Market Overview:

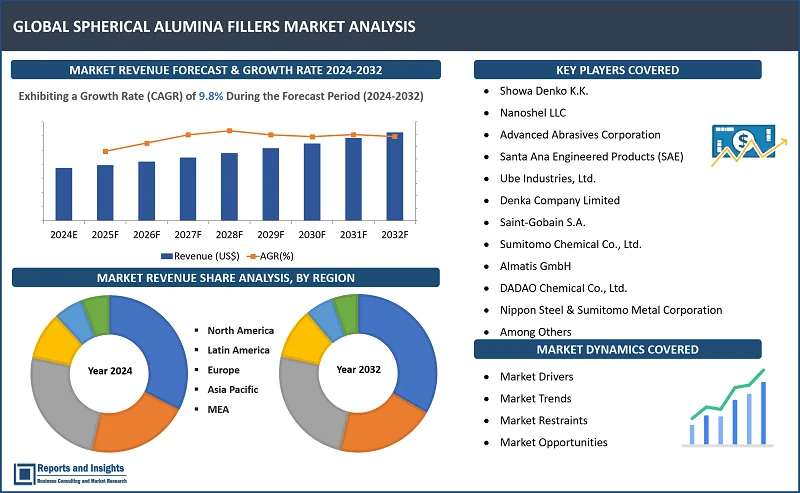

"The spherical alumina fillers market was valued at US$ 214.5 Million in 2023, and is expected to register a CAGR of 9.8% over the forecast period and reach US$ 497.5 Million in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

9.8% |

Alumina powder used in filler is a high-performance material with high thermal conductivity, good heat resistance, high electrical insulation, high hardness, and low thermal expansion. The spherical nature of this powder allows for high flow-ability and high packing density, thereby enhancing thermal management in electronic components, and is widely used in thermal interface materials, automotive components, ceramics and polymers, and other systems. The material also exhibits excellent mechanical and dielectric properties and is used for producing advanced composite materials.

Alumina fillers are produced using process such as spray drying, sol-gel synthesis, and other specialized techniques. Advancements in material engineering have been resulting in development of alumina fillers with more enhanced properties such as higher purity and improved performance at higher temperatures. Nanotechnology has also been playing a major role in developing nano-sized spherical alumina fillers, which offer even more precise control over thermal and mechanical properties in various applications.

Alumina fillers have been gaining traction recently in emerging technologies and applications including Electric Vehicles (EVs), 5G telecommunications, and advanced medical devices owing to improved heat dissipation and reliability in compact, high-performance and advanced medical devices.

Spherical Alumina Fillers Market Trends and Drivers:

A major factor driving market growth is the constantly expanding electronics industry, innovation in devices, technological advancements, and need for high-performance thermal management materials and components. These factors are driving rising need for spherical alumina fillers for use in thermal interface materials and electronic devices, including for semiconductors and power modules , among others. Also, the global automotive industry continues to expand rapidly with steady traction of the EV industry and need for more efficient thermal management systems and solutions to keep up with rising demand for these vehicles. In addition, advancements in material science and improvements in manufacturing techniques are resulting in production of spherical alumina with enhanced properties, higher purity, and consistent particle size distribution. These advancements are positioning the material further for high-end applications and supporting growth of the market to a major extent. Research and Development (R&D) to enhance properties and performance, including thermal conductivity and mechanical strength, of these spherical alumina fillers is supporting increasing adoption if applications in industries such as aerospace, telecommunications, and advanced medical devices.

Furthermore, the miniaturization trend and need for higher performance electronic components to function effectively under increased heat loads and expanding application into emerging technologies like 5G and renewable energy are key factors driving demand for improved spherical alumina fillers. Emergence and rising importance and performance of technologically advanced nano-sized spherical alumina fillers offering greater precision in thermal management and with improved mechanical properties is resulting in rapid expansion into advanced manufacturing and high-performance computing applications globally.

Spherical Alumina Fillers Market Restraining Factors:

Demand for spherical alumina fillers may be high and rising in specific applications and industries, but some factors remain as restraints to adoption and use. Primary among these include high cost, which can be a deterrence, especially for those end-use customers with budget constraints. The cost of production is high due to the complex process in creating high-purity, consistent spherical alumina fillers, and this can impact affordability.

