificial Intelligence (AI), Cloud Computing, Big Data Analytics, and Edge Computing. These technologies enhance connectivity, data analysis, and real-time decision-making, transforming industries.

How does industrial automation benefit different end-user industries?

In manufacturing, industrial automation boosts production efficiency and quality. In energy, it optimizes resource utilization. In automotive, it streamlines assembly lines. In pharmaceuticals, it enhances regulatory compliance. Each industry gains operational excellence.

What role does cybersecurity play in industrial automation?

Cybersecurity is critical in industrial automation to protect systems from cyber threats. As systems become interconnected, the risk of cyberattacks increases. Robust cybersecurity solutions safeguard sensitive data, prevent disruptions, and maintain operational integrity.

How does industrial automation contribute to sustainability and environmental goals?

Industrial automation promotes sustainability by optimizing processes, reducing energy consumption, and minimizing waste. Smart manufacturing techniques enabled by automation lead to efficient resource utilization, aligning with global environmental objectives.

What are the future prospects for human employment in an increasingly automated industry?

While automation replaces certain tasks, it also creates new roles in maintenance, programming, and supervision. Automation complements human skills, enhances workplace safety, and fosters innovation, ensuring a transformed but still essential workforce.