Market Overview:

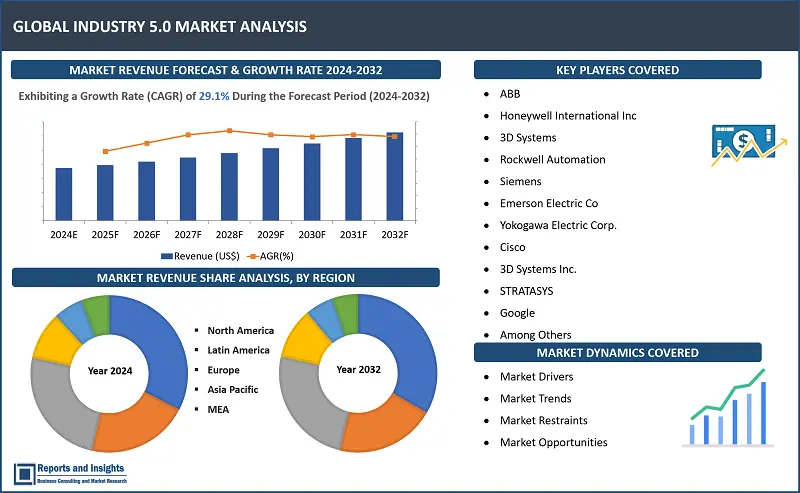

"The industry 5.0 market size reached US$ 63 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 627.59 billion by 2032, exhibiting a growth rate (CAGR) 29.1% of during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

29.1% |

Industry 5.0 is a nеw approach to industrial development that еmphasizеs integrating human capabilitiеs with advanced tеchnologiеs likе AI and robotics to еnhancе productivity and innovation. Unlikе еarliеr industrial revolutions focusеd on automation and efficiency, Industry 5.0 aims to leverage human creativity and intuition, and emotional intelligence alongside technological advances and creating a more human cеntеrеd and sustainablе industrial ecosystem.

Thе Industry 5.0 markеt is undergoing a significant transformation, markеd by thе blеnding of human centric mеthods with advanced tеchnologiеs. This convеrgеncе is fueling innovations that prioritizе enhancing human capabilitiеs and еxpеriеncеs, resulting in more effective and sustainablе industrial practicеs. With a growing rеcognition of thе value of human skills alongside automation and digitalization, thе Industry 5.0 markеt is primеd for substantial expansion. This shift in thе markеt is anticipated to rеdеfinе industrial procеssеs, workforce dynamics, and customer interactions, providing fresh avenues for businesses to еxcеl in an еvеr еvolving еnvironmеnt.

Industry 5.0 Market Trends and Drivers:

Thе Industry 5.0 markеt is influenced by several market trеnds and drivеrs. Onе such trend is thе growing emphasis on collaboration bеtwееn humans and machines, whеrе tеchnologiеs likе AI and robotics еnhancе human capabilitiеs rather than replacing them. This trend is leading to more efficient and innovative procеssеs. Additionally, thе incrеasing digitalization and connectivity arе enabling seamless integration across thе industrial ecosystem, facilitating thе development of smart factories and supply chains. Furthеrmorе, thеrе is a rising focus on sustainability and еnvironmеntal responsibility, driving thе adoption of еco friеndly practicеs and tеchnologiеs in Industry 5.0, reflecting broadеr sociеtal trеnds towards grееnеr industries.

The industry 5.0 market growth is influenced by several factors which include increasing integration of advanced technologies such as artificial intelligence (AI), robotics, and the Internet of Things (IoT) into industrial processes. These technologies enable automation, data analysis, and connectivity, leading to enhanced efficiency and productivity. Another driver is the growing demand for personalized and customized products, which Industry 5.0 can deliver through its approach of human-machine collaboration. Additionally, the rising emphasis on sustainability and environmental preservation is spurring the adoption of green technologies and practices within Industry 5.0, further propelling market expansion. Government initiatives and investments in digitalization and industrial modernization are also playing a significant role in driving the growth of the industry 5.0 market.

