Market Overview:

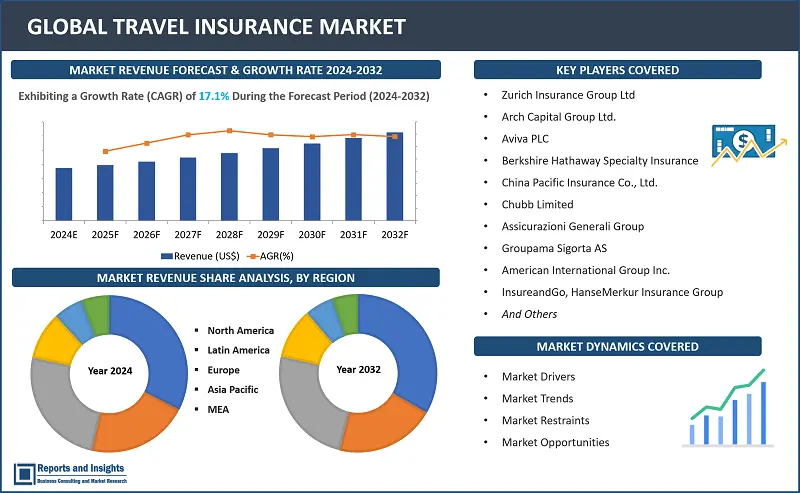

"The travel insurance market size reached US$ 15.8 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 65.4 billion by 2031, exhibiting a growth rate (CAGR) of 17.1% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

17.1% |

Travel insurance is a financial safeguard designed to protect individuals from unforeseen events during their journeys. It encompasses coverage for trip cancellations, interruptions, emergency medical situations, lost luggage, and travel delays. By mitigating the financial risks associated with unexpected circumstances, travel insurance provides reassurance to travelers, allowing them to navigate potential challenges and disruptions while away from home with greater peace of mind.

The travel insurance market is a dynamic and evolving sector that is pivotal in providing financial security for individuals undertaking journeys. Growth in the market is driven by increasing awareness of the uncertainties associated with travel, including rising international travel and the recognition of the importance of coverage against unforeseen events such as trip cancellations, medical emergencies, and lost belongings. Insurers are responding to changing consumer needs by offering diverse and customizable plans, tailored to specific types of travel, ensuring individuals have access to comprehensive protection that suits their unique requirements. The influence of technology is evident as online platforms simplify the process of comparing and purchasing policies, contributing to the overall accessibility and competitiveness of the travel insurance market.

Travel Insurance Market Trends and Drivers

The travel insurance market is witnessing notable trends and being driven by several factors. The rising prevalence of international travel, coupled with increased awareness of the uncertainties associated with unforeseen events, is a significant driver fueling market growth. Global health concerns have amplified the demand for coverage against trip cancellations and medical emergencies. Moreover, there is a noticeable shift towards more personalized and flexible insurance plans to accommodate diverse traveler needs. Technology advancements, particularly online platforms, are playing a pivotal role, simplifying the research, comparison, and purchase of policies for consumers. In essence, the market is adapting to changing traveler expectations by offering innovative solutions and responding to evolving global circumstances.

Travel Insurance Market growth is influenced by several factors which include a heightened awareness of the necessity for financial protection during travel, the increasing prevalence of global travel, and a growing recognition of the potential risks linked to unforeseen events. Furthermore, technological advancements, especially in online platforms, play a vital role in simplifying access to information and policy acquisitions, thereby fostering the overall expansion and accessibility of the travel insurance market.

Travel Insurance Restraining Factors

Despite the positive trajectory observed in the travel insurance market, growth is impeded by various restraining factors. Economic uncertainties and fluctuations can result in reduced travel spending, impacting the demand for insurance products. Ongoing changes in travel restrictions and safety concerns, particularly amid global health crises, pose challenges by influencing travel behavior. The perceived lack of transparency and complexity in policy terms and conditions is another deterrent for potential customers. Additionally, a lack of awareness and understanding regarding the benefits of travel insurance in certain demographics contributes to hesitancy in adopting such coverage. Addressing these challenges requires strategic initiatives to enhance economic stability, clarify policy terms, and raise awareness about the significance of travel insurance across diverse consumer segments.

