Market Overview

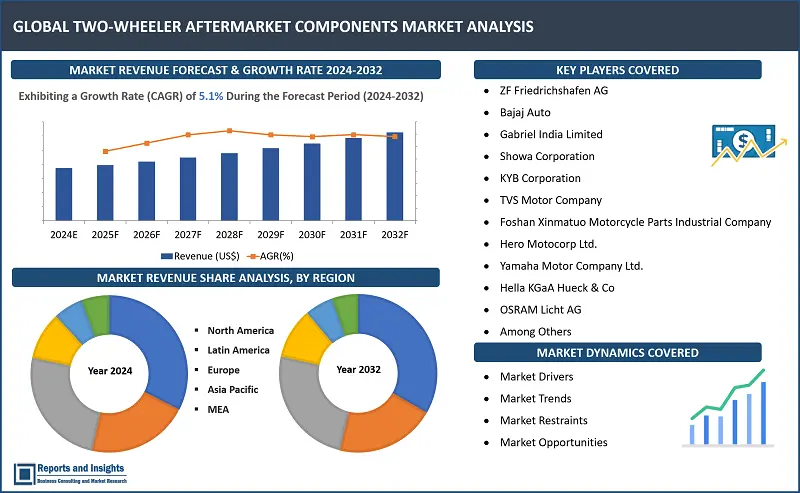

"The two-wheeler aftermarket components market size reached US$ 25.6 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 40.06 billion by 2032, exhibiting a growth rate (CAGR) of 5.1% during 2024-2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

5.1% |

Aftermarket components for two-wheelers are parts and accessories sold separately from the original equipment manufacturer (OEM) for motorcycles, scooters, and other similar vehicles. These components are utilized for maintenance, repairs, or customization, and include items such as tires, brakes, batteries, lights, exhaust systems, and various accessories. The aftermarket offers a broad selection of products to enhance the performance, appearance, and functionality of two-wheelers, meeting a variety of preferences and requirements.

The market for aftermarket components for two-wheelers includes the sale of parts and accessories for motorcycles, scooters, and similar vehicles that are not provided by the original equipment manufacturer (OEM). It offers a variety of products like tires, brakes, batteries, lights, exhaust systems, and accessories, meeting the needs of riders for maintenance, repair, and customization. This market is fueled by factors such as the rising number of two-wheeler users, the increasing demand for customization, and the availability of diverse products to improve performance and appearance.

Two-Wheeler Aftermarket Component Market Trends and Drivers:

The two-wheeler aftermarket component market is experiencing notable expansion, propelled by various trends and drivers. A significant driver is the rising disposable income, particularly in developing nations, which is increasing the demand for two-wheelers and, consequently, aftermarket components. Moreover, there is a growing trend of customization and performance enhancement among two-wheeler owners, further boosting the aftermarket component market. Increased awareness about vehicle maintenance and the wide array of aftermarket products available are also driving market growth. Additionally, the surge in e-commerce platforms for aftermarket component sales is contributing to the market's expansion.

The two-wheeler aftermarket component market growth is influenced by several factors which include the increasing global demand for two-wheelers, particularly in emerging economies where rising disposable incomes are driving sales of motorcycles and scooters, thus increasing the need for aftermarket components. Additionally, the trend of customization and personalization among two-wheeler owners is boosting the market for aftermarket parts and accessories. Moreover, the aging two-wheeler fleet in many developed economies is leading to higher replacement rates, further driving the aftermarket component market. The availability of a wide range of aftermarket components, including performance-enhancing parts and accessories, is also fueling market growth. Furthermore, the growth of e-commerce platforms has made it easier for consumers to access aftermarket components, contributing to market expansion.

Two-Wheeler Aftermarket Component Market Restraining Factors:

The two-wheeler aftermarket component market encounters several factors that restrain its growth. A major challenge is the presence of counterfeit products, which not only undermines the market's credibility but also poses safety risks to consumers. Furthermore, the absence of standardization in aftermarket components can result in compatibility issues and affect product quality. Additionally, the increasing complexity of modern two-wheelers and the requirement for specialized tools for repairs and installations may discourage consumers from purchasing aftermarket components. Economic downturns and fluctuations in raw material prices also present challenges to the market's expansion, as they can impact production costs and pricing strategies.

