Market Overview:

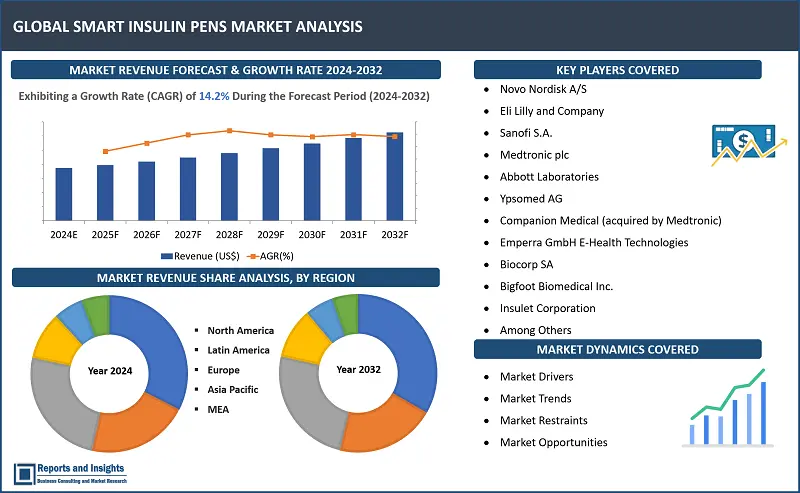

"The smart insulin pens market was valued at US$ 1.9 billion in 2023, and is expected to register a CAGR of 14.2% over the forecast period and reach US$ 6.2 billion in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Smart Insulin Pens Market Growth Rate (2024-2032) |

14.2% |

Smart insulin pens are advanced devices designed for individuals with diabetes to use to administer insulin, and these devices offer convenience, accuracy of dosage, and monitoring of information and data related to patient needs. Smart insulin pens are digital and can connect via the Internet to automatically send information about the time and dosage of insulin the user has received in an injection, and this is achieved through the use of an app on the user’s mobile device (typically a smartphone).

Smart insulin pen designs vary from manufacturer to manufacturer, and basic products may be in the form of an entire insulin pen or could be a cap the user attaches to certain existing pens or devices. While there are a number of steps and instructions to follow before administration, ultimately these devices deliver the recommended or prescribed insulin dosage at the push of a button. Compared to using a syringe and vial of insulin, users find insulin pens far easier to use, and the devices does away with need for a medicine cabinet and the required additional items or additional person to administer an injection.

These devices have digital interfaces that allow tracking of dosage, provide dosing recommendations, and can be connected with mobile apps for more detailed insights into monitoring, and other. Besides offering convenience for users to administer insulin when required anywhere-anytime, some advanced devices facilitate data management, which is crucial to maintaining optimal glucose levels. Smart insulin pens support effective diabetes management and the monitoring and data management capability enable patients to make more informed decisions related to insulin therapy, remind individuals about the next dose, reduce potential of missed dose or double dose, and also improve adherence to prescribed regimens.

Smart insulin pens are not just used by individuals or for personal use, but are also used in clinical settings, where healthcare professionals can utilize data stored in the devices to tailor treatment plans for patients. These devices are especially effective in managing type 1 and 2 diabetes, and enable users to achieve better glycemic control through continuous monitoring and alerts.

Rising global prevalence of diabetes, technological advancements and miniaturization of electronic components and devices, integration of Artificial Intelligence (AI) and algorithms for personalized dosing recommendations, and the use of Bluetooth technology for seamless connectivity in smart insulin pens are major trends in the current market. Also, development and use of companion apps for monitoring and managing diabetes and integration of continuous glucose monitoring data with broader digital platforms has been resulting in further enhancing capabilities of these devices and achieving more improved outcomes for diabetes patients.

