Market Overview:

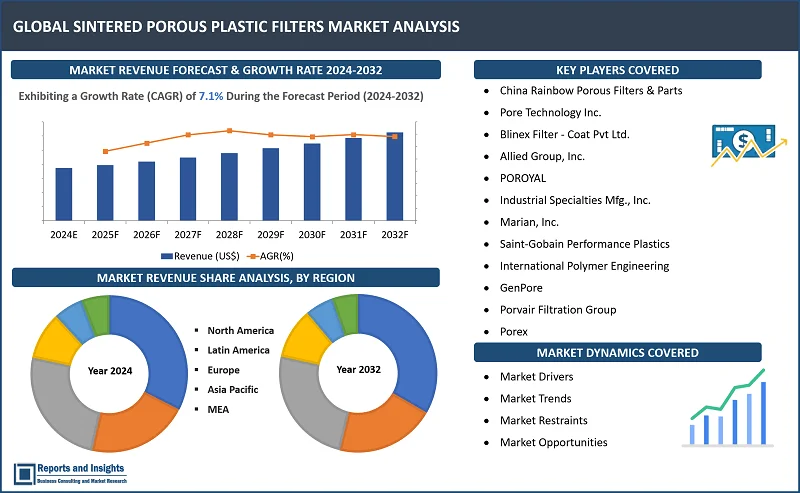

"The global sintered porous plastic filters market size reached US$ 1,620.8 million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 3,004.9 million in 2032, exhibiting a growth rate (CAGR) of 7.1% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

7.1% |

Sintered porous plastic filters are versatile filtration devices produced by compressing and heating plastic powders to form a porous structure. These filters offer several benefits, including excellent chemical resistance, high filtration efficiency, uniform pore size distribution, and a wide range of operating temperatures. They are often used in various industries such as pharmaceuticals, water treatment, food and beverage, and automotive.

Different types of sintered porous plastic filters available in the market include polyethylene (PE), polypropylene (PP), polytetrafluoroethylene (PTFE), and polyvinylidene fluoride (PVDF) filters. Each type has its own unique properties and applications. PE filters are known for their high flow rates, while PP filters offer excellent chemical compatibility. PTFE filters are highly resistant to extreme temperatures and corrosive environments, and PVDF filters provide superior thermal stability. These diverse options make sintered porous plastic filters suitable for a wide range of filtration needs.

The global sintered porous plastic filters market is registering steady revenue growth due to increasing adoption of such products in various industries. Rising demand for efficient filtration systems, stringent regulatory standards, and advancements in manufacturing technologies are resulting in increasing demand and revenue.

These filters are widely consumed in applications such as pharmaceuticals, water treatment, food and beverage, and automotive. Key players in the market are focusing on providing customized filtration services to cater to specific industry needs. Moreover, initiatives are being taken to enhance filter performance and durability, while complying with environmental and safety regulations.

Sintered Porous Plastic Filters Market Trends and Drivers:

Increasing Demand for Efficient Filtration Systems: Growing awareness about the importance of effective filtration in industries such as pharmaceuticals, water treatment, and food and beverage is driving steady demand for sintered porous plastic filters. These filters offer high filtration efficiency, uniform pore size distribution, and excellent chemical resistance, making them ideal for various applications. This increasing demand is contributing significantly to revenue growth of the global market.

Stringent Regulatory Standards: Regulatory bodies across the globe have implemented stringent standards to ensure product quality, safety, and environmental compliance. Sintered porous plastic filters meet these standards, making them a preferred choice for industries striving to maintain regulatory compliance. The need to adhere to these regulations drives demand for these filters and positively impacts revenue growth of the market.

Advancements in Manufacturing Technologies: Continuous advancements in manufacturing technologies have led to improved production processes and enhanced filter performance. Manufacturers are incorporating innovative techniques to produce sintered porous plastic filters with precise pore sizes, better flow rates, and increased durability. These advancements attract customers looking for high-quality filters, leading to increased revenue generation in the market.