Two-Wheeler Aftermarket Component Market Opportunities:

The two-wheeler aftermarket component market offers various opportunities for expansion and creativity. One significant prospect involves creating aftermarket components tailored to the increasing demand for electric two-wheelers, as the electric vehicle market continues to grow. Additionally, there is a rising preference for sustainable and environmentally friendly products, opening up a market for aftermarket components that prioritize energy efficiency and sustainability. Furthermore, the growing digitalization and connectivity in two-wheelers create opportunities for aftermarket components that enhance vehicle connectivity, such as GPS systems, smartphone integration, and digital displays. Collaborations with e-commerce platforms and the implementation of digital marketing strategies can also help aftermarket component manufacturers expand their reach and boost sales.

Two-Wheeler Aftermarket Component Market Segmentation:

-MARKET-IMAGE-2.webp)

By Two-Wheeler Type

- Standard Motorcycle

- Cruiser Motorcycle

- Sports Motorcycle

- Standard Scooter

- Maxi Scooter

- Mopeds

Standard motorcycles are currently dominating the market among the other two-wheeler types, they are favored for their versatility, comfortable riding position, and practicality for daily commuting and general-purpose riding. Cruiser motorcycles, with their laid-back style, and sports motorcycles, known for their high performance, also hold significant market shares, catering to riders with specific preferences. Standard scooters, maxi scooters, and mopeds cater to niche markets, with standard scooters being the most popular due to their convenience and suitability for urban environments.

By Product Type

- Components

- Consumables

Components are dominating among the other product types. Components are integral parts used in the manufacturing and assembly of larger products, ensuring their functionality and performance. They range from electronic chips to mechanical parts and are often standardized and sourced from specialized manufacturers. Consumables, in contrast, are items like batteries or printer ink that are regularly replaced during product use. While consumables are crucial for ongoing operation, components play a foundational role in product design and functionality.

By Sales Channel

- Authorized Dealers

- Independent Dealers

- Online

Authorized dealers are currently dominating among the sales channels. These dealers are directly affiliated with manufacturers and have the authorization to sell their products. They provide customers with genuine products, manufacturer warranties, and support. In contrast, independent dealers, although offering more variety and possibly lower prices, may not always offer the same level of after-sales service or guarantee the authenticity of products. Online sales have been rapidly growing due to their convenience and competitive pricing. However, concerns about product authenticity, customer service, and returns can sometimes impact customer confidence in online purchases.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

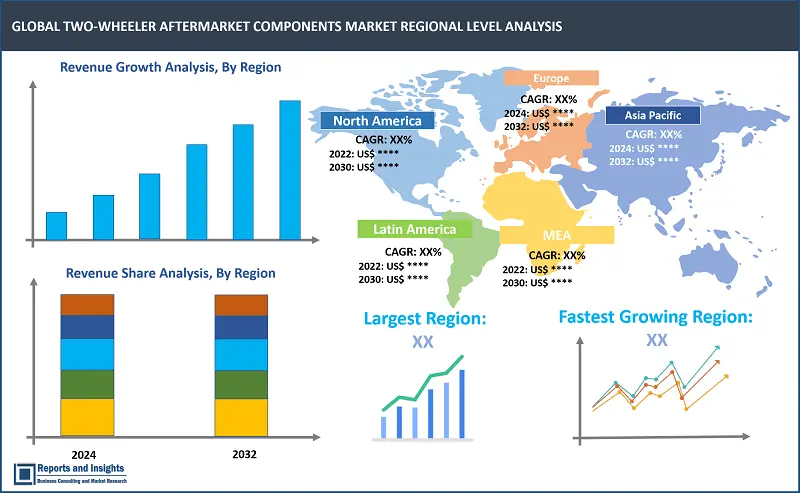

In the two-wheeler aftermarket component sector, Asia Pacific holds a dominant position. This is due to high consumer demand for motorcycles and scooters, driven by a culture that embraces both recreational riding and commuting on two wheels. The region benefits from a well-established network of dealers and retailers offering a diverse range of aftermarket components such as tires, brakes, batteries, and accessories. Furthermore, the large number of motorcycle enthusiasts and a thriving culture of aftermarket customization contribute significantly to Asia Pacific's leadership in this market.