Another factor is regulatory challenges and stringent safety norms associated with the disposal of alumina-based materials. Compliance to regulations and environmental norms can add up to operational costs, and this deters some companies from proceeding further with manufacturing and production of these materials.

Availability of alternative materials and solutions offering similar functionality and properties at lower cost can affect product demand and market growth. Materials such as boron nitride and carbon-based materials can offer comparable thermal conductivity and exhibit mechanical properties as spherical alumina fillers, but at lower cost, and this may appeal to a sizable consumer base.

Health risks associated with handling alumina powders, fine or nano forms in particular, does raise some concerns for manufacturers and end users, as well as for the safety of labor and workers. Companies are required to deploy appropriate safety measures to protect workers against inhalation and skin exposure, and these requisites can complicate manufacturing processes and increase production costs. In addition, supply chain disruptions and fluctuations in raw material prices can have a major impact on ensuring consistent availability and pricing stability of spherical alumina fillers, and these challenges can affect production and delivery schedules and cause complications to end use industries

Spherical Alumina Fillers Market Opportunities:

Innovation and technological advancements are key to opening up new opportunities in this market, similar to most other markets where electronics and advanced devices are major products. Continuous advancements and development of new technologies and application areas for high-performance components and interfaces in electronics requires development of advanced, high-purity spherical alumina fillers. Manufacturers can focus on meeting these needs arising from sectors such as EVs and 5G, and besides enabling access to new revenue streams and consumer bases, companies can further achieve product differentiation.

Companies can also focus on forming alliances and partnerships with other industry players to increase productivity and expand markets. Joint ventures with aerospace, electronics, automotive, and computer manufacturers can provide solution integration and synergy, mutual benefits and growth potential. Furthermore, investment in R&D for the development of new materials and solutions to address specific industry challenges can further the development of nano-sized spherical alumina fillers with highly advanced properties, and to create avenues for new applications and niche markets. Geographic expansion is another way companies can focus on exploiting new opportunities, creating local production or distribution channels, and serving local needs, while cutting back transportation challenges and costs.

Spherical Alumina Fillers Market Segmentation:

By Application

- Electronics

- Automotive

- Thermal Interface Materials

- Ceramics and Composites

The electronics application segment is expected to account for the largest revenue share in the spherical alumina fillers market over the forecast period. This can be attributed to increasing demand for high-performance thermal management materials in the rapidly expanding electronics industry, and superior thermal conductivity and low thermal expansion, making this material ideal for use in semiconductors, power modules, and other electronic devices. As devices become more compact and powerful, the need for efficient heat dissipation solutions increases, and this is supporting increasing demand for spherical alumina fillers and driving revenue growth of the spherical alumina fillers segment.

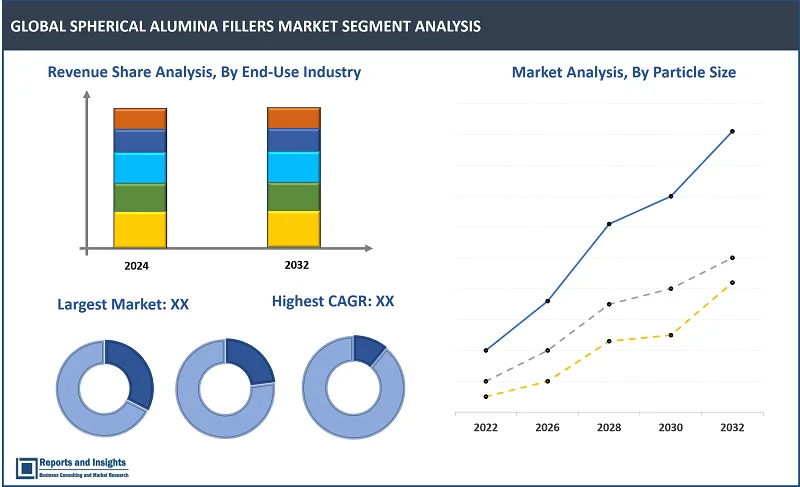

By Particle Size

- Nano-sized Fillers

- Micro-sized Fillers

- Macro-sized Fillers

Among the particle size segments, the micro-sized fillers segment is expected to account for the largest revenue share over the forecast period, and this can be attributed to broad applicability of this particle size in components and applications used across various industries, such as electronics, automotive, and thermal management. Micro-sized fillers offer a balance of performance and cost-effectiveness, providing improved thermal conductivity and mechanical properties without the higher costs associated with nano-sized fillers. This makes this type a preferred choice for a range of applications, including in thermal interface materials and advanced ceramics.

