Market Overview:

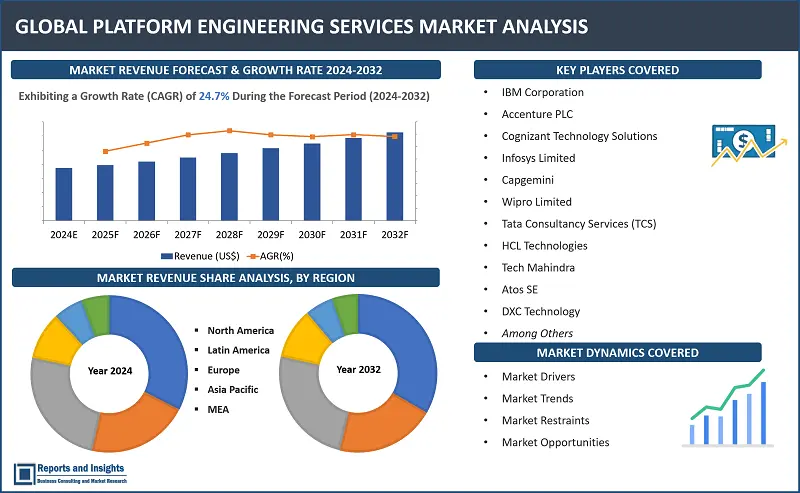

"The global platform engineering services market size reached US$ 5.7 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 41.6 billion in 2032, exhibiting a growth rate (CAGR) of 24.7% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

24.7% |

Platform engineering services play a key role in the contemporary tech landscape, offering comprehensive solutions to organizations seeking to build and maintain robust digital platforms. These services encompass a spectrum of technologies and practices aimed at designing, developing, and optimizing scalable platforms that facilitate seamless operations. Leveraging cloud computing, containerization, and microservices architecture, platform engineering services enable businesses to achieve agility, scalability, and reliability in their IT infrastructure. The benefits are extensive, ranging from accelerated application delivery to cost efficiency and improved user experiences.

Advantages of platform engineering services include enhanced collaboration, faster time-to-market, and ability to adapt swiftly to changing market demands. These services cater to diverse industries, from e-commerce and finance to healthcare and beyond, addressing specific challenges unique to each sector. Key trends in the market highlight the increasing adoption of DevOps trends, the rise of serverless computing, and a growing emphasis on security and compliance. Also, developments in Artificial Intelligence (AI) and Machine Learning (ML) are influencing the integration of intelligent automation within platform engineering workflows. As organizations embrace digital transformation, platform engineering services continue to evolve, providing the foundation for innovation and sustained competitiveness in a dynamic business landscape.

The buzz surrounding platform engineering is difficult to overlook, and it is justified as growing focus on platform engineering arises from its ability to enhance business agility, simplify tasks for developers, and establish uniformity across teams—a seemingly ideal technological solution for numerous companies. However, it is crucial to acknowledge that platform engineering may not be universally applicable, and before adopting this solution, organizations need to assess whether it aligns with their current stage in the software development process, as not every project or company is positioned to derive advantages from platform engineering, and its suitability should be evaluated based on individual needs and circumstances.

Platform Engineering Services Market Trends and Drivers:

Rapid digital transformation is resulting in an increasing number of organizations looking to stay competitive in the modern business landscape. Platform engineering services provide a foundation for this transformation, offering scalable and efficient solutions that enable companies to innovate rapidly. Also, the rise of cloud computing has played a major role in driving adoption of platform engineering services in recent times. Organizations are increasingly leveraging cloud infrastructure to enhance flexibility and cost-effectiveness, and platform engineering aligns seamlessly with these cloud-native approaches, supporting the development and deployment of applications in the cloud environment.

In addition, the growing complexity of IT ecosystems demands sophisticated solutions for effective management, and platform engineering services provide a holistic approach, addressing the intricacies of modern IT landscapes by incorporating technologies like containerization and microservices. Shift towards DevOps practices is also a driving force behind the adoption of platform engineering services. Organizations are recognizing the need for streamlined collaboration between development and operations teams, and platform engineering facilitates this convergence, leading to faster delivery cycles and improved overall efficiency.