Smart Insulin Pens Market Trends and Drivers:

Diabetes is a chronic, metabolic disease in which sufferers exhibit elevated levels of blood glucose or blood sugar, and prolonged and unchecked or unaddressed conditions can lead to serious damage to organs such as heart, blood vessels, eyes, kidneys, and nerves. Type 2 diabetes, which occurs typically in adults, is the most common, and is the condition which results in the body becoming resistant to insulin. Type 2 diabetes, usually prevalent in adults, occurs when the body does not create sufficient insulin, or becomes resistant to insulin. According to statistics published by the World Health Organization (WHO), prevalence of this type of diabetes has risen substantially in the past three decades, and this is evident in sufferers across all income levels. Also, prevalence of type 1 diabetes or juvenile diabetes, known also as insulin-dependent diabetes, has also been rising in the recent past, and this chronic condition has made an increasing number of younger individuals highly dependent on insulin to ensure survival.

In addition, statistics indicate a substantial increase in number of individuals being diagnosed with diabetes worldwide, which also highlights the potential need to be able to meet demand for treatment and insulin administering devices and others. For instance, approximately 537 million adults (20-79 years of age) are living with diabetes - 1 in 10 persons as of 2024 globally, and this is expected to increase to 643 million by 2030 and 783 million by 2045. Of this in 2024, North America and the Caribbean account for 63 million individuals with diabetes, Europe (69 million), Middle East and North Africa (136 million), Africa (55 million), South and Central America (49 million), United States (34.2 million), Undiagnosed diabetes (9.7 million adults), and Pre-diabetes (115.9 million).

With prevalence of diabetes rising significantly worldwide, the need for ease and convenience for delivering or administering insulin to the diabetes population of varying ages continues to drive advancements and innovation in medical devices, including smart insulin pens. Medical device manufacturers and technology development firms are also focusing on necessitating more efficient and user-friendly solutions for managing the condition associated with diabetes. This includes innovations in smart insulin pens to offer enhanced control and accurate and precise dosage administration, addressing consumer preferences and concerns that may be arising with regard to safety and efficacy of these devices and self-management tools.

Technological advancements and integration with mobile, glucose monitoring systems and platforms, and improving data-driven decision making and patient outcomes are also supporting demand for smart insulin pens, and rising popularity has been resulting in expanding consumer bases in various developed and developing countries recently. Such connectivity also serves to support personalized treatment plans and better adherence to prescribed regimens, and the advantage of having alerts and updates when required adds to the convenience and ease of use.

Awareness regarding diabetes-related programs and initiatives and participation by an increasing number of individuals is driving visibility and understanding of the benefits and advantages and supporting demand for smart insulin pens and devices. In addition, integration of AI and dosing recommendations and automatic adjustments to insulin need based on real-time data is serving to appeal to an increasing consumer base worldwide. Rapid traction of digital health platforms and telehealth consultation driving enhancement of patient care and creating long-term paths to positive health outcomes and improving quality of life for persons with diabetes is supporting growth of the smart insulin pens market to a major extent.

Smart Insulin Pens Market Restraining Factors:

A primary factor having a negative impact on the smart insulin pens is cost, and these advanced devices can be significantly more expensive than traditional insulin delivery methods, such as syringes and standard insulin pens. This limits affordability, especially for those consumers with financial constraints, inadequate insurance coverage, and consumer bases in a number of developing regions and countries. Another major factor, is the medical device industry is heavily regulated, and smart insulin pens must meet stringent safety and efficacy standards set by regulatory bodies such as the FDA and the European Medicines Agency, and also, approval processes for new devices can be lengthy and costly, potentially delaying market entry and innovation. In addition, smart insulin pens must ensure consistent accuracy and reliability in delivering insulin doses, as any issues with dosing precision or device malfunction can pose significant patient health risks, such as hypoglycemia or hyperglycemia. Safety concerns in this regard has been known to have a negative impact, leading to hesitation among some healthcare providers and patients to adopt the technology.

Despite technological advancements and the numerous benefits offered, smart insulin pens may still have some limitations. These manifest in the form of battery life, connectivity, and compatibility with other digital health devices, thereby hampering expected performance and device effectiveness, and affect user satisfaction. While a sizable consumer base of more tech-savvy individuals prefer more advanced and easier to use devices, some may not be too keen to shift away from familiar or traditional methods and ways of addressing their insulin needs. This resistance is more prevalent with older adults and consumers who are unsure how such devices and technologies function, may assume operation may be too complex for them, and those who are not comfortable with digital health tools and privacy concerns related to accessing relevant platforms and providing personal information.