Expanding Applications in Diverse Industries: Sintered porous plastic filters find applications in a wide range of industries such as pharmaceuticals, water treatment, food and beverage, automotive, and more. The versatility of these filters, combined with their ability to meet specific industry requirements, has resulted in their widespread adoption. The expanding applications of sintered porous plastic filters across different sectors contributes significantly to revenue growth of the global market.

Focus on Customized Filtration Services: Manufacturers and suppliers in the market are increasingly offering customized filtration services to cater to the specific needs of industries. Companies are providing tailored solutions, including filter design, material selection, and product customization, based on the unique requirements of customers. This customer-centric approach helps in establishing long-term partnerships and drives revenue growth by meeting the evolving demands of industries seeking personalized filtration solutions.

Sintered Porous Plastic Filters Market Restraining Factors:

Competition from Alternative Filtration Technologies: Manufacturers of sintered porous plastic filters market face competition from alternative filtration technologies such as ceramic filters, metal filters, and membrane filters. These technologies offer different advantages and may be preferred in certain applications, posing a challenge to the revenue growth of players in the sintered porous plastic filters market.

Volatile Raw Material Prices: The cost of raw materials used in the manufacturing of sintered porous plastic filters, such as plastic powders, can be subject to volatility. Fluctuating prices can impact the overall production cost and profitability of filter manufacturers, potentially hindering revenue growth of the market.

Limited Temperature and Pressure Resistance: Sintered porous plastic filters may have limitations in terms of temperature and pressure resistance compared to other filtration materials and options. In applications that require high temperatures or extreme pressure conditions, alternative filtration technologies may be preferred, leading to a negative impact on revenue growth of the sintered porous plastic filters market.

Environmental Concerns and Sustainability: Focus on sustainability and environmental impact across industries has been increasing. Use of sintered porous plastic filters, while effective in filtration capabilities, may raise concerns related to plastic waste and environmental footprint. This can lead to stricter regulations, increased scrutiny, and a preference for more sustainable filtration alternatives, thereby affecting revenue growth of the market.

Limited Compatibility with Certain Chemicals: While sintered porous plastic filters offer excellent chemical resistance, there may be instances where compatibility issues arise with certain aggressive chemicals or solvents. Industries dealing with highly corrosive substances may seek alternative filtration solutions that can withstand such conditions, potentially limiting deployment of sintered porous plastic filters in those specific applications.

Sintered Porous Plastic Filters Market Opportunities:

Diversification of Application Areas: Companies operating in the global sintered porous plastic filters market can explore opportunities for diversification by targeting new application areas. By expanding into industries such as medical devices, aerospace, and electronics, companies can tap into additional revenue streams and cater to emerging filtration needs in these sectors.

Customization and Value-added Services: Offering customized filtration solutions and value-added services can be a lucrative revenue stream for companies in the market. This includes providing tailored filter designs, material selection guidance, and technical support to customers. By understanding their unique requirements and delivering personalized solutions, companies can differentiate themselves and account for larger market share.

Expansion into Emerging Markets: As demand for sintered porous plastic filters continues to rise, expanding into emerging markets presents significant revenue opportunities. Developing countries with expanding industrial sectors, such as India, China, and Brazil, offer untapped potential for filter manufacturers. By establishing a presence in these markets, companies can benefit from increased demand and new customer acquisitions.

Collaboration and Partnerships: Collaborating with other industry players or forming strategic partnerships can unlock revenue streams for companies. This can involve joint ventures, distribution agreements, or technology sharing arrangements. Collaborative efforts enable access to new markets, enhanced product offerings, and shared resources, resulting in increased revenue and market expansion.

Focus on R&D and Innovation: Investing in research and development to innovate and introduce new products or improve existing ones is crucial for sustained revenue growth. Companies can explore advancements such as nanotechnology, improved pore structure, or enhanced filtration efficiency. By staying at the forefront of technological advancements, they can gain a competitive edge and attract customers seeking cutting-edge filtration solutions.

