Market Overview:

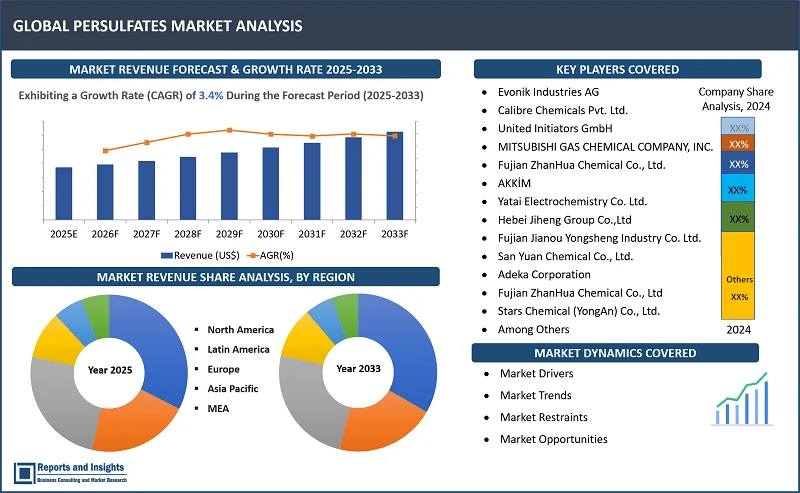

"The global persulfates market was valued at US$ 834.5 Million in 2024 and is expected to register a CAGR of 3.4% over the forecast period and reach US$ 1,127.4 Million in 2033."

|

Report Attributes |

Details |

|

Base Year |

2024 |

|

Forecast Years |

2025-2033 |

|

Historical Years |

2021-2023 |

|

Persulfates Market Growth Rate (2025-2033) |

3.4% |

Persulfates are a group of chemical compounds containing the persulfate anion and are powerful oxidizing agents used in various industries, including in the fields of chemistry, environmental science, and cosmetics. The most common persulfates include ammonium persulfate, sodium persulfate, and potassium persulfate used primarily in polymerization, cleaning, and environmental applications. Also, these compounds are used in processes that require the generation of free radicals such as polymerization where they initiate the polymerization of monomers in the production of plastics and synthetic rubbers. In addition, these are used in the treatment of wastewater where their strong oxidizing properties help break down organic pollutants, and in soil remediation processes, particularly in the oxidation of contaminants like chlorinated solvents. Persulfates are usually stable in dry conditions, but they decompose in the presence of heat or moisture, releasing oxygen and producing sulfate compounds.

The global persulfates market is registering significant growth, driven by the increasing demand across various industries such as chemicals, personal care, electronics, and water treatment. Moreover, the demand for personal care products such as hair bleaching agents, further drives the market demand for persulfates. Additionally, the demand for persulfates increases in the water treatment industry for their ability to treat contaminated water and soils, especially in the case of hazardous pollutants like chlorinated compounds and oils.

Persulfates Market Trends and Drivers:

The growing use of persulfates as oxidizing agents in water treatment, typically in the form of ammonium, sodium, or potassium persulfates to eliminate contaminants drive the global persulfates market growth. In water treatment, persulfates are effective in degrading a variety of organic pollutants, including petroleum hydrocarbons, Volatile Organic Compounds (VOCs), and heavy metals. Also, this is particularly beneficial in addressing contamination in groundwater, rivers, and industrial sites. In addition, the growing importance of environmental sustainability, stricter pollution control regulations, and the increasing need for safe drinking water contribute to the rising demand for persulfates.

Moreover, the rising miniaturization of electronic devices and the shift towards more complex designs require highly efficient cleaning agents such as persulfates to ensure the precision and reliability of components. Persulfates are vital for processes such as PCB (printed circuit board) etching and cleaning where their strong oxidizing properties help remove unwanted metallic and organic residues. The increasing demand for persulfates in the electronics industry with the innovation in consumer electronics, semiconductors, and emerging technologies like 5G and IoT, further contribute to the market growth.

Persulfates Market Restraining Factors:

One of the restraining factors of global persulfates is the high cost of production, including specialized equipment and raw materials for the synthesis of persulfates involves complex chemical reactions. This can prevent smaller manufacturers from entering the market and limiting the affordability of persulfates for certain industries, especially in price-sensitive markets.

Also, the supply chain for persulfates faces disruptions from several factors such as geopolitical tensions, trade restrictions, and natural disasters, impacting the production and distribution of these raw materials. The challenges in logistics such as shipping delays and container shortages also increase these supply chain issues, leading to delays and higher operational costs for manufacturers.

In addition, stringent environmental regulations and the increasing demand for greener alternatives can hinder market growth. Moreover, the hazardous nature of persulfates during storage and transportation poses safety risks, leading to increased compliance costs for companies in the industry.

