Market Overview:

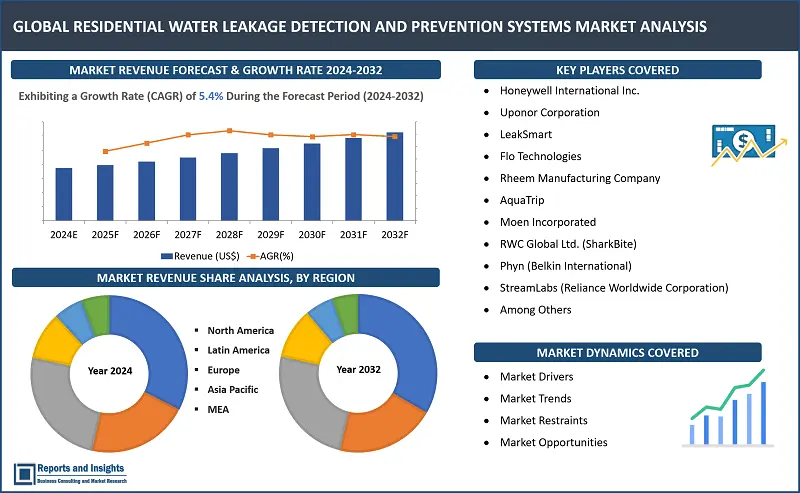

"The residential water leakage detection and prevention systems market size reached US$ 2.1 Billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 3.4 Billion by 2032, exhibiting a growth rate (CAGR) of 5.4% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

5.4% |

The global residential water leakage detection and prevention systems market is rapidly expanding due to increased awareness about water conservation and property protection. Market revenue growth is driven by key factors such as rising urbanization, climate changes, and technology advancements. Rapidly increasing water consumption and rising focus on detecting and preventing leaks and adopting effective related services and products, and also those based on IoT sensors and data analytics to provide real-time insights, are expected to drive revenue growth of the market. Key trends in the market include initiatives that promote water-efficient practices and increasing smart infrastructure. The advantages of these are twofold, and include mitigating property damage and reducing water wastage.

Analysis reveals a rising demand for innovative solutions as households seek sustainable ways to manage water resources and ensure home and infrastructure safety. Comprehensive analysis provides insights into market evolution and potential, and actionable insights and outlooks in the report help businesses make informed decisions in this evolving industry. Also, clarity and understanding of market trends help companies tailor their products to meet customer demands more effectively.

Residential Water Leakage Detection and Prevention Systems Market Trends and Drivers:

Technology Advancements: Integration of advanced technologies such as IoT sensors, Machine Learning (ML), and data analytics enables accurate and real-time leak detection, minimizing false alarms and enhancing overall efficiency.

Smart Home Adoption: Increasing adoption of smart home systems supports demand for connected leak detection solutions, allowing homeowners to monitor and control water usage remotely, thereby preventing potential property damage.

Water Scarcity Concerns: Rising global concerns about water scarcity are driving the need for efficient water management and measures to ensure long-term sustainability. Leak detection and prevention systems help conserve water resources, and as awareness regarding availability and advantages of such systems grows, demand among environmentally conscious consumers is expected to continue to increase.

Regulatory Support: Government regulations mandating water conservation and leak prevention measures in residential buildings is supporting market growth, and this is also having positive effects in the residential sector, as an increasing number of homeowners are investing in leak detection and prevention systems.

Insurance Industry Partnerships: Insurance providers incentivize homeowners to install leak detection systems by advising them to opt for enlisting services and product providers offering discounts on premiums. Such partnerships encourages wider adoption of these solutions and contributes to market growth.

Rising Property Values: Leak detection systems enable maintaining property condition and help owners to avoid potential decrease in value due to leaks and related damage over time. Homebuyers prioritize residences equipped with various value-addition and preventive measures, and increasing adoption of such systems is positively impacting demand and revenue growth of the market.

Residential Water Leakage Detection and Prevention Systems Market Restraining Factors:

High Initial Costs: The upfront investment required for purchasing and installing sophisticated leak detection and prevention systems can deter cost-conscious consumers, thereby limiting market penetration.

