Market Overview:

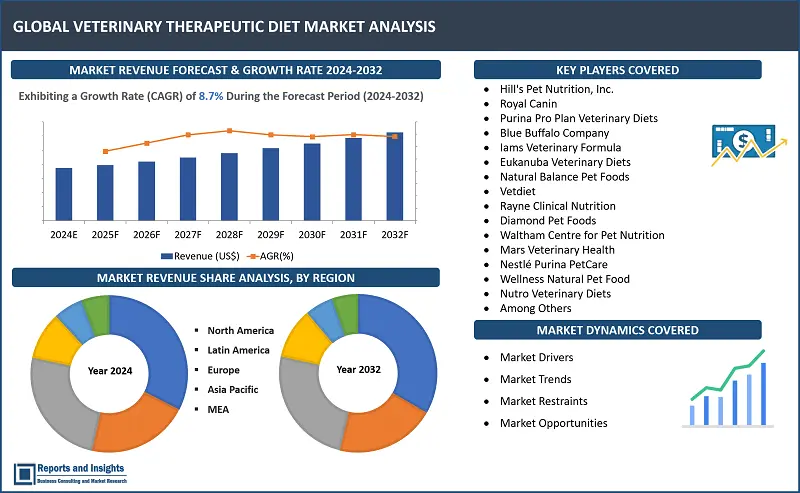

"The veterinary therapeutic diet market was valued at US$ 1.5 Billion in 2023, and is expected to register a CAGR of 8.7% over the forecast period and reach US$ 3.2 Bn in 2032."

|

Report Attributes |

Details |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2021-2023 |

|

Veterinary Therapeutic Diet Market Growth Rate (2024-2032) |

8.7% |

Veterinary therapeutic diet products aid is addressing specific health conditions in animals and comprise precise formulations of ingredients, high-quality proteins, fibers, vitamins, minerals, and other essential nutrients tailored to meet the unique physiological needs of pets with medical conditions such as obesity, renal failure, gastrointestinal disorders, diabetes, and food allergies, among others. Advancements in development and formulation of veterinary therapeutic diet and products and inclusion of novel ingredients such as omega-3 fatty acids, prebiotics, and probiotics, which support and enhance immunity and gut health are driving increasing product demand. In addition, personalized diets based on genetics, age, breed-specific requirements have been gaining traction, especially in developed economies.

Also, development of veterinary therapeutic diet products with natural and organic ingredients is serving to attract pet owners with preference for clean-label products. Innovations in nutrigenomics, which entails the study of interaction between nutrition and genes, and enables development of diets that can influence gene expression related to health conditions in animals is also gaining traction. In addition, advancements in veterinary science have resulted in the introduction of therapeutic diets for less common conditions, such as cognitive dysfunction syndrome in aging pets, and also highlights level of commitment and focus on improving animal health outcomes through scientifically-backed nutritional and therapeutic interventions.

Veterinary Therapeutic Diet Market Trends and Drivers:

Rising prevalence of chronic diseases in pets, increasing pet ownership rates, and inclining awareness regarding pet health and wellness are some key factors driving steady growth of the veterinary therapeutic diet market. Pet parents or animal owners are becoming increasingly aware and knowledgeable about specific nutritional needs of animals and this is having a positive impact on preference for specialized diets to manage conditions in animals such as obesity, renal failure, and gastrointestinal issues. Manufacturers of products are also progressing along with technological advancements in manufacturing and packaging of various products, and innovations such as precision formulation, enhanced palatability, and use of high-quality ingredients to ensure efficacy and safety of therapeutic diets. The use of more eco-friendly and convenient packaging materials and solutions are serving to support product demand.

Increasing expenditure on pet healthcare and rising popularity of premium pet food products, along with inclining adoption of personalized nutrition plans tailored to criteria such as genetic age and breed-specific needs of pets are factors supporting revenue growth of the market. Advancements in nutrigenomics and increasing awareness regarding personalized plans for pets and animal wellbeing and health are having positive impact on market growth and expected to increase the demand for veterinary therapeutics diet.

