Market Overview:

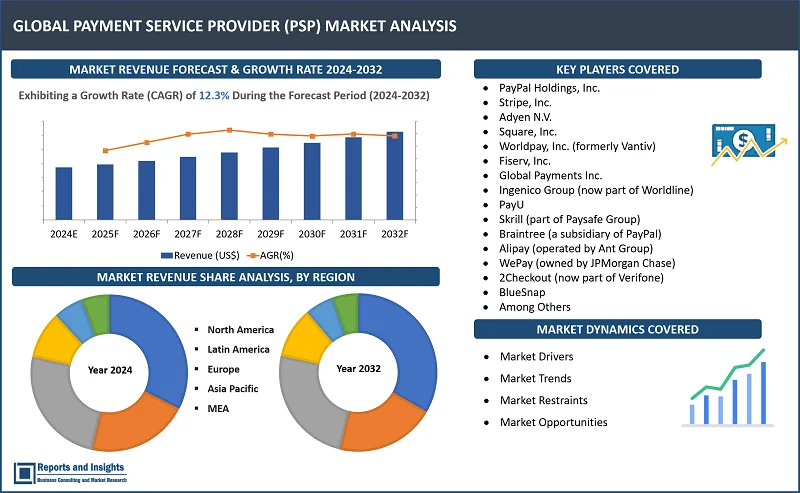

"The global payment service provider (PSP) market size reached US$ 38.2 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 108.5 billion in 2032, exhibiting a growth rate (CAGR) 12.3% of during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Payment Service Provider Market Growth Rate (2024-2032) |

12.3% |

The financial world continues to evolve with regard to cashless and digital payments, frictionless payment methods, real-time payments, digital wallets, open banking, mobile banking, Point of Sale (PoS), and cryptocurrencies, among others, and innovations in payment processing solutions have been gaining rapid popularity in the global market. Payment Service Providers (PSPs), who are typically third-party companies that are affiliated with banks, card networks, and financial institutions provide comprehensive payment solutions to customers and end-users to facilitate electronic payments for business transactions through a single platform. PSPs provide the requisite infrastructure, security protocols, and regulation compliances, and handle end-to-end transactions, payment authorization, data encryption, fraud prevention, and settlement of funds. The services offered can be conveniently accessed and used for transacting through a single platform or via integrated platforms.

Payment service providers integrate with payment gateways to manage the technical aspects of payments, and also ensure that transactions are secure and comply with industry standards such as Payment Card Industry Data Security Standard (PCI-DSS). PSPs also manage settlement of funds into merchant accounts and provide detailed reports for financial reconciliation. Customers can also use such platforms for global reach for business purposes and make payments or transact in multiple currencies and settle transactions in preferred currency, which offers much-needed flexibility and aids businesses to expand into new markets and cater to international customers.

A major factor driving the rapid shift towards total digitization of transactions across financial sectors and businesses and supporting use of PSPs in advancements on technology and integration into various processes and infrastructure. Integration of Block chain, Artificial Intelligence (AI), Machine Learning (ML), and Near Field Communication (NFC) are serving to enhance security, as well as provide transparency in payment transactions. In addition, AI and ML algorithms aid in fraud detection and prevention, and are gaining importance in analyzing transaction patterns in real-time to identify and mitigate potential risks.

Some payment modes supported by PSPs include Credit & Debit Cards (Visa, MasterCard, American Express, and others); Bank Transfers (Direct debits and credit transfers); Digital Wallets (PayPal, Apple Pay, Google Wallet, and others); Mobile Payments (Payments via mobile apps and Near Field Communication (NFC) technology; and Alternative Payment Methods (Cryptocurrencies, buy-now-pay-later services, and others).

Payment Service Provider Market Trends and Drivers:

Growth of the global Payment Service Provider (PSP) market is driven by key factors that reflect the evolving landscape of financial transactions. Primary among these, is the rapid expansion of e-commerce and need to adopt payment processing solutions, and increasing number of businesses and banking institutions are focusing on providing more seamless and secure payment options to leverage emerging opportunities in the market.