Furthermore, rapid rate of technological change, continuous need for advanced smart insulin pens, associated challenges for device manufacturers, and competition from alternative diabetes technologies such as insulin pumps, which offer comprehensive solutions for patients, are having an impact in sales and market revenue.

Smart Insulin Pens Market Opportunities:

Device manufacturers in the global smart insulin pens market can explore potential opportunities to expand their market presence and create additional revenue streams. Product innovation and development of new features that enhance user experience is a major approach and strategy to expand user base and create new revenue streams. By integrating AI-driven algorithms for personalized dosing recommendations and improving connectivity with other digital health platforms, manufacturers can provide added value to patients and healthcare providers, and lead to product differentiation. Geographical market expansion is also a key strategy, and entering into emerging markets where diabetes prevalence is increasing such as Asia Pacific and Latin America, and developing and offering tailored devices and solutions to meet the domestic needs and preferences, along with appropriate pricing strategies based on local economic conditions, in such markets can drive device adoption, sales, and revenues. Entering into partnerships and collaborations with pharmaceutical companies and healthcare providers can create opportunities for development of integrated solutions, resulting in combined offerings, such as smart insulin pens bundled with specific insulin brands or paired with continuous glucose monitoring systems.

Offering subscription models for replacement parts such as cartridges and needles, or offering ongoing supplies at discounted rates, can present device manufacturers with opportunity of a steady revenue and drive customer loyalty and retain a stable user base.

Smart Insulin Pens Market Segmentation:

By Product Type

- Connected Smart Insulin Pens

- Bluetooth-Enabled Smart Insulin Pens

Among the product type segments, the connected smart insulin pens segment is expected to account for the largest revenue share. This is supported by growing preference for devices that offer seamless integration with mobile apps and digital health platforms, providing real-time data tracking and analysis. Connected smart insulin pens enable personalized dosing recommendations and improve patient outcomes by facilitating precise insulin administration. The convenience and enhanced control provided by these pens make them increasingly popular among diabetes patients and healthcare providers.

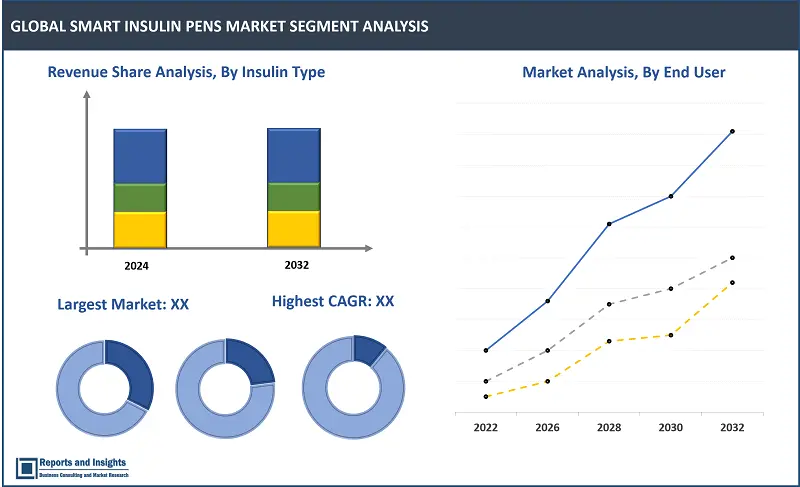

By Insulin Type

- Short-acting Insulin

- Intermediate-acting Insulin

- Long-acting Insulin

Among the insulin type segments, the long-acting insulin segment is expected to account for the largest revenue share in the smart insulin pens market. This projection is justified by the rising demand for long-acting insulin formulations, which offer sustained glucose control over extended periods and require fewer daily injections. The convenience and efficiency of long-acting insulin make it a preferred choice for many patients managing diabetes. Smart insulin pens enhance the administration of long-acting insulin by ensuring precise dosing, data tracking, and improved adherence to treatment plans.