By Purity

- High-purity Spherical Alumina Fillers

- Standard-purity Spherical Alumina Fillers

The high-purity spherical alumina fillers segment is expected to account for the largest revenue share in the market. High revenue growth of this segment is driven by increasing demand for superior performance and reliability across various industries such as electronics, automotive, and aerospace. High-purity fillers offer consistent properties, including enhanced thermal conductivity and mechanical strength, making these fillers ideal for advanced applications requiring precision and quality.

By End-User Industry

- Consumer Electronics

- Automotive Industry

- Aerospace and Defense

- Medical Devices

Among the end-user segments, the consumer electronics segment is expected to account for the largest revenue share in the spherical alumina fillers market. Increasing adoption of advanced electronic devices, including smartphones, laptops, and wearables, is driving steady demand for effective thermal management solutions. Spherical alumina fillers offer high thermal conductivity, enabling efficient heat dissipation in compact and powerful electronics. As consumer electronics continue to advance in performance and miniaturization, the demand for spherical alumina fillers is expected to increase significantly.

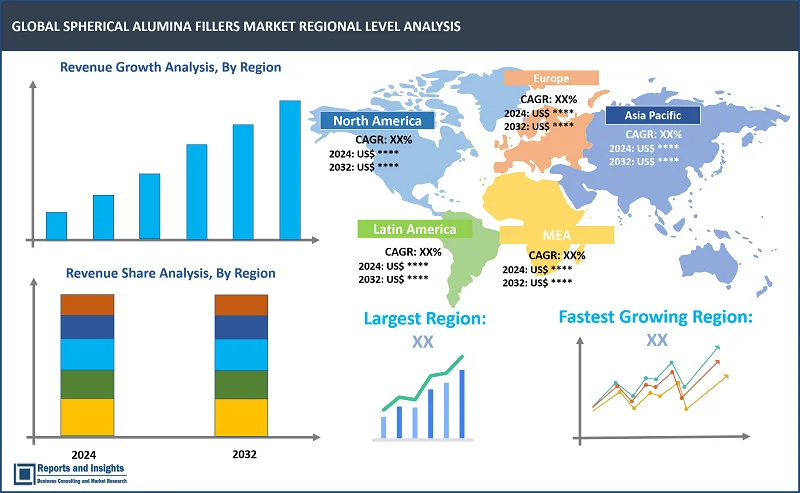

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global spherical alumina fillers market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regional markets, Europe accounted for the largest revenue share of around 32.4% in 2023. This can be attributed to several factors such as stringent quality standards, rigorous research and development activities, well-developed manufacturing infrastructure as well as the geographic advantages of the region. Well-established manufacturing infrastructure allows for efficient production and supply of spherical alumina fillers, giving European companies a competitive advantage. In addition, the strong commitment to quality standards gives European spherical alumina filler manufacturers a reputation for reliability and excellence, which contributes to their dominance in the global market. Furthermore, Europe's proximity to other major markets, such as North America and Asia, provides logistical advantages in terms of transportation and distribution.

Leading Companies in Spherical Alumina Fillers Market & Competitive Landscape:

The competitive landscape in the global spherical alumina fillers market is characterized by the presence of multiple global and regional players competing for market share. Companies are focusing on innovation, quality control, and strategic partnerships to differentiate themselves and maintain a competitive edge. Major players are investing in research and development to improve the properties of spherical alumina fillers, such as increasing thermal conductivity and purity, to meet the evolving demands from industries such as electronics and automotive.

Leading companies are also expanding their consumer base by diversifying their product portfolios to cater to emerging technologies such as electric vehicles and 5G. In addition, companies are forming strategic alliances and collaborations with other industry players to strengthen their market position and expand their distribution networks. By offering customized solutions and enhanced customer service, these companies focus on building long-term relationships with clients and accounting for a larger market share.