Key factors resulting in rapid shift towards services offered by payment service providers include convenience of setting up merchant accounts necessary for making payments either with debit or credit cards, help businesses to optimize their respective payment processes presence of advanced systems to identify and prevent potential fraudulent activities and transactions, availability of subscription-based services, automated billing and payment cycles, and customer support to assist with merchant queries and payment-related issues. insights into transaction and data to help businesses to optimize their respective payment processes.

Using a PSP over other payment modes and channels offer the advantage of accessing an all-in-one solution for managing various payment methods, which reduces the complexity for merchants to a major extent. Also, presence of enhanced security measures and compliance with industry standards safeguards against potential fraud and data breaches. PSPs also offer simple integration with e-Commerce platforms, Point of Sale (POS) systems, and other business and payment tools.

Scalability is another factor that enhances appeal of PSPs, as these companies can scale with business growth, which supports increasing transaction volumes without compromising performance. In addition, multi-currency support and global payment methods offered by PSPs enable businesses to operate internationally and beyond borders. Moreover, rewards and benefits such as loyalty programs, bulk transaction discounts and lower fees for high-volume merchants, tailored or customizable payment solutions to meet specific needs and requirements of different businesses. PSPs also provide access to comprehensive data analytics to monitor performance and improve payment strategies.

In addition, emphasis on enhancing security measures is having major impact on the market, and with the escalating threat of cybercrime and fraudulent activities, businesses and consumers alike seek robust security features in payment solutions. The integration of technologies such as tokenization, biometrics, and advanced encryption has become imperative to build trust and safeguard financial transactions. Moreover, globalization of businesses and increasing trend of cross-border trade have created incline in demand for international payment processing solutions. Companies operating on a global scale require efficient and cost-effective payment systems that can seamlessly process transactions of varying currencies.

Furthermore, the evolution of regulatory frameworks and compliance standards has prompted more businesses to adopt technologically advanced payment processing solutions that ensure adherence to industry regulations. As regulatory requirements become more stringent, organizations are turning to comprehensive solutions that not only streamline transactions, but also ensure compliance with the ever-changing financial landscape.

Payment Service Provider Market Restraining Factors:

Besides the advantages and benefits mentioned above, some factors can impact decision to use payment service providers. This includes fees for transactions, chargebacks, and other services, which can be high, especially for small businesses with high transaction volumes. Also, high dependence on a third-party provider for critical payment infrastructure and potential of technical glitches or disruption of Internet service can lead to inability to process payments, affect sales, and impact customer satisfaction. In addition, some PSPs charge monthly maintenance fees or additional costs for certain services, which can be burdensome for small businesses, and possible hidden charges or fees for specific services or chargebacks can affect bottom line of a business.

Concerns over security and data privacy following high-profile data breaches and cybersecurity threats have raised apprehensions among businesses and consumers, despite solutions being announced as advanced payment processing solutions. Also, stringent compliance requirements can burden PSPs with complex regulatory obligations, affecting operational efficiency and increasing compliance costs. Moreover, evolving regulatory frameworks across different jurisdictions pose challenges for PSPs to ensure compliance while operating in multiple markets.

Cost factors also inhibit demand, as PSPs incur substantial expenses related to infrastructure, security measures, and regulatory compliance, impacting profit margins. Research and Development (R&D) challenges further impede growth, as PSPs need to continually invest in innovation to stay competitive and address evolving consumer preferences and technological advancements. In addition, disadvantages associated with the use of PSPs, such as transaction fees and concerns over data security and privacy, deter some consumers and businesses from adopting these services.

Availability of substitutes and alternatives, including traditional payment methods like cash and checks, as well as emerging technologies like cryptocurrency, also limit PSP adoption in certain segments. Other associated factors restraining revenue growth include market saturation in mature markets, increasing competition among PSPs, and economic uncertainties affecting consumer spending patterns.

