Market Overview:

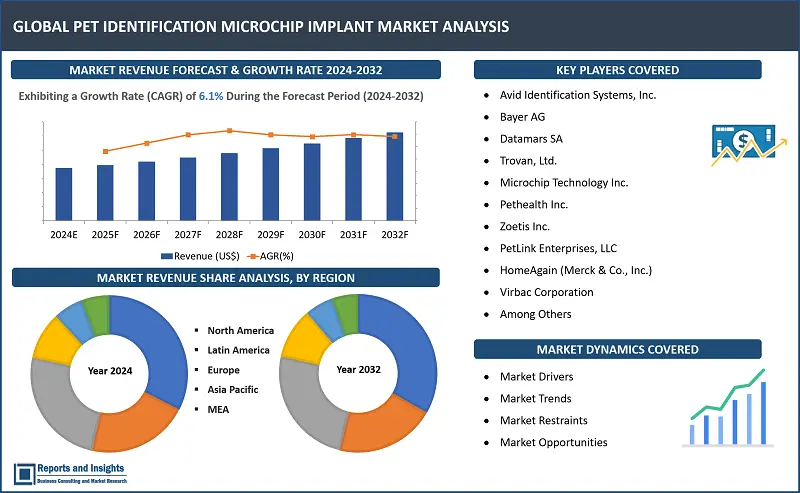

"The global pet identification microchip implant market was valued at US$ 389.3 Mn in 2023, and is projected to be valued at US$ 663.3 Mn by 2032 end. Sales revenue is expected to increase at a CAGR of 6.1% during the forecast period (2024-2032)."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

6.1% |

Pet Identification (ID) microchip implants have been gaining remarkable traction among pet owners and animal lovers worldwide, and microchipping is a trend that is expanding across, both developed and developing countries. Microchipping involves injecting tiny devices, typically the size of a grain of rice, under the skin of the animal, and each carry a unique 15-digit identification number that never changes, and this is linked to the pet owner's contact information. The technology behind these microchips has evolved over the years, with the latest versions offering enhanced features such as Radio Frequency Identification (RFID) tags and Global Positioning System (GPS) tracking and even health monitoring.

Pet ID microchips serve to identify the owners in the event of a pet being lost or stolen, or to add a level of identification when traveling locally or internationally, or vacationing with pets, and for tracking and identifying animals during military pet transport. A simple scan reveals the embedded ID, facilitating intimation or contacting the owner. Beyond reunification, the technology provides several benefits, including the ability to store medical records, track activity levels, and even set up virtual boundaries through geofencing. Microchipping also serves as a highly reliable form of identification that enables pairing the exact paperwork and health records to the correct animal. Also, having ISO-compatible microchip implanted in a pet, owners can be ascertained and contacted, and scanning of the microchip enables pets to identified and traced across international borders.

One of the key advantages of pet ID microchips is their permanence; unlike collars or tags that can be lost or removed, the implant provides a reliable and lifelong means of identification. These also offer pet owners convenience of accessing their pet's information through mobile apps or online platforms, and integration of Artificial Intelligence (AI) for predictive health analysis and the development of smaller, more advanced microchip models are some trends observed in the market.

Pet Identification Microchip Implant Market Trends and Drivers:

Rising awareness regarding the benefits associated with pet ID microchip implants, concerns for pet safety, and rising number of lost or stolen pets are some key factors that are resulting in an increasing number of pet owners opting for more reliable and permanent identification solutions. Also, stringent regulations and guidelines imposed by governments and animal welfare organizations are prompting pet owners to comply with mandatory pet identification measures. A number of countries currently require pets to be microchipped as part of responsible pet ownership, and this is further driving the adoption of this technology. In addition, advancements in microchip technology have expanded the functionality of these devices, providing additional features such as GPS tracking, health monitoring, and integration with mobile apps. These enhanced capabilities appeal to pet owners who are increasingly tech-savvy and seek comprehensive solutions for managing their pets' well-being.

Pet Identification Microchip Implant Market Restraining Factors:

Cost is a significant barrier, particularly for budget-conscious pet owners, and while the prices of microchip implants have decreased over time, the initial investment and associated fees for implantation may still pose a deterrent for some demographics. Also, there is a lack of universal standards and regulations governing pet microchipping, leading to confusion and hesitancy among some pet owners. Varying regulations across regions and a lack of interoperability can create barriers to seamless identification and tracking, thereby limiting the overall effectiveness of the technology.

In addition, concerns about the safety and potential health risks associated with microchip implants may deter some pet owners from adopting this technology. Although numerous studies have affirmed the safety of microchipping, misconceptions persist, contributing to hesitancy among a portion of the pet-owning population. Moreover, reliance on scanning technology for microchip detection poses a challenge, as it requires the cooperation of veterinary clinics, animal shelters, or other facilities. The availability and accessibility of scanning equipment can vary, affecting the efficiency of the identification process. Furthermore, lack of education and awareness about the benefits of pet ID microchips among a sizable base of pet owners remains a critical factor, and addressing misconceptions and promoting the advantages of microchipping through comprehensive education campaigns could play a pivotal role in overcoming this barrier and fostering greater adoption.

