Market Overview:

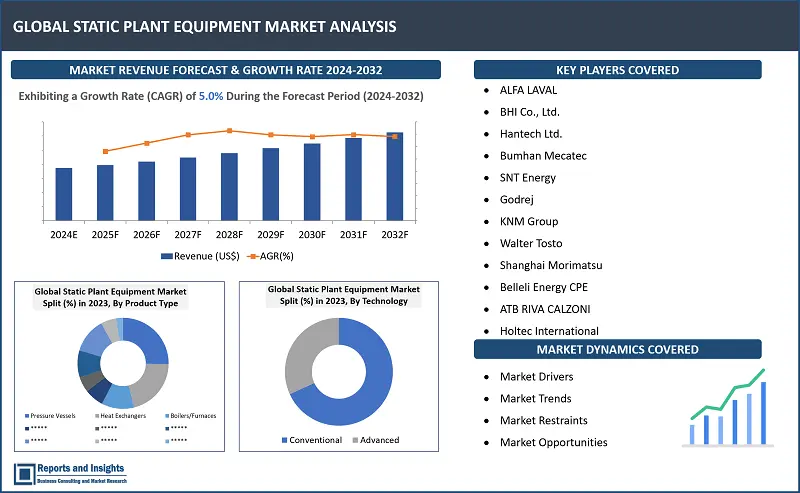

"The global static plant equipment market was valued at US$ 137,046.6 Mn in 2023, and is projected to be valued at US$ 211,722.2 Mn by 2032 end. Sales revenue is expected to increase at a CAGR of 5.0% during the forecast period (2024-2032)."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

5.0% |

Static plant equipment refers to the fixed, non-moving, or stationary machinery and equipment used in various industries for regular operations, including in oil & gas, petrochemicals, power generation plants, chemicals processing, water treatment, mining and minerals, refining, and manufacturing industries. These equipment are produced using materials such as metal, polymers, and composites, and are designed to withstand high temperatures, pressures, and to last in conditions and environments that are subject to exposure and effects from chemical reactions, storage, and separation, among others.

Static equipment used in oil and gas facilities are designed to be robust and are regularly inspected for failure modes such as deformation and distortion, fracture and separation, surface and material changes, stress-corrosion cracking, hydrogen damage, corrosion fatigue, and elevated temperature failures. This is crucial as a significant volume or number of units of mechanical equipment falls under static equipment category, comprising pressure vessels, heat exchangers, storage tanks, fired heaters, and pig launchers, among others. Static equipment used in the oil and gas industry also include heat exchangers, reactors, towers, and columns, and these are expected to meet stringent technical and safety standards.

Growth of the global static plant equipment market is driven significantly by increasing focus on workplace safety and regulatory compliance, and rising investment on modern static equipment that meets industry safety standards and aids in reducing carbon footprint. Continuous innovations in static plant equipment, including materials, design improvements for efficiency and safety, and integration of advanced technologies are factors driving market growth. In addition, growth is supported to a major extent by the transition towards condition monitoring and predictive maintenance, utilizing sophisticated sensors and monitoring systems to identify irregularities in metrics such as vibration, temperature, and pressure, and ensure timely maintenance and repair, and reduced downtime.

Static Plant Equipment Market Trends and Drivers:

Demand for static plant equipment in industries such as oil and gas, petrochemicals, power generation, chemicals processing, water treatment, mining and minerals, refining, and manufacturing is driven by various factors. Firstly, the ongoing global need for energy and resources is driving steady demand for static plant equipment in extraction, production, and processing operations in the oil and gas industry. Demand is also high from power generation and mining industries, where the requirement for efficient and safe equipment such as heat exchangers, pressure vessels, and reactors is essential to comply with regulations. Rising concerns regarding environmental sustainability and compliance is also a key factor driving demand for advanced static plant equipment, and investments in innovative solutions to improve energy efficiency, reduce emissions, and support clean technologies such as Carbon Capture and Storage (CCS) across various industries has been shifting significantly in this direction in recent times.

Another major factor driving demand for static plant equipment is aging infrastructure in mature oil and gas fields and need for replacements and upgrades. This can also include need for retrofitting of existing facilities with newer, more advanced and modern and efficient equipment to maintain operational continuity and compliance with evolving regulations.

Advancements in materials science, such as the development of corrosion-resistant and high-temperature alloys, enhance equipment longevity and performance. These materials improve the efficiency, safety, and performance of static plant equipment, which is especially important in industries like chemicals processing and refining, where harsh operating conditions can impact equipment life.