Payment Service Provider Market Opportunities:

Technological advancements such as digital transformation and increasing digitalization of businesses is a major factor supporting a steady shift towards advanced payment solutions, and this coupled with rise of e-Commerce is driving need for more robust online payment systems. Advancements and integration in Artificial Intelligence (AI), blockchain, and biometric authentication are enhancing what PSPs are offering, and this trend is expected to continue to aid in expanding customer bases and revenues for service providers.

Companies and PSPs can leverage opportunities in emerging markets, diversify service offerings, and engage in strategic collaborations to expand avenues and drive revenue growth. These initiatives enable manufacturers to cater to evolving consumer demands, enhance competitiveness, and capitalize on emerging trends in the global payment service provider landscape.

Payment Service Provider Market Segmentation:

By Payment Method Type

- Credit Cards

- Debit Cards

- E-wallets

- Bank Transfers

- Cryptocurrencies

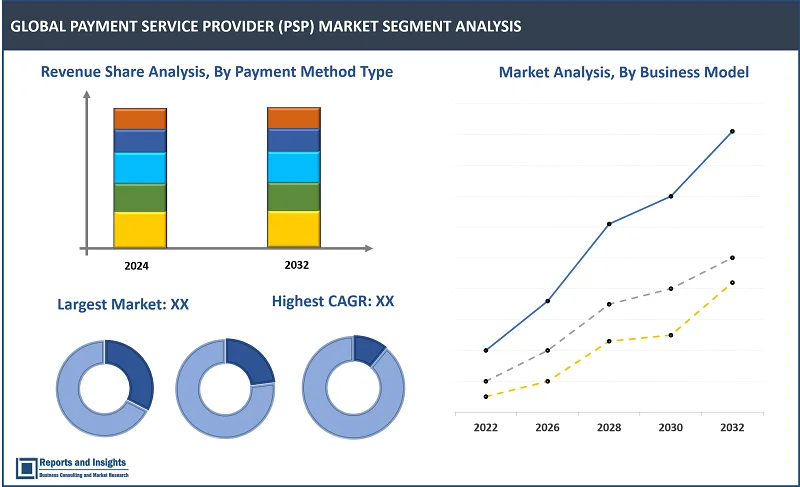

Among the payment method type segments in the global Payment Service Provider (PSP) market, the credit card segment is expected to account for the largest revenue share over the forecast period. This projection is supported by wide usage and acceptance of credit card payments, consumer preference for convenience and security, and established infrastructure across global retail and e-commerce sectors. In addition, credit card usage is supported by incentives such as rewards programs and consumer protections, and the high transaction volumes and fees associated with credit card payments further contribute to preference.

By Transaction Mode

- Online Payments

- Point of Sale (POS) Payments

- Mobile Payments

- Peer-to-Peer (P2P) Payments

- Recurring Payments

Online payments segment is expected to account for the largest revenue share among transaction mode segments in the Payment Service Provider (PSP) market. This is due to the significant rise in e-commerce, convenience of online transactions, and growing preference for digital over cash payments. The increasing use of smartphones and mobile apps for shopping, coupled with the expansion of global internet access, further supports this growth. Additionally, businesses are increasingly adopting online payment solutions to streamline operations and enhance customer experiences.