Pet Identification Microchip Implant Market Opportunities:

Leading players in the pet ID microchip implant market create avenues for revenue opportunities by advocating for and contributing to the establishment of global regulatory standards. A unified framework would streamline compliance, reduce confusion among pet owners, and create a more conducive environment for more widespread adoption. Collaborative efforts to influence standardization could also result in a more cohesive and efficient market. Also, continued innovation in microchip technology presents a substantial opportunity, and companies can invest in research and development to enhance existing features, such as real-time GPS tracking and health monitoring, making microchips even more attractive to pet owners. Advancements may also include the development of smaller, more sophisticated implants that offer increased functionality while ensuring the comfort and safety of the pets.

In addition, leading players can invest in comprehensive educational campaigns to raise awareness about the benefits of pet ID microchips, and by dispelling myths, addressing concerns, and emphasizing the positive outcomes, companies can contribute to a more informed and receptive pet-owning population, thereby driving greater adoption rates. Forming strategic partnerships with veterinary clinics and animal shelters can also facilitate widespread access to microchip scanning services. Such collaborations ensure that the infrastructure for microchip identification is readily available, promoting the effectiveness of the technology and increasing its value proposition for pet owners. Leading players can also explore opportunities for integrating pet ID microchip data with broader pet healthcare ecosystems, which could involve collaboration with pet insurance providers, healthcare platforms, and other relevant stakeholders to create a holistic approach to pet well-being.

Pet Identification Microchip Implant Market Segmentation:

By Type of Microchip

- Standard Identification Microchips

- Advanced Technology Microchips (GPS-enabled, Health Monitoring)

The advanced technology microchips segment is expected to register an inclining revenue growth rate over the forecast period, and this can be attributed to increasing demand for microchipping options with more sophisticated features, such as GPS tracking and health monitoring, among pet owners. The rising trend of pet owners considering their pets as integral family members and humanization has led to a higher willingness to invest in advanced technology solutions to ensure their pets' safety and well-being. Also, the appeal of real-time tracking capabilities in the event of a pet being lost or stolen enhances the value proposition of advanced microchips over standard ID microchips.

By Pet Type

- Dogs

- Cats

- Other Small Pets (e.g., Rabbits, Ferrets)

The dogs segment is projected to account for largest revenue share among the pet type segments and this is attributed to sheer population of dogs worldwide and the strong bond between dog owners and their pets. Dogs are the most commonly kept companion animals globally, and as responsible pet ownership becomes a priority, dog owners are increasingly investing in identification and tracking solutions as well as for health monitoring. Also, regulatory measures and guidelines, often favoring mandatory microchipping for dogs, contribute to a higher adoption rate.

By End-User Application

- Veterinary Clinics

- Animal Shelters and Rescue Organizations

- Pet Owners (Individual Consumers)

The pet owners (individual consumers) segment is expected to continue to account for largest revenue share over the forecast period. This is driven by the increasing trend of individual pet owners taking a proactive approach to safeguard the well-being of their pets and animal companions. As awareness about the benefits of microchipping grows, pet owners are becoming more inclined to invest in these devices as a reliable means of identification and security.

By Distribution Channel

- Veterinary Clinics and Hospitals

- Pet Specialty Stores

- Online Retailers

The veterinary clinics and hospitals segment is expected to continue to account for largest revenue share as visits to veterinary clinics as trusted sources for pet healthcare and services is relatively high. Veterinary professionals are often the primary advocates for microchipping, and the controlled environment of a clinic ensures the accurate and safe implantation of microchips.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