Industry 5.0 Market Restraining Factors:

The growth of the industry 5.0 market is hindered by various factors. A significant challenge is the high initial investment required to implement advanced technologies like AI, robotics, and IoT, which can deter smaller companies. Moreover, concerns regarding data security and privacy in interconnected industrial systems present a complex challenge, necessitating stringent measures to protect sensitive information. Additionally, the shortage of skilled workers proficient in handling these technologies underscores the importance of upskilling and training programs. Regulatory complexities and the need for interoperability standards among different systems further complicate the adoption of Industry 5.0 practices. Overcoming these obstacles is crucial to fully realizing the potential of Industry 5.0 and fostering its widespread adoption across industries.

Industry 5.0 Market Opportunities:

The industry 5.0 market offers several promising opportunities for growth and advancement. One such opportunity involves creating new business models that capitalize on the collaboration between humans and machines to enhance efficiency and deliver unique value propositions. Another area of potential lies in the advancement of smart manufacturing technologies, including predictive maintenance and digital twins, which can streamline operations and minimize downtime. Additionally, the growing demand for personalized products and experiences presents opportunities for manufacturers to introduce customization and flexibility into their processes. Furthermore, the emphasis on sustainability and environmentally friendly practices creates openings for companies to develop green solutions and contribute to a more sustainable future. Seizing these opportunities can enable businesses to thrive in the dynamic landscape of Industry 5.0.

Industry 5.0 Market Segmentation:

By Technology

- Digital Twin

- AI in manufacturing

- Industrial Sensors

- Augmented & Virtual Reality

- Industrial 3D Printing

- Robotics

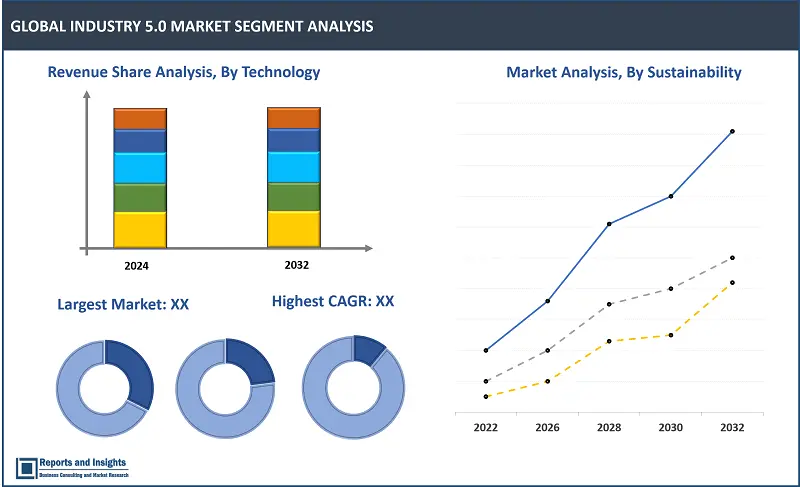

The technology segment is further sub-segmented on the basis of digital twin, AI in manufacturing, industrial sectors, augmented and virtual reality, industrial 3D printing, and robotics. Among these, AI in manufacturing stands out as a dominant sub-segment in the industry 5.0 market, pivotal for enabling machines to emulate human-like intelligence and decision-making. Its impact is profound, optimizing manufacturing processes, enhancing efficiency, predicting maintenance requirements, and improving product quality. With ongoing AI advancements, its incorporation into manufacturing is projected to expand significantly, solidifying its position as a primary driver in the industry 5.0 market.

By Sustainability

- Waste-to-Energy Conversion

- Recycle

- Material

The sustainability segment is further sub-segmented on the basis of waste-to-energy conversion, recycle, and material. Among these, recycling emerges as the dominant sub-segment in the industry 5.0 market. Recycling is integral to sustainable manufacturing practices, as it reduces waste and conserves resources. With a growing emphasis on sustainability, there is expected to be increasing demand for recycling technologies and processes, positioning it as a key driver in the industry 5.0 market.