Leading Two-Wheeler Aftermarket Component Manufacturers & Competitive Landscape:

The two-wheeler aftermarket component market is highly competitive, with several key players vying for market share and actively engaging in strategic initiatives. These companies focus on product innovation, technological advancements, and expanding their product portfolios to gain a competitive edge. These companies are continuously investing in research and development activities to enhance their product offerings and cater to the evolving needs of customers in terms of efficiency, performance, and sustainability.

These companies include:

- ZF Friedrichshafen AG

- Bajaj Auto

- Gabriel India Limited

- Showa Corporation

- KYB Corporation

- TVS Motor Company

- Foshan Xinmatuo Motorcycle Parts Industrial Company

- Hero Motocorp Ltd.

- Yamaha Motor Company Ltd.

- Hella KGaA Hueck & Co

- OSRAM Licht AG

- BMW Group

- BITUBO S.r.l.

Recent News and Development

-

November 2023: Uno Minda, a top-tier supplier, has introduced a new range of aftermarket LED blinkers for two-wheelers.

- May 2023: TVS Racing has partnered with KidZania, a renowned edutainment theme park, to introduce a unique racing experience tailored for young enthusiast riders, marking a first-of-its-kind initiative.

Two-Wheeler Aftermarket Component Market Research Scope

|

Report Metric |

Report Details |

|

Market size available for the years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

5.1% |

|

Segment covered |

Two-wheeler type, product type, sales channel and regions. |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

Germany |

|

Largest Market |

Asia Pacific |

|

Key Players |

ZF Friedrichshafen AG, Bajaj Auto, Gabriel India Limited, Showa Corporation, KYB Corporation, TVS Motor Company, Foshan Xinmatuo Motorcycle Parts Industrial Company, Hero Motocorp Ltd, Yamaha Motor Company Ltd., Hella KGaA Hueck Co, OSRAM Licht AG, BMW Group and BITUBO S.r.l. |

Frequently Asked Question

At what CAGR will the two-wheeler aftermarket component market expand?

The market is anticipated to rise at 5.1% through 2032.

Which region accounted for the largest market share in 2023?

Asia Pacific region accounted for the largest market share in 2023.

What are some key factors driving revenue growth of the two-wheeler aftermarket component market?

Some key factors driving two-wheeler aftermarket component market revenue growth include increasing two-wheeler sales, e-commerce, and online retailing, technological advancements, and regulatory changes.

What are some major challenges faced by companies in the two-wheeler aftermarket component market?

Companies face challenges such as technological complexities, distribution challenges, price competition, and counterfeit products.

How is the competitive landscape in the two-wheeler aftermarket component market?

The market is competitive, with key players focusing on technological advancements, product innovation, and strategic partnerships. Factors such as product quality, reliability, after-sales services, and customization capabilities play a significant role in determining competitiveness.

Who are the leading key players in two-wheeler aftermarket component market?

The leading key players in the two-wheeler aftermarket component market are ZF Friedrichshafen AG, Bajaj Auto, Gabriel India Limited, Showa Corporation, KYB Corporation, TVS Motor Company, Foshan Xinmatuo Motorcycle Parts Industrial Company, Hero Motocorp Ltd, Yamaha Motor Company Ltd., Hella KGaA Hueck & Co, OSRAM Licht AG, BMW Group and BITUBO S.r.l.

How is the two-wheeler type segmented?

: By two-wheeler type is segmented on the basis of standard motorcycle, cruiser motorcycle, sports motorcycle, standard scooter, maxi scooter, and mopeds.

What is the size of the global two-wheeler aftermarket component market in 2023?

The global two-wheeler aftermarket component market size reached US$ 25.6 Billion in 2023.