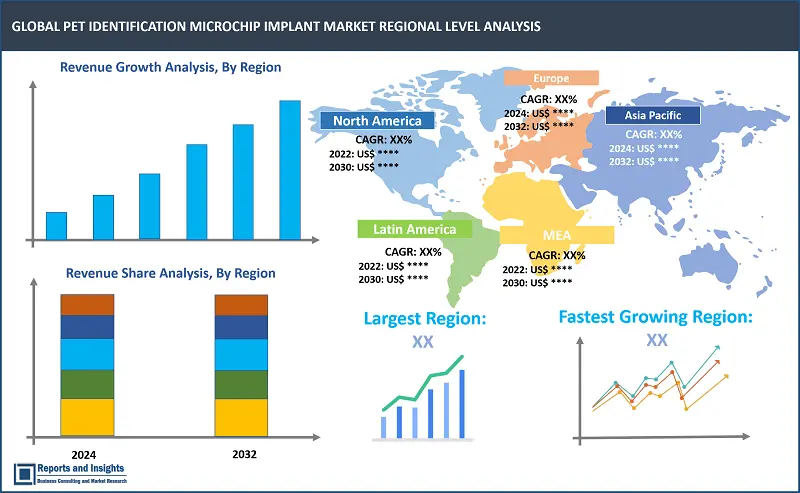

The global pet Identification (ID) microchip implant is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America has been a prominent market, with the United States and Canada leading in adoption due to stringent pet regulations and a high level of awareness among pet owners. In Europe it is mandatory to have an ISO-compatible chip implanted in a pet, and countries such as the United Kingdom, Germany, and France have shown significant adoption. In the Asia Pacific region, Australia and Japan have been key contributors. Some common factors driving overall growth in these regions include regulatory compliance mandating pet identification, increasing pet ownership, particularly in urban areas, rising awareness regarding availability and benefits of microchip implants, and overall feeling of responsibility and concern for safety, health, and wellness of pets among owners.

Leading Pet Identification Microchip Implant Providers & Competitive Landscape:

The competitive landscape in the global pet Identification (ID) microchip implant market is characterized by the presence of key players employing various strategies to maintain their positions and expand their consumer base. Leading companies are focusing on continuous innovation to enhance the features and functionalities of microchip implants, offering solutions beyond basic identification, such as GPS tracking and health monitoring. Strategic partnerships with veterinary clinics, animal shelters, and pet healthcare providers are being formed to establish a widespread network for microchip scanning services, ensuring accessibility and efficiency.

Marketing initiatives that emphasize the benefits of microchipping in reuniting lost pets and ensuring their overall well-being play a crucial role in expanding consumer awareness and adoption. Also, investments in educational campaigns to dispel myths and address concerns surrounding microchip technology contribute to building trust and fostering greater acceptance among pet owners. Adoption of such strategies allows leading companies to navigate the competitive landscape and maintain a strong presence in the global market.

These companies include:

- Avid Identification Systems, Inc.

- Bayer AG

- Datamars SA

- Trovan, Ltd.

- Microchip Technology Inc.

- Pethealth Inc.

- Zoetis Inc.

- PetLink Enterprises, LLC

- HomeAgain (Merck & Co., Inc.)

- Virbac Corporation

Recent Development:

- December 2023: AVID announced launch of its new MiniTracker 4, which is the latest evolution of the ever popular pet MicroChip scanner range the company offers. This model features Bluetooth connectivity, and the microchip number can be sent directly to devices such as PC, smartphone, or tablet of owner, or veterinary practice or rescue centre computer system. This can help reduce errors regarding microchip numbers, and has scanned MicroChip history and comes with a large display screen.

Pet Identification Microchip Implant Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

6.1% |

|

Segment covered |

Type of Microchip, Pet Type, End-user Application, Distribution Channel |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Asia Pacific |

China |

|

Largest Market |

North America |

|

Key Players |

Avid Identification Systems, Inc., Bayer AG, Datamars SA, Trovan, Ltd., Microchip Technology Inc., Pethealth Inc., Zoetis Inc., PetLink Enterprises, LLC, HomeAgain (Merck & Co., Inc.), Virbac Corporation |

Frequently Asked Question

What is the market size of the pet Identification (ID) microchip implant in 2023?

The pet Identification microchip implant size reached US$ 389.3 million in 2023.

At what CAGR will the pet Identification (ID) microchip implant expand?

The market is expected to register a 6.1% CAGR through 2024-2032.

Who is a leader in the pet Identification (ID) microchip implant market?

Avid Identification Systems, Inc. is a leader in the global pet Identification (ID) microchip implant market.

What are some key factors driving revenue growth of the global pet Identification (ID) microchip implant market?

Key factors driving revenue growth include increasing pet ownership, regulatory compliance, technological advancements in microchip features, rising awareness among pet owners, and the growing trend of pet identification for safety and well-being.

What are some major challenges faced by companies in the global pet Identification (ID) microchip implant market?

Common challenges include cost concerns for pet owners, regulatory variations across regions, concerns about the safety of microchip implants, reliance on scanning technology, and the need for continuous education to address misconceptions.

How is the competitive landscape in the global pet Identification (ID) microchip implant market?

The competitive landscape is characterized by leading companies focusing on innovation, forming strategic partnerships, investing in marketing and educational campaigns, and continuously enhancing features. The market is dynamic, with companies adapting to changing consumer preferences and technological advancements.

How is the global pet Identification (ID) microchip implant market segmented?

The global pet Identification (ID) microchip implant market is segmented by type of microchip, pet type, end-user application, and distribution channel.

Who are the key players in the global pet Identification (ID) microchip implant market?

Key players in the market include Avid Identification Systems, Inc., Bayer AG, Datamars SA, Trovan, Ltd., Microchip Technology Inc., Pethealth Inc., Zoetis Inc., PetLink Enterprises, LLC, HomeAgain (Merck & Co., Inc.), and Virbac Corporation.