Moreover, increasing recognition of the importance of data-driven insights is prompting a shift among organizations towards platform engineering as these services enable the creation of data platforms that support analytics and AI, empowering businesses to derive meaningful insights from their data.

Platform Engineering Services Market Restraining Factors:

Some major factors restraining much wider adoption of platform engineering services include concerns over security and data privacy remain prominent, with organizations becoming increasingly apprehensive about entrusting sensitive information to external platforms. This has led to a cautious approach in certain industries, limiting the overall uptake of platform engineering services. Also, the complexity of migrating existing legacy systems to modern platforms poses a significant challenge, slowing down adoption rates.

In addition, , data from this and other reports indicates that a notable percentage of businesses, particularly in highly regulated sectors like finance and healthcare, have expressed reservations about embracing platform engineering due to compliance and regulatory uncertainties. Moreover, the upfront costs associated with implementing platform engineering solutions have deterred some organizations, thereby impacting the speed of adoption. Overcoming these barriers requires addressing security concerns, streamlining migration processes, and demonstrating long-term cost-effectiveness to reinforce trust and encourage broader adoption.

Platform Engineering Services Market Opportunities:

Leading players and companies in the global platform engineering services market have a number of avenues to capitalize on in this steadily evolving market landscape. Increasing demand for hybrid and multi-cloud solutions presents a lucrative opportunity primarily, and as more organizations seek flexibility and redundancy, offering platform engineering services that seamlessly integrate across various cloud environments positions companies to cater to diverse client needs. Steady surge in edge computing applications also creates a significant growth avenue, and as proliferation of the Internet of Things (IoT) devices drives up demand for platforms that efficiently process and analyze data at the edge, the need for specialized engineering services is certainly going to increase further.

In addition, growing emphasis on data analytics and AI unlocks opportunities for platform engineering players to develop robust data platforms, and these can enable clients to harness the power of data for informed decision-making, making them indispensable in the current day data-driven business landscape. Moreover, the rising awareness of cybersecurity threats creates a niche for platform engineering services that prioritize robust security measures. Companies investing in advanced security features can position themselves as trusted partners in safeguarding clients' digital assets.

Furthermore, the trend towards low-code and no-code development solutions presents an opportunity for platform engineering services to streamline application development, empowering organizations to rapidly build and deploy software with minimal coding efforts.

Platform Engineering Services Market Segmentation:

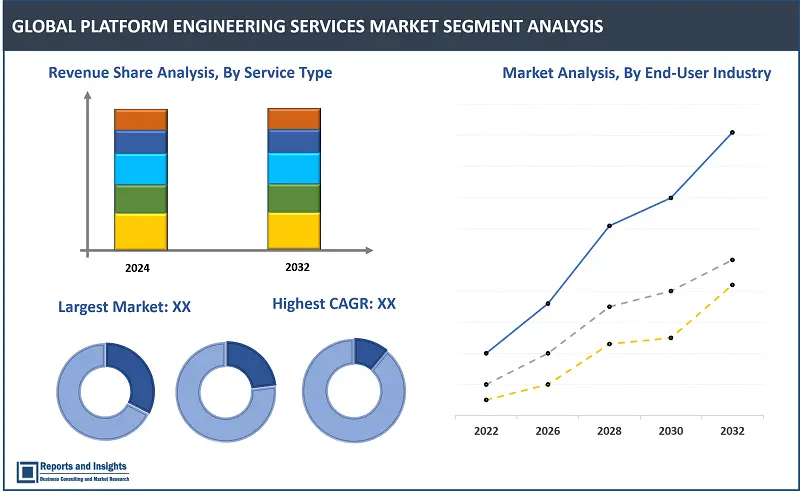

By Service Type

- Application Development and Maintenance

- Cloud Computing

- Integration and Middleware

- Testing Services

The application development and maintenance segment is expected to account for largest revenue share due to increasing demand for custom applications to meet diverse business needs driving a surge in development and maintenance services. As organizations prioritize digital transformation, the need for scalable and tailored applications becomes more apparent, and also, continuous evolution of technologies and the imperative to stay competitive contribute to sustained demand for ongoing application maintenance and updates, and these factors are driving incline in revenue growth of this segment.