Persulfates Market Opportunities:

Companies can collaborate to leverage complementary strengths, improve their R&D capabilities, and expand their reach into new regions. Strategic partnerships between chemical manufacturers and technology providers to develop innovative persulfate-based products that cater to specific industrial needs present opportunities for market growth. Also, partnerships between water treatment companies and persulfate producers address the growing demand for effective, eco-friendly wastewater treatment solutions. In addition, the rising demand for clean energy technologies where that are utilized in energy storage systems and environmental remediation processes, further opens up new opportunities.

In emerging markets, regional growth is particularly notable due to rapid industrialization, urbanization, and an increasing focus on sustainable practices. Countries in Asia-Pacific like China, India, and Southeast Asian nations are seeing higher consumption of persulfates. The construction, textile, and automotive sectors in these regions are expanding, driving the demand for persulfates, especially in polymer production and surface cleaning. In addition, emerging markets offer unique opportunities due to the expansion of infrastructure and manufacturing facilities.

Persulfates Market Segmentation:

By Product Type

- Ammonium Persulfate

- Potassium Persulfate

- Sodium Persulfate

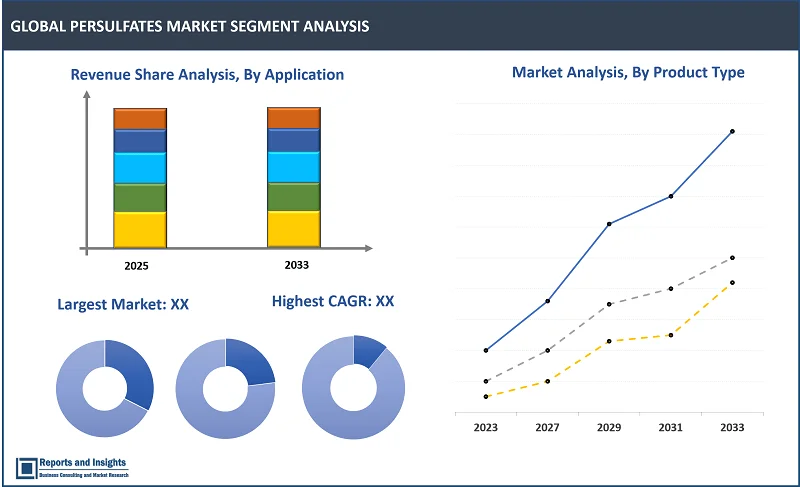

Thе ammonium persulfate sеgmеnt among the product type sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе global persulfates markеt. The dominance can be attributed to its wide applications, particularly in the polymer and textile industries where it is used as a polymerization initiator. Also, the increasing use in the production of cleaning agents, disinfectants, and as a bleaching agent in various processes contribute to the dominance in the market.

By Functionality

- Bleaching Agent

- Oxidizing Agent

- Cleaning Agent

- Catalyst

- Others

Thе oxidizing agent sеgmеnt among thе functionality sеgmеnt is еxpеctеd to account for thе largеst rеvеnuе sharе in thе global persulfates markеt. The dominance can be attributed to use of persulfates across various industries like chemicals, water treatment, polymer production, electronics, and cosmetics. They decompose into free radicals, making these ideal for initiating chemical reactions in polymerization, cleaning processes, and environmental applications.

By Application

- Polymerization Initiator

- Emulsion Polymerization

- Bulk Polymerization

- Oxidizing Agent

- Textile Bleaching

- Cosmetic Formulations

- Paper Pulp Processing

- Cleaning and Etching Agent

- Printed Circuit Boards

- Metal Surface Treatment

- Soil and Groundwater Remediation

- Hair Bleaching and Dyeing

- Disinfectants and Cleaning Agents

Among the application segments, polymerization initiator segment is expected to account for the largest revenue share. The dominance can be attributed to synthetic polymers like PVC, polystyrene, and acrylics which are produced using persulfates, including ammonium, potassium, and sodium persulfates using polymerization reactions.

By End-use Industry

- Cosmetics & Personal Care

- Chemicals and Polymers

- Electronics and Semiconductors

- Textiles and Fabrics

- Food Processing

- Packaging

- Environmental Remediation

- Pulp and Paper Industry

- Agriculture

- Oil & Gas

- Water Treatment

- Others

Among the end-use industry segments, chemical and polymers segment is expected to account for the largest revenue share. The dominance can be attributed to their wide applications as powerful oxidizing agents in processes such as water treatment, bleaching, and chemical synthesis and as initiators in the production of polymers, particularly in the production of acrylics and styrene-based materials. Also, the demand for high-performance polymers in sectors such as packaging, automotive, and electronics increase the demand and market growth of persulfates.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

Thе global persulfates markеt is dividеd into fivе kеy rеgions: North Amеrica, Europе, Asia Pacific, Latin Amеrica and thе Middlе East and Africa. Regionally, the U.S. is the dominant player in the North American market due to the strong presence of industries such as polymer manufacturing and water treatment. Also, the demand for cosmetics and personal care products has strengthened persulfates consumption. Europe also is the key market with countries such as Germany and France leading in industrial applications. The region’s strict environmental regulations are pushing companies to adopt safer and more efficient chemicals, further enhancing demand for persulfates. Asia-Pacific is registering the fastest growth due to industrialization, particularly in China, India, and Southeast Asia with the rising demand from the electronics, polymer, and water treatment industries. While, Latin America and the Middle East have emerging markets for persulfates with increasing demand in water treatment and oil & gas sectors.