By End User

- Hospitals & Clinics

- Homecare Settings

- Specialty Diabetes Clinics

The homecare settings segment is expected to account for the largest revenue share among the end-user segments over the forecast period. This can be attributed to the growing trend towards patient-centric care and self-management of chronic conditions such as diabetes. Smart insulin pens empower patients to monitor their blood glucose levels and administer insulin accurately and independently in their homes. This convenience, combined with the ability to track data and share it with healthcare providers, drives adoption in homecare settings. The shift toward remote healthcare and telemedicine also supports demand and is driving revenue growth of this segment.

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Among the distribution channel segments, the retail pharmacies segment is expected to account for the largest revenue share over the forecast period. This projected growth is expected to be driven by the accessibility and convenience retail pharmacies offer to consumers, allowing patients to easily purchase smart insulin pens and associated supplies. Retail pharmacies also provide the opportunity for patients to seek advice from pharmacists about device usage and diabetes management. As the adoption of smart insulin pens increases, the established network of retail pharmacies serves as a key distribution channel to meet rising consumer demand.

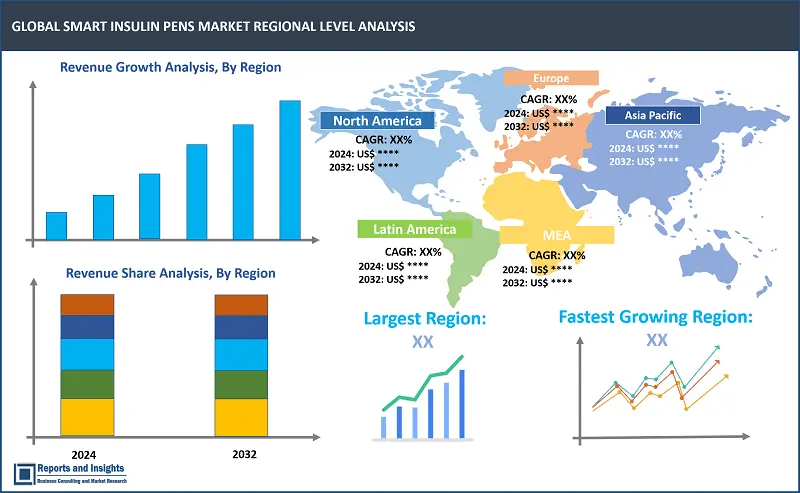

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global smart insulin pens market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regional markets, North America is the leading market, supported by high diabetes prevalence, advanced healthcare infrastructure, and strong awareness of diabetes management technologies. In North America, the United States (US) is a key market leader due to its substantial patient population and high healthcare expenditure.

In Europe, leading countries include Germany, the United Kingdom (UK), and France, where robust healthcare systems and a focus on technological innovation support market growth. Asia-Pacific is an emerging market, with countries such as China and India registering rapid revenue growth due to increasing diabetes prevalence rates and improving healthcare facilities.

Some common factors driving overall growth in the global smart insulin pens market are technological advancements (such as AI and connectivity), increasing diabetes prevalence, and a shift toward personalized healthcare and patient-centric management.

Leading Companies in Smart Insulin Pens Market & Competitive Landscape:

The competitive landscape in the global smart insulin pens market is dynamic and characterized by the presence of established players and emerging companies. Leading manufacturers such as Novo Nordisk A/S, Eli Lilly and Company, and Sanofi S.A. are investing in research and development to innovate and differentiate their products. Key strategies include the integration of advanced features such as Bluetooth connectivity, AI-driven dosing recommendations, and compatibility with other digital health tools to enhance the user experience and improve patient outcomes. Companies are also forming strategic partnerships and collaborations with healthcare providers, pharmaceutical companies, and technology firms to expand their product portfolios and market reach. Additionally, manufacturers are focusing on providing comprehensive patient education and support programs to foster brand loyalty and ensure patient engagement. These strategies enable leading companies to maintain their position and expand their consumer base in the global smart insulin pens market.

