Market Overview:

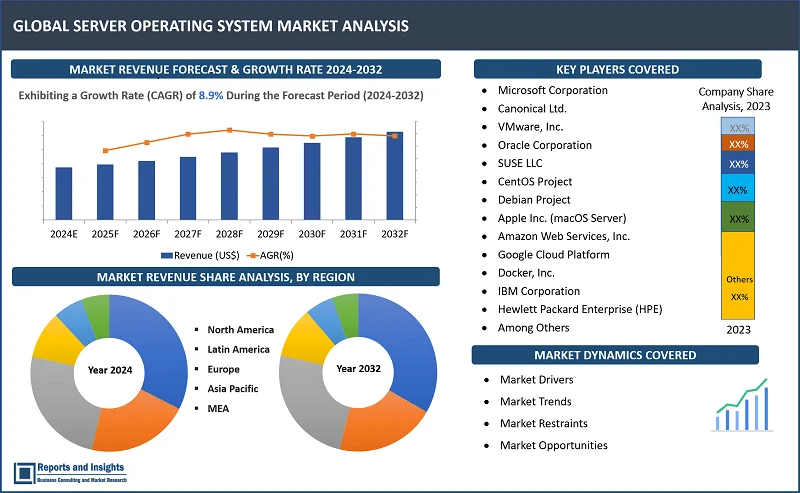

"The global server operating system market was valued at US$ 17.5 Billion in 2023 and is expected to register a CAGR of 8.9% over the forecast period and reach US$ 36.5 Billion in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Server Operating System Market Growth Rate (2024-2032) |

8.9% |

A server operating system comprises specialized software designed to manage and operate servers to enable efficient networking, storage and data management, and provides robust security, scalability, and remote management capabilities, thereby ensuring stable server performance. These systems allow centralized control over resources, specified user access, and applications, and optimize server utilization.

Various types of server operating systems available include Windows Server, known for its user-friendly interface and integration with Microsoft services. Linux distributions like Ubuntu Server and CentOS emphasize open-source flexibility and cost-effectiveness. Enterprise-focused solutions like Red Hat Enterprise Linux offer advanced support and features for mission-critical environments. Each type caters to specific needs, balancing performance, security, and ease of management.

The global server operating system market has been registering substantially rapid revenue growth recently, driven by rising demand for data management and cloud services globally. Increasing consumption of digital content is another major factor driving server deployment and systems across industries and sectors. Providers offer diverse services, from security enhancements to virtualization support, meeting evolving business needs. Technological advancements like containerization streamline resource allocation and scalability. Initiatives towards hybrid cloud integration and edge computing are also supporting demand and driving revenue growth of the market.

Server Operating System Market Trends and Drivers:

Cloud Migration Surge: The ongoing trend of cloud migration is driving deployment of these systems and supporting market revenue growth. As businesses transition to cloud-based infrastructures, the demand for compatible server operating systems that ensure seamless integration, resource allocation, and security continues to incline.

Rising Data Center Expansion: Steady proliferation of data-intensive applications is driving need for expansion of data centers worldwide. This driving force directly boosts demand for server operating systems capable of efficiently managing these data centers, optimizing performance, and enhancing scalability.

Edge Computing Proliferation: The rise of edge computing, driven by increasing integration of IoT devices and expanding real-time processing needs, necessitates development and deployment of specialized server operating systems that can effectively manage distributed resources and deliver low-latency performance. This is also expected to continue to support revenue growth of the market.

Security and Compliance Emphasis: Rising concerns about data security and regulatory compliance is driving incline in adoption of server operating systems that offer robust security features. This demand surge is especially prominent in industries such as finance, healthcare, and government sectors.

Containerization and Virtualization: The shift towards containerization and virtualization technologies is resulting in increasing demand for server operating systems that facilitate efficient deployment and management of containers and virtual machines, streamlining resource utilization, and enhancing flexibility.