Companies are also engaging in product strategies focusing on organic ingredients and clean-label formulations to align with consumer preferences for healthier and environmentally friendly food and nutrition products for pets and animals. Also, collaborations between veterinarians, pet nutrition experts, and food manufacturers are serving to develop and introduce innovative and credible products and solutions on the market. These initiatives are supported majorly by the dynamic market landscape, increasing scientific research in food products and therapeutic diet solutions, and technological advancements in tools and approaches.

Veterinary Therapeutic Diet Market Restraining Factors:

A primary factor having an impact on growth of the veterinary therapeutic diet market is high costs associated with therapeutic diets, and particularly in regions with lower consumer disposable income. These specialized products go through rigorous manufacturing processes and contain high-quality ingredients, and hence are offered at premium pricing, making them less accessible to a broader audience. Other factors are stringent food safety regulations and the potential health risks associated with therapeutic diets. Testing and compliance approvals from regulatory bodies can be extensive, and this can delay product launches and increase production costs.

In addition, Research and Development (R&D) in the veterinary therapeutic diet sector can be time-consuming and expensive, and developing diets that are both effective and palatable, requires significant investment in scientific research, clinical trials, and ingredient sourcing, among others. The complexity involved in formulating such diets to meet specific health needs of different animals further amplifies production challenges. Moreover, availability of substitutes and alternatives such as generic pet foods, supplements, and diets prepared at home by pet owners can restrain potential market growth.

Furthermore, potential risks associated with the use of therapeutic diets, and lack of response or adverse effects or reactions caused by some products to pets or animals can add to existing skepticism regarding efficacy and safety. Lack of awareness and misinformation about benefits of these products and solutions can have a negative impact on adoption. This coupled with competition for well-established regular pet food brands and slow innovation in this space, combines with challenges in maintaining product quality and reaching wider audiences and markets and enhancing distribution networks are expected to have a combined impact on potential revenue streams of players in the market.

Veterinary Therapeutic Diet Market Opportunities:

Leading players in the global veterinary therapeutic diet market have a number of potential opportunities to leverage. Manufacturers can capitalize on the growing trend towards personalized pet nutrition by developing tailored therapeutic diets based on genetic, age, and breed-specific needs. This approach leverages advancements in nutrigenomics and precision nutrition, allowing companies to offer highly customized products that meet specific health requirements of pets, thereby creating additional revenue streams. Pet ownership rates are rising in countries in Asia Pacific and Latin America, and this is supported by rising disposable income and spending capacity. Companies can strategize and enter such markets by setting up local production facilities and entering into partnerships with regional distributors to enhance market presence and drive sales.

Development of new and innovative products containing natural, organic, and clean-label ingredients can serve to attract appeal of health-conscious pet owners. Emphasizing on benefits of such ingredients and aligning with changing consumer preferences for better transparency and sustainability can differentiate products and brands in the competitive market landscape.

Also, investment in R&D initiatives to continuously improve and innovate diet formulations can enable development of superior health outcomes for pets and contribute to pet owner loyalty. Strategic agreements, mergers and acquisitions can open avenues for rapid expansion and integration of technologies and further advancements and innovation in offerings. Collaborating with veterinary clinics, pet care chains, and biotech firms can enhance product offerings and market reach, while mergers or acquisitions can enable access to new technologies, expertise, and established distribution networks to further ease penetration into new markets and enhance revenue growth. Furthermore, leveraging digital marketing and e-commerce platforms can boost sales volumes to a significant extent, and also enhance brand visibility. Creating engaging and interactive online content, utilizing social media platforms and influencers, and offering subscription services and options can enhance customer engagement and support retention.

Veterinary Therapeutic Diet Market Segmentation:

By Animal Type

- Dogs

- Cats

- Others

Among the animal type segments, the dog segment is expected to account for the largest revenue share in the veterinary therapeutic diet market. Revenue growth projection is supported by the higher prevalence of chronic health conditions in dogs, such as obesity, diabetes, and arthritis, which drive demand for specialized diets. Also, dog owners tend to spend more on premium pet care products, including therapeutic diets, and this coupled with rising awareness of pet health and wellness among dog owners is contributing significantly to increased product demand and revenue growth of this segment.