Travel Insurance Market Opportunities

The travel insurance market is poised for growth and advancement, presenting various opportunities. Increased awareness of the importance of financial protection during travel creates a potential for expanding market reach and attracting new customer segments. Customizing insurance products to cater to specific travel needs, such as adventure travel or extended vacations, offers opportunities to tap into niche markets. Leveraging technology, including artificial intelligence and data analytics, provides avenues for improving processes, enhancing customer experiences, and creating more personalized insurance solutions. Collaborations with travel agencies, online booking platforms, and other stakeholders in the travel industry offer ways to reach a wider audience. Furthermore, the rise of new travel trends, such as remote work and digital nomadism, provides opportunities to design innovative insurance products that align with evolving travel behaviors. Overall, the travel insurance market can seize these opportunities by remaining adaptable, embracing technological advancements, and staying attuned to the changing landscape of travel preferences and lifestyles.

Travel Insurance Market Segmentation:

By Insurance Cover

- Single-Trip Travel Insurance

- Annual Multiply-Trip Travel Insurance

- Long-Stay Travel Insurance

The travel insurance market is categorized into three segments based on coverage types. Single-Trip Travel Insurance is designed for individuals embarking on a specific journey, safeguarding against unforeseen events such as trip cancellations, medical emergencies, or lost baggage during that particular excursion. Annual Multiply-Trip Travel Insurance caters to frequent travelers, presenting a comprehensive policy covering multiple trips within a year, offering a blend of cost-effectiveness and convenience. Long-Stay Travel Insurance is customized for extended journeys, providing comprehensive coverage for an extended duration and addressing distinct risks associated with prolonged stays abroad. These segments offer a range of options, empowering consumers to choose insurance plans that suit their specific travel requirements and preferences.

By Distribution Channel

- Insurance Companies

- Insurance Intermediaries

- Banks

- Insurance Brokers

The distribution channels within the travel insurance sector are diverse and include various entities. Insurance companies are primary providers, directly offering a range of travel insurance policies to consumers. Insurance intermediaries act as facilitators between consumers and insurance providers, aiding in the selection and purchase of policies. Banks incorporate travel insurance into their financial products, often bundling coverage with banking services. Additionally, insurance brokers, functioning as independent agents, assist consumers by navigating the insurance market, comparing policies, and securing customized travel insurance solutions. Together, these distribution channels contribute to the accessibility of travel insurance, providing consumers with multiple avenues to obtain coverage tailored to their specific needs and preferences.

By End User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

The travel insurance market strategically caters to diverse end-user segments, addressing the specific needs of different traveller demographics. Tailored for senior citizens, this segment offers comprehensive coverage addressing the unique health and travel concerns associated with aging. Education travellers, such as students studying abroad, benefit from specialized insurance that covers academic-related risks and provides financial protection during their educational journeys. Business travellers can access policies designed to mitigate the specific risks associated with professional travel, ensuring coverage for business-related contingencies. Meanwhile, family travellers are provided with comprehensive plans that address the varied needs of families, including health coverage and protection against trip cancellations and unforeseen events. Each end-user segment represents a targeted approach, offering travellers insurance solutions precisely aligned with their individual requirements and circumstances in the dynamic landscape of travel insurance.

