Market Overview:

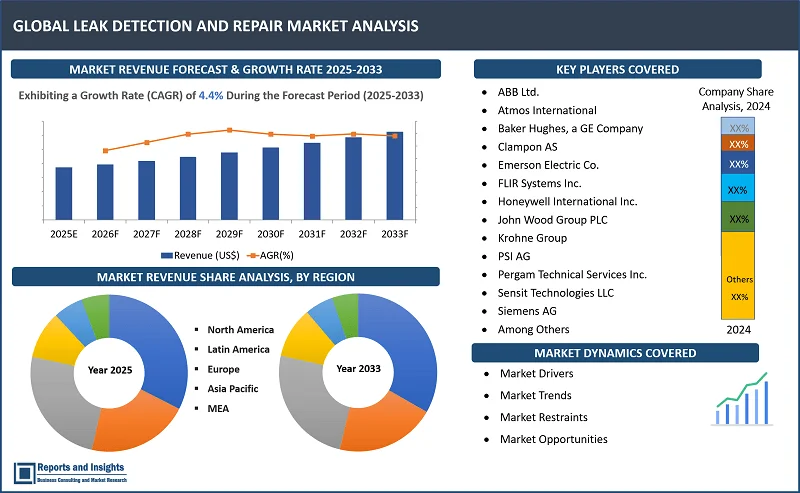

"The global leak detection and repair market was valued at US$ 21.2 Billion in 2024 and is expected to register a CAGR of 4.4% over the forecast period and reach US$ 31.2 Billion in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Leak Detection and Repair Market Growth Rate (2025-2033) |

4.4% |

Leak detection and repair is the systematic approach to finding and correcting leaks through unintended emissions of hazardous gases or vapors usually in an industrial process, such as in chemical plants, refineries, or natural gas facilities. This process involves the use of advanced technologies like infrared cameras, gas analyzers, or ultrasonic detectors to detect leakage from valves, pipes, and connectors, which are then promptly repaired to minimize environmental damage, obtain regulatory compliance, and improve operational efficiency. LDAR programs are indispensable in the reduction of airborne pollutants, saving resources, and safety at the workplace.

The Leak Detection and Repair (LDAR) market is a fast-growing sector, driven by strict environmental regulations, an increase in focus on sustainability, and a need for fugitive emission reduction in the oil and gas, chemical, and manufacturing industries. Technologies and services range from high-end detection equipment, including infrared cameras, ultrasonic detectors, and gas analyzers, to software solutions for data management and compliance tracking. The growing adoption of proactive maintenance strategies, developments in sensor technologies, and government moves to reduce greenhouse gas emissions are all factors augmenting the market for LDAR as a vital part of industrial activities.

Leak Detection and Repair Market Drivers and Trends:

The LDAR market is driven by stringent environmental regulations aimed at reducing greenhouse gas emissions, rising awareness of the environmental and economic impacts of fugitive emissions, and the growing emphasis on sustainability across industries. Key trends in the market encompass the use of advanced detection technologies such as optical gas imaging, ultrasonic sensors, and AI-based analytics, as well as IoT-enabled systems for real-time monitoring. Furthermore, increased deployment of drones in leak detection on inaccessible areas and the move toward predictive maintenance strategies in the market suggest it is increasingly innovative and operationally efficient.

Leak Detection and Repair Market Restraining Factors:

The main restrainers for the leak detection and repair market are the huge initial investment costs for the advanced technologies of detection, which include infrared cameras and IoT-based systems. Therefore, these technologies could be discouraging to entrants, especially small and medium-sized enterprises. The operational challenges related to implementing intricate LDAR programs, for example skilled staff and frequent equipment calibration requirements are other restrainers. Variability in regulatory enforcement across regions and the reluctance of some industries to invest in proactive measures due to cost concerns further hinder market growth. These factors can slow the pace of adoption despite the clear environmental and operational benefits of LDAR systems.

Leak Detection and Repair Market Opportunities:

The growth opportunities in the Leak Detection and Repair (LDAR) market revolve around sensor technology advancements, artificial intelligence combined with the Internet of Things, and real-time monitoring. Increasing adoption of automated and drone-based detection solutions also contribute to the growth momentum of this market. A widespread push toward net-zero emissions and more stringent environmental regulations in most countries create an appropriate environment for the adoption of LDAR systems, especially in emerging economies with growing industrial bases. Adding to this is the growing desire for less expensive, more portable detection devices combined with the scope for LDAR applications to grow in water management and renewable energy sectors is going to generate new opportunities for market players to innovate and grow.