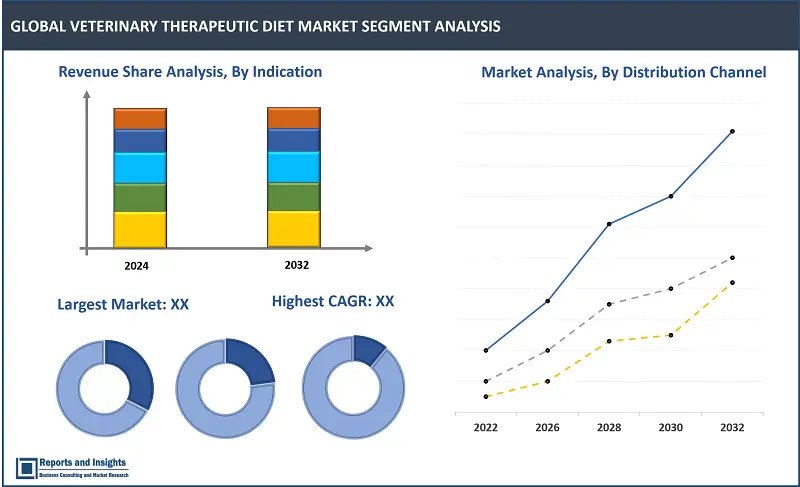

By Indication

- Weight Management

- Renal Care

- Gastrointestinal Health

- Dermatological Care

- Diabetes Management

- Cardiac Health

- Joint Health

- Other Indications

Among the indication segments, the weight management segment is expected to account for the largest revenue share in the veterinary therapeutic diet market. This is supported by increasing prevalence of obesity among pets, particularly dogs and cats, which poses significant health risks such as diabetes, joint problems, and cardiovascular issues. Pet owners are becoming more aware of the importance of maintaining healthy weights for their pets, driving demand for specialized weight management diets. In addition, veterinarians frequently recommend these diets as part of comprehensive treatment plans, and this is having a positive impact on revenue growth of this segment.

By Product Type

- Dry Food

- Wet/Canned Food

- Semi-Moist Food

- Treats and Supplements

Among the product type segments, the dry food segment is expected to account for the largest revenue share and this projection is supported by high demand for these product types owing to convenience, longer shelf life, and cost-effectiveness compared to wet or semi-moist options. Dry food is also easier to store and handle, making it a preferred choice for many pet owners. In addition, dry therapeutic diets often incorporate specialized formulations to address various health issues, making this type a versatile and widely adopted option in managing pet health conditions.

By Distribution Channel

- Veterinary Clinics and Hospitals

- Pet Specialty Stores

- Online Retailers

- Other Channels (Supermarkets, Hypermarkets)

The veterinary clinics and hospitals segment is expected to account for the largest revenue share in the veterinary therapeutic diet market. This projection is justified by the trust and credibility these establishments hold with pet owners, who rely on veterinary professionals for expert health advice and tailored diet recommendations. In addition, veterinary clinics often serve as the primary point of diagnosis for health conditions that require therapeutic diets, facilitating immediate purchase and adoption of prescribed products. This direct link between diagnosis and diet recommendation drives higher sales through this channel.