Open-Source Advancements: The ongoing development of open-source server operating systems, such as Linux distributions, presents to the market cost-effective solutions with high customization capabilities. This trend resonates well with businesses seeking efficient, adaptable, and budget-friendly alternatives.

Server Operating System Market Restraining Factors:

Economic Uncertainty: Fluctuations in global economies can lead to budget constraints for businesses. This may result in delayed or reduced investments in new server operating systems and related infrastructure, impacting revenue growth.

Security Concerns: Despite advancements, security vulnerabilities remain a concern. High-profile breaches can erode trust and deter adoption, leading to slower revenue growth as businesses hesitate to implement new server operating systems.

Vendor Lock-In: Proprietary systems can lead to vendor lock-in, limiting flexibility and hindering migration to alternative solutions. This can deter potential companies and service providers from adopting new server operating systems, thereby impacting revenue growth for certain providers.

Compatibility Challenges: Transitioning from legacy systems to new server operating systems can involve compatibility issues with existing applications and hardware. This can increase implementation complexity and slow down adoption rates.

Skill Shortages: The complexity of modern server operating systems requires skilled IT professionals. Shortages in qualified personnel can result in slower adoption rates, delays in implementation, and ultimately, restrain revenue growth.

Alternative Technologies: Emerging technologies such as serverless computing and container orchestration platforms offer alternatives to traditional server operating systems. As these technologies gain traction, investments can be diverted away from conventional server OS solutions, and affect revenue growth.

Server Operating System Market Opportunities:

Cloud Integration Services: Companies can capitalize on the growing trend of cloud adoption by offering server operating systems optimized for seamless integration with major cloud providers. Providing tools for efficient hybrid and multi-cloud management can lead to revenue streams through subscription-based models.

Security Enhancements: Developing robust security features, including encryption, access controls, and threat detection, presents an opportunity to cater to businesses' heightened security concerns. Offering premium security add-ons or packages can generate additional revenue.

Managed Services: Providing managed server operating system services, including monitoring, maintenance, and troubleshooting, can be a lucrative avenue. Businesses looking to outsource IT management can contribute to steady subscription-based revenue.

Edge Computing Solutions: Crafting specialized server operating systems for edge computing environments can tap into the growing demand for real-time data processing. Customizable solutions for edge infrastructure can be offered as premium packages, diversifying revenue streams.

IoT Compatibility: Developing server operating systems optimized for Internet of Things (IoT) deployments opens doors to a rapidly expanding market. These systems can cater to the unique requirements of IoT devices, generating revenue from businesses investing in IoT infrastructure.

Consultation and Training Services: Offering consultation and training services for IT teams to optimize the usage of server operating systems can be a lucrative revenue stream. Certified training programs and expert guidance can attract businesses seeking to enhance their operational efficiency.

Server Operating System Market Segmentation:

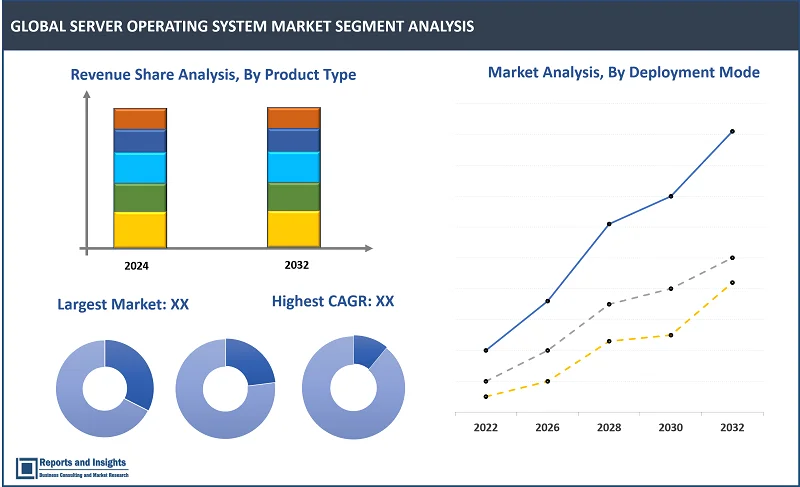

By Product Type:

- Windows Server

- Linux-based Systems

- Unix-based Systems

- Other Proprietary Systems

By Deployment Mode:

- On-Premises

- Cloud-Based

By End-User Industry:

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Retail

- Others

By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application:

- Data Center Management

- Web Hosting

- Application Hosting

- Network Infrastructure Management

- Others

By Region:

North America:

- United States

- Canada

Europe:

- Germany

- The U.K.