Leak Detection and Repair Market Segmentation:

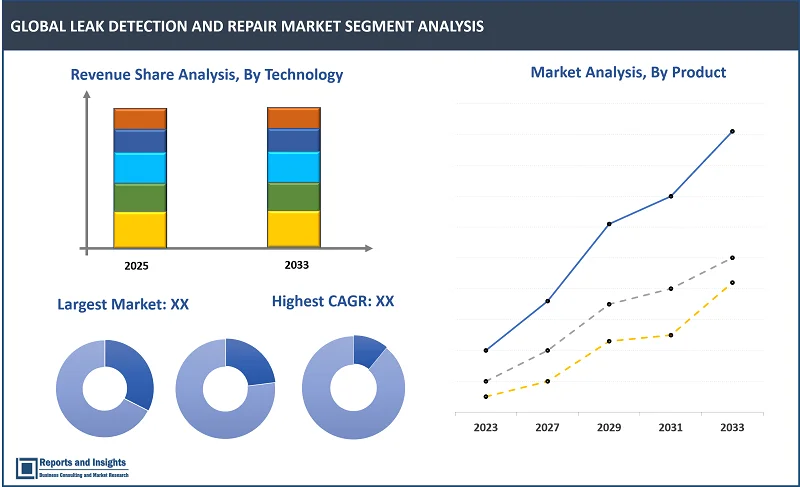

By Component

- Equipment

- Services

The services sub-segment of the leak detection and repair market is currently dominating the equipment segment. This fact can be attributed to the increasing requirements of specialized LDAR services in oil and gas industries which require the identification and monitoring of leaks to be addressed efficiently. These services are often preferred due to their ability to provide comprehensive solutions, combining expertise and advanced technologies like optical gas imaging and data analytics. Additionally, stringent regulatory requirements for environmental compliance and emissions reduction further push companies to outsource to specialized service providers, making this sub-segment a key revenue generator in the LDAR market.

By Product

- Handheld Gas Detectors

- UAV-Based Detectors

- Vehicle-based Detectors

- Manned Aircraft Detectors

Handheld gas detectors lead the product segment in the Leak Detection and Repair (LDAR) market. The handiness, cost-effectiveness, and versatility of these devices make them appropriate for detection on the ground in real time for use in the oil and gas industries, water management, and chemical manufacturing, among others. These detectors are critical in detecting the occurrence of leaks immediately in confined and hard-to-reach areas where other methods are not feasible. While the UAV-based detectors and vehicle-based detectors are gaining ground in more expansive and auto-monitoring, handheld gas detectors continue to be the most numerous because of their easy handling and can be used by many people.

By Technology

- Volatile Organic Compounds (VOC) Analyzer

- Optical Gas Imaging (OGI)

- Laser Absorption Spectroscopy

- Ambient/Mobile Leak Monitoring

- Acoustic Leak Detection

- Audio-Visual-Olfactory Inspection

Optical Gas Imaging (OGI) technology dominates the Leak Detection and Repair (LDAR) market. OGI cameras, utilizing infrared light emission to recognize and visualize gas leaks, are highly adopted in real-time detection of multiple gas types, including methane and volatile compounds. The non-intrusive technique does not interfere with operations while locating leaks in complex systems. Additional support for the popularity of OGI comes from the increasing demand for environmental regulations and enhanced efficiency, as well as accuracy, in leak detection. For the oil and gas, chemical, and utility industries, OGI has thus become a popular solution. While other technologies, including VOC analyzers and laser absorption spectroscopy, are gaining popularity, the popularity of OGI is because of its real-time visual feedback and its efficiency in large-scale applications.

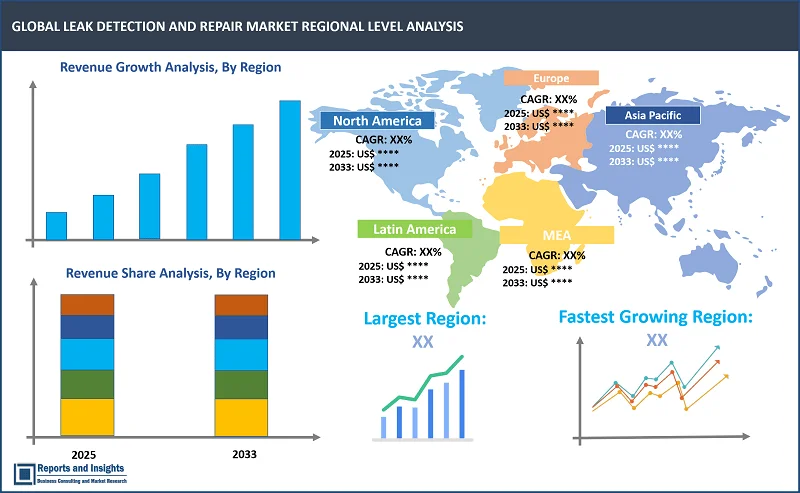

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The North American region dominates the Leak Detection and Repair (LDAR) market, primarily due to stringent environmental regulations and a high level of adoption of advanced leak detection technologies. In this region, the United States is particularly mindful and has set stringent regulations, including Leak Detection Regulations (LDAR), which mandate industries to monitor and repair leaks and reduce greenhouse gas emissions. Also, the steady investments in oil and gas infrastructure coupled with the rising demand for green practices have boosted the region's position in the market. Moreover, there is a prominent presence of major players, which provide advanced LDAR solutions.