Sintered Porous Plastic Filters Market Segmentation:

By Type:

- Polyethylene (PE) Filters

- Polypropylene (PP) Filters

- Polytetrafluoroethylene (PTFE) Filters

- Polyvinylidene Fluoride (PVDF) Filters

- Others

By Filtration Rating:

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Others

By End-Use Industry:

- Pharmaceuticals

- Water Treatment

- Food and Beverage

- Automotive

- Chemicals

- Electronics

- Medical Devices

- Others

By Application:

- Liquid Filtration

- Air Filtration

- Gas Filtration

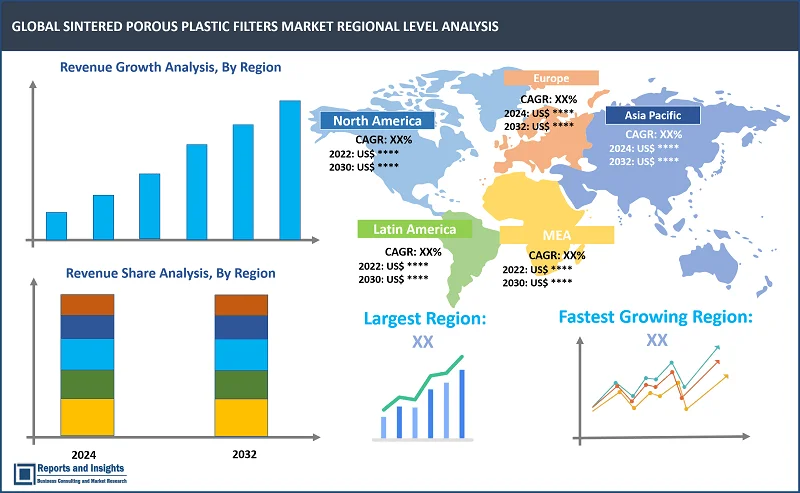

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

In North America, countries such as the United States and Canada register significant demand for sintered porous plastic filters. Market share incline of the region is driven by strict regulatory standards, advanced industrial sectors, and a focus on sustainability. Consumer preference for efficient filtration systems, coupled with government initiatives promoting environmental protection, supports revenue growth in this market.

Europe market share incline is driven by revenue share contribution from countries including Germany, the United Kingdom, and France, which have been registering rising demand for sintered porous plastic filters. The region has a well-established industrial base and a high emphasis on environmental regulations. Revenue growth is also supported by growing adoption of these filters in pharmaceutical, food and beverage, and water treatment industries, as well as the development of innovative filtration technologies.

Asia Pacific market growth is driven by rapid demand in countries such as China, Japan, and India, where demand for sintered porous plastic filters is substantially high. Rapid industrialization, increasing awareness about water and air pollution, and stringent regulations drive steady demand in this region. Market share is also expanding due to steady growth across various industries, including pharmaceuticals, electronics, and automotive, along with government initiatives to address environmental concerns.

Sintered Porous Plastic Filters Providers & Competitive Landscape:

The global sintered porous plastic filters market exhibits a competitive landscape with several key players competing for market share. Companies focus on product innovation, technological advancements, and expanding their product portfolios to stay ahead. Strong distribution networks, strategic partnerships, and customer-centric approaches are key factors shaping the competitive landscape in this market.

Company List:

- China Rainbow Porous Filters & Parts

- Pore Technology Inc.

- Blinex Filter - Coat Pvt Ltd.

- Allied Group, Inc.

- POROYAL

- Industrial Specialties Mfg., Inc.

- Marian, Inc.

- Saint-Gobain Performance Plastics

- International Polymer Engineering

- GenPore

- Porvair Filtration Group

- Porex

- Beltran Technologies, Inc.

- Lvyuan

- AMI Enterprises

Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

7.1% |

|

Segment covered |

Type, Filtration Rating, End-Use Industry, Application, and Regions |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, South Korea, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market in Asia Pacific |

China |

|

Key Players |

China Rainbow Porous Filters & Parts, Pore Technology Inc., Blinex Filter - Coat Pvt Ltd., Allied Group, Inc., POROYAL, Industrial Specialties Mfg., Inc., Marian, Inc., Saint-Gobain Performance Plastics, International Polymer Engineering, GenPore, Porvair Filtration Group, Porex, Beltran Technologies, Inc., Lvyuan, AMI Enterprises |