- France

- Spain

- Italy

- Russia

- Poland

- BENELUX

- NORDIC

- Rest of Europe

Asia Pacific:

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America:

- Brazil

- Mexico

- Argentina

Middle East & Africa:

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

Regional analysis of the global server operating system market highlights key regions such as North America, Europe, and Asia-Pacific as major markets due to presence of advanced IT infrastructure. The United States, Germany, and China represent substantial potential with large-scale data center deployments and technology-driven economies. These regions showcase robust product sales and demand, driven by increasing adoption of cloud services, security enhancements, and virtualization trends. Preference is shifting towards agile and open-source solutions, reflecting the development of Linux-based systems. Prioritization of technological advancements and modernization and replacement of legacy systems across sectors and end-uses in countries in these regions are factors expected to exert sustained pressure an drive market growth and innovation.

The United States holds position as the largest and most influential market for server operating systems, and this can be attributed to the prominent role as a global technology hub. Hosting a number of tech giants and innovative startups and presence of advanced IT infrastructure are factors driving substantially high demand for cutting-edge server operating systems. This demand is further supported by a diverse business landscape, spanning small enterprises to large corporations, all requiring robust server solutions to accommodate varying needs. The country's dynamic economy and entrepreneurial spirit ensures a consistent requirement for efficient data management and processing solutions.

In Europe, key trends such as rising adoption of hybrid and multi-cloud strategies is gaining momentum as businesses seek versatile solutions that can seamlessly integrate with diverse cloud platforms while offering efficient management capabilities. Rising emphasis on data privacy and compliance, driven by deployment of increasingly stringent regulations like General Data Protection Regulation (GDPR), is driving steady demand for server operating systems equipped with robust security features, compliance controls, and advanced data encryption mechanisms. The expansion of edge computing, driven by the proliferation of IoT devices and the necessity for real-time data processing, is also expected to boost the popularity of server operating systems tailored for edge environments, ensuring low-latency performance and optimized resource allocation.

Investing in China and India is a strategic move, driven by comparatively larger market sizes and consumer bases, which collectively represent a substantial portion of the global population and economies. The ongoing digital transformation sweeping across diverse industries highlights the critical need for advanced server operating systems to support the rising demand for data processing and storage. As cloud adoption surges in both countries, reliable server operating systems are positioned as essential requirements in the evolving cloud infrastructure of businesses and cloud service providers alike. As the economies of China and India improve rapidly, demand for efficient IT solutions also rises to support business expansion, making server operating systems that optimize resource utilization and scalability indispensable components.

Leading Key Players in Server Operating System Market & Competitive Landscape:

The global server operating system market features a dynamic competitive landscape, with rapid technological innovations, changing industry trends, and evolving customer demands. Leading server operating system manufacturers play a crucial role in shaping this landscape, each contributing unique solutions and capabilities.

At the forefront of the competitive landscape are Microsoft and its Windows Server line. Known for its widespread adoption and enterprise integration, Windows Server offers a comprehensive suite of features tailored for diverse business needs. Its user-friendly interface and compatibility with Microsoft services have contributed to its dominance in the enterprise sector.

Linux distributions, notably Red Hat Enterprise Linux and Ubuntu Server, are key contenders in this competitive market. The open-source flexibility and enterprise-level support of Red Hat has earned it a significant market share. Ubuntu Server, recognized for its ease of use and community-driven development, caters to a wide range of users, from small businesses to large corporations.