In addition, the integration of digital technologies, including Internet of Things (IoT), sensors, data analytics, and automation, enhances the capabilities of static plant equipment. These technologies allow real-time monitoring, predictive maintenance, and remote control, leading to increased operational efficiency and safety. New applications and end uses of static plant equipment also contribute to market growth. For instance, the expanding water treatment industry relies on advanced static equipment such as tanks, filters, and separators to ensure clean water supply and waste treatment. Similarly, the food and beverage industry benefits from heat exchangers and other equipment for processing and preservation.

Furthermore, emerging markets in regions such as Asia Pacific, Latin America, and Africa present significant opportunities for market expansion. Industrialization and infrastructure development in developing countries in these regions drive demand for static plant equipment across multiple sectors.

Technological innovations also play a major role in the evolving market scenario, and development of advanced materials such as corrosion-resistant alloys and composite materials offering enhanced equipment durability and performance of equipment, as well as integration of smart features, real-time monitoring , and predictive maintenance are driving preference for newer equipment currently.

This trend coupled with continuous innovations in static plant equipment, including materials, design improvements for efficiency and safety, and integration of advanced technologies such as 3D printing/additive manufacturing, and digitalization, are expected to drive steady traction of more advanced equipment and support market revenue growth. market growth.

Moreover, the transition towards condition monitoring and predictive maintenance, utilizing sophisticated sensors and monitoring systems to identify irregularities in metrics such as vibration, temperature, and pressure, minimizes downtime and boosts equipment dependability, and increasing adoption of these solutions is expected to support revenue growth of the market over the forecast period.

Static Plant Equipment Market Restraining Factors:

Demand for static plant equipment across industries such as oil and gas, petrochemicals, power generation, chemicals processing, water treatment, mining and minerals, refining, and manufacturing varies significantly, but the factors having impact remain static for most.

Market volatility and price sensitivity, particularly affects the oil and gas industry and can lead to decreased investments in exploration and production projects, thereby impacting demand for static plant equipment. Environmental regulations are becoming increasingly stringent and emission controls across industries compel companies to invest in more costly and complex static plant equipment that meets these standards. This increases production costs, potentially deterring demand from cost-sensitive sectors.

High initial investment required for static plant equipment is another barrier, especially for smaller companies with budget constraints, and overall costs include not only purchasing the equipment, but also installation, maintenance, and compliance with safety norms, potentially discouraging adoption to some extent. Aging infrastructure is also a major factor applicable across industries, including power generation and refining, and this poses a risk to operational safety and efficiency, as well as workforce safety. Also, companies may delay equipment replacement due to the high costs associated with upgrading existing systems, resulting in lower demand for new static plant equipment.

Competition from alternative technologies and solutions is another restraining factor. Rise of modular and prefabricated equipment can cause a demand shift away from traditional static plant equipment, as these alternatives offer advantages such as faster installation and reduced costs, challenging established players in the market.

Other negative trends affecting the market include supply chain disruptions, whether due to geopolitical tensions, natural disasters, or other factors, such incidents can delay production and delivery of static plant equipment, affecting demand.

A key factor having a negative impact on manufacturers of static plant equipment is need for compliance to various regulations and norms such as use of specific or specialized and expensive materials and designs for various equipment, which invariably entails major investment and adds to complexity of production as well as cost of products, and deployment and use. Also, the long lifespan of such equipment due to high-quality materials, design, efficiency, and overall durability results in reduced purchase and upgrade frequency rates. In addition, technological advancements such as development and availability of modular and prefabricated equipment and alternative solutions are serving to disrupt the market and are creating a shift away from traditional static plant equipment.

Furthermore, a factor that is slowly, but steadily gaining momentum is the ongoing global shift towards renewable and cleaner energy resources such as solar, wind, and water, and efforts to reduce dependence on fossil fuels. This trend can divert investments away from oil and gas projects, and have an impact on demand for and sales of static plant equipment.

Static Plant Equipment Market Player Opportunities:

Leading players and companies in the global static plant equipment market can leverage a variety of opportunities, including expanding their revenue streams and market presence across industries such as oil and gas, petrochemicals, power generation, chemicals processing, water treatment, mining and minerals, refining, and manufacturing. For instance, manufacturers can offer comprehensive lifecycle services including predictive maintenance, repairs, and upgrades for static plant equipment. This creates ongoing revenue streams, strengthens customer relationships, and ensures consistent operational efficiency. Also, integrating digital technologies such as Internet of Things (IoT), sensors, and data analytics into static plant equipment can enhance performance monitoring and maintenance, and by providing customers with real-time insights and smart solutions, manufacturers can differentiate their offerings and create value-added services.