Leading Companies in Global Persulfates Market & Competitive Landscape:

The competitive landscape in the global persulfates market is characterized by intense competition among leading manufacturers seeking to leverage maximum market share. Major companies focus on the production and distribution of persulfates used across industries like chemicals, cosmetics, water treatment, and polymer manufacturing. Some key strategies adopted by leading companies include investing significantly in Research and Development (R&D) to manufacture a wide range of persulfate products,. In addition, companies focus on improving durability, energy efficiency, and properties of global persulfates, and maintain their market position by steady expansion of their consumer base. Companies also engage in strategic partnerships and collaborations with research firms and manufacturers, which allows them to integrate their global persulfates with different technologies. Moreover, the market dynamics for new treatments can be significantly influenced by the approval and regulatory environment.

These companies include:

- Evonik Industries AG

- Calibre Chemicals Pvt. Ltd.

- United Initiators GmbH

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Fujian ZhanHua Chemical Co., Ltd.

- AKKİM

- Yatai Electrochemistry Co. Ltd.

- Hebei Jiheng Group Co.,Ltd

- Fujian Jianou Yongsheng Industry Co. Ltd.

- San Yuan Chemical Co., Ltd.

- Adeka Corporation

- Fujian ZhanHua Chemical Co., Ltd

- Stars Chemical (YongAn) Co., Ltd.

- ABC Chemicals(Shanghai)Co., Ltd.

- Shaanxi Baohua Technologies Co., Ltd.

- Sinchem Industry Co., Limited

- Hengshui Jiamu Chemical Co. Ltd.

- Tongling Huaxing Chemical Co., LTD

Persulfates Market Research Scope

|

Report Metric |

Report Details |

|

Persulfates Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

3.4% |

|

Segment covered |

By Product Type, Functionality, Application, and End-Use Industry |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

Evonik Industries AG, Calibre Chemicals Pvt. Ltd, United Initiators GmbH, MITSUBISHI GAS CHEMICAL COMPANY, INC., Fujian ZhanHua Chemical Co., Ltd., AKKİM , Yatai Electrochemistry Co. Ltd., Hebei Jiheng Group Co.,Ltd, Fujian Jianou Yongsheng Industry Co. Ltd., San Yuan Chemical Co., Ltd., Adeka Corporation, Fujian ZhanHua Chemical Co., Ltd, Stars Chemical (YongAn) Co., Ltd., ABC Chemicals(Shanghai)Co., Ltd., Shaanxi Baohua Technologies Co., Ltd., Sinchem Industry Co., Limited, Hengshui Jiamu Chemical Co. Ltd., Tongling Huaxing Chemical Co., LTD., and among others. |

Frequently Asked Question

What is the size of the global persulfates market in 2024?

The global persulfates market size reached US$ 834.5 Million in 2024.

At what CAGR will the global persulfates market expand?

The global persulfates market is expected to register a 3.4% CAGR through 2025-2033.

How big can the global persulfates market be by 2033?

The market is estimated to reach US$ 1,127.43 Million by 2033.

What are some key factors driving revenue growth of the global persulfates market?

Key factors driving revenue growth in the global persulfates market includes rising demand in end-use industries, improvements in persulfate production processes, growing demand for pollution control, sustainability initiatives, and others.

What are some major challenges faced by companies in the global persulfates market?

Companies in the global persulfates market face challenges such as raw material cost volatility, supply chain disruptions, competition from substitutes, market demand fluctuations, and others.

How is the competitive landscape in the global persulfates market?

The competitive landscape in the global persulfates market is marked by intense rivalry among leading manufacturers. Companies compete on product quality, innovation, and cost-effectiveness.

How is the global persulfates market report segmented?

The global persulfates market report segmentation is based on product type, functionality, application, and end-use industry.

Who are the key players in the global persulfates market report?

Key players in the global persulfates market report include Evonik Industries AG, Calibre Chemicals Pvt. Ltd, United Initiators GmbH, MITSUBISHI GAS CHEMICAL COMPANY, INC., Fujian ZhanHua Chemical Co., Ltd., AKKİM , Yatai Electrochemistry Co. Ltd., Hebei Jiheng Group Co.,Ltd, Fujian Jianou Yongsheng Industry Co. Ltd., San Yuan Chemical Co., Ltd., Adeka Corporation, Fujian ZhanHua Chemical Co., Ltd, Stars Chemical (YongAn) Co., Ltd., ABC Chemicals(Shanghai)Co., Ltd., Shaanxi Baohua Technologies Co., Ltd., Sinchem Industry Co., Limited, Hengshui Jiamu Chemical Co. Ltd., Tongling Huaxing Chemical Co., LTD.