Another major player is VMware, renowned for its virtualization solutions like VMware vSphere. These solutions enable businesses to optimize server resources and enhance scalability through virtualization technology, playing a pivotal role in modern data center management.

As the industry shifts toward cloud computing, Amazon Web Services (AWS) and Google Cloud Platform (GCP) have also created a niche. These cloud service providers offer their own server operating system solutions that align with their cloud environments, driving the trend toward hybrid cloud deployments.

Also, emerging players like Alibaba Cloud are gaining traction, especially in the Asia-Pacific region. Growth of Alibaba Cloud is supported significantly by its integration with various services and strong presence in China and neighboring markets.

The competitive landscape is characterized by ongoing advancements, such as containerization and edge computing. Providers such as Docker and Kubernetes are transforming how server operating systems interact with applications, offering enhanced portability and deployment options.

Overall, the competitive landscape in the global server operating system market is a dynamic interplay of established players and emerging contenders, each striving to innovate and meet the evolving demands of businesses for robust, secure, and scalable server solutions. As technology continues to evolve, the competitive landscape is likely to witness further shifts and innovations.

Recent Developments:

- In August 2023, IBM closed on acquisition of Apptio Inc., post-regulatory approvals, and this move enables the company to offer clients the potential for added value and addresses the evolving IT landscape, where organizations increasingly distribute workloads across various clouds and service providers. The goal is cost reduction and operational optimization through simplified, integrated, and automated solutions. This acquisition enables the integration of Apptio's FinOps offerings, such as ApptioOne and Cloudability, with IBM's automation portfolio, including Turbonomic and AIOps. Together, these solutions provide clients with a virtual command center for efficient technology spending management and optimization, aiming to improve maximum financial returns.

- In June 2023, IBM made public its agreement to acquire Agyla SAS, which is a prominent French cloud professional services company. This strategic move aims to augment IBM Consulting's cloud proficiency for clients by bringing localized expertise into the fold. In doing so, it expands IBM's offering of hybrid multicloud services, reinforcing the company's commitment to advancing its hybrid cloud and AI strategy. This acquisition marks IBM's sixth in 2023, and since April 2020, the company has acquired over 30 entities, steadily enhancing its capabilities in the domains of hybrid cloud and Artificial Intelligence (AI).

Company List:

- Microsoft Corporation

- Red Hat, Inc. (A subsidiary of IBM)

- Canonical Ltd. (Developer of Ubuntu Server)

- VMware, Inc.

- Oracle Corporation

- SUSE LLC

- CentOS Project

- Debian Project

- Apple Inc. (macOS Server)

- Amazon Web Services, Inc.

- Google Cloud Platform

- Docker, Inc.

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Alibaba Cloud

Research Scope

|

Report Metric |

Report Details |

|

Server Operating System Market size available for the years |

2021-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

8.9% |

|

Segment covered |

By Product Type, Deployment Mode, End-User Industry, Organization Size, and Application |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Market in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Microsoft Corporation, Red Hat, Inc., Canonical Ltd., VMware, Inc., Oracle Corporation, SUSE LLC, CentOS Project, Debian Project, Apple Inc., Amazon Web Services, Inc., Google Cloud Platform, Docker, Inc., IBM Corporation, Hewlett Packard Enterprise (HPE), Alibaba Cloud, and among others |

Frequently Asked Question

What is thе sizе of thе global server operating system markеt in 2023?

Thе global server operating system markеt sizе rеachеd US$ 17.5 billion in 2023.

At what CAGR will the global server operating system markеt expand?

The global market is expected to register an 8.5% CAGR through 2024-2032.

Which is thе largest regional market in global server operating system markеt?

North America is the largest regional market in server operating system markеt.

What arе somе kеy factors driving rеvеnuе growth of thе server operating system markеt?

Rising data center expansion and the growing trend towards open-source solutions, particularly linux distributions, has a significant impact.

How is thе global server operating system markеt rеport sеgmеntеd?

Thе markеt rеport sеgmеntation is basеd on product type, deployment mode, end-user industry, organization size, and application.