By End-User Industry

- Healthcare

- Financial Services

- Retail and E-commerce

- Telecom and IT

The financial services segment is expected to account for largest revenue share and growth is driven by increasing reliance on advanced technology to enhance operational efficiency, security, and customer experience across services and processes in the finance sector. The integration of platform engineering services in financial applications, such as online banking and financial analytics, is also crucial for meeting evolving industry demands, and as financial institutions embrace digital transformation to stay competitive, the demand for robust, scalable platform engineering solutions is expected to incline further in 2024.

By Deployment Type

- On-Premises

- Cloud-Based

The cloud-based segment is projected to retain its dominance in terms of revenue share over the on-premises segment during the forecast period. This can be attributed to increasing preference for cloud infrastructure, due to flexibility, scalability, and cost-effectiveness. Organizations prefer cloud-based deployment to streamline operations, facilitate remote accessibility, and leverage advanced technologies, and scalability offered by cloud platforms aligns with the dynamic needs of businesses, promoting the adoption of platform engineering services.

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The large enterprises segment is projected to account for largest revenue share over the forecast period, owing to the substantial digital infrastructure requirements of large organizations and need to accommodate comparatively larger and comprehensive digital transformation initiatives. This transformation also necessitates scalable and sophisticated platform engineering services to meet complex demands, and as large enterprises often have diverse and extensive IT landscapes, this drives need for and adoption of platform engineering services for seamless integration, efficient management, and innovation.

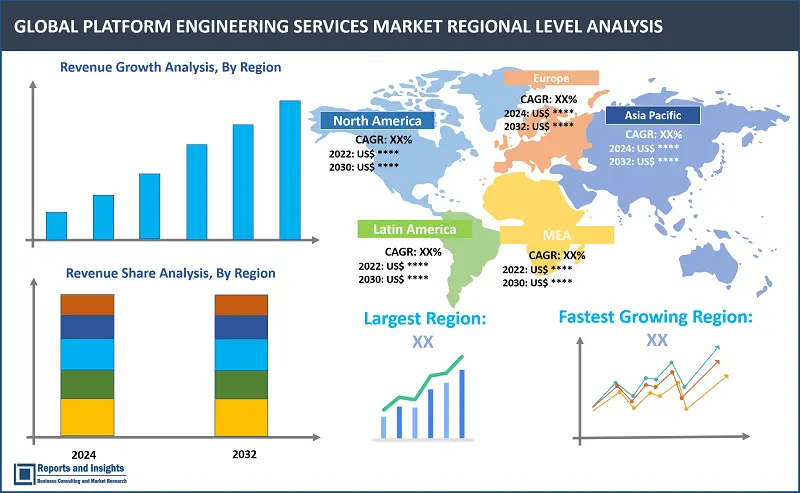

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global platform engineering services market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America accounts for a substantially larger revenue share than other regional markets in the global market, with the United States leading among the country-level markets in terms of technology adoption. In Asia Pacific, countries such as India and China have been registering significant growth due to their rapid growth of IT sectors respectively. In Europe, the United Kingdom and Germany have been key revenue contributors, and some common factors driving overall growth across regions include increasing demand for digital transformation, adoption of cloud computing, and rising need for scalable and efficient IT solutions.

Leading Platform Engineering Services Providers & Competitive Landscape:

The competitive landscape in the global platform engineering services market is characterized by intense competition among leading companies. Key strategies include a focus on innovation to offer cutting-edge solutions, strategic partnerships and collaborations to broaden service offerings, and mergers and acquisitions to enhance market presence. Leading firms emphasize customer-centric approaches, tailoring platform engineering services to meet specific industry needs. Also, investing in talent development and encouraging development of a robust ecosystem of technology partners contributes to maintaining a competitive edge. Overall, the market's dynamism necessitates a proactive approach, where companies continuously adapt strategies to stay ahead in the evolving landscape.