By Business Model

- Aggregator Model

- Merchant Acquirer Model

- Payment Facilitator Model

- Subscription Model

The merchant acquirer model segment is expected to account for the largest revenue share among the business model segments in the Payment Service Provider (PSP) market. Dominance of this model is driven by ability to handle high transaction volumes and provide comprehensive payment processing solutions to merchants. Merchant acquirers offer value-added services like fraud protection, data analytics, and customer support, making them attractive to businesses. Additionally, their established relationships with banks and card networks ensure seamless transaction processing, further boosting their adoption and revenue generation.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

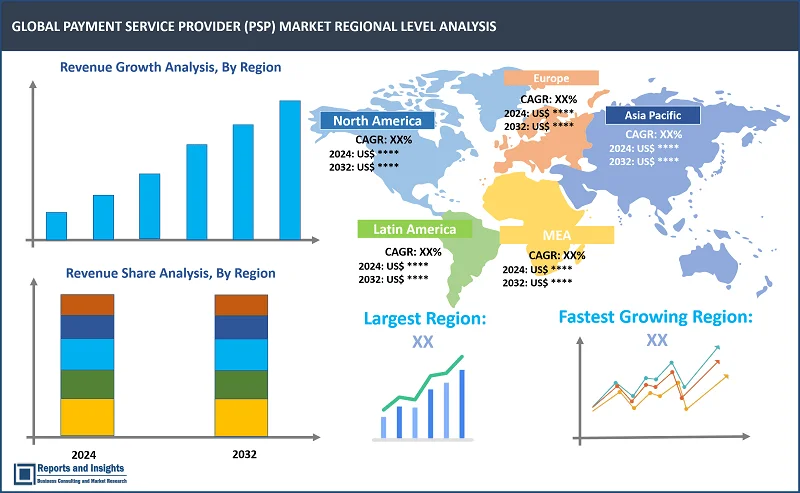

The global Payment Service Provider (PSP) Market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America is a leading regional market in terms of revenue share and usage of PSPs, driven by the presence of major players like PayPal, Stripe, and Square, as well as a highly developed e-Commerce landscape. Also, the United States (US) is the primary revenue contributor, benefiting from high consumer spending, advanced digital infrastructure, and widespread adoption of online payment solutions.

In Asia Pacific, China leads is terms of use of PSPs, supported by the dominance of digital payment platforms such as Alipay and WeChat Pay, along with a large population increasingly embracing e-Commerce and mobile payments. Europe market revenue is driven by major contribution from countries such as the United Kingdom (UK), Germany, and France, where established financial institutions and regulatory frameworks support innovation and adoption of PSP services.

Leading Companies in Payment Service Provider Market & Competitive Landscape:

The competitive landscape in the global Payment Service Provider (PSP) market is intense, with a number of leading companies focused on leveraging maximum market share. Key players such as PayPal, Stripe, and Adyen are employing various strategies to maintain their positions and expand their consumer bases. One key strategy is innovation in payment solutions, including the development of new technologies such as contactless payments, biometric authentication, and blockchain-based transactions. These innovations enhance security, speed, and convenience for consumers and businesses alike.

In addition, strategic partnerships and acquisitions enable PSPs to expand their service offerings, enter new markets, and reach a wider customer base. Moreover, high focus on customer experience, through intuitive interfaces, responsive customer support, and personalized services, helps PSPs differentiate themselves in a crowded market and build brand loyalty.

These companies include:

- PayPal Holdings, Inc.

- Stripe, Inc.

- Adyen N.V.

- Square, Inc.

- Worldpay, Inc. (formerly Vantiv)

- Fiserv, Inc.

- Global Payments Inc.

- Ingenico Group (now part of Worldline)

- PayU

- Skrill (part of Paysafe Group)

- Braintree (a subsidiary of PayPal)

- Alipay (operated by Ant Group)

- WePay (owned by JPMorgan Chase)

- 2Checkout (now part of Verifone)

- BlueSnap

Recent Development:

-

May 2024: Stripe introduced a suite of new payment solutions and financial services tailored for the UK market, aimed at facilitating access to capital and fostering the growth of British businesses. Among the newly unveiled features are Stripe Capital, offering business financing options, as well as Open Banking-powered payment alternatives at reduced costs and quicker payout times. With Stripe Capital now accessible in the UK, small businesses have the opportunity to secure flexible funding to fuel their growth initiatives, whether it be acquiring new equipment, expanding their workforce, or enhancing customer experiences. Utilizing transaction and business history data from Stripe, Stripe Capital proactively assesses businesses for financing eligibility. Approved funds are disbursed the following business day, with repayment structured to align with the businesses' revenue streams. Initially available to UK businesses operating directly through Stripe, Stripe Capital will extend its reach later in the year to encompass UK marketplaces and platforms leveraging Stripe Connect, enabling them to extend financing options to their own users. Furthermore, Stripe has recently launched its inaugural Open-Banking-powered payment solution, Pay by Bank, within the UK market. This real-time, cost-effective payment method enables consumers to directly transact from their bank accounts. Notable enterprises such as online car marketplace Cinch and insurance brokerage AJ Gallagher have already adopted Pay by Bank, citing benefits such as reduced payment expenses and improved cash flow management.

- March 2024: PayPal introduced PayPal Complete Payments, which is a comprehensive payment solution enabling Small and Medium-Sized Businesses (SMBs) to accept a variety of payment methods, including PayPal, Apple Pay, Google Pay, credit and debit cards, and other alternative payment options. This new offering provides SMBs with the broadest range of payment choices to date, enhancing conversion rates and customer retention. Beyond offering a diverse array of payment methods, PayPal Complete Payments also includes advanced fraud and chargeback protection. This feature helps minimize financial losses and reduces the time SMBs spend managing disputes.

Payment Service Provider Market Research Scope

|

Report Metric |

Report Details |

|

Payment Service Provider Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

12.3% |

|

Segment covered |

Payment Method Type, Transaction Mode, Business Model, and Region |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

UK |

|

Largest Market |

North America |

|

Key Players |

PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Square, Inc., Worldpay, Inc. (formerly Vantiv), Fiserv, Inc., Global Payments Inc., Ingenico Group (now part of Worldline), PayU, Skrill (part of Paysafe Group), Braintree (a subsidiary of PayPal), Alipay (operated by Ant Group), WePay (owned by JPMorgan Chase), 2Checkout (now part of Verifone), BlueSnap |

Frequently Asked Question

What is the market size of the Payment Service Provider (PSP) market in 2023?

The Payment Service Provider (PSP) market size reached US$ 38.2 billion in 2023.

At what CAGR will the Payment Service Provider (PSP) market expand?

The market is expected to register a 12.3% CAGR through 2024-2032.

Who are leaders in the Payment Service Provider (PSP) market?

Companies such as PayPal, Stripe, Adyen, Square, and Worldpay are considered leaders in this space, and market leadership can vary depending on factors such as market share, revenue, technological innovation, and geographic presence.

What are some key factors driving revenue growth of the Payment Service Provider (PSP) market?

Increasing adoption of digital payments worldwide, rapid proliferation of e-commerce and mobile commerce, growing demand for contactless and online payment solutions, expanding Internet and smartphone penetration, and emergence of new payment technologies such as blockchain and biometrics.

What are some major challenges faced by companies in the Payment Service Provider (PSP) market?

Companies in the market face various challenges, including stringent regulatory requirements and compliance burdens, increasing cybersecurity threats and fraud risks, rapid technological advancements requiring continuous innovation, high level of competition from both established players and new entrants.

How is the competitive landscape in the Payment Service Provider (PSP) market?

The competitive landscape in the Payment Service Provider (PSP) market is characterized by intense rivalry among key players striving to expand market share and maintain competitive advantages. Companies differentiate themselves through factors such as the breadth and quality of their service offerings, technological innovation, pricing strategies, geographic reach, customer service, and strategic partnerships.

How is the Payment Service Provider (PSP) market segmented?

The market is segmented based on payment method type, transaction mode, business model, and region.

Who are the key players in the global Payment Service Provider (PSP) market?

PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Square, Inc., Worldpay, Inc., Fiserv, Inc., Global Payments Inc., Ingenico Group, PayU, Skrill, Alipay, WePay, 2Checkout, and BlueSnap.