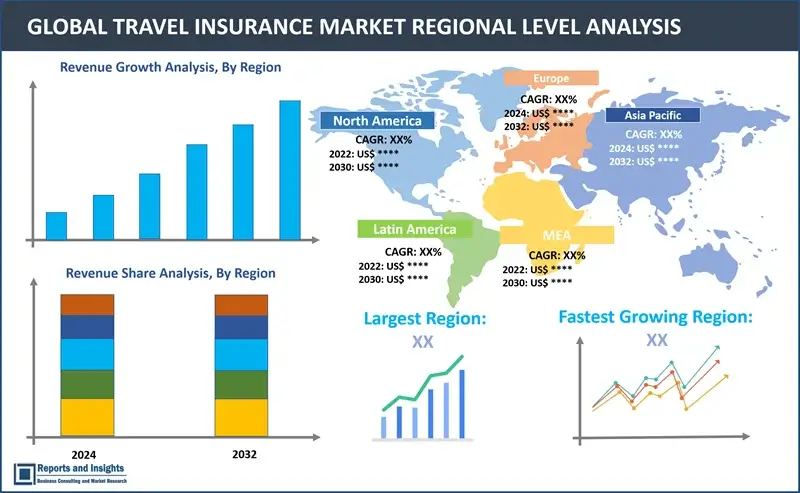

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

The travel insurance market exhibits distinctive characteristics across various regions, influencing consumer preferences and market dynamics. In North America, there is a notable focus on providing comprehensive coverage and assistance services, catering to the preferences of travellers seeking extensive protection. Europe emphasizes the importance of flexible policies to accommodate diverse travel patterns and cultural variations. The Asia Pacific region experiences a surge in demand for travel insurance due to increased outbound tourism, with a specific interest in coverage for medical emergencies and trip cancellations. Latin America witnesses a growing interest in travel insurance as more individuals embark on international journeys, prompting a need for coverage aligned with regional travel trends. In the Middle East and Africa, there is a rising awareness of the benefits of travel insurance, particularly related to business travel and adventure tourism, driving the demand for policies tailored to specific travel purposes. Recognizing these regional intricacies is crucial for insurance providers to offer tailored and pertinent coverage options, contributing to market growth in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Leading Travel Insurance Providers & Competitive Landscape:

The travel insurance market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- Zurich Insurance Group Ltd

- Arch Capital Group Ltd.

- Aviva PLC

- Berkshire Hathaway Specialty Insurance

- China Pacific Insurance Co., Ltd.

- Chubb Limited

- Assicurazioni Generali Group

- Groupama Sigorta AS

- American International Group Inc.

- InsureandGo, HanseMerkur Insurance Group

- Ping An Insurance Company of China, Ltd.

- Seven Corners Inc. (US)

- SOMPO Holdings, Inc.

- American Express

- Travelex Insurance Services Inc.

- Allianz Partners

Recent News and Development

- November 2023: Visitor Guard introduces essential winter travel insurance for visitors to the United States.

- February 2022: Vistara announced a partnership with Allianz Partners to offer optional travel insurance to its passengers. This service allows customers to purchase travel insurance while booking domestic or international flights. Initially available to Indian citizens residing in India, the option is set to expand to other global markets such as Singapore, the United Arab Emirates, and Europe in the second phase throughout the year.

- January 2022: Allianz Partners also collaborated with Singapore Airlines, a leading global provider of insurance products and services. This strategic partnership not only aimed to enhance Allianz's presence in the rapidly growing Asia Pacific market but also focused on delivering comprehensive protection products and travel insurance globally, addressing the increasing number of passengers on Singapore Airlines each year.

Travel Insurance Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

17.1% |

|

Segment covered |

Insurance cover, distribution channel, end-user, and regions. |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

Zurich Insurance Group Ltd, Arch Capital Group Ltd., Aviva PLC, Berkshire Hathaway Specialty Insurance, China Pacific Insurance Co., Ltd., Chubb Limited, Assicurazioni Generali Group, Groupama Sigorta AS, American International Group Inc., InsureandGo, HanseMerkur Insurance Group, Ping An Insurance Company of China, Ltd., Seven Corners Inc. (US), SOMPO Holdings, Inc., American Express, Travelex Insurance Services Inc., and Allianz Partners. |

Frequently Asked Question

What are some key factors driving revenue growth of the travel insurance market?

Some key factors driving market revenue growth include increasing travel frequency, rising awareness of risks, globalization and international business travel.

What are some major challenges faced by companies in the travel insurance market?

Companies face challenges such as dynamic regulatory environment, climate change and natural disasters, cancellation and refund issues, and competitive pricing pressure.

How is the competitive landscape in the global travel insurance market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

What is the market size of travel insurance market in the year 2023?

The travel insurance market size reached US$ 15.8 billion in 2023.

At what CAGR will the travel insurance market expand?

The market is anticipated to rise at 17.1% CAGR through 2032.

What are the potential opportunities for companies in the travel insurance market?

Companies can leverage opportunities such as digital transformation and integration, focus on health and wellness coverage, and enhanced consumer engagement.

Which region has the biggest market share in travel insurance market?

Europe has the biggest market share in travel insurance market.

How is the travel insurance market segmented?

The market is segmented based on factors such as insurance cover, distribution channel, end-user and regions.