Limited Awareness: Lack of awareness about the potential risks of water leakage and the benefits of detection and prevention measures hampers the adoption of these solutions, especially in regions with lower awareness levels.

Complex Installation: Some leak detection systems require complex installation procedures, leading to additional expenses and discouraging adoption among homeowners who are not technologically inclined.

False Alarms: Over-sensitive sensors and unreliable technology can lead to false alarms, causing frustration for homeowners and reducing their trust in the effectiveness of these systems.

Maintenance Challenges: Regular maintenance and calibration are essential for the accurate functioning of leak detection systems. Homeowners may be reluctant to invest time and effort in upkeep.

Market Fragmentation: The presence of numerous providers offering a variety of leak detection solutions can lead to confusion among consumers due to uncertainty about product quality and reliability, and this can inhibit decision-making and slow down market growth.

Residential Water Leakage Detection and Prevention Systems Market Opportunities:

Product Innovation: Companies can leverage opportunities by continually innovating their leak detection solutions, integrating AI, machine learning, and predictive analytics to enhance accuracy and early detection capabilities.

Subscription Models: Offering subscription-based services that include regular maintenance, software updates, and customer support can create a steady revenue stream while ensuring optimal system performance.

Data Monetization: Leveraging the data collected from sensors and user behavior, companies can provide insights to water utilities, municipalities, or research institutions, creating an additional revenue source.

Bundled Services: Partnering with insurance companies, plumbing services, or home security providers to create comprehensive home protection bundles can enhance value proposition and drive higher revenue per customer.

Retrofit Market: Targeting older homes that lack modern plumbing systems with retrofit solutions can tap into an underserved market segment, as these homeowners seek ways to modernize their properties.

International Expansion: Exploring markets with high water scarcity or regions with increasing urbanization can offer growth prospects, as demand for leak detection systems rises in areas facing water-related challenges.

Residential Water Leakage Detection and Prevention Systems Market Segmentation:

By Product Type:

- Smart Leak Detectors

- Whole-Home Leak Prevention Systems

- Passive Leak Detection Systems

By Technology:

- Internet of Things (IoT) Integration

- Wireless Connectivity

- Artificial Intelligence (AI) and Machine Learning

- Cloud-Based Monitoring

- Remote Control and Alerts

By End-User:

- Single-Family Homes

- Multi-Family Apartments

- Condominiums

- Commercial Buildings

- Industrial Buildings

By Distribution Channel:

- Online Retail

- Brick-and-Mortar Retail

- Specialty Stores

- Direct Sales

- Distributors and Wholesalers

By Application:

- Kitchen and Bathroom Areas

- Basements and Crawl Spaces

- Utility Rooms

- Landscapes and Gardens

- HVAC Systems

By Region:

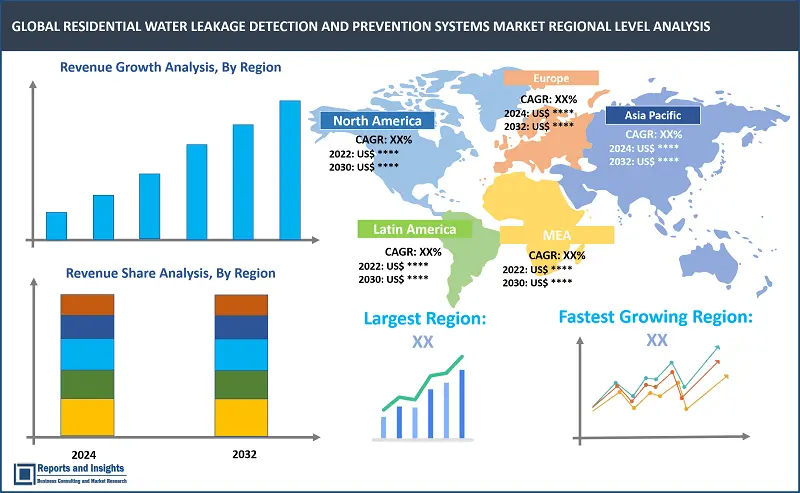

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Regional analysis reveals significant potential and key markets for sales of residential water leakage detection and prevention systems. North America, with its technological adoption and climate variations, registers robust demand for smart leak detection and prevention systems. Europe emphasizes sustainability, which is driving demand due to stringent water conservation policies. In Asia-Pacific, rapid urbanization and water scarcity concerns drive the need for leak detection and prevention solutions. Emerging economies in Latin America and Africa exhibit increasing interest as homeowners prioritize property protection. Preferences lean toward technologically advanced products with user-friendly interfaces. Increasing infrastructure developments and rising awareness of these solutions in countries in various regions is expected to continue to drive global market revenue growth.

Leading Residential Water Leakage Detection and Prevention Systems Providers & Competitive Landscape:

The global residential water leakage detection and prevention systems market is characterized by a competitive landscape shaped by innovation, technology, and rising emphasis on sustainability. Leading manufacturers are offering advanced leak detection and prevention solutions that cater to the rising demand for property protection, water conservation, and smart home integration.

Some of the major players in the residential water leakage detection and prevention systems market include Honeywell International Inc., renowned for its wide range of smart home products, including leak detection systems that provide real-time alerts and remote monitoring, and Uponor Corporation, which stands out with its expertise in plumbing and infrastructure solutions, offering comprehensive leak detection systems that are seamlessly integrated into buildings.

Another major player is LeakSmart, recognized for its cutting-edge smart home technology that enables real-time water monitoring and automatic shut-off in the event of leaks. Flo Technologies excels in leveraging artificial intelligence and machine learning to provide homeowners with insights into their water usage patterns and real-time leak detection. Rheem Manufacturing Company is a key contender with its innovative water heaters and integrated leak detection systems. AquaTrip specializes in whole-house water leak detection, offering a system that not only detects leaks but also shuts off the water supply to prevent further damage.

Companies are focusing on resolving product glitches and addressing key challenges such as false alarms, installation complexity, and maintenance requirements. As the demand for efficient water management solutions continues to rise, players in the residential water leakage detection and prevention systems market are at the forefront of delivering innovative products that not only safeguard properties but also contribute to water conservation efforts on a global scale.

Company List:

- Honeywell International Inc.

- Uponor Corporation

- LeakSmart

- Flo Technologies

- Rheem Manufacturing Company

- AquaTrip

- Moen Incorporated

- RWC Global Ltd. (SharkBite)

- Phyn (Belkin International)

- StreamLabs (Reliance Worldwide Corporation)

- iHome Systems

- Aclara Technologies LLC

- Grohe AG

- Eddy Solutions

- Flologic Systems

Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2022-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

5.4% |

|

Segment covered |

Product Type, Technology, End-User, Distribution Channel, Application, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Market in Europe |

Germany |

|

Largest Market in Asia Pacific |

China |

|

Key Players |

Honeywell International Inc., Uponor Corporation, LeakSmart, Flo Technologies, Rheem Manufacturing Company, AquaTrip, Moen Incorporated, RWC Global Ltd. (SharkBite), Phyn (Belkin International), StreamLabs (Reliance Worldwide Corporation), iHome Systems, Aclara Technologies LLC, Grohe AG, Eddy Solutions, and Flologic Systems |

Frequently Asked Question

What are some key trends driving growth of the market?

Increasing awareness about water conservation, rising adoption of smart home technologies, and growing emphasis on property protection against water damage.

What is the market size of the market in 2023?

The market size reached US$ 2.1 Billion in 2023.

At what CAGR will the market expand?

The market is expected to register a 5.4% CAGR through 2024-2032.

Which end-user segments are driving demand for residential water leakage detection and prevention systems?

Demand is supported by end-user segments such as single-family homes, multi-family apartments, condominiums, commercial buildings, and industrial buildings. Increasing recognition of the importance of water conservation and property protection in these segments is driving adoption of leak detection and prevention systems.

How is the residential water leakage detection and prevention systems market segmented?

The market report is segmented on the basis of product type, technology, end-user, distribution channel, application, and regions.