Market Overview:

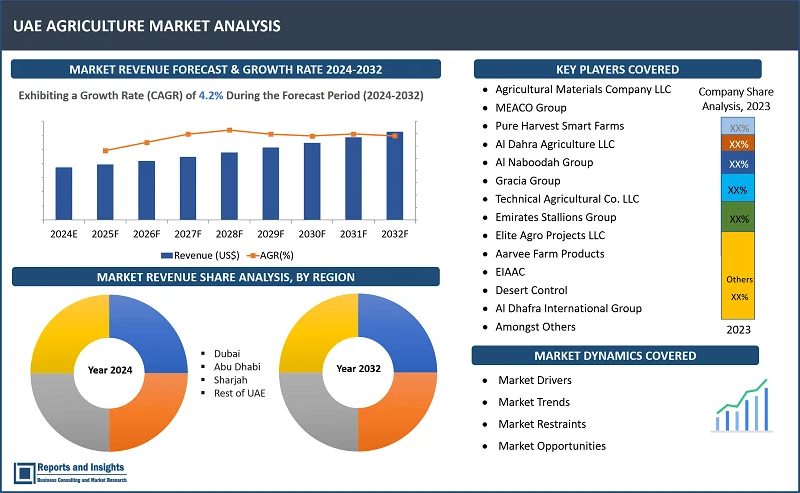

"The UAE Agriculture market was valued at US$ 3.2 Billion in 2023 and is expected to register a CAGR of 4.2% over the forecast period and reach US$ 4.7 Billion in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Market Growth Rate (2024-2032) |

4.2% |

The agriculture landscape in the UAE is undergoing significant changes that are reengineering the country’s food production system and supporting its food security and sustainability objectives. Even though the country is characterized by a harsh desert climate and limited arable land, the UAE is committing vast resources in overcoming these challenges to increase local food production through innovative practices. State of the art technologies such as vertical farming, hydroponics, aquaponics and controlled-environment agriculture are on the ascent. Such methods enable the UAE to grow crops with exceptionally low water and land use thus defeating the environmental restraints experienced by normal agribusiness.

The initiatives by various governments are also vital in ensuring the agricultural transformation. The National Food Security Strategy 2051 of the UAE seeks to improve the local production of food and decrease the level of imports which supplies more than half of the food consumed in the country. In this respect, the state is offering financial rewards as well as encouraging cooperations of local farmers and foreign agricultural business companies. Investments in research and development also help in the development of new crops which can survive droughts as well as other farming systems that consume less water.

The rise of sustainable and organic farming is another major trend which is activated by the consumer’s unease with the conventional food systems and their preference for organic, healthier, locally grown food. Organic farming practices are gaining ground as both farmers and consumers are becoming more conscious of the health and environmental advantages.

The change towards advanced agricultural practices incorporating various technological advancements is shifting the UAE market as improving the food production capacity of the country promotes a more sustainable use of resources and makes the UAE more competitive within the region in terms of agri-tech development.

UAE Agriculture Market Trends and Drivers:

The agricultural landscape in the UAE is changing rapidly fuelled by several driving factors including technological advancements, government initiatives, and consumer behavior. One of the most major trends is the adoption of agri-tech solutions, such as vertical gardens, hydroponics, or smart farming systems. These technologies are important in increasing the output of the crops with minimal use of water and land, which is appropriate to the natural limitations of the UAE which has dry soil and less water. The improvements in plant production under controlled environments are allowing production of more diverse crops by farmers all year round, thus increasing the local food production.

The growth of the industry is greatly influenced by government policies. The National Food Security Strategy 2051 of the UAE aims to enhance local food supply by means of investment, adoption of subsidies, and promotion of collaborations between local farmers and international agriculture technology firms. The strategy is focused on decreasing the level of food imports in the country which is presently the majority of the food available within the country. In addition, the government of the UAE is improving the development of drought resistant and climate resilient crops.

There is also a substantial growth in demand for organic and local foods among consumers, which is another significant factor that is driving the focus on sustainable agriculture. Growing awareness regarding health among the population is encouraging the need for organic food thus advocating for sustainable agricultural practices.

Last but not least, these trends are transforming the UAE agriculture sector, positioning the nation at the forefront of sustainable and modernized farming practices, and enhancing its strategies for long term food security.

UAE Agriculture Market Restraining Factors:

Promising as it may seem, the agriculture sector of the UAE is hampered by numerous limitations. One of the obstacles, perhaps the most important, is the fact that the country is predominantly a desert with very little cultivable land and limited fresh water. Coupled with high temperatures and low fertility of soil, the conventional agricultural practices have become less practical and very costly, thus creating tendency to rely on outside food sources.