By Region

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Poland

- Benelux

- Nordic

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

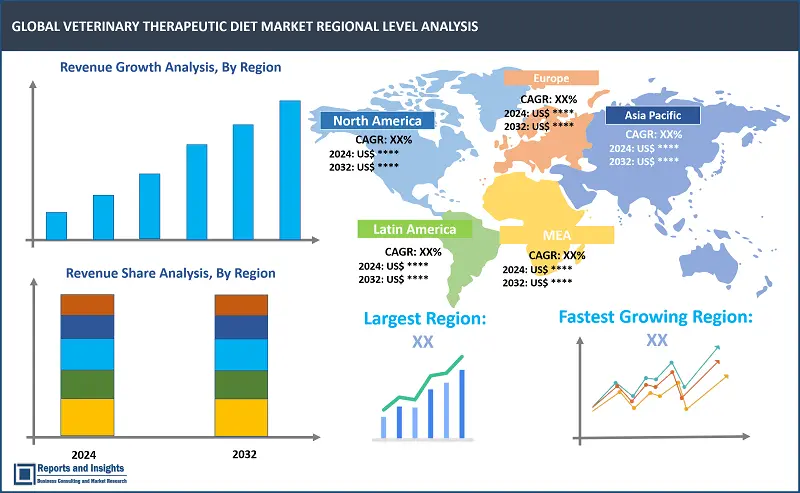

The global veterinary therapeutic diet market is divided into five key regions: North America leads among the regional markets in terms of revenue share, driven by major revenue contribution from the United States (US) and Canada. This is supported by high level of pet ownership, coupled with increasing awareness of pet health and wellness in these countries. Also, major players such as Hill's Pet Nutrition, Royal Canin, and Purina Pro Plan Veterinary Diets have a strong presence in this regional market.

In Europe, countries such as the United Kingdom (UK), Germany, and France account for significantly robust revenue share contribution, supported by the growing trend of humanization of pets and the availability of advanced veterinary care facilities.

The Asia Pacific market is registering a rapid revenue growth rate, with Japan, China, and Australia emerging as key country markets. Factors driving overall growth include rising prevalence of chronic diseases in pets, increasing disposable income levels, and growing emphasis on preventive healthcare for animals.

Leading Companies in Veterinary Therapeutic Diet Market & Competitive Landscape:

The competitive landscape in the global veterinary therapeutic diet market is intense, with leading companies employing various strategies to maintain their positions and expand their consumer bases. One key strategy is continuous product innovation, where companies invest in research and development to formulate new diets that address emerging health concerns in pets. Also, strategic partnerships with veterinarians and pet care professionals help in promoting brand credibility and expanding distribution networks.

Another key approach is marketing and advertising efforts focused on educating pet and animal owners about the benefits of therapeutic diets, leveraging digital platforms and influencer marketing to reach a wider audience. Furthermore, companies emphasize quality control and adherence to food safety regulations to build trust among consumers. Overall, a combination of product innovation, strategic partnerships, effective marketing, and quality assurance measures are essential for leading companies to thrive in this competitive market.

These companies include:

- Hill's Pet Nutrition, Inc.

- Royal Canin

- Purina Pro Plan Veterinary Diets

- Blue Buffalo Company

- Iams Veterinary Formula

- Eukanuba Veterinary Diets

- Natural Balance Pet Foods

- Vetdiet

- Rayne Clinical Nutrition

- Diamond Pet Foods

- Waltham Centre for Pet Nutrition

- Mars Veterinary Health

- Nestlé Purina PetCare

- Wellness Natural Pet Food

- Nutro Veterinary Diets

Recent Developments:

- May 2024: Purina Pro Plan Veterinary Diets for dogs and cats have been made available to US customers through Amazon's online store, expanding the availability of therapeutic nutrition. These diets, including the newly introduced Multi Care canine supplement, join the brand's range of treats and supplements. Developed by experts to meet the advanced nutritional needs of pets, Pro Plan Veterinary Diets offer targeted nutrition for specific health conditions diagnosed by a licensed veterinarian. With over 30 formulas backed by a team of over 500 scientists, including nutritionists, behaviorists, and veterinarians, these diets address various indications. Examples include Purina Pro Plan Veterinary Diets HA Hydrolyzed Formulas, designed for pets with food sensitivities, and Purina Pro Plan Veterinary Diets EN Gastroenteric Formulas, supporting digestive health. Additionally, Purina Pro Plan Veterinary Diets UR Urinary Ox/St Formulas help reduce the risk of urinary stone formation.

- April 2024: ROYAL CANIN U.S., which is a division of Mars, Incorporated, has expanded its Veterinary Gastrointestinal (GI) portfolio to address common digestive issues in cats and dogs. The new products are designed to provide tailored nutrition for pets requiring specialized diets to support their gastrointestinal (GI) health and microbiome. The lineup includes ROYAL CANIN Gastrointestinal Low Fat Small Dog, formulated for small dogs with fat-restricted dietary needs, and ROYAL CANIN Gastrointestinal High Fiber Loaf in Sauce Canine, featuring a unique fiber blend to regulate intestinal transit. In addition, ROYAL CANIN Gastrointestinal Hydrolyzed Protein Feline offers a palatable option for cats with food sensitivities, while ROYAL CANIN Gastrointestinal Fiber Response Thin Slices in Gravy combines hydration and fiber benefits for feline digestive health.