These companies include:

- Showa Denko K.K.

- Nanoshel LLC

- Advanced Abrasives Corporation

- Santa Ana Engineered Products (SAE)

- Ube Industries, Ltd.

- Denka Company Limited

- Saint-Gobain S.A.

- Sumitomo Chemical Co., Ltd.

- Almatis GmbH

- DADAO Chemical Co., Ltd.

- Nippon Steel & Sumitomo Metal Corporation

- Materion Corporation

- Toray Industries, Inc.

- Zibo Zhongyi Advanced Material Co., Ltd.

- CoorsTek, Inc.

Recent Developments:

- In August 2023, Sumitomo Chemical revealed it was making significant advancements by developing innovative production technology for ultra-fine α-alumina. The company plans to begin large-scale production in September 2023, at its newly established facilities at the Ehime Works. Through partnerships with its clients, the company aims to expand markets in ICT, energy-saving, and life science industries by introducing technological innovations in inorganic materials. Sumitomo Chemical targets a 30% increase in sales revenue in its ultra-high purity alumina sector by FY2025 compared to FY2023. The newly mass-produced NXA series products are ultra-fine α-alumina materials primarily utilized in industrial applications. These products feature uniform, ultra-fine particles with a size of 150 nm (0.15 μm) or smaller.

- In 2022, Denka Company Limited started full-scale operation of the new production line of spherical alumina, which was constructed at the Tuas Plant of Denka Advantech Pte. Ltd. (DAPL), the Denka's consolidated subsidiary in Singapore. Through this full-scale operation of the new production line, Denka will expand its production capacity of spherical alumina to around five times than current capacity (vs. FY2018) and become the leading manufacturer with approximately 60 percent of the global market share.

Spherical Alumina Fillers Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

9.8% |

|

Segment covered |

Application; Particle Size; Purity; End-User |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

Showa Denko K.K., Nanoshel LLC, Advanced Abrasives Corporation, Santa Ana Engineered Products (SAE), Ube Industries, Ltd., Denka Company Limited, Saint-Gobain S.A., Sumitomo Chemical Co., Ltd., Almatis GmbH, DADAO Chemical Co., Ltd., Nippon Steel & Sumitomo Metal Corporation, Materion Corporation, Toray Industries, Inc., Zibo Zhongyi Advanced Material Co., Ltd., CoorsTek, Inc |

Frequently Asked Question

What is the size of the global spherical alumina fillers market in 2023?

The global spherical alumina fillers market size reached US$ 214.5 Million in 2023.

At what CAGR will the global spherical alumina fillers market expand?

The global market is expected to register a 9.8% CAGR through 2024-2032.

Who is the leader in the spherical alumina fillers market?

Showa Denko K.K. is a leader in the market and offers high-quality products and innovative solutions, and holds a strong position in the global industry.

What are some key factors driving revenue growth of the spherical alumina fillers market?

Increasing demand for efficient thermal management in the electronics and automotive industries, and advancements in materials science leading to improved filler properties.

What are some major challenges faced by companies in the spherical alumina fillers market?

High production costs, supply chain disruptions, and fluctuations in raw material prices. Additionally, stringent environmental and safety regulations may complicate manufacturing processes and increase operational costs. The availability of alternative materials with similar properties at lower costs can also pose a threat to market share.

How is the competitive landscape in the spherical alumina fillers market?

The competitive landscape in the spherical alumina fillers market is dynamic, with several global and regional players competing for market share.

How is the Spherical Alumina Fillers Market report segmented?

The Spherical Alumina Fillers Market report is segmented based on Application, Particle Size, Purity, End-User Industry, and Region.

Who are the key players in the Spherical Alumina Fillers Market report?

Showa Denko K.K., Nanoshel LLC, Advanced Abrasives Corporation, Santa Ana Engineered Products (SAE), Ube Industries, Ltd., Denka Company Limited, Saint-Gobain S.A., Sumitomo Chemical Co., Ltd., Almatis GmbH, DADAO Chemical Co., Ltd., Nippon Steel & Sumitomo Metal Corporation, Materion Corporation, Toray Industries, Inc., Zibo Zhongyi Advanced Material Co., Ltd., CoorsTek, Inc.