Water deficit is a problem above all, due to the fact that farming or agriculture is a water-dependent sector and the country is entirely reliant on desalination plants for much of its water supply. The exorbitant expenses incurred in the process of desalination, as well as in the management of water resources, discourages the feasibility of embarking on large scale agribusiness ventures.

In addition, while technological advances in farming such as hydroponics and vertical farming help in the present problems, their costs in establishment and continued upkeep might be a disincentive to the growth of small-scale farmers. Even with skilled farming techniques, employment of the local human resource proves challenging as there are only few people who are adequately trained.

UAE Agriculture Market Opportunities:

The UAE agriculture sector has many prospects geared by the agri-tech developments and government backing. New concepts like vertical farming, hydroponics, aquaponics are addressing the issues of less farming space and harsh weather conditions enabling efficient food production and sustainability. Since most consumers have a preference for locally grown and organic food, the demand for such farms, which practice green and advanced farming is on the rise.

Policies such as the National Food Security Strategy 2051 are creating a favorable scenario for commercial agriculture in the country, which is attracting local and foreign investors in the sector. Research and development of drought-tolerant crops along with the introduction of water-efficient technologies helps in the development of new agricultural practices.

Owing to the strategic positioning of the UAE as a trading center, agricultural products can easily be exported to neighboring regions making agribusiness an appealing area of investments for both domestic and global markets for growth and development.

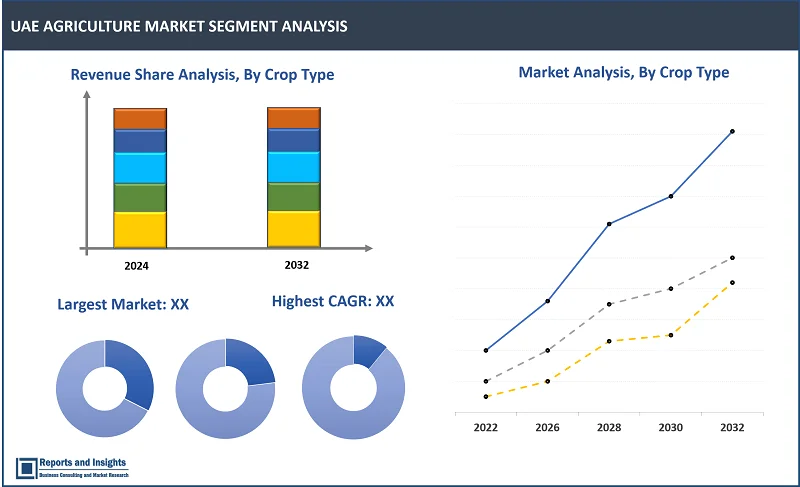

UAE Agriculture Market Segmentation:

By Crop Type

- Food Crops/Cereals

- Fruits

- Vegetables

- Oilseeds and Pulses

Food crops and cereals is holding the majority of the market share of the UAE agriculture market due to the country's heavy reliance on staple crops like wheat, rice, and barley to meet the food security needs of its growing population. These crops are essential in the national diet and are heavily imported or grown locally using advanced agricultural techniques like hydroponics and controlled-environment farming. The UAE government also prioritizes cereals for strategic stockpiling to ensure food supply stability.

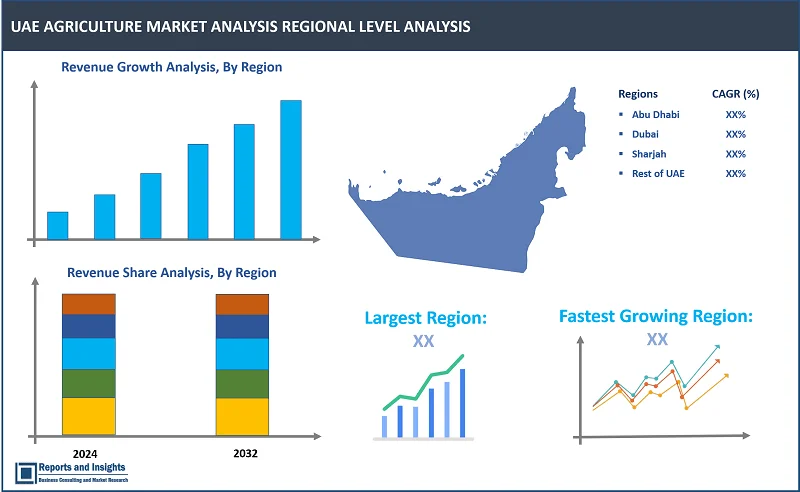

By Region

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Leading Companies in UAE Agriculture Market & Competitive Landscape:

The UAE agriculture market is highly competitive, with leading players adopting advanced technologies and sustainable farming practices to enhance productivity and reduce reliance on imports. Key strategies include investment in vertical farming, hydroponics, and greenhouse cultivation to maximize crop yields in the country's arid climate. Companies are also focusing on partnerships with global agribusiness firms to access cutting-edge technologies and expertise. Additionally, there is a growing emphasis on organic farming and sustainable agriculture to meet the increasing consumer demand for healthier, locally produced food. These approaches help firms strengthen their market presence and address food security challenges.

These companies include:

- Agricultural Materials Company LLC

- MEACO Group

- Pure Harvest Smart Farms

- Advanta Seeds

- Al Dahra Agriculture LLC

- Al Naboodah Group

- AGRI VENTURES FZE

- Gracia Group

- Technical Agricultural Co. LLC

- Emirates Stallions Group

- Elite Agro Projects LLC

- Aarvee Farm Products

- Pegasus Agriculture Group

- Emirates International Agricultural Advanced Company (EIAAC)

- Desert Control

- Al Dhafra International Group

- SGS Gulf Limited

- Vacker Group

- Al Mubarak Agro-Chemicals

- BADIA FARMS

- Among Others

Recent Development:

- October 2024, Koppert Biological Systems Inc. announced their rebranded Side Effects app to help growers optimize their integrated pest management programs. The app currently provides critical advice on the side effects of chemical agents on biological control products and pollinators to more than 40,000 users worldwide.

UAE Agriculture Market Research Scope

|

Report Metric |

Report Details |

|

UAE Agriculture Market size available for the years |

2021-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

5.6% |

|

Segment covered |

Crop Type and Regions |

|

Region Scope |

UAE |

|

Quantitative Units |

Volume in Thousand Kilo; revenue in USD million, and CAGR from 2024 to 2032 |

|

Key Players |

Agricultural Materials Company LLC, MEACO Group, Pure Harvest Smart Farms, Advanta Seeds, Al Dahra Agriculture LLC, Al Naboodah Group, AGRI VENTURES FZE, Gracia Group, Technical Agricultural Co. LLC, Emirates Stallions Group, Elite Agro Projects LLC, Aarvee Farm Products, Pegasus Agriculture Group, Emirates International Agricultural Advanced Company (EIAAC), Desert Control, Al Dhafra International Group, SGS Gulf Limited, Vacker Group, Al Mubarak Agro-Chemicals, BADIA FARMS, and among others. |

|

Report Coverage |

Historical Data, Revenue Forecast, Company Share Analysis, Pricing Analysis, Market Dynamics |

Frequently Asked Question

What is the market size of the UAE agriculture market in 2023?

The UAE Agriculture market size reached US$ 3.2 Billion in 2023.

At what CAGR will the UAE agriculture market expand?

The market is expected to register a 4.2% CAGR through 2024-2032.

How big can the UAE agriculture market be by 2032?

The market is estimated to reach US$ 4.7 billion by 2032.

What are some key factors driving revenue growth of the UAE agriculture market?

Some key factors driving revenue growth are increased consumer demand for organically and pesticide-free produce and the enhanced focus on sustainable agricultural practices, among others.

What are some major challenges faced by adopters of UAE agriculture solutions?

Some key challenges include high cost of biocontrol agents than traditional chemical pesticides, high up-front expenses, among others.

How is the competitive landscape in the UAE agriculture market?

The UAE agriculture market is highly competitive, with leading players adopting advanced technologies and sustainable farming practices to enhance productivity and reduce reliance on imports.

How is the UAE agriculture market segmented?

The market report is segmented based on crop type and regions.

Which top companies are included in the UAE Agriculture market report?

Top companies included in the report are Agricultural Materials Company LLC, MEACO Group, Pure Harvest Smart Farms, Advanta Seeds, Al Dahra Agriculture LLC, Al Naboodah Group, AGRI VENTURES FZE, Gracia Group, Technical Agricultural Co. LLC, Emirates Stallions Group, Elite Agro Projects LLC, Aarvee Farm Products, Pegasus Agriculture Group, Emirates International Agricultural Advanced Company (EIAAC), Desert Control, Al Dhafra International Group, SGS Gulf Limited, Vacker Group, Al Mubarak Agro-Chemicals, BADIA FARMS, and among others.