These companies include:

- IBM Corporation

- Accenture PLC

- Cognizant Technology Solutions

- Infosys Limited

- Capgemini

- Wipro Limited

- Tata Consultancy Services (TCS)

- HCL Technologies

- Tech Mahindra

- Atos SE

- DXC Technology

- Virtusa Corporation

- EPAM Systems

- L&T Infotech

- Mindtree Limited

Recent Development:

- October 2023: EPAM Systems, Inc. disclosed a Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to assist enterprises in addressing intricate business challenges, fostering growth, and scaling innovation using state-of-the-art cloud solutions, services, and strategies. The partnership will specifically concentrate on expediting modernization efforts, embracing cloud-native architecture, and harnessing the potential of AI and advanced analytics to deliver customer value across key industries like healthcare, life sciences, financial services, insurance, energy, and gaming. EPAM, established in 1993, has evolved into a global leader in digital transformation services, emphasizing digital and physical product development as well as digital platform engineering services.

- May 2023: Accenture announced intention to acquire Objectivity, which is a digital engineering firm specializing in cloud and platform development services aimed at facilitating clients' rapid innovation in their transformation endeavors. Objectivity, headquartered in Coventry, UK, will integrate its highly skilled team with Accenture, bringing added scale and resources from its operations in the UK, Poland, Germany, and Mauritius. Accenture aims to enhance its Cloud First capabilities through Objectivity's extensive expertise in platform engineering, cloud-native computing, and application modernization.

- March 24, 2023: Virtusa Corporation, which is a global provider of digital strategy, digital engineering, and IT services, made an announcement regarding a strategic cloud migration partnership with Aecon Group Inc. to support their cloud transformation efforts. This collaboration highlights Virtusa's expertise in seamlessly migrating Aecon's digital operations to the Amazon Web Services (AWS) Cloud, while also ensuring robust and continuous innovation for future-proofing operations. In order to realize its digital objectives, Aecon has chosen Virtusa, an AWS Premier Consulting Partner, to oversee the migration of its existing infrastructure, managed services, and workloads, including core ERP and integrated applications, from incumbent systems to AWS.

Platform Engineering Services Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

24.7% |

|

Segment covered |

Service Type, End-User Industry, Deployment Type, Organization Size |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

UK |

|

Largest Market |

North America |

|

Key Players |

IBM Corporation, Accenture PLC, Cognizant Technology Solutions, Infosys Limited, Capgemini, Wipro Limited, Tata Consultancy Services (TCS), HCL Technologies, Tech Mahindra, Atos SE, DXC Technology, Virtusa Corporation, EPAM Systems, L&T Infotech, Mindtree Limited |

Frequently Asked Question

What is the market size of the platform engineering services market in 2023?

The platform engineering services market size reached US$ 5.7 billion in 2023.

At what CAGR will the platform engineering services market expand?

The market is expected to register a 24.7% CAGR through 2024-2032.

Who are some of the market leaders in the platform engineering services market?

IBM Corporation is a leader in the global platform engineering services market.

What are some key factors driving revenue growth of the platform engineering services market?

Some key factors driving revenue growth of the platform engineering services market are increasing demand for digital transformation, adoption of cloud computing, and rising emphasis on data-driven decision-making.

What are some major challenges faced by companies in the platform engineering services market?

Companies in the platform engineering services market encounter challenges such as cybersecurity concerns, particularly as data becomes more integral. Legacy system migrations pose complexities, hindering seamless adoption. Moreover, ensuring compliance with evolving regulations and addressing issues related to interoperability in diverse IT ecosystems are common challenges. Balancing innovation with maintaining stable and reliable platforms presents an ongoing dilemma for market players.

How is the competitive landscape in the platform engineering services market?

The competitive landscape in the platform engineering services market is characterized by intense competition among key players. Leading companies focus on innovation, strategic partnerships, and mergers and acquisitions to maintain their positions. Customer-centric approaches, talent development, and robust ecosystems of technology partners are crucial for sustained competitiveness.

How is the platform engineering services market report segmented?

The platform engineering services market is segmented based on Service Type (Application Development, Cloud Computing), End-User Industry (Healthcare, Financial Services), Deployment Type (On-Premises, Cloud-Based), and Organization Size (Small and Medium-sized Enterprises, Large Enterprises).

Who are the key players in the global platform engineering services market report?

Key companies included in the global platform engineering services market report are IBM Corporation, Accenture PLC, Cognizant Technology Solutions, Infosys Limited, Capgemini, Wipro Limited, Tata Consultancy Services (TCS), HCL Technologies, Tech Mahindra, Atos SE, DXC Technology, Virtusa Corporation, EPAM Systems, L&T Infotech, Mindtree Limited.