In addition, entering into strategic partnerships with engineering firms and technology providers can help manufacturers incorporate innovative designs and advanced materials into their equipment, and such collaborations can result in the creation of more efficient, durable, and safer static plant equipment and attracting customers seeking cutting-edge solutions. Moreover, diversifying product portfolios and offering tailored solutions can help manufacturers cater to various industry-specific needs. For instance, designing specialized static plant equipment for renewable energy sectors like solar and wind can open new markets and revenue streams.

Global market expansion and localized presence is another key avenue to drive revenues. By expanding into emerging markets with growing industrial and infrastructure needs, manufacturers can tap into new opportunities, and establish localized production and service centers to better understand regional demands and offer customized solutions. Furthermore, collaborating with other industry players such as Engineering, Procurement, and Construction (EPC) contractors, research institutions, and consultancy firms can enhance market access and provide opportunities for joint ventures. For instance, working with EPC contractors allows manufacturers to integrate static plant equipment into larger projects, creating mutually beneficial partnerships. Additionally, investing in research and development to create innovative products such as high-efficiency heat exchangers and corrosion-resistant pressure vessels can help manufacturers stay ahead of the competition.

Static Plant Equipment Market Segmentation

By Product Type

- Pressure Vessels

- Heat Exchangers

- Boilers

- Reactors

- Condenser

- Columns and Towers

- Storage Tanks

- Separators

- Furnaces

- Others

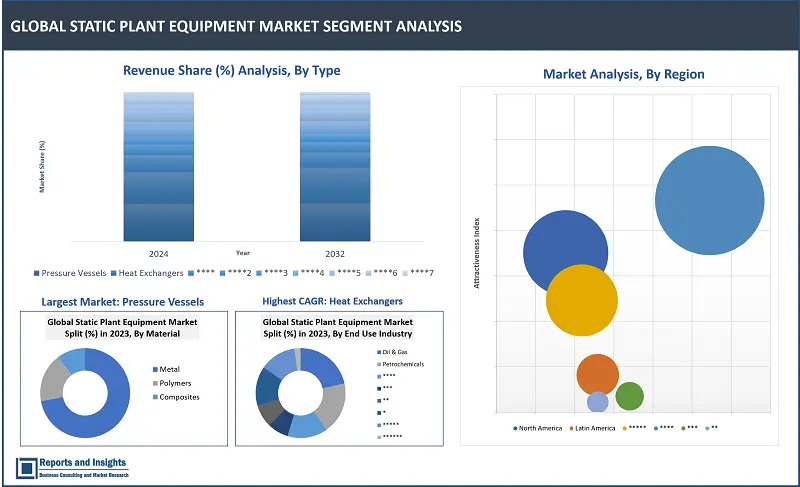

Among the product type segments in 2023, the pressure vessels segment accounted for the largest revenue share. Pressure vessels are essential components in industries such as oil and gas, petrochemicals, chemicals, and power generation. These units are used to store, transport, and process fluids under high pressure and temperature conditions, making them indispensable for various processes.

By Material Type

- Metal

- Polymers

- Composites

Among the material type segments, the metal segment accounted for the largest revenue share in 2023. Metals are preferred for capacity to endure extreme pressure and temperature variations, making the material deal for demanding applications such as pressure vessels, reactors, and boilers. High thermal conductivity, exemplified in materials such as steel and aluminum, ensures efficient heat transfer in static equipment like heat exchangers.

By Technology

- Conventional

- Advanced

The conventional segment among the technology segments accounted for largest revenue share in 2023, and this can be attributed to reliability and cost-effectiveness and a number of industries continue to depend on conventional technologies for static plant equipment because owing to a proven track record, familiarity among operators, and lower initial investment costs. In addition, conventional technologies are well-understood, making them easier to implement and maintain, which contributes to their dominance in the market.