These companies include:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Medtronic plc

- Abbott Laboratories

- Ypsomed AG

- Companion Medical (acquired by Medtronic)

- Emperra GmbH E-Health Technologies

- Biocorp SA

- Bigfoot Biomedical Inc.

- Insulet Corporation

- Roche Holding AG

- Owen Mumford Ltd.

- Cellnovo Group SA (acquired by MicroPort Scientific)

- Pendiq GmbH

Recent Developments:

- January 2023: Biocorp announced that the FDA cleared its Mallya smart insulin pen device for marketing. The Mallya is a smart sensor that attaches to insulin pen injectors to collect and record treatment information, such as the date and time of injection, and transmit it to a digital application. The Mallya device can monitor doses of glucagon-like peptide 1 (GLP-1) receptor agonists. According to Biocorp, the manufacturer, it is the first device in the United States to seamlessly link insulin and GLP-1 injector pens to a mobile app. Mallya is compatible with many commonly used insulin pens.

- November 2022: Eli Lilly and Company launched the Tempo Personalized Diabetes Management Platform in the US. The platform targets adults with type 1 or type 2 diabetes and helps patients and healthcare providers make data-driven treatment decisions. The system comprises three components: The Tempo Smart Button, an FDA-approved device that captures and transmits insulin dose information via Bluetooth; the TempoSmart app, which is a co-branded version of Welldoc's BlueStar app that receives and shares data from the Tempo Smart Button with healthcare providers; and the Tempo Pen, which is a prefilled insulin delivery device compatible with the Tempo Smart Button. This integrated approach aims to support personalized diabetes management using Lilly insulins.

Smart Insulin Pens Market Research Scope

|

Report Metric |

Report Details |

|

Smart Insulin Pens Market Size available for the Years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

14.2% |

|

Segment Covered |

Product Type, Insulin Types, End User, Distribution Channel |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

The U.K. |

|

Largest Market |

North America |

|

Key Players |

Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Medtronic plc, Abbott Laboratories, Ypsomed AG, Companion Medical (acquired by Medtronic), Emperra GmbH E-Health Technologies, Biocorp SA, Bigfoot Biomedical Inc., Insulet Corporation, Roche Holding AG, Owen Mumford Ltd., Cellnovo Group SA (acquired by MicroPort Scientific), Pendiq GmbH |

Frequently Asked Question

What is the size of the global smart insulin pens market in 2023?

The global smart insulin pens market size reached US$ 1.9 Billion in 2023.

At what CAGR will the global smart insulin pens market expand?

The global market is expected to register a 14.2% CAGR through 2024-2032

Who are leaders in the smart insulin pens market?

Novo Nordisk A/S, Eli Lilly and Company, and Sanofi S.A. have a strong presence due to their established market share, robust product portfolios, and continuous innovation in the diabetes management space.

What are some key factors driving revenue growth of the smart insulin pens market?

Increasing prevalence of diabetes globally, technological advancements in smart insulin pens, integration with digital health platforms, and growing awareness about diabetes management solutions.

What are some major challenges faced by companies in the smart insulin pens market?

Major challenges include the high cost of smart insulin pens, regulatory hurdles that impact product development and market entry, concerns regarding dosing accuracy and device reliability, and competition from alternative diabetes management technologies.

How is the competitive landscape in the smart insulin pens market?

The competitive landscape in the smart insulin pens market is characterized by the presence of established players and emerging companies.

How is the smart insulin pens market report segmented?

The smart insulin pens market report is segmented based on product type, insulin types, end user, distribution channel, and region

Who are the key players in the smart insulin pens market report?

Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Medtronic plc, Abbott Laboratories, Ypsomed AG, Companion Medical (acquired by Medtronic), Emperra GmbH E-Health Technologies, Biocorp SA, Bigfoot Biomedical Inc., Insulet Corporation, Roche Holding AG, Owen Mumford Ltd., Cellnovo Group SA (acquired by MicroPort Scientific), Pendiq GmbH