Leading Companies in Leak Detection and Repair Market & Competitive Landscape:

The leak detection and repair market are highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- ABB Ltd.

- Atmos International

- Baker Hughes, a GE Company

- Clampon AS

- Emerson Electric Co.

- FLIR Systems Inc.

- Honeywell International Inc.

- John Wood Group PLC

- Krohne Group

- PSI AG

- Pergam Technical Services Inc.

- Sensit Technologies LLC

- Siemens AG

- Synodon Inc.

- Schneider Electric SE

- Thermo Fisher Scientific Inc.

- TUV SUD AG

- Viper Innovations Ltd.

- Yokogawa Electric Corp.

- Zeus Intelligence

Recent News and Development

- January 2024: A leading manufacturer of gas detection solutions, CO2Meter launched a detector that has been developed to track gases in the industrial space. The CM-900 series is designed to measure high carbon dioxide or low oxygen to protect employees who work around and near hazardous gases from situations such as accidents that may have resulted from leaks.

- September 2023: DOD Technologies, a provider of commercial and industrial gas detection systems, equipment, and services, launched the ChemLogic Revive CL4R Four-Point Toxic Gas Detection System. This system is designed to replace and upgrade fixed four-point monitors and operates based on ChemLogic colorimetric technology, taking samples of ambient air up to 500 feet away to detect leaks of dangerous gases.

- January 2023: ChampionX Emissions Technologies is a leading company in emitting detection solutions for the oil and gas industry. The company released AURA OGI, a world-class innovative Optical Gas Imaging (OGI) camera. The AURA OGI MidWave InfraRed smart camera takes images of greater resolution than any other camera available in the market. Using this technology enhances gas leak detection with built-in smart navigation and routes.

Research Scope

|

Report Metric |

Report Details |

|

Leak Detection and Repair Market Size available for the years |

2021-2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2033 |

|

Compound Annual Growth Rate (CAGR) |

4.4% |

|

Segment covered |

By Component, Product, Technology, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

ABB Ltd., Atmos International, Baker Hughes, Clampon AS, Emerson Electric Co., FLIR Systems Inc., Honeywell International Inc., John Wood Group PLC, Krohne Group, PSI AG, Pergam Technical Services Inc., Sensit Technologies LLC, Siemens AG, Synodon Inc., Schneider Electric SE, Thermo Fisher Scientific Inc., TUV SUD AG, Viper Innovations Ltd., Yokogawa Electric Corp., Zeus Intelligence, and among others |

Frequently Asked Question

What is the market size of the leak detection and repair market in 2024?

The leak detection and repair market size reached US$ 21.2 Billion in 2024.

At what CAGR will the leak detection and repair market expand?

The market is expected to register a 4.4% CAGR through 2025-2033.

How big can the leak detection and repair market be by 2033?

The market is estimated to reach US$ 31.2 Billion by 2033.

What are some key factors driving revenue growth of the leak detection and repair market?

Some key factors driving revenue growth include stringent environmental regulations, rising awareness of environmental impact, technological advancements, increased industrialization, government initiatives and incentives, and rising energy costs.

What are some major challenges faced by companies in the leak detection and repair market?

Major challenges include high initial costs, skilled workforce requirement, regulatory complexity, data management issues, detection limitations, resistance to adoption, and maintenance and calibration.

How is the competitive landscape in the leak detection and repair market?

The competitive landscape is characterized by the presence of several global and regional players. Companies compete on factors such as product quality, price, distribution network, and brand reputation. Innovation and marketing strategies play crucial roles in gaining market share.

How is the leak detection and repair market report segmented?

The market report is segmented into component, product, technology, and regions.

Who are the key players in the leak detection and repair market report?

Key players in the market report include ABB Ltd., Atmos International, Baker Hughes, Clampon AS, Emerson Electric Co., FLIR Systems Inc., Honeywell International Inc., John Wood Group PLC, Krohne Group, PSI AG, Pergam Technical Services Inc., Sensit Technologies LLC, Siemens AG, Synodon Inc., Schneider Electric SE, Thermo Fisher Scientific Inc., TUV SUD AG, Viper Innovations Ltd., Yokogawa Electric Corp., Zeus Intelligence, and among others.