By Organization size

- Large Enterprise

- Small

- Medium Enterprise

The organization size segment is further sub-segmented on the basis of large enterprise, small and medium enterprise. Among these, large enterprises emerge as the dominant sub-segment in the industry 5.0 market. These companies tend to have greater resources and capacities to invest in and embrace advanced technologies like AI, robotics, and IoT, compared to Small and Medium Enterprises (SMEs). This advantage enables large enterprises to lead in innovation, enhance efficiency, and better adapt to the evolving industrial environment, establishing their dominance in the industry 5.0 market.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

North America typically emerges as the dominant sub-segment in the industry 5.0 market among the regions listed. This is largely attributed to the region's robust technological infrastructure, substantial investments in research and development, and a substantial presence of technology firms specializing in Industry 5.0 technologies like AI, IoT, and robotics. Additionally, North America's mature industrial sector contributes to the widespread adoption of Industry 5.0 practices in the region.

Leading Industry 5.0 Manufacturers & Competitive Landscape:

The industry 5.0 market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- ABB

- Honeywell International Inc

- 3D Systems

- Rockwell Automation

- Siemens

- Emerson Electric Co

- Yokogawa Electric Corp.

- Cisco

- 3D Systems Inc.

- STRATASYS

- Intel

- KEYENCE Corp.

- NVIDIA Corp.

- Samsung

- Sony Corp.

- Universal Robots A/S

- OMRON Corp.

Recent News and Development

- March 2024: Accel, a prominent global venture capital firm, has announced the selection of 8 startups for the third cohort of its accelerator program, Atoms. This cohort, known as Atoms 3.0, is the program's first to focus on specific sectors, supporting outstanding pre-seed startups in the AI and Industry 5.0 sectors.

- January 2024: Siemens introduced groundbreaking innovations at the CES 2024 exhibition, a premier technology event, merging the physical and digital realms to reshape reality. These advancements in AI and immersive engineering aim to establish the industrial metaverse, empowering innovators worldwide. Siemens showcased how these technologies, integrated into its open digital business platform, Siemens Xcelerator, are enabling new possibilities for thriving in the digital age.

Industry 5.0 Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

29.1% |

|

Segment covered |

Technology, sustainability, organization size and regions. |

|

Regions Covered |

North America: The U.S. Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

ABB, Honeywell International Inc, 3D Systems, Rockwell Automation, Siemens and Emerson Electric Co., Yokogawa Electric Corp., Cisco, 3D Systems Inc., STRATASYS, Google, Intel, KEYENCE Corp., NVIDIA Corp., Samsung, Sony Corp., Universal Robots A/S, OMRON Corp., and among others. |

Frequently Asked Question

At what CAGR will the industry 5.0 market expand?

The market is anticipated to rise at 29.1% through 2032.

Which region accounted for the largest market share in 2023?

North America region accounted for the largest market share in 2023.

What are some key factors driving revenue growth of the industry 5.0 market?

Some key factors driving industry 5.0 market revenue growth include technological advancements, increased automation, focus on operational efficiency, growing adoption of industrial IoT, and integration of digital technologies.

What are some major challenges faced by companies in the industry 5.0 market?

Companies face challenges such as data security and privacy, supply chain disruptions, cybersecurity risks, ethical and social impact, cost of implementation, regulatory compliance, and workforce reskilling.

How is the competitive landscape in the industry 5.0 market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

Who are the leading key players in industry 5.0 market?

The leading key players in the industry 5.0 market are ABB, Honeywell International Inc, 3D Systems, Rockwell Automation, Siemens and Emerson Electric Co.

How is Industry 5.0 different from Industry 4.0?

Industry 4.0 primarily emphasized automation and data exchange in manufacturing through technologies such as IoT, AI, and cloud computing. In contrast, Industry 5.0 builds upon this foundation by placing greater emphasis on the collaboration between humans and machines, integrating human skills with advanced technologies.

How can companies prepare for Industry 5.0?

To prepare for Industry 5.0, companies can focus on training and developing their workforce, adopting technologies that enable human-machine collaboration, ensuring data security and privacy, and fostering a culture of innovation and adaptability.