- January 2024: Hill’s Pet Nutrition, which is a division of Colgate-Palmolive, announced a series of new product innovations for its therapeutic pet food line. Some products include the z/d Low Fat Hydrolyzed Soy Canine diet, tailored for dogs with food and fat sensitivities, is incorporated with Hill’s ActivBiome+ ingredient to support gut microbiome health, digestive function, and overall well-being. The c/d Multicare Low Fat Canine diet, launching in June, targets dogs with fat sensitivities while also promoting urinary health. Also, the company will unveil an upgraded version of the Gastrointestinal Biome Felines diet, now known as Gastrointestinal Biome Stress Felines.

Veterinary Therapeutic Diet Market Research Scope

|

Report Metric |

Report Details |

|

Veterinary Therapeutic Diet Market Size available for the Years |

2021-2023 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Compound Annual Growth Rate (CAGR) |

8.7% |

|

Segment covered |

Animal Type; Indication; Product Type; Distribution Channel |

|

Regions Covered |

North America: The U.S. & Canada Latin America: Brazil, Mexico, Argentina, & Rest of Latin America Asia Pacific: China, India, Japan, Australia & New Zealand, ASEAN, & Rest of Asia Pacific Europe: Germany, The U.K., France, Spain, Italy, Russia, Poland, BENELUX, NORDIC, & Rest of Europe The Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, and Rest of MEA |

|

Fastest Growing Country in Europe |

UK |

|

Largest Market |

North America |

|

Key Players |

Hill's Pet Nutrition, Inc., Royal Canin, Purina Pro Plan Veterinary Diets, Blue Buffalo Company, Iams Veterinary Formula, Eukanuba Veterinary Diets, Natural Balance Pet Foods, Vetdiet, Rayne Clinical Nutrition, Diamond Pet Foods, Waltham Centre for Pet Nutrition, Mars Veterinary Health, Nestlé Purina PetCare, Wellness Natural Pet Food, Nutro Veterinary Diets |

Frequently Asked Question

What is the size of the global veterinary therapeutic diet market in 2023?

The global size veterinary therapeutic diet market reached US$ 1.5 Billion in 2023.

At what CAGR will the global veterinary therapeutic diet market expand?

The global market is expected to register a 8.7% CAGR through 2024-2032.

Who is the leader in the veterinary therapeutic diet market?

Hill's Pet Nutrition, Inc. is widely recognized as a leader in the veterinary therapeutic diet market, offering a comprehensive range of therapeutic diets tailored to address various health conditions in pets.

What are some key factors driving revenue growth of the veterinary therapeutic diet market?

Some key factors include increasing prevalence of chronic health conditions in pets, rising pet ownership rates, and growing awareness of pet health and wellness among consumers.

What are some major challenges faced by companies in the veterinary therapeutic diet market?

Companies in the market encounter challenges such as stringent food safety regulations, high research and development costs associated with formulating specialized diets, and competition from alternative pet food options.

How is the competitive landscape in the veterinary therapeutic diet market?

The competitive landscape in the market is characterized by intense rivalry among key players such as Hill's Pet Nutrition, Inc., Royal Canin, and Purina Pro Plan Veterinary Diets. These companies employ various strategies, including product innovation, strategic partnerships with veterinarians, effective marketing, and quality assurance measures, to maintain their positions and expand their consumer bases.

How is the veterinary therapeutic diet market report segmented?

The market report is segmented on the basis of animal type, indication, product type, distribution channel, and region.

Who are the key players in the Veterinary Therapeutic Diet Market report?

Hill's Pet Nutrition, Inc., Royal Canin, Purina Pro Plan Veterinary Diets, Blue Buffalo Company, Iams Veterinary Formula, Eukanuba Veterinary Diets, Natural Balance Pet Foods, Vetdiet, Rayne Clinical Nutrition, Diamond Pet Foods, Nestlé Purina PetCare, Wellness Natural Pet Food, and Nutro Veterinary Diets