By End-User Industry

- Oil & Gas

- Petrochemicals

- Power Generation Plants

- Chemicals Processing

- Water Treatment

- Mining and Minerals

- Refining Industry

- Manufacturing

- Other End-User Industries

Among the end-user industry segments, the oil & gas segment accounted for largest revenue share in 2023. This can be attributed to extensive use of equipment such as pressure vessels, storage tanks, and heat exchangers for processing and transportation of fluids under high pressure and temperature in the oil and gas industry. Also, demand for reliable, durable, and efficient and safe equipment is relatively higher than other industries die to need to function in harsh operating conditions.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The global static plant equipment market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regional markets, Asia Pacific market accounted for a significantly larger revenue share, with major revenue share contribution from China and India, owing to rapid industrial growth, and surge in demand for static equipment across various industries like oil & gas, petrochemicals, power generation, and manufacturing. Also, rapid urbanization, infrastructure development, and increasing investments in industrial projects continue to contribute to the significant revenue share of the APAC region.

North America also accounted for a robust revenue share owing to presence of a mature industrial sector with a focus on technological innovation and advanced manufacturing processes such as digitalization and 3D printing. Europe market growth was moderately lower, but is expected to remain steady with major contributions from Germany and the United Kingdom over the forecast period.

Leading Companies in Static Plant Equipment Market & Competitive Landscape:

The competitive landscape in the global static plant equipment market for applications in oil and gas, petrochemicals, power generation, chemicals processing, water treatment, mining and minerals, refining, and manufacturing industries is characterized by a mix of established multinational companies and regional players. Leading companies focus on offering innovative, high-quality equipment tailored to specific industry needs, often integrating advanced materials and digital technologies for enhanced performance and efficiency.

Key strategies adopted by leading players include investing in research and development to create innovative products, such as more efficient heat exchangers and corrosion-resistant pressure vessels. They also establish strategic partnerships and alliances with engineering firms and technology providers to improve product offerings and expand market access. Companies further enhance their market presence by expanding into emerging markets, providing comprehensive lifecycle services such as maintenance and upgrades, and focusing on sustainability to meet evolving industry regulations and customer preferences.

These companies include:

- BHI Co., Ltd.

- Hantech Ltd.

- Bumhan Mecatec

- SNT Energy

- Godrej

- KNM Group

- Walter Tosto

- Shanghai Morimatsu

- Belleli Energy CPE

- ATB RIVA CALZONI

- Holtec International

- Dongfang Electric Corporation

- Hangzhou Steam Turbine Auxiliary Equipment Co., Ltd.

- Shanghai Electric

- AVK Holding A/S

- ALFA LAVAL

Static Plant Equipment Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

5.0% |

|

Segment covered |

Product; Material; Technology; End-User Industry |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

North America |

|

Key Players |

BHI Co., Ltd.; Hantech Ltd; Bumhan Mecatec; SNT Energy; Godrej; KNM Group; Walter Tosto; Shanghai Morimatsu; Belleli Energy CPE; ATB RIVA CALZONI; Holtec International; Dongfang Electric Corporation; Hangzhou Steam Turbine Auxiliary Equipment Co., Ltd.; Shanghai Electric; AVK Holding A/S; ALFA LAVAL |

Frequently Asked Question

What is the size of the global static plant equipment market in 2023?

The static plant equipment market size reached US$ 137,046.6 Million in 2023.

At what CAGR will the global static plant equipment market expand?

The global market is expected to register a 5.0% CAGR through 2024-2032.

Who are leaders in the static plant equipment market?

Companies such as BHI Co., Ltd., Alfa Laval, Shanghai Electric, and Godrej are considered key leaders due to their extensive product portfolios, global presence, and focus on innovation.

What are some key factors driving revenue growth of the static plant equipment market?

Expansion of industries such as oil and gas, petrochemicals, power generation, and water treatment, which demand efficient and durable equipment and Advancements in materials and digital technologies.

What are some major challenges faced by companies in the static plant equipment market?

Companies in the static plant equipment market face challenges such as market volatility, particularly in the oil and gas sector, which can impact investments and demand.

How is the competitive landscape in the static plant equipment market?

The competitive landscape in the static plant equipment market is intense, with leading players striving to differentiate themselves through innovation and customer-focused services.

How is the static plant equipment market report segmented?

The static plant equipment market report is segmented based on product type, material type, end-user industry, and region.

Who are the key players in the static plant equipment market report?

BHI Co., Ltd.; Hantech Ltd; Bumhan Mecatec; SNT Energy; Godrej; KNM Group; Walter Tosto; Shanghai Morimatsu; Belleli Energy CPE; ATB RIVA CALZONI; Holtec International; Dongfang Electric Corporation; Hangzhou Steam Turbine Auxiliary Equipment Co., Ltd.; Shanghai Electric; AVK Holding A/S; ALFA LAVAL.